Answered step by step

Verified Expert Solution

Question

1 Approved Answer

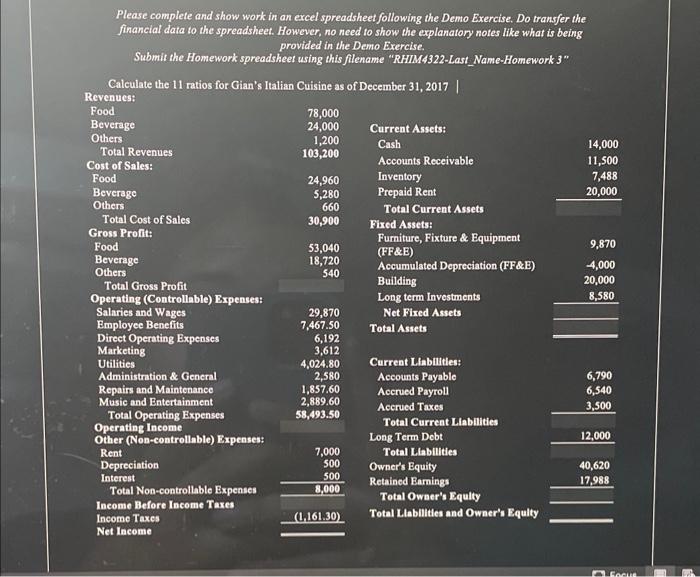

Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the financial data to the spreadsheet. However, no need

Please complete and show work in an excel spreadsheet following the Demo Exercise. Do transfer the financial data to the spreadsheet. However, no need to show the explanatory notes like what is being provided in the Demo Exercise. Submit the Homework spreadsheet using this filename "RHIM4322-Last Name-Homework 3" Calculate the 11 ratios for Gian's Italian Cuisine as of December 31, 2017 | Revenues: Food 78,000 Beverage 24,000 Current Assets: Others 1,200 Cash Total Revenues 103,200 Accounts Receivable Cost of Sales: Food 24,960 Inventory Beverage 5,280 Prepaid Rent 14,000 11,500 7,488 20,000 Others 660 Total Current Assets Total Cost of Sales 30,900 Fixed Assets: Gross Profit: Furniture, Fixture & Equipment Food 9,870 53,040 (FF&E) Beverage 18,720 Accumulated Depreciation (FF&E) -4,000 Others 540 Total Gross Profit Building 20,000 Operating (Controllable) Expenses: Long term Investments 8,580 Salaries and Wages 29,870 Net Fixed Assets Employee Benefits 7,467.50 Total Assets Direct Operating Expenses 6,192 Marketing 3,612 Utilities 4,024.80 Current Liabilities: Administration & General 2,580 Accounts Payable 6,790 Repairs and Maintenance 1,857.60 Accrued Payroll 6,540 Music and Entertainment 2,889.60 Accrued Taxes 3,500 Total Operating Expenses 58,493.50 Operating Income Total Current Liabilities Other (Non-controllable) Expenses: Long Term Debt 12,000 Rent 7,000 Total Liabilities Depreciation 500 Owner's Equity 40,620 Interest 500 Retained Earnings 17,988 Total Non-controllable Expenses 8,000 Total Owner's Equity Income Before Income Taxes Income Taxes (1,161.30) Total Liabilities and Owner's Equity Net Income Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started