Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete all of the requirements. thank you Wade and Mirabelle Sharkey are a married couple filing jointly. They have no children and report the

please complete all of the requirements. thank you

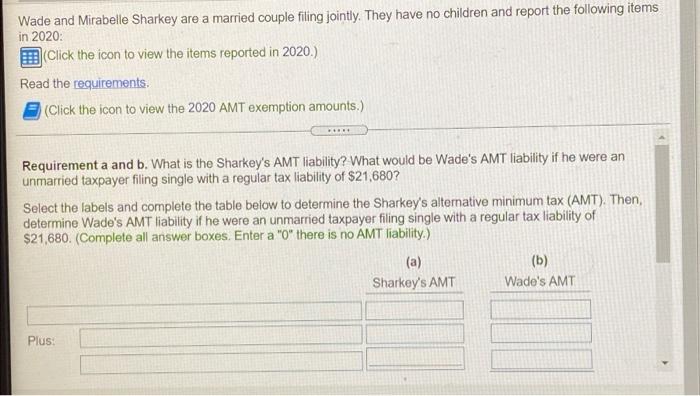

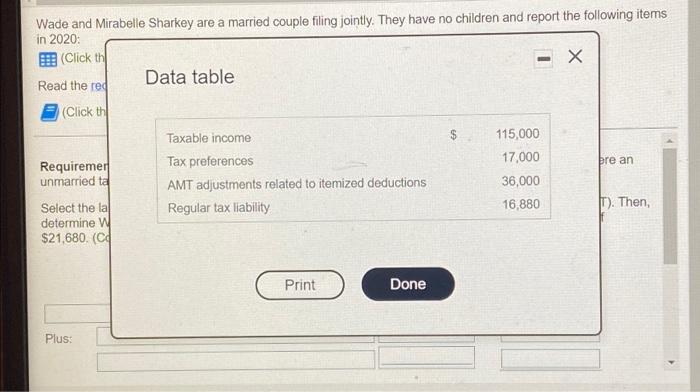

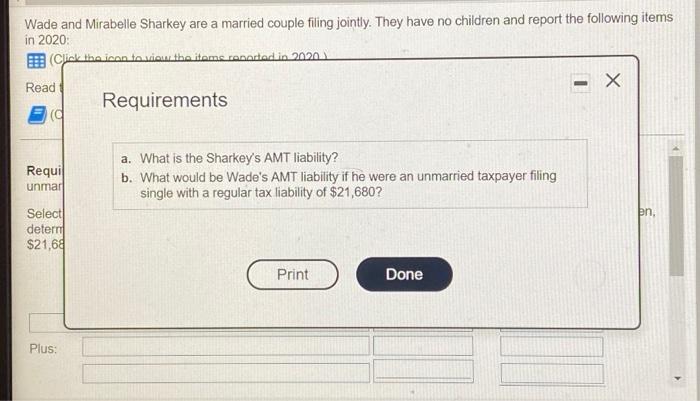

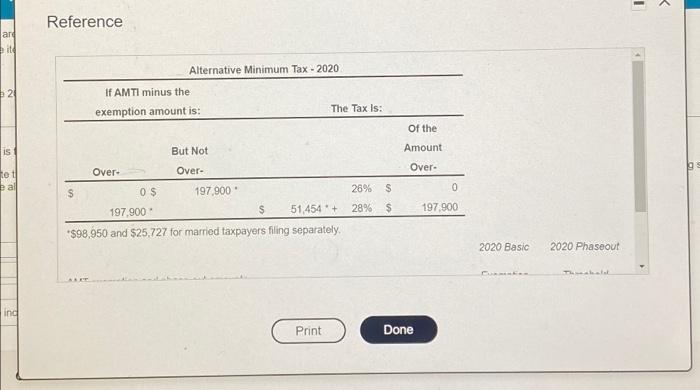

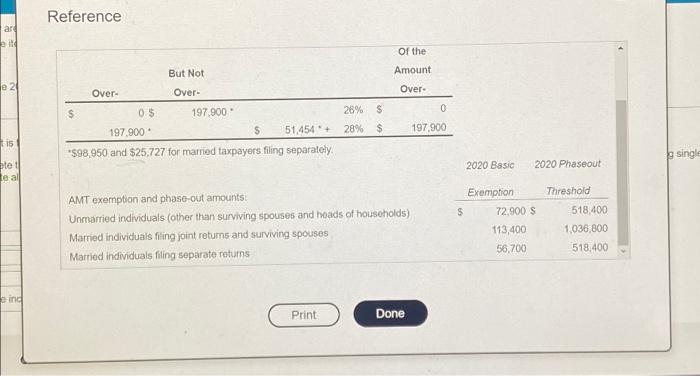

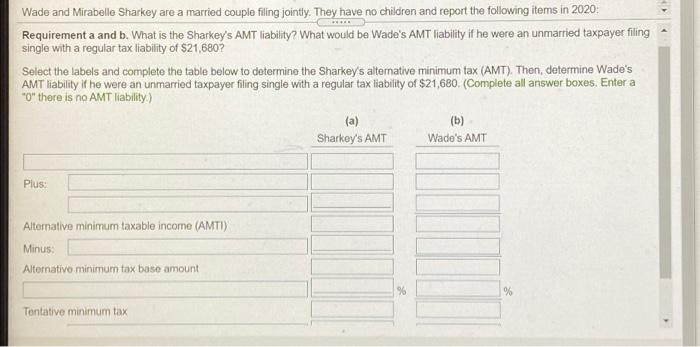

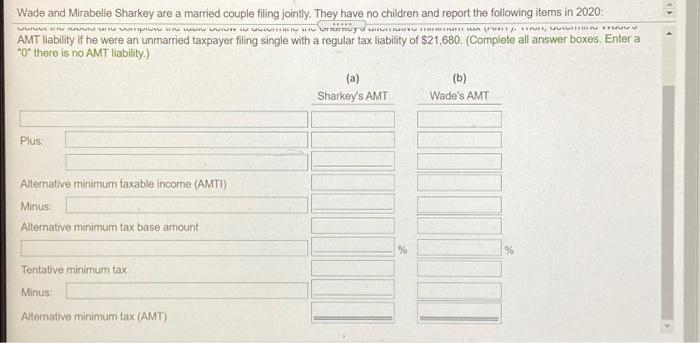

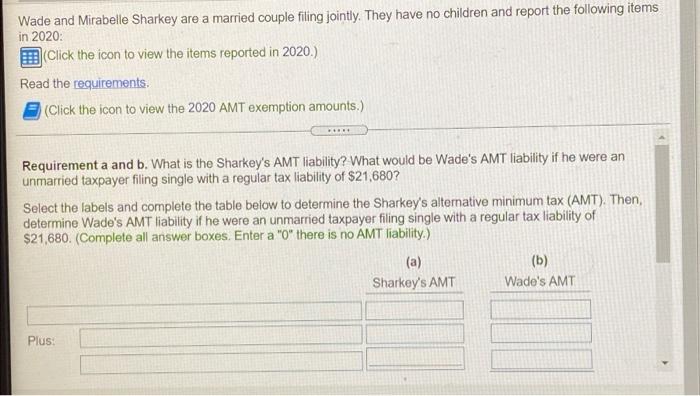

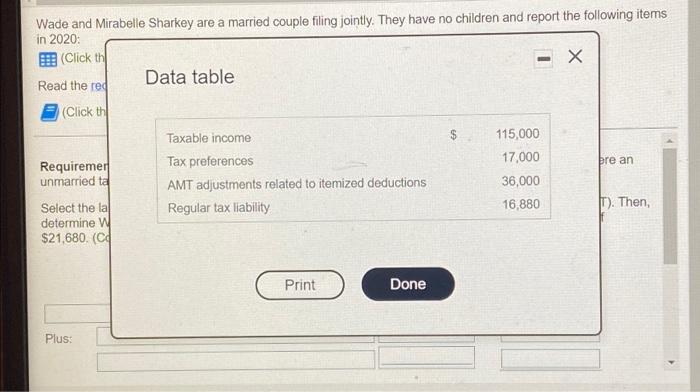

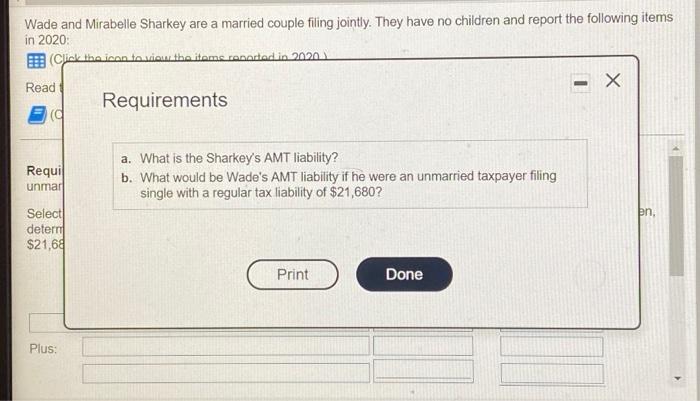

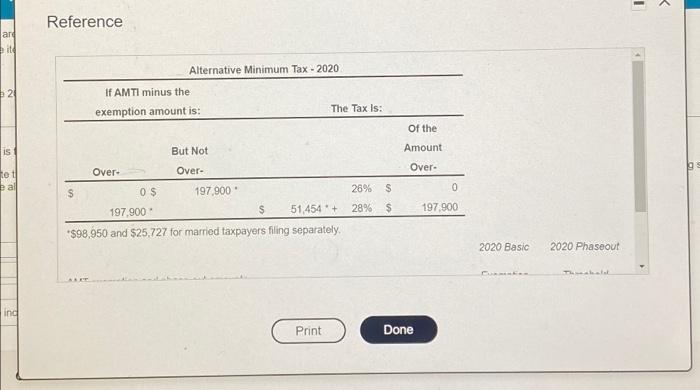

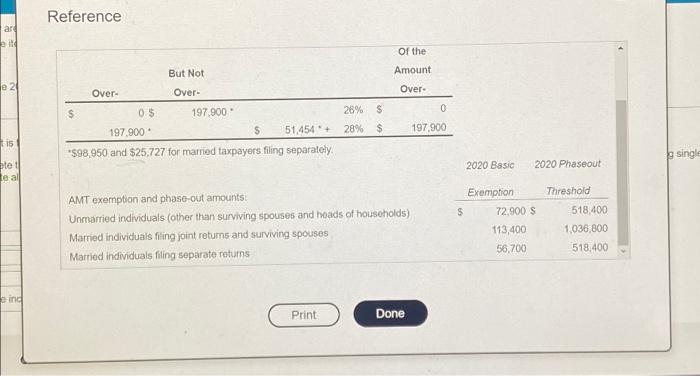

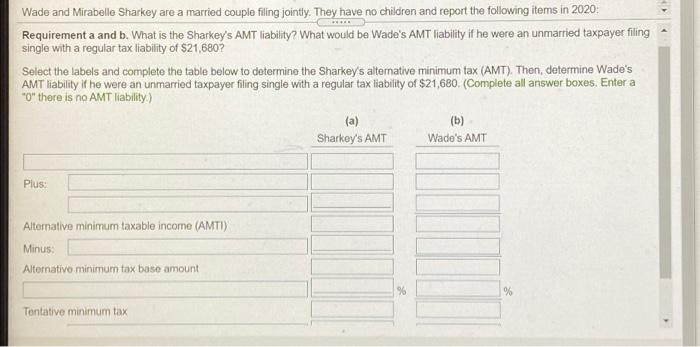

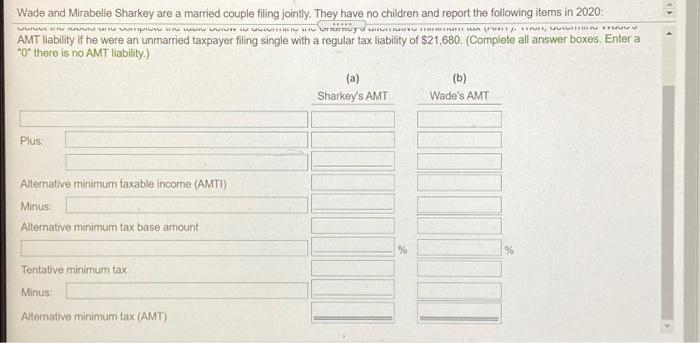

Wade and Mirabelle Sharkey are a married couple filing jointly. They have no children and report the following items in 2020: Click the icon to view the items reported in 