Please Complete 3,4 and 5.

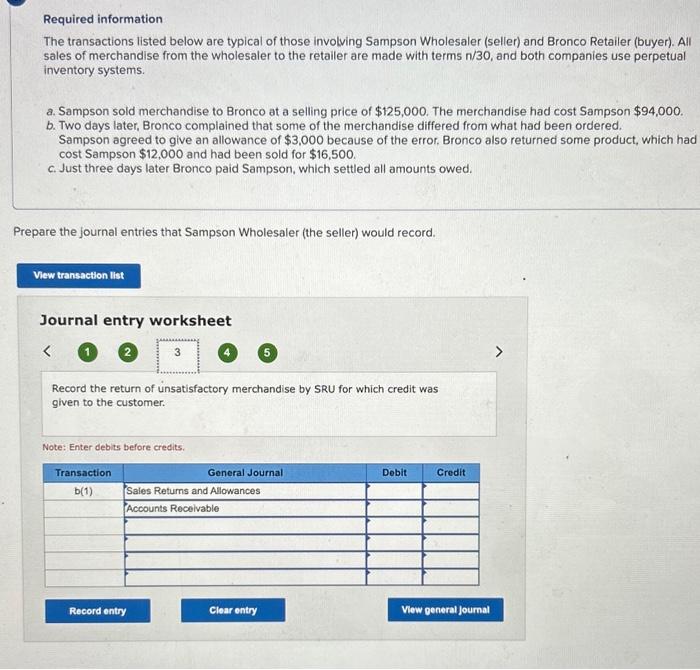

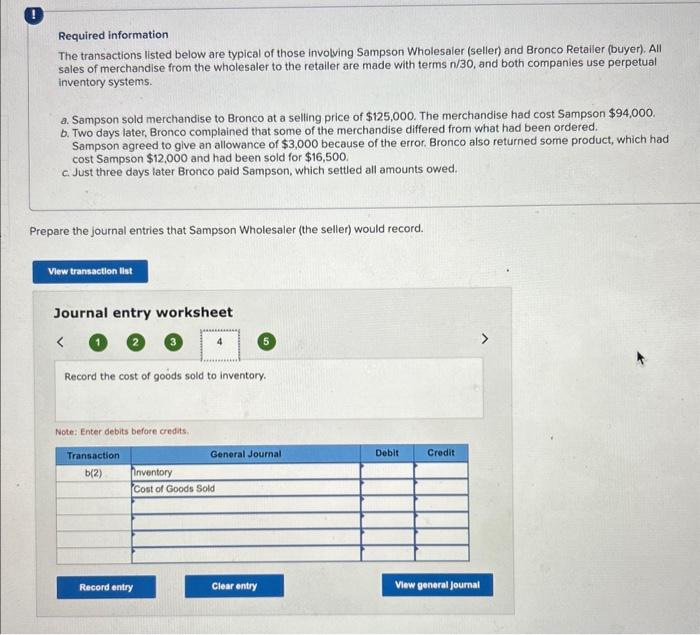

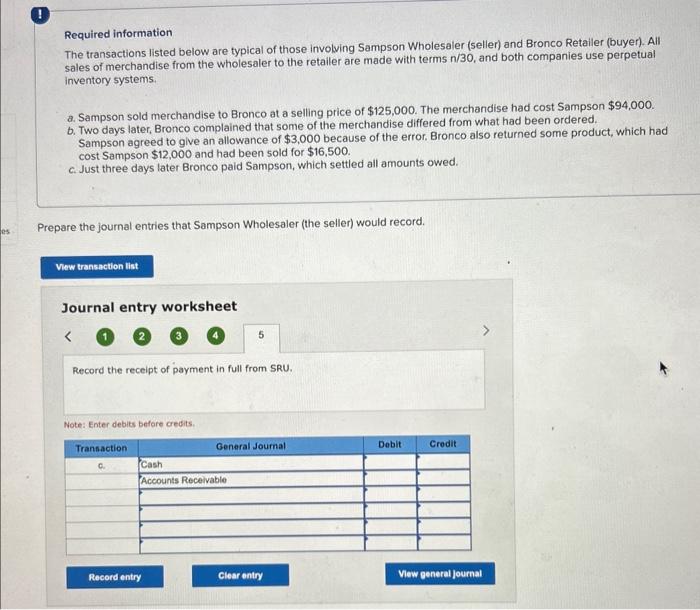

Required information The transactions listed below are typical of those involving Sampson Wholesaler (seller) and Bronco Retailer (buyer). All sales of merchandise from the wholesaler to the retailer are made with terms n/30, and both companies use perpetual inventory systems. a. Sampson sold merchandise to Bronco at a selling price of $125,000. The merchandise had cost Sampson $94,000. b. Two days later, Bronco complained that some of the merchandise differed from what had been ordered. Sampson agreed to give an allowance of $3,000 because of the error. Bronco also returned some product, which had cost Sampson $12,000 and had been sold for $16,500. c. Just three days later Bronco paid Sampson, which settled all amounts owed. Prepare the journal entries that Sampson Wholesaler (the seller) would record. Journal entry worksheet Note: Enter debits before credits. Required information The transactions listed below are typical of those involving Sampson Wholesaler (seller) and Bronco Retailer (buyer). All sales of merchandise from the wholesaler to the retailer are made with terms n/30, and both companies use perpetual inventory systems. a. Sampson sold merchandise to Bronco at a selling price of $125,000. The merchandise had cost Sampson $94,000. b. Two days later, Bronco complained that some of the merchandise differed from what had been ordered. Sampson agreed to give an allowance of $3,000 because of the error. Bronco also returned some product, which had cost Sampson $12,000 and had been sold for $16,500. c. Just three days later Bronco paid Sampson, which settled all amounts owed. Prepare the journal entries that Sampson Wholesaler (the seller) would record. Journal entry worksheet Note: Enter debits before credits. Required information The transactions listed below are typical of those involving Sampson Wholesaler (seller) and Bronco Retailer (buyer). All sales of merchandise from the wholesaler to the retailer are made with terms n/30, and both companies use perpetual inventory systems. a. Sampson sold merchandise to Bronco at a selling price of $125,000. The merchandise had cost Sampson $94,000. b. Two days later, Bronco complained that some of the merchandise differed from what had been ordered. Sampson agreed to give an allowance of $3,000 because of the error. Bronco also returned some product, which had cost Sampson $12,000 and had been sold for $16,500. c. Just three days later Bronco paid Sampson, which settled all amounts owed. Prepare the journal entries that Sampson Wholesaler (the seller) would record. Journal entry worksheet 1 Record the return of insatisfactory merchandise by SRU for which credit was given to the customer. Note: Enter debits before credits