Answered step by step

Verified Expert Solution

Question

1 Approved Answer

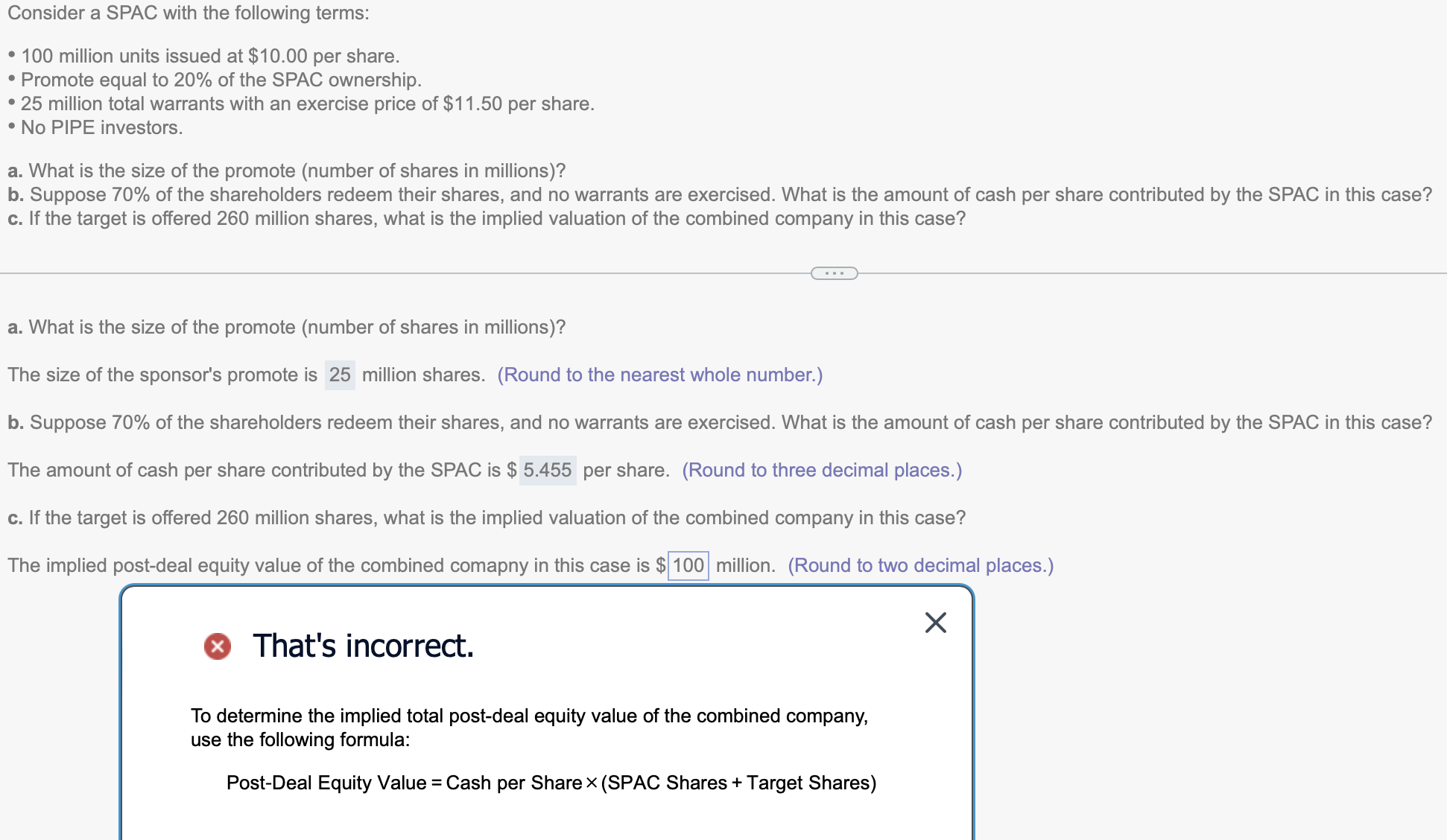

Please Complete letter C.) utilizing letters A.) and B.) if they are needed as they are both correct. Consider a SPAC with the following terms:

Please Complete letter C.) utilizing letters A.) and B.) if they are needed as they are both correct.

Consider a SPAC with the following terms: - 100 million units issued at $10.00 per share. - Promote equal to 20% of the SPAC ownership. - 25 million total warrants with an exercise price of $11.50 per share. - No PIPE investors. a. What is the size of the promote (number of shares in millions)? b. Suppose 70% of the shareholders redeem their shares, and no warrants are exercised. What is the amount of cash per share contributed by the SPAC in this case? c. If the target is offered 260 million shares, what is the implied valuation of the combined company in this case? a. What is the size of the promote (number of shares in millions)? The size of the sponsor's promote is million shares. (Round to the nearest whole number.) b. Suppose 70% of the shareholders redeem their shares, and no warrants are exercised. What is the amount of cash per share contributed by the SPAC in this case? The amount of cash per share contributed by the SPAC is $ per share. (Round to three decimal places.) c. If the target is offered 260 million shares, what is the implied valuation of the combined company in this case? The implied post-deal equity value of the combined comapny in this case is $ million. (Round to two decimal places.) That's incorrect. To determine the implied total post-deal equity value of the combined company, use the following formula: Post-Deal Equity Value = Cash per Share ( SPAC Shares + Target Shares )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started