please ........

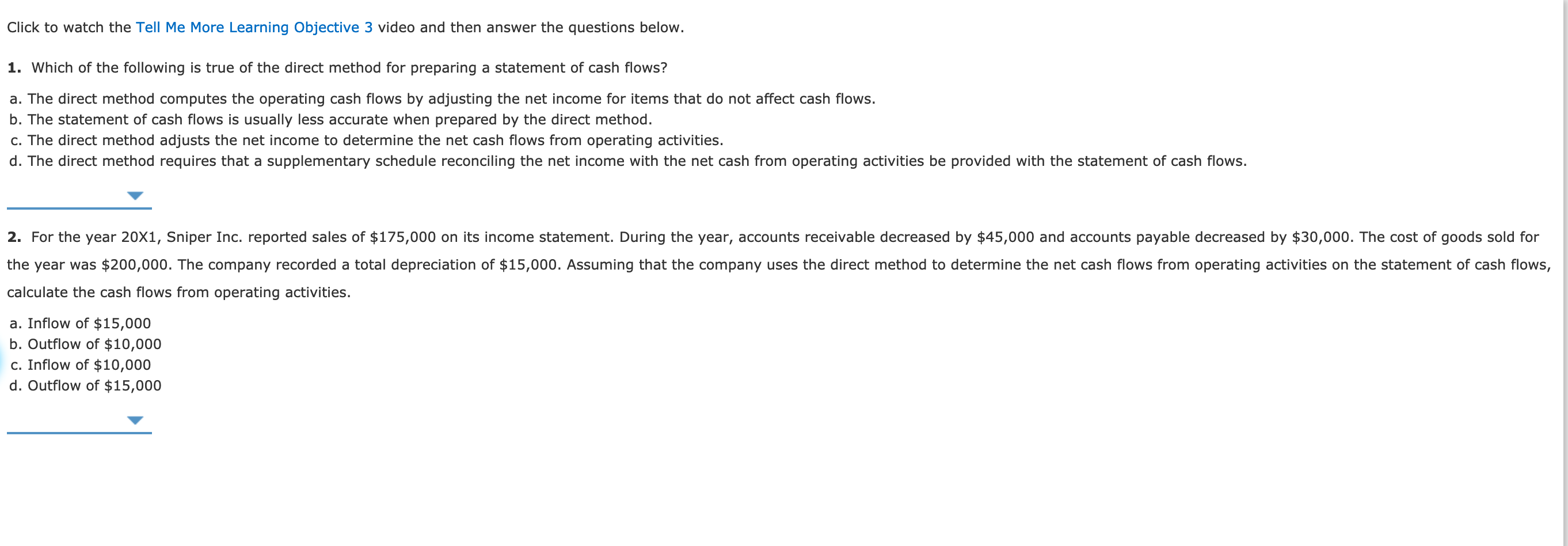

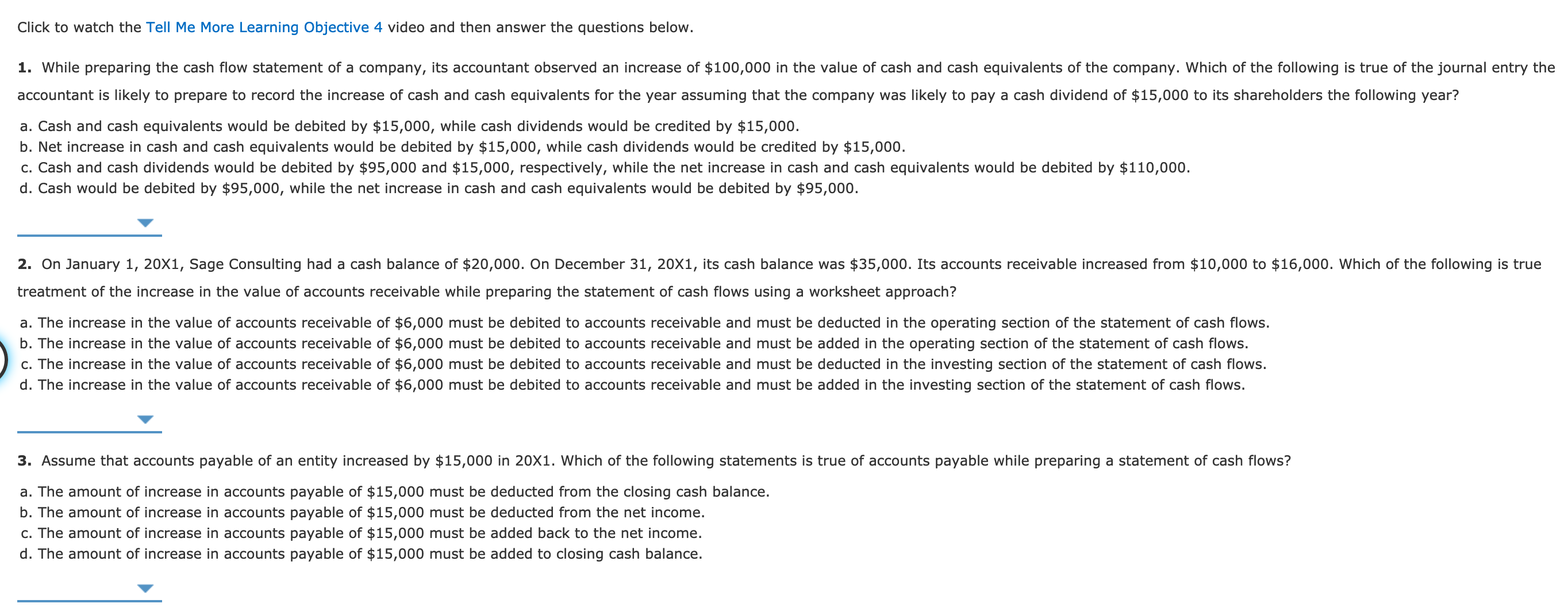

Click to watch the Tell Me More Learning Objective 3 video and then answer the questions below. 1. Which of the following is true of the direct method for preparing a statement of cash flows? a. The direct method computes the operating cash flows by adjusting the net income for items that do not affect cash flows. b. The statement of cash flows is usually less accurate when prepared by the direct method. c. The direct method adjusts the net income to determine the net cash flows from operating activities. d. The direct method requires that a supplementary schedule reconciling the net income with the net cash from operating activities be provided with the statement of cash flows. 2. For the year 20X1, Sniper Inc. reported sales of $175,000 on its income statement. During the year, accounts receivable decreased by $45,000 and accounts payable decreased by $30,000. The cost of goods sold for the year was $200,000. The company recorded a total depreciation of $15,000. Assuming that the company uses the direct method to determine the net cash flows from operating activities on the statement of cash flows, calculate the cash flows from operating activities. a. Inflow of $15,000 b. Outflow of $10,000 c. Inflow of $10,000 d. Outflow of $15,000Click to watch the Tell Me More Learning Objective 4 video and then answer the questions below. 1. While preparing the cash ow statement of a company, its accountant observed an increase of $100,000 in the value of cash and cash equivalents of the company. which of the following is true of the journal entry the accountant is likely to prepare to record the increase of cash and cash equivalents for the year assuming that the company was likely to pay a cash dividend of $15,000 to its shareholders the following year? a. Cash and cash equivalents would be debited by $15,000, while cash dividends would be credited by $15,000. b. Net increase in cash