Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete all the requirments. Thank you The income statement and additional data of Raylor Services, Inc., follow: (Click the Icon to view the income

Please complete all the requirments. Thank you

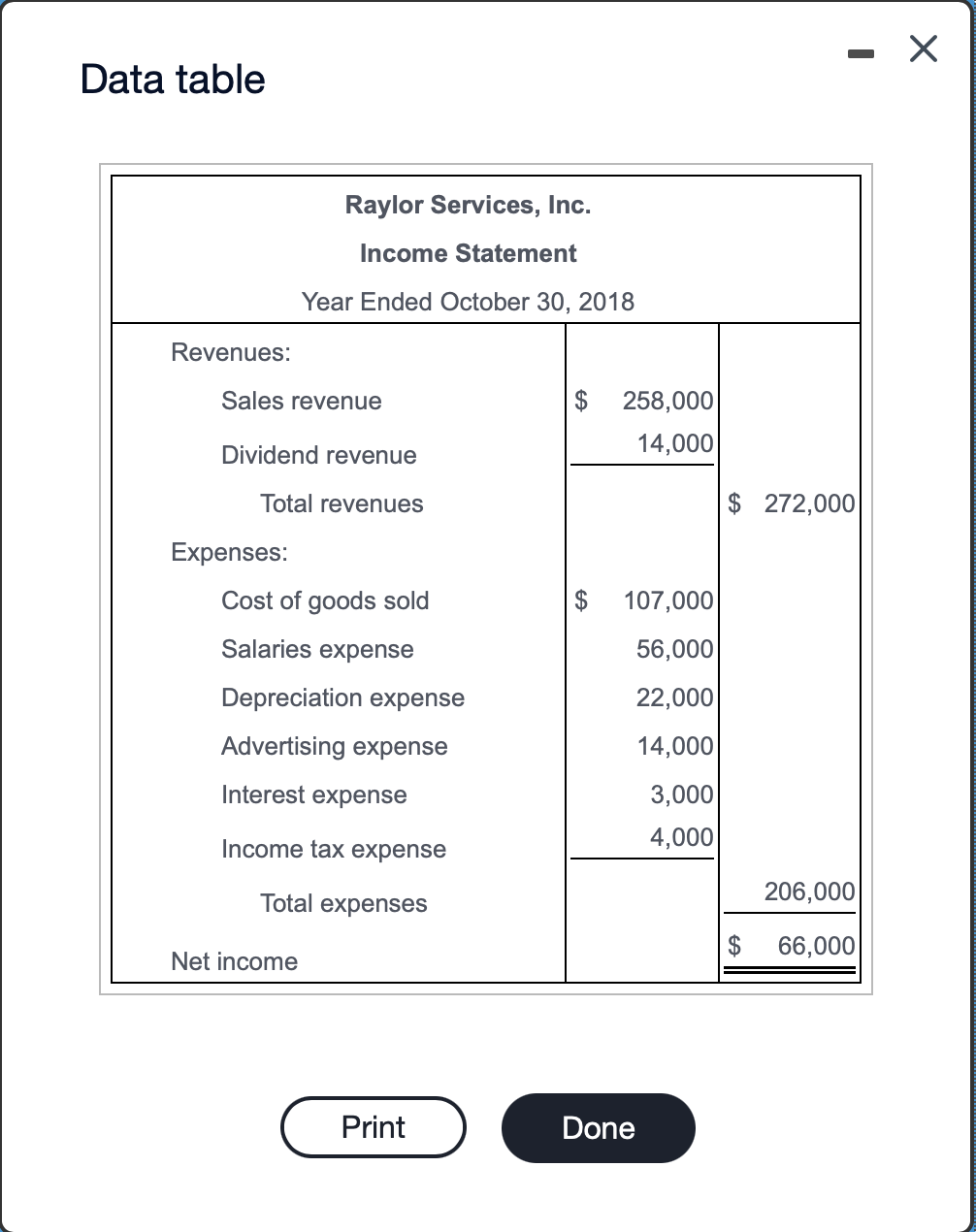

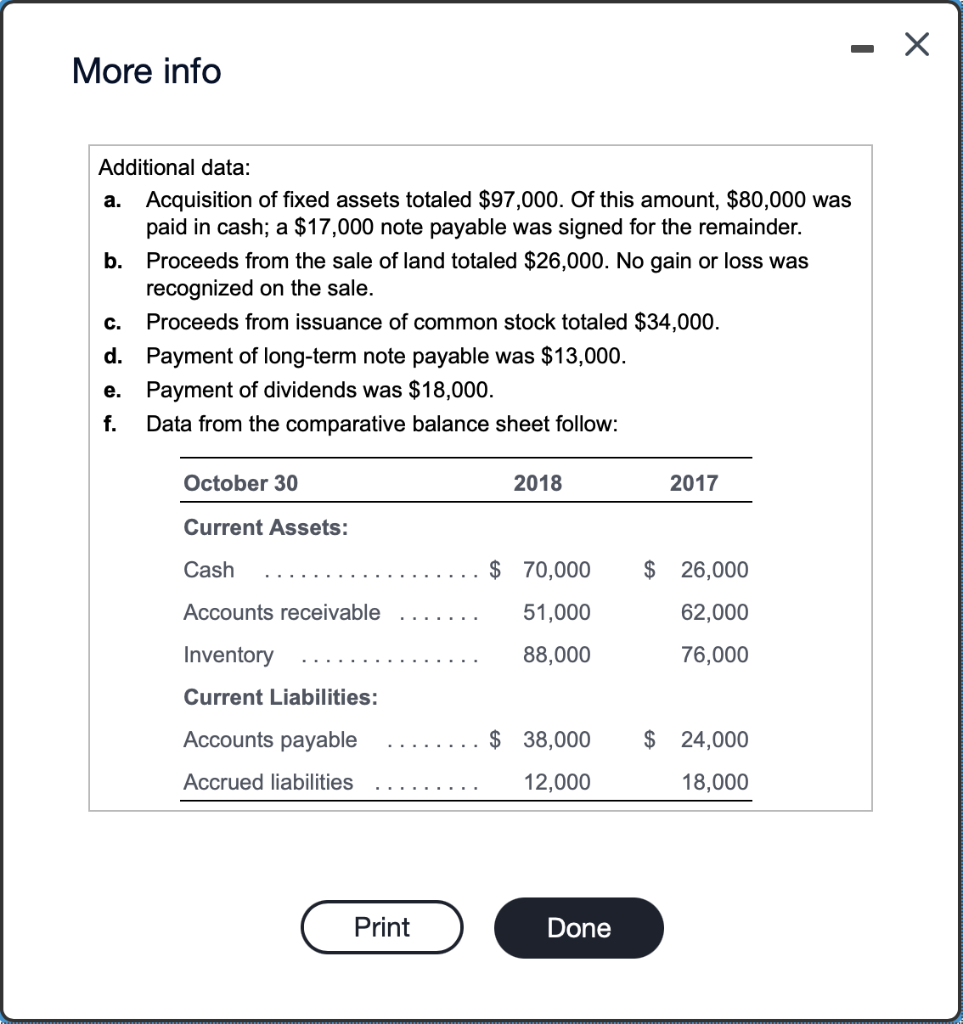

The income statement and additional data of Raylor Services, Inc., follow: (Click the Icon to view the income statement.) i (Click the icon to view the additional data.) Read the requirements. Requirement 1. Prepare Raylor Services' statement of cash flows for the year ended October 30, 2018, using the indirect method. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Raylor Services, Inc. Statement of Cash Flows Year Ended October 30, 2018 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Net cash provided by (used for) operating activities Cash flows from investing activities: Not soh nmulded hu fused for immoting athline The income statement and additional data of Raylor Services, Inc., follow (Click the icon to view the additional data.) EEE (Click the icon to view the income statement.) Read the requirements. Net cash provided by (used for) operating activities Cash flows from investing activities: Net cash provided by (used for) investing activities Cash flows from financing activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash during the year Cash balance, October 30, 2017 Cash balance, October 30, 2018 Requirement 2. Calculate Raylor Services' free cash flow for the year ended October 30, 2018. Raylor Services' free cash flow for the year ended October 30, 2018 is $ Requirement 3. Evaluate Raylor Services' cash flows for the year. In your evaluation, mention all three categories of cash flows as well as free cash flow and give the reason for your evaluation. Raylor Services operations provided net cash flows of . The majority of the cash flow came from , as it should in a successful company. The investing activities is a good indication that the company The income statement and additional data of Raylor Services, Inc., follow: (Click the icon to view the income