Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete all requirements investment. Expected net cash inflows are as follows: (Click the icon to view the expected net cash inflows.) Read the requirements.

Please complete all requirements

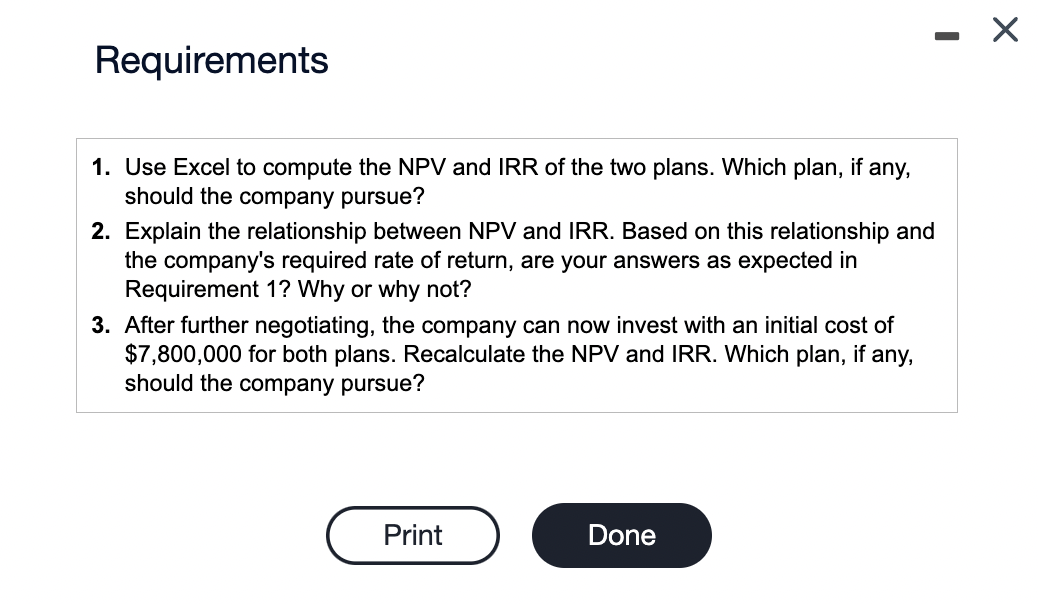

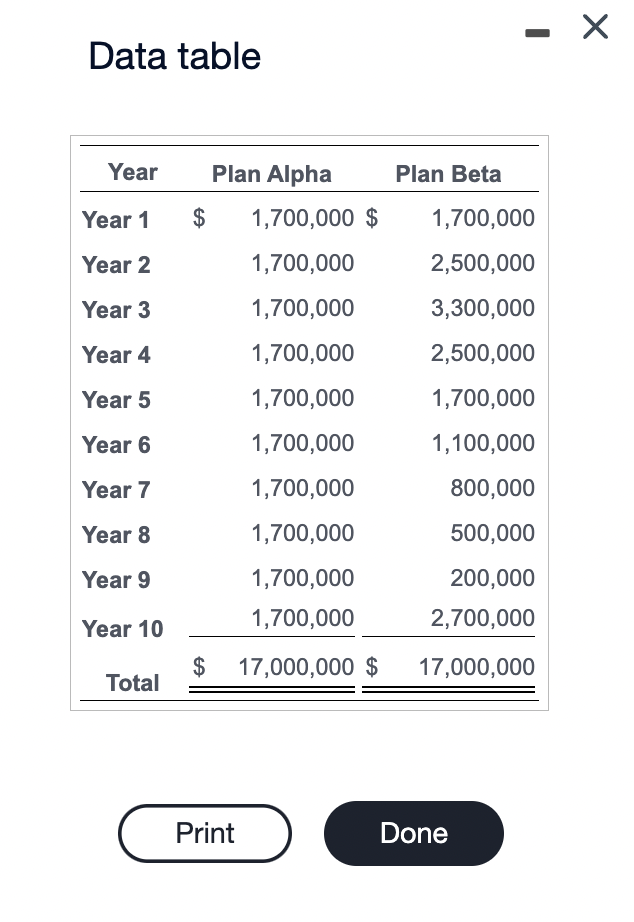

investment. Expected net cash inflows are as follows: (Click the icon to view the expected net cash inflows.) Read the requirements. whole dollar and the IRR calculations to two decimal places, X.XX\%.) The NPV (net present value) of Plan Alpha is The NPV (net present value) of Plan Beta is Requirements 1. Use Excel to compute the NPV and IRR of the two plans. Which plan, if any, should the company pursue? 2. Explain the relationship between NPV and IRR. Based on this relationship and the company's required rate of return, are your answers as expected in Requirement 1 ? Why or why not? 3. After further negotiating, the company can now invest with an initial cost of $7,800,000 for both plans. Recalculate the NPV and IRR. Which plan, if any, should the company pursue? Data table investment. Expected net cash inflows are as follows: (Click the icon to view the expected net cash inflows.) Read the requirements. whole dollar and the IRR calculations to two decimal places, X.XX\%.) The NPV (net present value) of Plan Alpha is The NPV (net present value) of Plan Beta is Requirements 1. Use Excel to compute the NPV and IRR of the two plans. Which plan, if any, should the company pursue? 2. Explain the relationship between NPV and IRR. Based on this relationship and the company's required rate of return, are your answers as expected in Requirement 1 ? Why or why not? 3. After further negotiating, the company can now invest with an initial cost of $7,800,000 for both plans. Recalculate the NPV and IRR. Which plan, if any, should the company pursue? Data tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started