Answered step by step

Verified Expert Solution

Question

1 Approved Answer

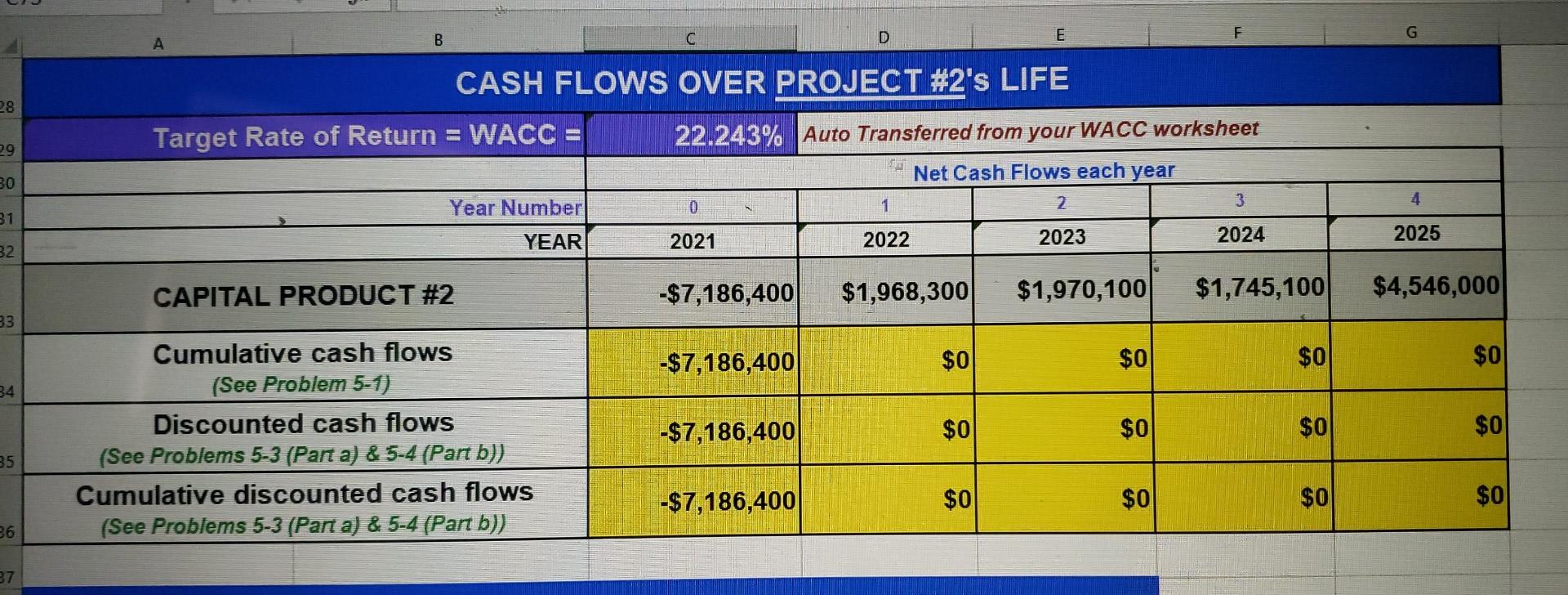

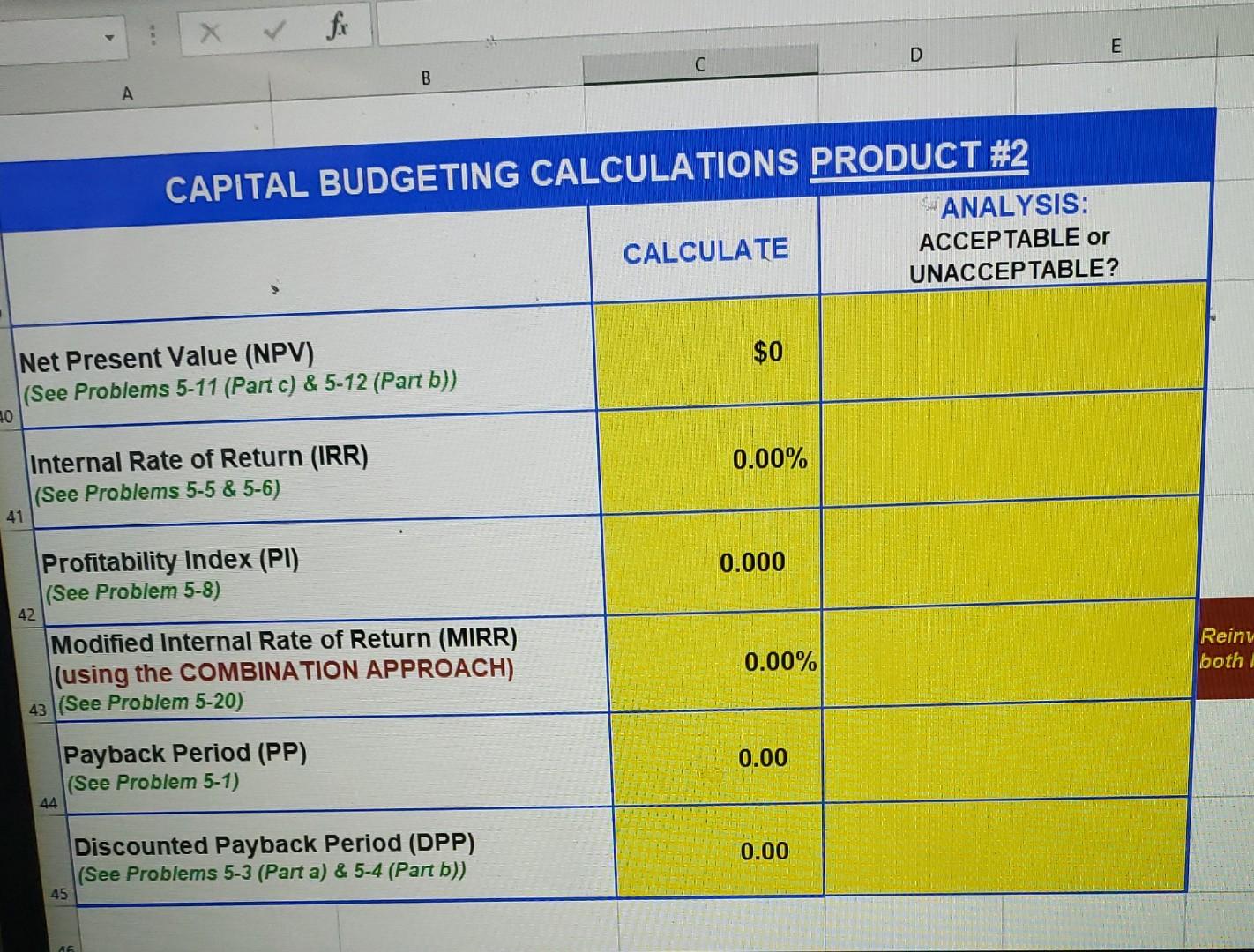

please complete both tables and show work please. will rate! B D E F G 28 CASH FLOWS OVER PROJECT #2's LIFE Target Rate of

please complete both tables and show work please. will rate!

B D E F G 28 CASH FLOWS OVER PROJECT #2's LIFE Target Rate of Return = WACC 22.243% Auto Transferred from your WACC worksheet 29 30 Net Cash Flows each year 2 3 Year Number 1 4 0 31 YEAR 2021 2022 2023 2024 2025 82 CAPITAL PRODUCT #2 -$7,186,400 $1,968,300 $1,970,100 $1,745,100 $4,546,000 33 -$7,186,400 $0 $0 $0 $0 84 -$7,186,400 $0 $0 $0 Cumulative cash flows (See Problem 5-1) Discounted cash flows (See Problems 5-3 (Part a) & 5-4 (Part b)) Cumulative discounted cash flows (See Problems 5-3 (Part a) & 5-4 (Part b)) $0 35 -$7,186,400 $0 $0 $0 $0 36 37 E D B CAPITAL BUDGETING CALCULATIONS PRODUCT #2 ANALYSIS: CALCULATE ACCEPTABLE or UNACCEPTABLE? $0 Net Present Value (NPV) (See Problems 5-11 (Parc) & 5-12 (Part b)) 40 0.00% Internal Rate of Return (IRR) (See Problems 5-5 & 5-6) 41 0.000 Profitability Index (PI) (See Problem 5-8) 42 Reiny both 0.00% Modified Internal Rate of Return (MIRR) (using the COMBINATION APPROACH) 43 (See Problem 5-20) 0.00 Payback Period (PP) (See Problem 5-1) 44 0.00 Discounted Payback Period (DPP) (See Problems 5-3 (Part a) & 5-4 (Part b)) 45Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started