statement.) (Click the icon to view the additional data.) Read the requirements. Net cash provided by (used for) investing activities Cash flows from financing activities: Net cash provided by (used for) financing activities Net increase (decrease) in cash during the year Cash balance, October 30, 2017 Cash balance, October 30, 2018 Requirement 2. Calculate Raylor Services' free cash flow for the year ended October 30, 2018. Raylor Services' free cash flow for the year ended October 30, 2018 is $ Requirement 3. Evaluate Raylor Services' cash flows for the year. In your evaluation, mention all three categories of cash flows as well as free cash flow and give the reason for your evaluation. Raylor Services operations provided net cash flows of . The majority of the cash flow came from as it should in a successful company. The IS and the net cash financing activities of indicates that the company The free cash flow indicates that the company have free cash available investing activities is a good indication that the company Data table Revenues: Sales revenue Dividend revenue Total revenues Cost of goods sold Salaries expense Depreciation expense Advertising expense Interest expense Income tax expense Total expenses Print Expenses: Raylor Services, Inc. Income Statement Year Ended October 30, 2018 Net income $ 258,000 14,000 $ 107,000 56,000 22,000 14,000 3,000 4,000 Done $ 272,000 206,000 $ 66,000 More info Additional data: a. Acquisition of fixed assets totaled $97,000. Of this amount, $80,000 was paid in cash; a $17,000 note payable was signed for the remainder. b. Proceeds from the sale of land totaled $26,000. No gain or loss was recognized on the sale. C. Proceeds from issuance of common stock totaled $34,000. d. Payment of long-term note payable was $13,000. e. Payment of dividends was $18,000. f. Data from the comparative balance sheet follow: October 30 2018 2017 Current Assets: Cash $ 70,000 $ 26,000 Accounts receivable 51,000 62,000 Inventory 88,000 76,000 Current Liabilities: Accounts payable $ 38,000 $ 24,000 Accrued liabilities 12,000 18,000 Print Done XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started