Answered step by step

Verified Expert Solution

Question

1 Approved Answer

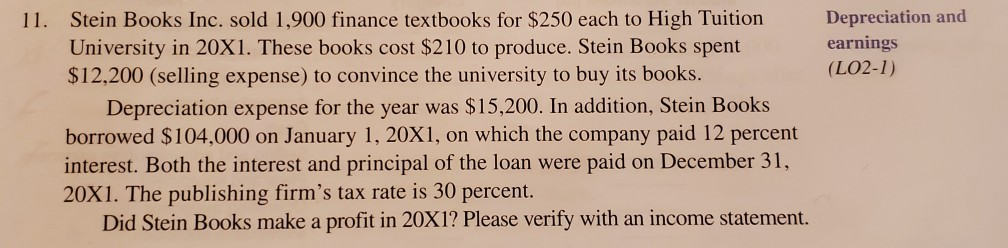

Please clearly show step-by-step calculations and logic and technique applied in arriving at answer. 11. Depreciation and earnings (LO2-1) Stein Books Inc. sold 1,900 finance

Please clearly show step-by-step calculations and logic and technique applied in arriving at answer.

11. Depreciation and earnings (LO2-1) Stein Books Inc. sold 1,900 finance textbooks for $250 each to High Tuition University in 20X1. These books cost $210 to produce. Stein Books spent $12,200 (selling expense) to convince the university to buy its books. Depreciation expense for the year was $15,200. In addition, Stein Books borrowed $104,000 on January 1, 20X1, on which the company paid 12 percent interest. Both the interest and principal of the loan were paid on December 31, 20X1. The publishing firm's tax rate is 30 percent. Did Stein Books make a profit in 20X1? Please verify with an income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started