Please Complete:

1. All MCQs located on page 326 and 327 ( All Multiple choice questions ).

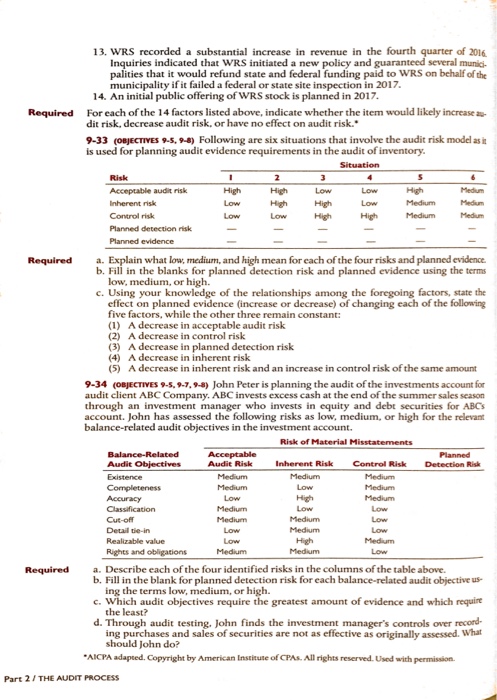

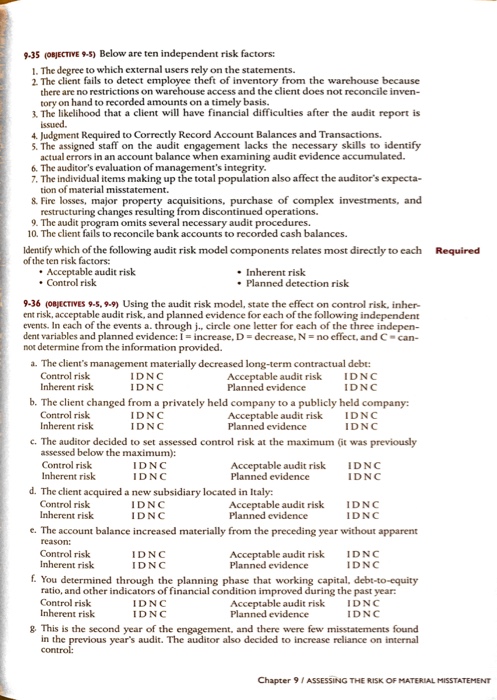

2.Solve question 9-34 and 9-36 on page 330-1.

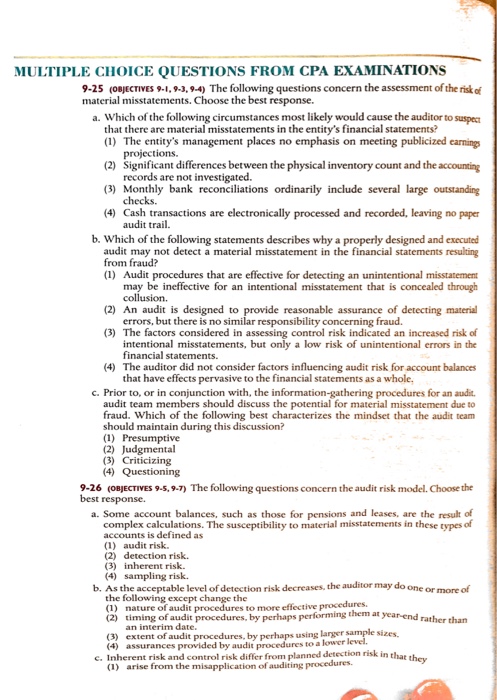

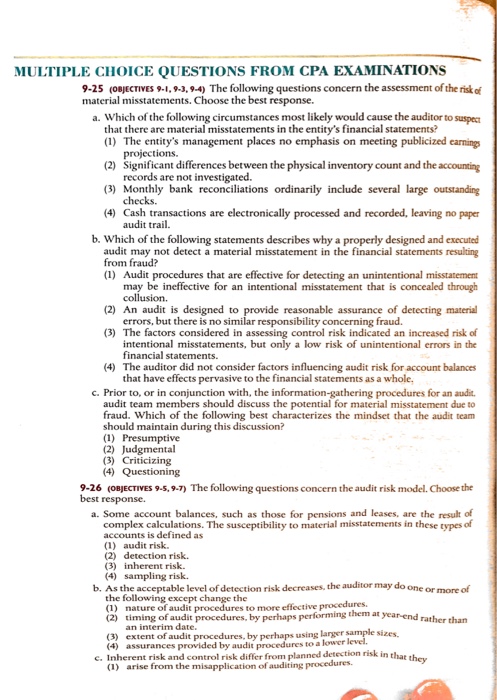

MULTIPLE CHOICE QUESTIONS FROM CPA EXAMINATIONS 9-25 coBIECTIVEs 9-1.9 3,9-4) The following questions concern the assessment oftheriskof material misstatements. Choose the best response. a. Which of the following circumstances most likely would cause the auditor to suspec that there are material misstatements in the entity's financial statements? (1) The entity's management places no emphasis on meeting publicized earnings projections nt differences between the physical inventory count and the accounting records are not investigated. (3 Monthly bank reconciliations ordinarily include several large outstanding checks processed and recorded, leaving no paper audit trail. b. Which of the following statements describes why a properly designed and executed audit may not detect a material misstatement in the financial statements resulting from fraud? (1) Audit procedures that are effective for detecting an unintentional misstatement may be ineffective for an intentional misstatement that is concealed through collusion (2) An audit is designed to provide reasonable assurance of detecting material errors, but there is no similar responsibility concerning fraud. (3 The factors considered in assessing control risk indicated an increased risk of intentional misstatements, but only a low risk of unintentional errors in the financial statements (4) The auditor did not consider factors influencing audit risk for account balances that have effects pervasive to the financial statements as a whole, c. Prior to, or in conjunction with, the information-gathering procedures for an audit. audit team members should discuss the potential for material misstatement due to fraud. Which of the following best characterizes the mindset that the audit team should maintain during this discussion? (1) Presumptive (2) Judgmental (3 Criticizing (4) Questioning 9-26 (oBJECTIVES 9-s, 9-7 The following questions concern the audit risk model. Choose the best response. a. Some account balances, such as those for pensions and leases, are the result of complex calculations. The susceptibility to material misstatements in these types of is defined as accounts audit risk. (4) sampling risk. b. As the acceptable level of detection risk decreases, the auditor may do one or more of the following except change the (1) nature of audit procedures to more effective procedur at year-end rather than (2) timing of audit procedures, by perhaps performing them terim date extent of audit procedures, by perhaps using larger sample sizes. (4) assurances provided by audit proced ures to a c. inherent risk and control risk differ from planned detection risk in that they (i) arise from the misapplication ofauditing procedures