Please complete all of the requirements. Thank you!

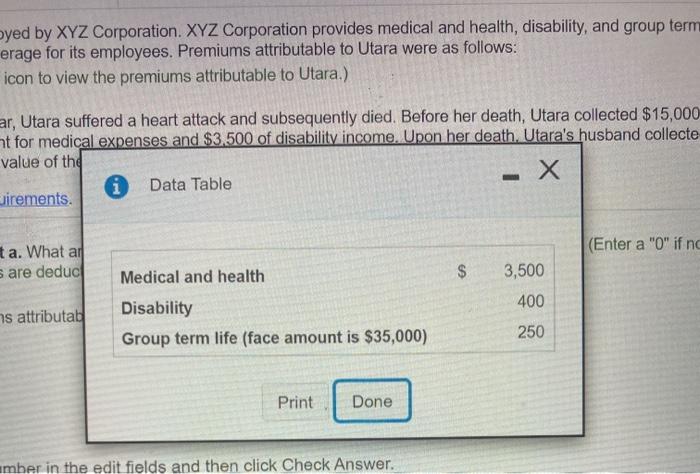

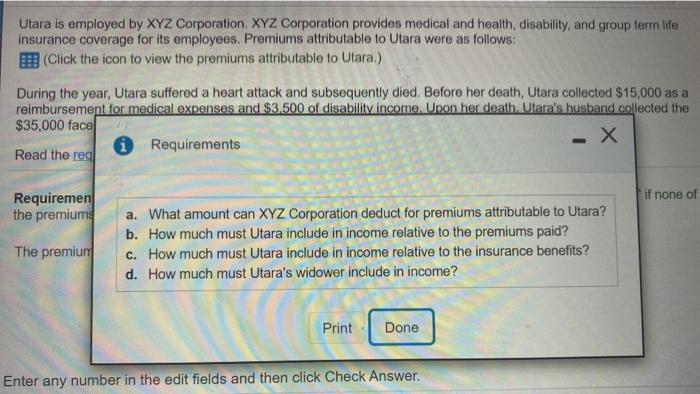

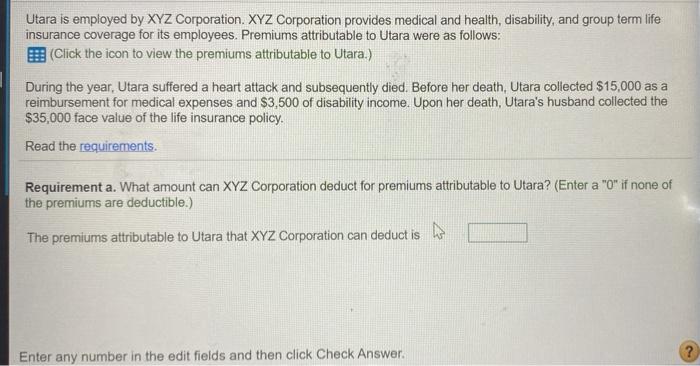

Utara is employed by XYZ Corporation. XYZ Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Utara were as follows: Click the icon to view the premiums attributable to Utara.) During the year, Utara suffered a heart attack and subsequently died. Before her death, Utara collected $15,000 as a reimbursement for medical expenses and $3,500 of disability income. Upon her death, Utara's husband collected the $35,000 face value of the life insurance policy. Read the requirements. Requirement a. What amount can XYZ Corporation deduct for premiums attributable to Utara? (Enter a "0" if none of the premiums are deductible.) The premiums attributable to Utara that XYZ Corporation can deduct is D Enter any number in the edit fields and then click Check Answer. yed by XYZ Corporation. XYZ Corporation provides medical and health, disability, and group term erage for its employees. Premiums attributable to Utara were as follows: icon to view the premiums attributable to Utara.) ar, Utara suffered a heart attack and subsequently died. Before her death, Utara collected $15,000 at for medical expenses and $3.500 of disability income. Upon her death. Utara's husband collecte value of the i Data Table buirements. (Enter a "0" if nc ta. What ar s are deduc Medical and health $ 3,500 400 as attributab Disability Group term life (face amount is $35,000) 250 Print Done amber in the edit fields and then click Check Answer. Utara is employed by XYZ Corporation. XYZ Corporation provides medical and health disability, and group term life insurance coverage for its employees. Premiums attributable to Utara were as follows: (Click the icon to view the premiums attributable to Utara.) During the year, Utara suffered a heart attack and subsequently died. Before her death, Utara collected $15,000 as a reimbursement for medical expenses and $3,500 of disability income. Upon her death. Utara's husband collected the $35,000 face * Requirements Read the real if none of Requiremen the premium The premium a. What amount can XYZ Corporation deduct for premiums attributable to Utara? b. How much must Utara include in income relative to the premiums paid? C. How much must Utara include in income relative to the insurance benefits? d. How much must Utara's widower include in income? Print Done Enter any number in the edit fields and then click Check