and cash equivalents would be debited by $15,000, while cash dividends would be credited by $15,000. c. Cash and cash dividends would be debited by $95,000 and $15,000, respectively, while the net increase in cash and cash equivalents would be debited by $110,000. d. Cash would be debited by $95,000, while the net increase in cash and cash equivalents would be debited by $95,000. v 2. On January 1, 20X1, Sage Consulting had a cash balance of $20,000. On December 31, 20X1, its cash balance was $35,000. Its accounts receivable increased from $10,000 to $16,000. Which of the following is true treatment of the increase in the value of accounts receivable while preparing the statement of cash flows using a worksheet approach? a. The increase in the value of accounts receivable of $6,000 must be debited to accounts receivable and must be deducted in the operating section of the statement of cash flows. b. The increase in the value of accounts receivable of $6,000 must be debited to accounts receivable and must be added in the operating section of the statement of cash ows. c. The increase in the value of accounts receivable of $6,000 must be debited to accounts receivable and must be deducted in the investing section of the statement of cash ows. d. The increase in the value of accounts receivable of $6,000 must be debited to accounts receivable and must be added in the investing section of the statement of cash ows. V 3. Assume that accounts payable of an entity increased by $15,000 in 20X1. Which of the following statements is true of accounts payable while preparing a statement of cash flows? a. The amount of increase in accouns payable of $15,000 must be deducted from the closing cash balance. b. The amount of increase in accounts payable of $15,000 must be deducted from the net income. c. The amount of increase in accounts payable of $15,000 must be added back to the net income. d. The amount of increase in accounts payable of $15,000 must be added to closing cash balance. v