please complete another risk as the 2 examples above

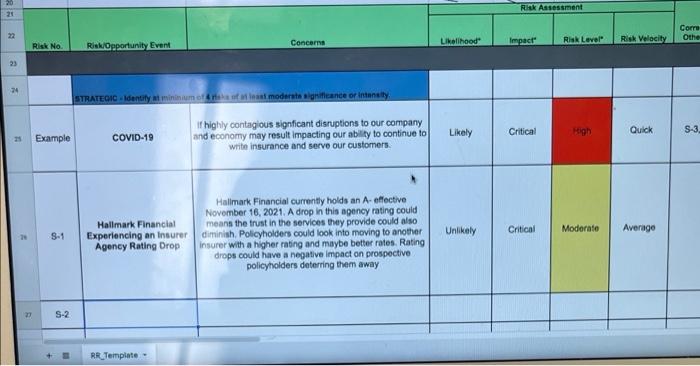

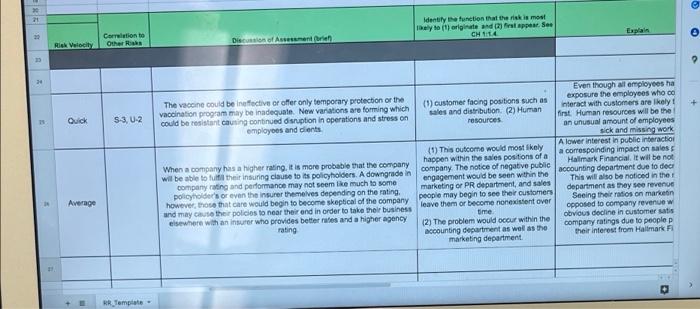

Students must identify and complete the risk register for at least 4 STRATEGIC, 5 UNDERWRITING AND 3 ESG risks to get an 80. The identified risks have to be of at least moderate concern. More credit is given to more unique or emerging risks. A risk that is widely known will receive very little to no credit. Ex: COVID-19 as a risk in itself. However, additional risks arising from COVID-19 are acceptable. RAK Assessment 21 22 Corre Othe Likelihood Risk Level Concerna Risk No Risk Velocity Impact Risk Opportunity Event 23 24 STRATEGIC Identity a mininum of last moderstegance or intensity Critical if highly contagious signficant disruptions to our company and economy may result impacting our ability to continue to write insurance and serve our customers. Example Likely Quick COVID-19 S-3 Bigh Critical Hallmark Financial currently holds an A-effective November 16, 2021. A drop in this agency rating could means the trust in the services they provide could also diminish Policyholders could look into moving to another insurer with a higher rating and maybe better rates Rating drops could have a negative impact on prospective policyholders deterring them away 8.1 Moderato Unlikely Hallmark Financial Experiencing an insurer Agency Rating Drop Average 22 S-2 RR Template @ 21 Idently function that there is most Tely to originate and first appear. Ses CH 1 Explain Correlation to Others 0 Discussion of Assessment bien * * * Rilek Velocity + T Quick S-3, U-2 Even though it employees ha The vaccine could be ineffective or offer only temporary protection of the exposure the employees who co (1) customer facing positions such as vaccination program may be inadequate. New variations are forming which Interact with customers are likely sales and distribution (2) Human could be resistant causing continued disruption in operations and stress on first. Human resources will be the resources employees and clients an unusual amount of employees sick and missing work A lower interest in public interaction (1) This outcome would most likely a corresponding impact on sales happen within the sales positions of a When a company has a higher rating. It is more probable at the company company. The notice of negative public accounting department due to deci Hallmark Financial. It will be not will be able to fill the insuring clute to its policyholders. A downgrade in company rating and performance may not seem like much to some engagement would be soon within the This will also be noticed in the policyholder's or even the insure themelves depending on the rating, marketing or PR department, and sales department as they see revenue people may begin to see their customers however, those that care would begin to become skeptical of the company Seeing their ratios on marketin and may chut the policies to near their end in order to take their business leave them or become nonexistent over opposed to company revenue w time elsewhere with an insurer who provides better rates and a higher agency Obvious decline in customer satis rating (2) The problem would occur within the accounting department as well as the company ratings due to people p their interest from Hallmark marketing department Average RR Template- Students must identify and complete the risk register for at least 4 STRATEGIC, 5 UNDERWRITING AND 3 ESG risks to get an 80. The identified risks have to be of at least moderate concern. More credit is given to more unique or emerging risks. A risk that is widely known will receive very little to no credit. Ex: COVID-19 as a risk in itself. However, additional risks arising from COVID-19 are acceptable. RAK Assessment 21 22 Corre Othe Likelihood Risk Level Concerna Risk No Risk Velocity Impact Risk Opportunity Event 23 24 STRATEGIC Identity a mininum of last moderstegance or intensity Critical if highly contagious signficant disruptions to our company and economy may result impacting our ability to continue to write insurance and serve our customers. Example Likely Quick COVID-19 S-3 Bigh Critical Hallmark Financial currently holds an A-effective November 16, 2021. A drop in this agency rating could means the trust in the services they provide could also diminish Policyholders could look into moving to another insurer with a higher rating and maybe better rates Rating drops could have a negative impact on prospective policyholders deterring them away 8.1 Moderato Unlikely Hallmark Financial Experiencing an insurer Agency Rating Drop Average 22 S-2 RR Template @ 21 Idently function that there is most Tely to originate and first appear. Ses CH 1 Explain Correlation to Others 0 Discussion of Assessment bien * * * Rilek Velocity + T Quick S-3, U-2 Even though it employees ha The vaccine could be ineffective or offer only temporary protection of the exposure the employees who co (1) customer facing positions such as vaccination program may be inadequate. New variations are forming which Interact with customers are likely sales and distribution (2) Human could be resistant causing continued disruption in operations and stress on first. Human resources will be the resources employees and clients an unusual amount of employees sick and missing work A lower interest in public interaction (1) This outcome would most likely a corresponding impact on sales happen within the sales positions of a When a company has a higher rating. It is more probable at the company company. The notice of negative public accounting department due to deci Hallmark Financial. It will be not will be able to fill the insuring clute to its policyholders. A downgrade in company rating and performance may not seem like much to some engagement would be soon within the This will also be noticed in the policyholder's or even the insure themelves depending on the rating, marketing or PR department, and sales department as they see revenue people may begin to see their customers however, those that care would begin to become skeptical of the company Seeing their ratios on marketin and may chut the policies to near their end in order to take their business leave them or become nonexistent over opposed to company revenue w time elsewhere with an insurer who provides better rates and a higher agency Obvious decline in customer satis rating (2) The problem would occur within the accounting department as well as the company ratings due to people p their interest from Hallmark marketing department Average RR Template