Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete a 2021 return based upon the attached information. Please complete a 2021 return based upon the attached information. Jane Curtain owns Jane's Window

Please complete a 2021 return based upon the attached information.

Please complete a 2021 return based upon the attached information.

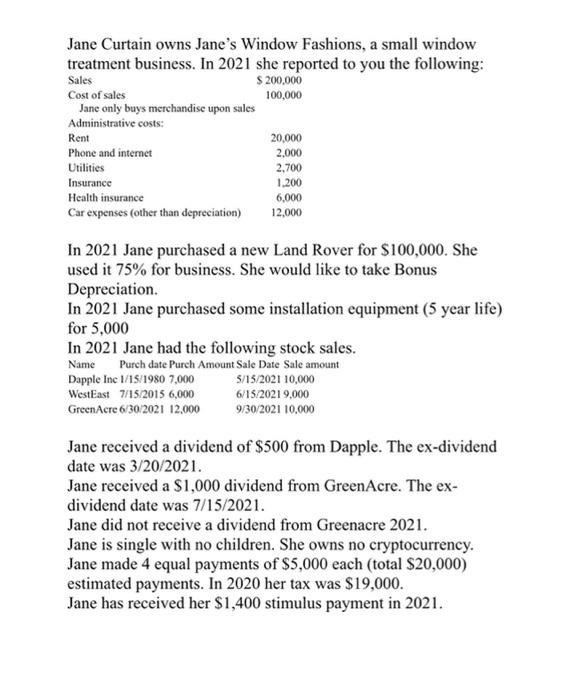

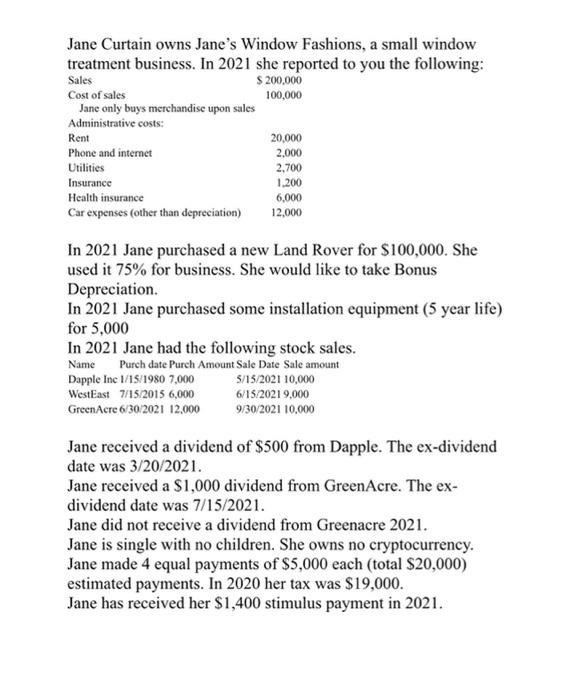

Jane Curtain owns Jane's Window Fashions, a small window treatment business. In 2021 she reported to you the following: Sales $ 200,000 Cost of sales 100,000 Jane only buys merchandise upon sales Administrative costs: Rent 20,000 Phone and internet 2.000 Utilities 2,700 Insurance 1,200 Health insurance Car expenses (other than depreciation) 12,000 6,000 In 2021 Jane purchased a new Land Rover for $100,000. She used it 75% for business. She would like to take Bonus Depreciation. In 2021 Jane purchased some installation equipment (5 year life) for 5,000 In 2021 Jane had the following stock sales. Name Purch date Purch Amount Sale Date Sale amount Dapple Inc 1/15/1980 7.000 5/15/2021 10,000 WestEast 7/15/2015 6,000 6/15/20219,000 Green Acre 6/30/2021 12,000 9/30/2021 10.000 Jane received a dividend of $500 from Dapple. The ex-dividend date was 3/20/2021. Jane received a $1,000 dividend from GreenAcre. The ex- dividend date was 7/15/2021. Jane did not receive a dividend from Greenacre 2021. Jane is single with no children. She owns no cryptocurrency. Jane made 4 equal payments of $5,000 each (total $20,000) estimated payments. In 2020 her tax was $19,000. Jane has received her $1,400 stimulus payment in 2021. Jane Curtain owns Jane's Window Fashions, a small window treatment business. In 2021 she reported to you the following: Sales $ 200,000 Cost of sales 100,000 Jane only buys merchandise upon sales Administrative costs: Rent 20,000 Phone and internet 2.000 Utilities 2,700 Insurance 1,200 Health insurance Car expenses (other than depreciation) 12,000 6,000 In 2021 Jane purchased a new Land Rover for $100,000. She used it 75% for business. She would like to take Bonus Depreciation. In 2021 Jane purchased some installation equipment (5 year life) for 5,000 In 2021 Jane had the following stock sales. Name Purch date Purch Amount Sale Date Sale amount Dapple Inc 1/15/1980 7.000 5/15/2021 10,000 WestEast 7/15/2015 6,000 6/15/20219,000 Green Acre 6/30/2021 12,000 9/30/2021 10.000 Jane received a dividend of $500 from Dapple. The ex-dividend date was 3/20/2021. Jane received a $1,000 dividend from GreenAcre. The ex- dividend date was 7/15/2021. Jane did not receive a dividend from Greenacre 2021. Jane is single with no children. She owns no cryptocurrency. Jane made 4 equal payments of $5,000 each (total $20,000) estimated payments. In 2020 her tax was $19,000. Jane has received her $1,400 stimulus payment in 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started