Please complete all requirements. Thank you!!!

Please complete all requirements. Thank you!!!

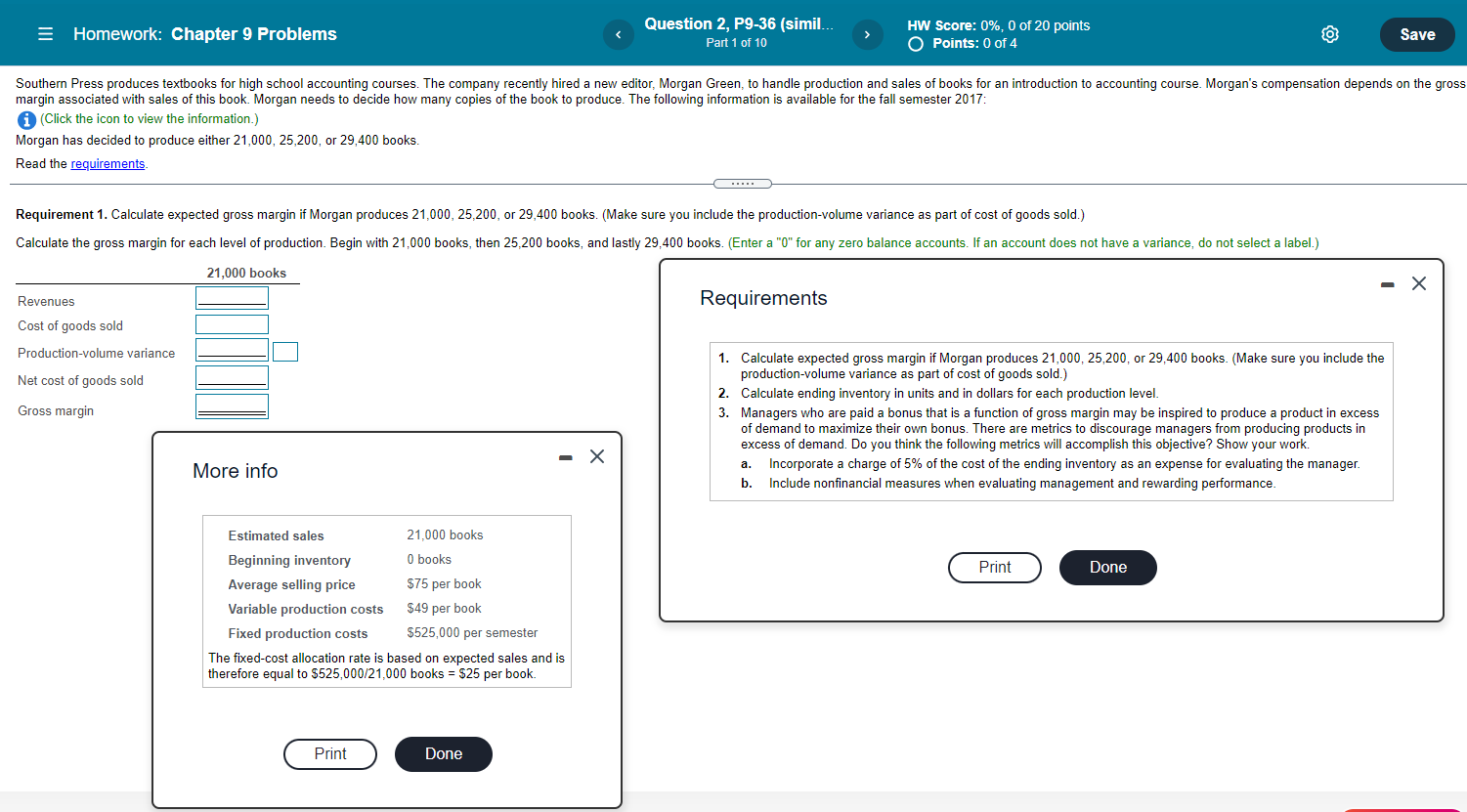

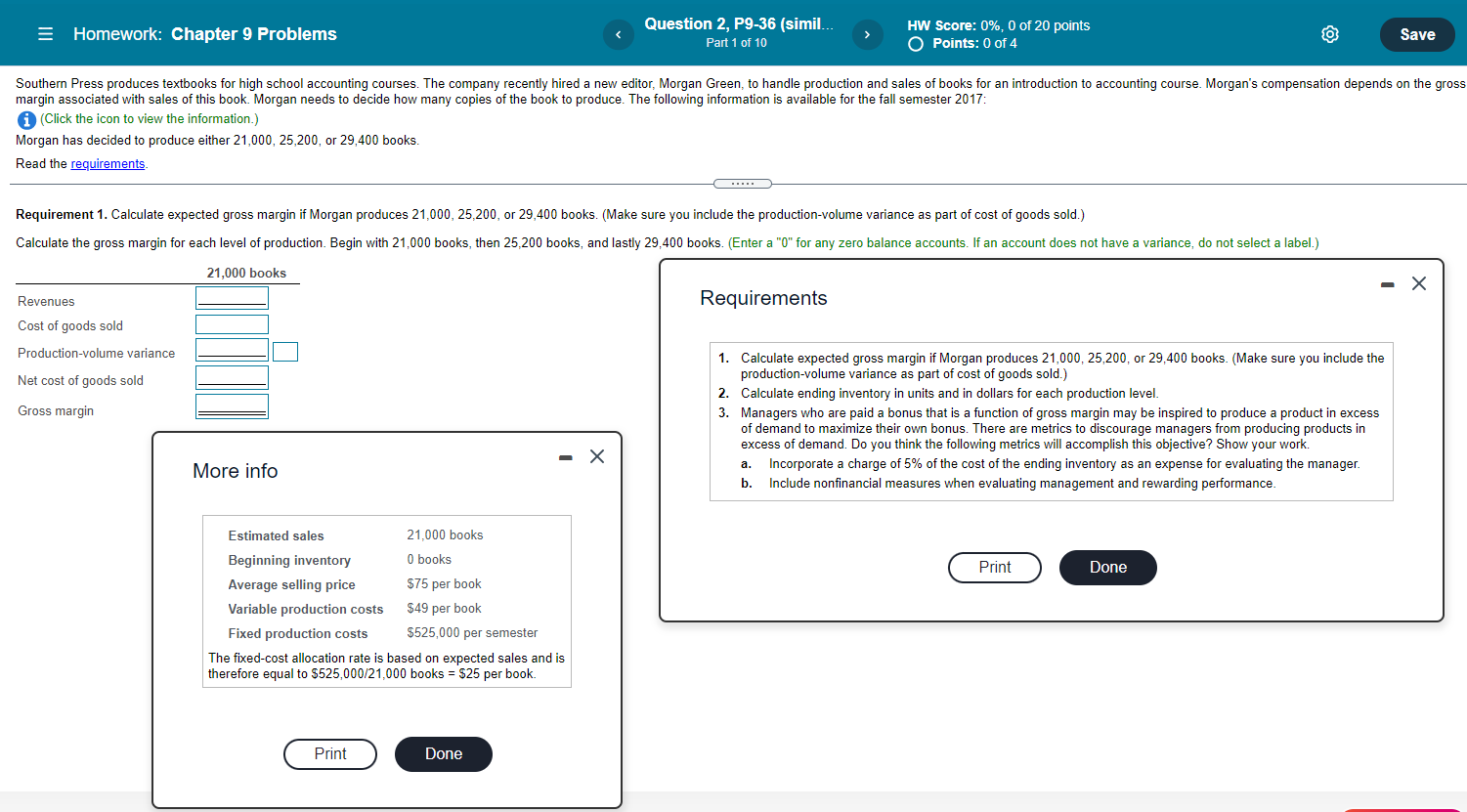

= Homework: Chapter 9 Problems Question 2, P9-36 (simil... Part 1 of 10 HW Score: 0%, 0 of 20 points O Points: 0 of 4 O Save Southern Press produces textbooks for high school accounting courses. The company recently hired a new editor, Morgan Green, to handle production and sales of books for an introduction to accounting course. Morgan's compensation depends on the gross margin associated with sales of this book. Morgan needs to decide how many copies of the book to produce. The following information is available for the fall semester 2017: (Click the icon to view the information.) Morgan has decided to produce either 21,000, 25,200, or 29,400 books. Read the requirements ... Requirement 1. Calculate expected gross margin if Morgan produces 21,000, 25,200, or 29,400 books. (Make sure you include the production-volume variance as part of cost of goods sold.) Calculate the gross margin for each level of production. Begin with 21,000 books, then 25,200 books, and lastly 29,400 books. (Enter a "0" for any zero balance accounts. If an account does not have a variance, do not select a label.) 21,000 books - X Revenues Requirements Cost of goods sold Production-volume variance Net cost of goods sold Gross margin 1. Calculate expected gross margin if Morgan produces 21,000, 25,200, or 29,400 books. (Make sure you include the production-volume variance as part of cost of goods sold.) 2. Calculate ending inventory in units and in dollars for each production level. 3. Managers who are paid a bonus that is a function of gross margin may be inspired to produce a product in excess of demand to maximize their own bonus. There are metrics to discourage managers from producing products in excess of demand. Do you think the following metrics will accomplish this objective? Show your work. Incorporate a charge of 5% of the cost of the ending inventory as an expense for evaluating the manager. b. Include nonfinancial measures when evaluating management and rewarding performance. a. More info Print Done Estimated sales 21,000 books Beginning inventory 0 books Average selling price $75 per book Variable production costs $49 per book Fixed production costs $525,000 per semester The fixed-cost allocation rate is based on expected sales and is therefore equal to $525,000/21,000 books = $25 per book. Print Done

Please complete all requirements. Thank you!!!

Please complete all requirements. Thank you!!!