Question

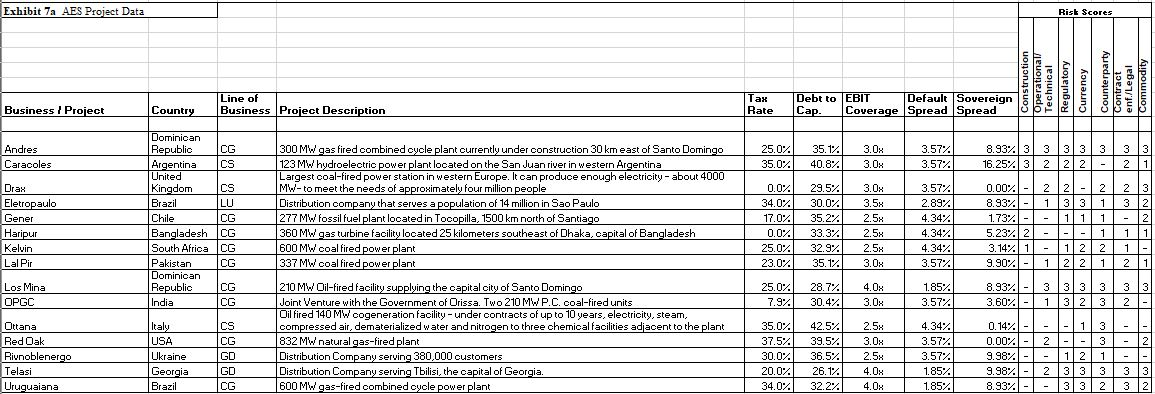

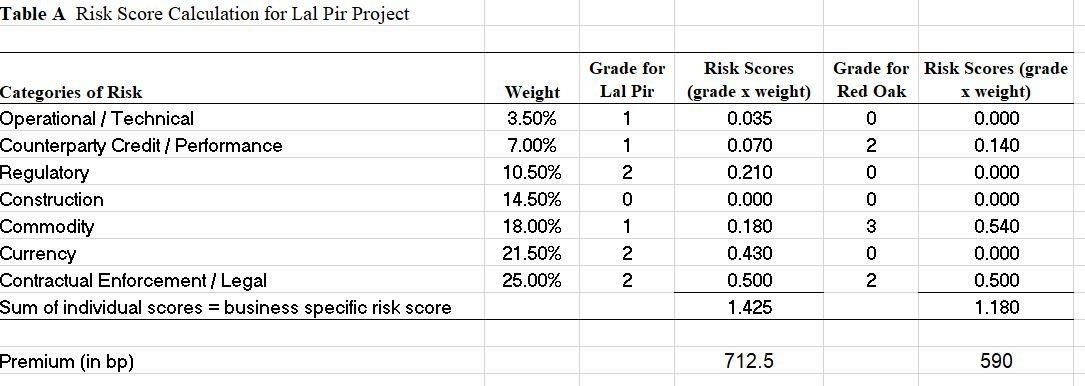

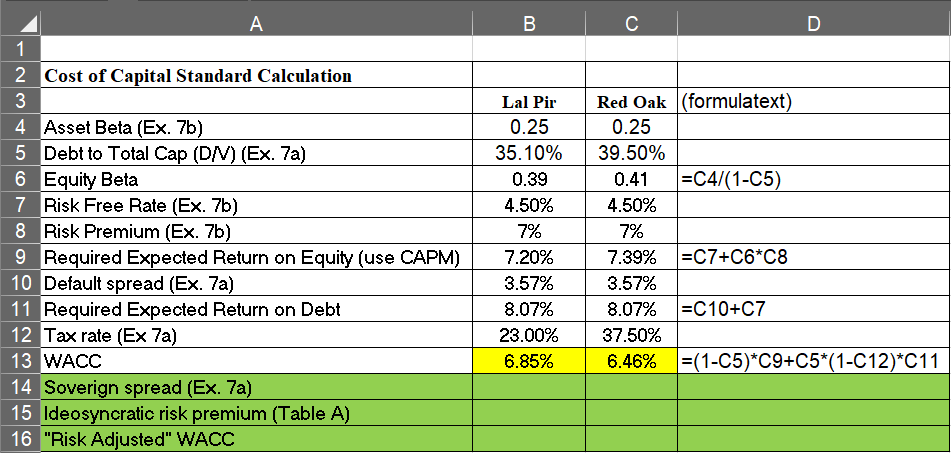

Please complete calculations for all 3 lines highlighted in green in Table 1, for Lal Pir and Red Oak below, using 2 tables below (table

Please complete calculations for all 3 lines highlighted in green in Table 1, for Lal Pir and Red Oak below, using 2 tables below (table A & table 7.a). Also please include formula text.

Table 7.a. looks small here, please right click and save to your computer to zoom in, or right click and open in new window to view. Thank you

Table 7.a. looks small here, please right click and save to your computer to zoom in, or right click and open in new window to view. Thank you

What more do you need? If you have less knowledge about this, why are you attempting to answering it and stopping others from viewing it that know how to?

