Answered step by step

Verified Expert Solution

Question

1 Approved Answer

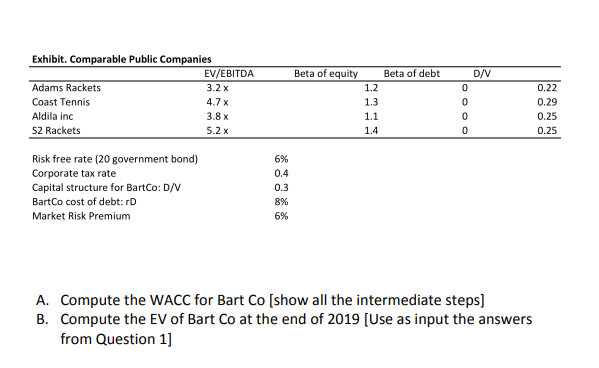

Please complete Excel Beta of equity Beta of debt D/V Exhibit. Comparable Public Companies EV/EBITDA Adams Rackets 3.2 x Coast Tennis 4.7 x Aldila inc

Please complete Excel

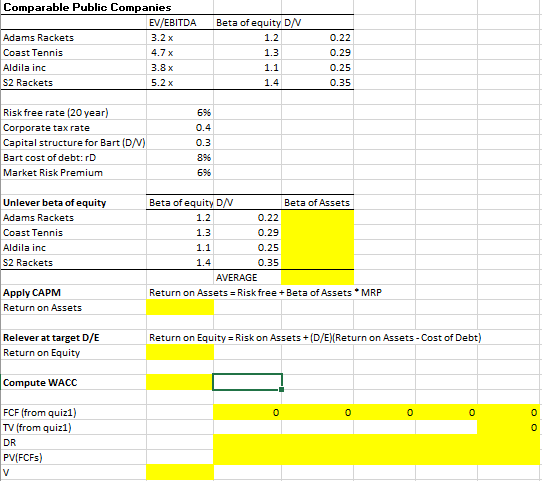

Beta of equity Beta of debt D/V Exhibit. Comparable Public Companies EV/EBITDA Adams Rackets 3.2 x Coast Tennis 4.7 x Aldila inc 3.8 x 52 Rackets 5.2 x 1.2 1.3 1.1 1.4 OOOO 0.22 0.29 0.25 0.25 Risk free rate (20 government bond) Corporate tax rate Capital structure for BartCo: D/V BartCo cost of debt: D Market Risk Premium 6% 0.4 0.3 8% 6% A. Compute the WACC for Bart Co (show all the intermediate steps] B. Compute the EV of Bart Co at the end of 2019 (Use as input the answers from Question 1] Comparable Public Companies EV/EBITDA Adams Rackets 3.2 x Coast Tennis 4.7 x Aldila inc 3.8 x S2 Rackets 5.2 x Beta of equity DN 1.2 1.3 1.1 1.4 0.22 0.29 0.25 0.35 Risk free rate (20 year) Corporate tax rate Capital structure for Bart (DN) Bart cost of debt: D Market Risk Premium 696 0.4 0.3 896 696 Unlever beta of equity Adams Rackets Coast Tennis Aldila inc S2 Rackets Beta of equity DN Beta of Assets 1.2 0.22 1.3 0.29 1.1 0.25 1.4 0.35 AVERAGE Return on Assets = Risk free + Beta of Assets * MRP Apply CAPM Return on Assets Return on Equity = Risk on Assets +(D/E)Return on Assets - Cost of Debt) Relever at target D/E Return on Equity Compute WACC 0 0 0 0 OO FCF (from quiz1) TV (from quiz1) DR PV(FCFS) v Beta of equity Beta of debt D/V Exhibit. Comparable Public Companies EV/EBITDA Adams Rackets 3.2 x Coast Tennis 4.7 x Aldila inc 3.8 x 52 Rackets 5.2 x 1.2 1.3 1.1 1.4 OOOO 0.22 0.29 0.25 0.25 Risk free rate (20 government bond) Corporate tax rate Capital structure for BartCo: D/V BartCo cost of debt: D Market Risk Premium 6% 0.4 0.3 8% 6% A. Compute the WACC for Bart Co (show all the intermediate steps] B. Compute the EV of Bart Co at the end of 2019 (Use as input the answers from Question 1] Comparable Public Companies EV/EBITDA Adams Rackets 3.2 x Coast Tennis 4.7 x Aldila inc 3.8 x S2 Rackets 5.2 x Beta of equity DN 1.2 1.3 1.1 1.4 0.22 0.29 0.25 0.35 Risk free rate (20 year) Corporate tax rate Capital structure for Bart (DN) Bart cost of debt: D Market Risk Premium 696 0.4 0.3 896 696 Unlever beta of equity Adams Rackets Coast Tennis Aldila inc S2 Rackets Beta of equity DN Beta of Assets 1.2 0.22 1.3 0.29 1.1 0.25 1.4 0.35 AVERAGE Return on Assets = Risk free + Beta of Assets * MRP Apply CAPM Return on Assets Return on Equity = Risk on Assets +(D/E)Return on Assets - Cost of Debt) Relever at target D/E Return on Equity Compute WACC 0 0 0 0 OO FCF (from quiz1) TV (from quiz1) DR PV(FCFS) vStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started