Answered step by step

Verified Expert Solution

Question

1 Approved Answer

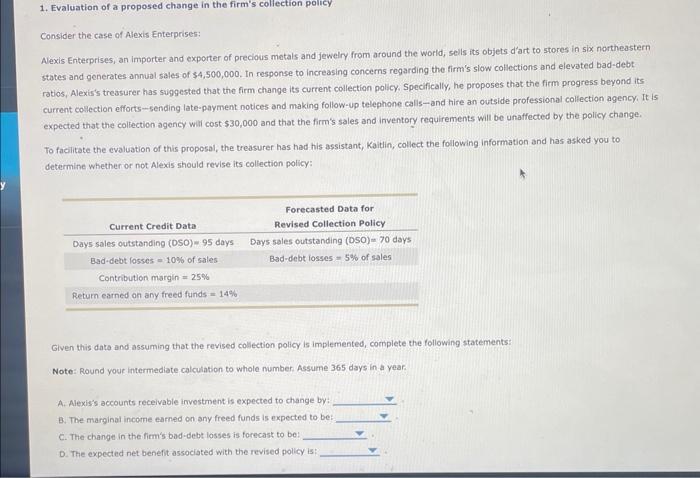

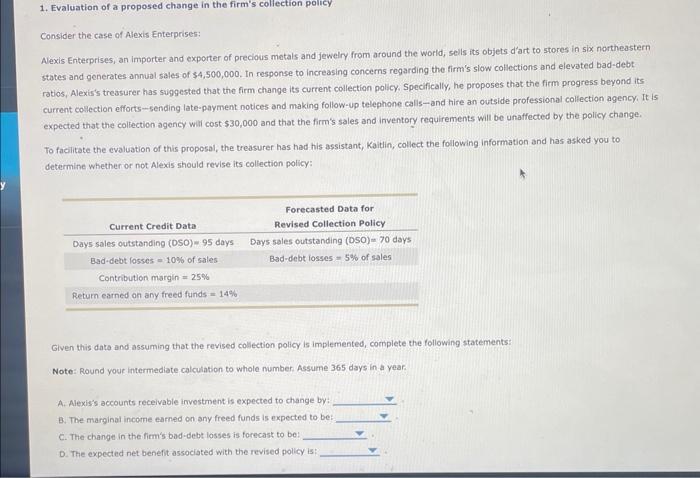

please complete all blanks thank you 1. Evaluation of a proposed change in the firm's coliection policy Consider the case of Alexis Enterprises: Nexis Enterprises,

please complete all blanks thank you

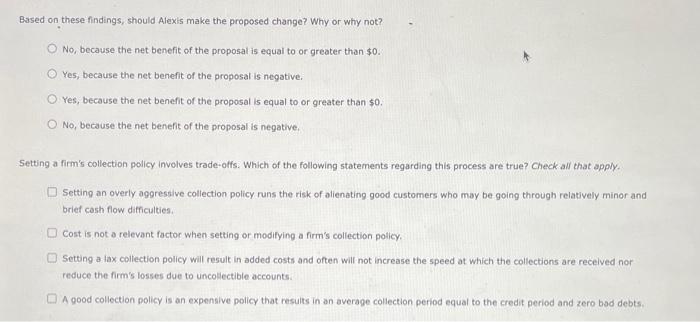

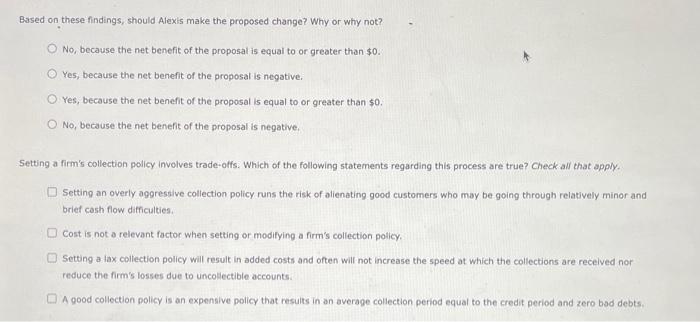

1. Evaluation of a proposed change in the firm's coliection policy Consider the case of Alexis Enterprises: Nexis Enterprises, an importer and exporter of precious metals and jewelry from around the world; sells its objets d'art to stores in six northeastern states and generates annual sales of $4,500,000. In response to increasing concerns regarding the firm's siow collections and elevated bad-debt. ratios, Alexis's treasurer has suggested that the firm change its current collection policy, Specifically, he proposes that the firm progress beyond its current collection efforts-sending late-payment notices and making follow-up telephone calis-and hire an outside professional coliection agencyi It is expected that the colfection agency will cost $30,000 and that the firm's sales and inventory requirements will be unaffected by the policy change. To facilitate the evaluation of this proposal, the treasurer has had his assistant, Kaitlin, collect the following information and has asked you to determine whether or not Alexis should revise its collection policy: Given this data and assuming that the revised collection policy is implemented, complete the following statements: Note: Round your intermediate calculation to whole number Assume 365 days in a year: A. Aexis's accounts receivable investment is expected to change by: B. The marginat income earned on any freed funds is expected to be: C. The change in the firm's bad debt losses is forecast to be: D. The expected net benefit associated with the revised policy is: Based on these findings, should Alexis make the proposed change? Why or why not? No, because the net benefit of the proposal is equal to or greater than $0. Yes, because the net benefit of the proposal is negative. Yes, because the net benefit of the proposal is equal to or greater than $0. No, because the net benefit of the proposal is negative. Setting a firm's collection policy involves trade-offs. Which of the following statements regarding this process are true? Check all that apply. Setting an overly aggressive collection policy runs the risk of alienating good customers who may be going through relatively minor and brief cash flow difficulties. Cost is not a relevant factor when setting or modifying a firm's collection policy. Setting a lax collection policy will result in added costs and often will not increase the speed at which the collections are recelved nor reduce the firm's losses due to uncoliectible accounts. A good collection policy is an expensive policy that resuits in an average collection period equal to the credit period and zero bad debts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started