Exhibit 7a AES Project Data Construction Operational Technical Regulatory Currency Counterparty Contract enf./Legal Commodity Business / Project Country Line of Business Project Description Tax Rate Debt to EBIT D efault Sovereign Cap. Coverage Spread Spread w w Andres Caracoles CG cs 25.0Z 35.02 35.12 40.82 3.0x 3.0x 3.572 3.572 8.937 16.25% 3 3 3 2 3 2 3 2 3 - 2 11 cs 3.5721 Drax Eletropaulo Gener Haripur Kelvin Lal Pir Dominican Republic Argentina United Kingdom Brazil Chile Bangladesh South Africa Pakistan Dominican Republic India 300 MW gas fired combined cycle plant currently under construction 30 km east of Santo Domingo 123 MW hydroelectric power plant located on the San Juan river in western Argentina Largest coal-fired power station in western Europe. It can produce enough electricity - about 4000 Mw-to meet the needs of approximately four million people Distribution company that serves a population of 14 million in Sao Paulo 277 MW fossil fuel plant located in Tocopilla, 1500 km north of Santiago 360 MW gas turbine facility located 25 kilometers southeast of Dhaka, capital of Bangladesh 600 MW coal fired power plant 337 MW coal fired power plant 0.02 34.02 17.02 0.0% 25.02 23.02 29.52 30.0% 35.22 33.3% 32.9% 35.12 3.0x 3.5x 2.5x 2.5x 2.5x 3.0x 0.002 - 2 2 - 2 8.937 - 1 3 3 1 1.732 - - 1 1 1 5.234 2 - - - 1 3.142 1 - 1 2 2 9.902 - 122 1 2.897 4.34% 4.342 4.34% 3.57% CG CG CG 2 3 3 2 - 2 1 1 1 - 2 1 3 31 2 - Los Mina OPGC CG CG 25.04. 7.9% 28.74 30.4% 4.0x 3.0x 1.85% 3.57% 8.93% - 3.604 - 3 1 3 3 3 2 3 3 Ottana CS Italy USA Ukraine Georgia Brazil Red Oak Rivnoblenergo Telasi Uruguaiana 210 MW Oil-fired facility supplying the capital citu of Santo Domingo Joint Venture with the Government of Orissa. Two 210 MW P.C. coal-fired units Oil fired 140 MW cogeneration facility - under contracts of up to 10 years, electricity, steam, compressed air, dematerialized water and nitrogen to three chemical facilities adjacent to the plant 832 MW natural gas-fired plant Distribution Company serving 380,000 customers Distribution Company serving Tbilisi, the capital of Georgia. 600 MW gas-fired combined cycle power plant GD 35.02 37.5% 30.02 20.02 34.02 42.5% 39.52 36.5% 26.12 32.22 2.5x 3.0x 2.5x 4.0x 4.0x 4.34% 3.572 3.572 1.85% 1.85% 0.142 - - - 1 3 - - 0.002 - 2 - - 3 - 2 9.984 - - 121-1- 9.984 - 2 3 3 3 3 3 8.932 - - 3 3 2 3 2 GO CG Table A Risk Score Calculation for Lal Pir Project Grade for Lal Pir 1 Categories of Risk Operational / Technical Counterparty Credit / Performance Regulatory Construction Commodity Currency Contractual Enforcement / Legal Sum of individual scores = business specific risk score Weight 3.50% 7.00% 10.50% 14.50% 18.00% 21.50% 25.00% NN +ON+ Risk Scores (grade x weight) 0.035 0.070 0.210 0.000 0.180 0.430 0.500 1.425 Grade for Risk Scores (grade Red Oak x weight) 0 0.000 2 0.140 0.000 0.000 0.540 0.000 0.500 1.180 NO WOO Premium (in bp) 712.5 590 - B . C | Lal Pir 0.25 35.10% 0.39 4.50% 7% 2 Cost of Capital Standard Calculation 3 4 Asset Beta (Ex. 7b) 5 Debt to Total Cap (DN) (Ex. 7a) 6 Equity Beta 7 Risk Free Rate (Ex. 7b) 8 Risk Premium (Ex. 7b) 9 Required Expected Return on Equity (use CAPM) 10 Default spread (Ex. 7a) 11 Required Expected Return on Debt 12 Tax rate (Ex 7a) 13 WACC 14 Soverign spread (Ex. 7a) 15 Ideosyncratic risk premium (Table A) 16 "Risk Adjusted" WACC Red Oak (formulatext) 0.25 39.50% 0.41 =C4/(1-C5) 4.50% 7% 7.39% =C7+C6*C8 3.57% 8.07% =C10+C7 37.50% 6.46% =(1-C5)*C9+C5*(1-C12)*C11 7.20% 3.57% 8.07% 23.00% 6.85%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started