Answered step by step

Verified Expert Solution

Question

1 Approved Answer

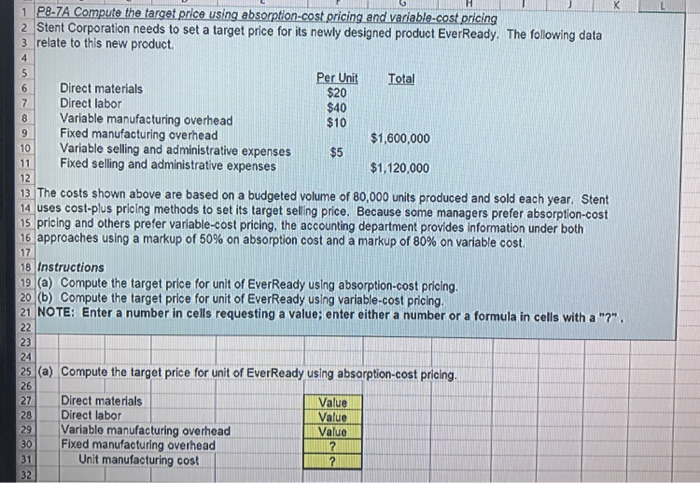

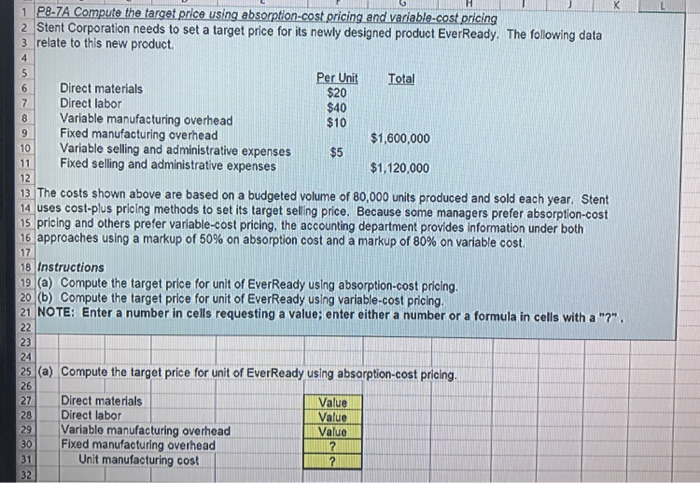

please complete each part and number 1 G H 1 P8-7A Compute the target price using absorption-cost pricing and variable-cost pricing 2 Stent Corporation needs

please complete each part and number 1

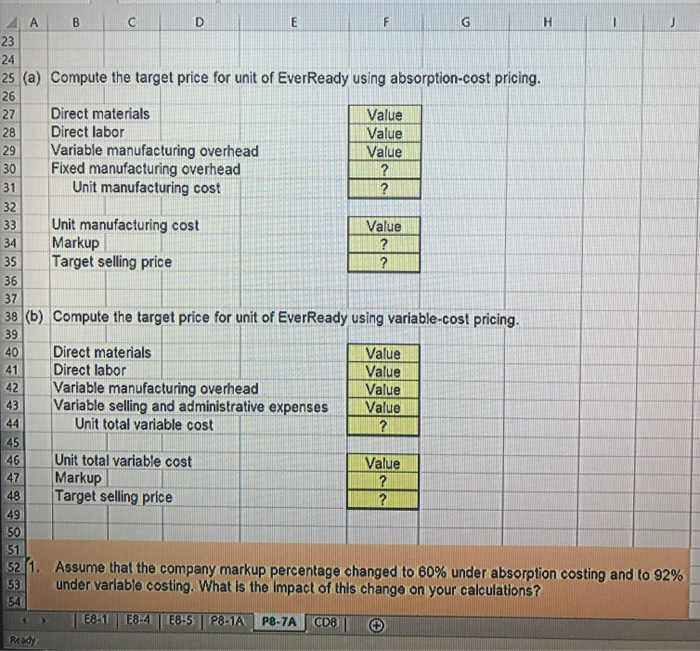

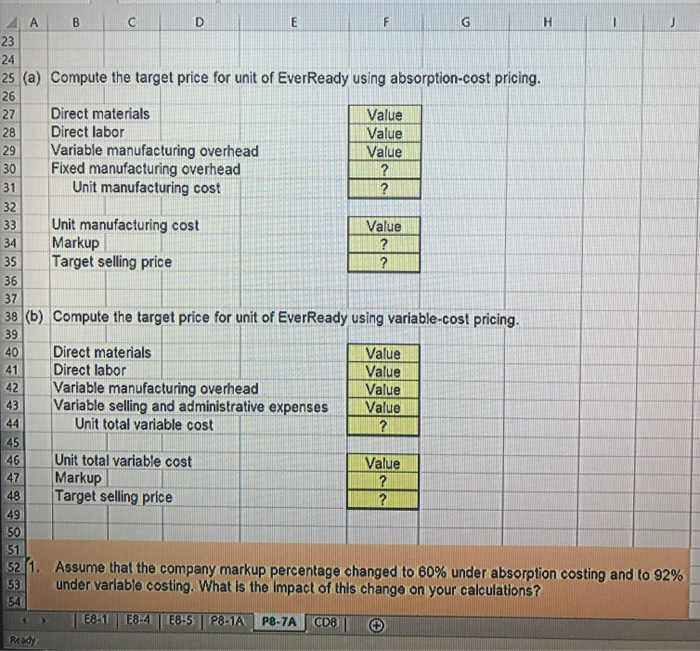

G H 1 P8-7A Compute the target price using absorption-cost pricing and variable-cost pricing 2 Stent Corporation needs to set a target price for its newly designed product EverReady. The following data 3 relate to this new product. Per Unit $20 Total $10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses 9 10 $1,600,000 $1,120,000 12 13. The costs shown above are based on a budgeted volume of 80,000 units produced and sold each year. Stent 14 uses cost-plus pricing methods to set its target selling price. Because some managers prefer absorption-cost 15 pricing and others prefer variable-cost pricing, the accounting department provides information under both 16 approaches using a markup of 50% on absorption cost and a markup of 80% on variable cost. 17 18 Instructions 19(a) Compute the target price for unit of EverReady using absorption-cost pricing. 20 (b) Compute the target price for unit of EverReady using variable-cost pricing. 21 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". 22 25 (a) Compute the target price for unit of EverReady using absorption-cost pricing. 27 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Value Value A B C D 25 (a) Compute the target price for unit of EverReady using absorption-cost pricing. Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Value Value Value Value Unit manufacturing cost Markup Target selling price 38 (b) Compute the target price for unit of EverReady using variable-cost pricing. Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expenses Unit total variable cost Value Value Value Value Value Unit total variable cost Markup Target selling price 52 1. Assume that the company markup percentage changed to 60% under absorption costing and to 92% 53 under variable costing. What is the impact of this change on your calculations? E81 E8- 468-5 PB-1AP8-7A CDL Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started