Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete in excel format. This process tells us where the change in value is going, but it sheds little light on where the change

Please complete in excel format.

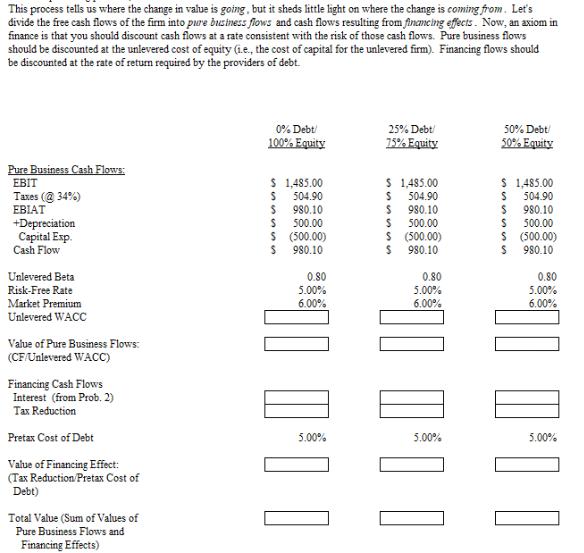

This process tells us where the change in value is going, but it sheds little light on where the change is coming from. Let's divide the free cash flows of the firm into pure business flows and cash flows resulting from financing effects. Now, an axiom in finance is that you should discount cash flows at a rate consistent with the risk of those cash flows. Pure business flows should be discounted at the unlevered cost of equity (i.e., the cost of capital for the unlevered firm). Financing flows should be discounted at the rate of return required by the providers of debt. Pure Business Cash Flows: EBIT Taxes (@34%) EBIAT +Depreciation Capital Exp. Cash Flow Unlevered Beta Risk-Free Rate Market Premium Unlevered WACC Value of Pure Business Flows: (CF/Unlevered WACC) Financing Cash Flows Interest (from Prob. 2) Tax Reduction Pretax Cost of Debt Value of Financing Effect: (Tax Reduction/Pretax Cost of Debt) Total Value (Sum of Values of Pure Business Flows and Financing Effects) 0% Debt/ 100% Equity $ 1,485.00 S 504.90 S 980.10 500.00 $ (500.00) 980.10 sss S 0.80 5.00% 6.00% 0 00 00 5.00% 25% Debt/ 75% Equity $ 1,485.00 S 504.90 S 980.10 S 500.00 $ (500.00) $ 980.10 0.80 5.00% 00 6.00% 5.00% 50% Debt 50% Equity $ 1,485.00 S S 504.90 980.10 S 500.00 S (500.00) S 980.10 0.80 5.00% 6.00% 00 00 0

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Since youre asking for assistance in completing a financial exercise in excel format which involves calculating the weighted average cost of capital WACC and the value of the business and financing ef...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started