2020.) Read the requirements. Click the icon to view the 2020 AMT exemption amounts.) Requirement a and b. What is the Sharkey's AMT liability? What would be Wade's AMT liability if he were an unmarried taxpayer filing single with a regular tax liability of $21,680? Select the labels and complete the table below to determine the Sharkey's alternative minimum tax (AMT). Then, determine Wade's AMT liability if he were an unmarried taxpayer filing single with a regular tax liability of $21,680. (Complete all answer boxes. Enter a "0" there is no AMT liability.) (a) (b) Sharkey's AMT Wade's AMT Plus: 1 Wade and Mirabelle Sharkey are a married couple filing jointly. They have no children and report the following items in 2020: Click the Data table Read the red (Click the Taxable income 115,000 Requiremer Tax preferences 17,000 pre an unmarried to AMT adjustments related to itemized deductions 36,000 Select the la Regular tax liability 16,880 T). Then, determine W $21,680. (C $ Print Done Plus: Wade and Mirabelle Sharkey are a married couple filing jointly. They have no children and report the following items in 2020 Click the icon to view the iteme reported in 2020 Read Requirements q - Requi unmar a. What is the Sharkey's AMT liability? b. What would be Wade's AMT liability if he were an unmarried taxpayer filing single with a regular tax liability of $21,680? pn. Select deterni $21,69 Print Done Plus: a Wade and Mirabelle Sharkey are a married couple filing jointly. They have no children and report the following items in 2020: *** UUU ULIO WIN WWIIU MIUOTTUTTO DRIVE VITU AMT liability if he were an unmarried taxpayer filing single with a regular tax liability of $21,680. (Complete all answer boxes. Enter a *o* there is no AMT liability.) (a) (b) Sharkey's AMT Wade's AMT Plus Alternative minimum taxable income (AMTI) Minus Alternative minimum tax base amount % % Tentative minimum tax Minus Alternative minimum tax (AMT)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started