Please complete letters B and C... Please show your work so I can understand how you got the answers! Thank you in advance.

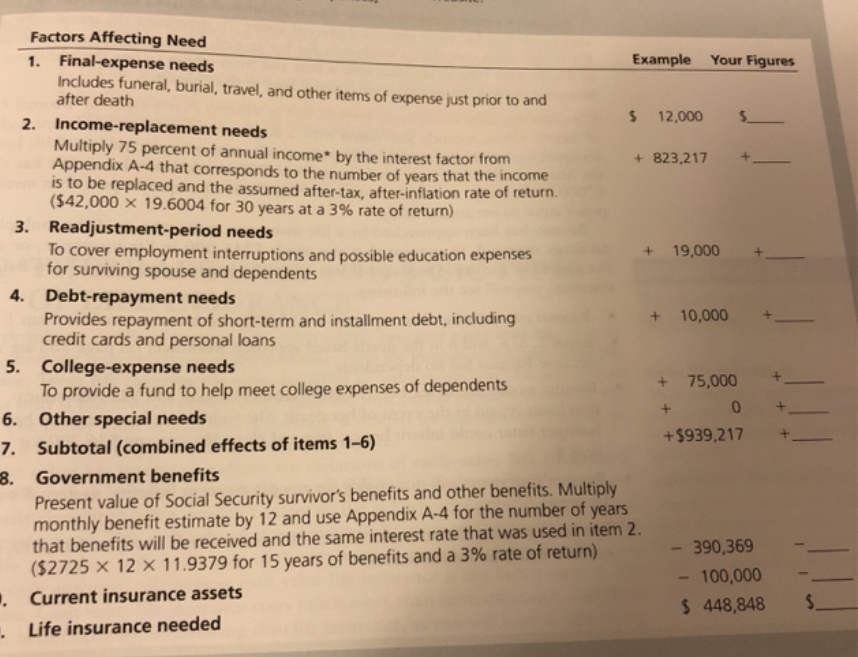

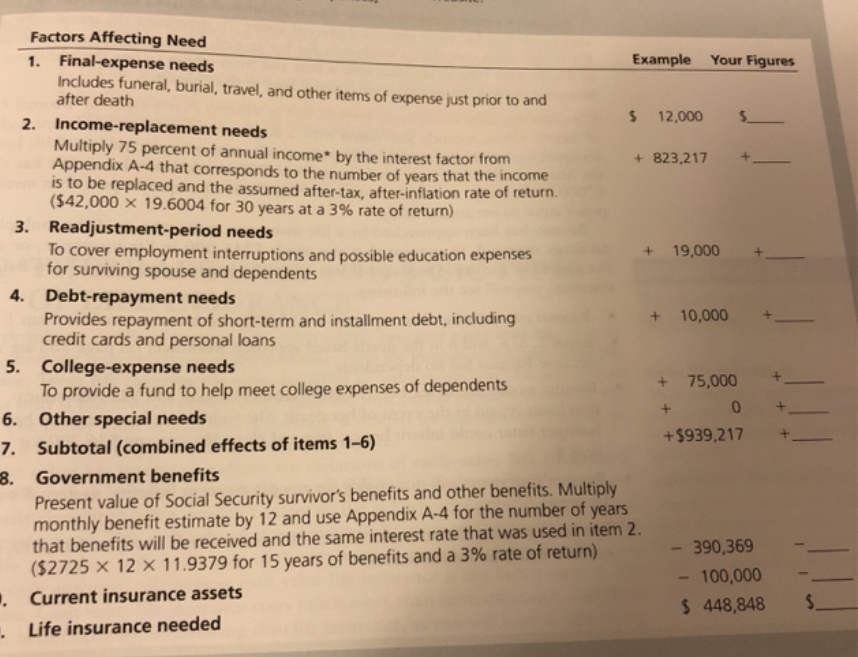

! CASE 1 The Johnsons Change Their Life Insurance Coverage Harry and Belinda Johnson spend $20 per month on life insurance in the form of a premium on a $10,000, paid-at-65 cash-value policy on Harry that his parents bought for him years ago. Belinda has a group term in surance policy from her employer with a face amount of $200,000. By choosing a group life insurance plan from his menu of employee benefits, Harry now has $100,000 of group term life insurance. Harry and Belinda have decided that, because they have no children, they could reduce their life insurance needs by protecting one an other's income for only four years, assuming the sur- vivor would be able to fend for himself or herself after that time. They also realize that their savings fund is so low that it would have no bearing on their life insurance needs. Harry and Belinda are basing their calculations on a projected 4 percent rate of return after taxes and infla- tion. They also estimate the following expenses: $15,000 for final expenses, $20,000 for readjustment expenses, and $5,000 for repayment of short-term debts. (a) Should the $3,000 interest earnings from Harry's trust fund be included in his annual income for the purposes of calculating the likely dollar loss if he were to die? (See the discussions about the Johnsons in Chapter 1 beginning on page 34.) Explain your response. (b) Based on your response to the previous question, how much more life insurance does Harry need? Use the Run the Numbers worksheet on page 366 to arrive at your answer. (c) Repeat the calculations to arrive at the additional life insurance needed on Belinda's life. (d) How might the Johnsons most economically meet any additional life insurance needs you have determined they may have? Factors Affecting Need 1. Final-expense needs Example Your Figures Includes funeral, burial, travel, and other items of expense just prior to and after death $ 12,000 Income-replacement needs Multiply 75 percent of annual income* by the interest factor from + 823,217 Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return (542,000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment period needs To cover employment interruptions and possible education expenses + 19,000 for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including + 10,000 credit cards and personal loans 5. College-expense needs + 75,000 To provide a fund to help meet college expenses of dependents + 0 6. Other special needs +$939,217 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. - 390,369 ($2725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) - 100,000 Current insurance assets $ 448,848 Life insurance needed + + + ! CASE 1 The Johnsons Change Their Life Insurance Coverage Harry and Belinda Johnson spend $20 per month on life insurance in the form of a premium on a $10,000, paid-at-65 cash-value policy on Harry that his parents bought for him years ago. Belinda has a group term in surance policy from her employer with a face amount of $200,000. By choosing a group life insurance plan from his menu of employee benefits, Harry now has $100,000 of group term life insurance. Harry and Belinda have decided that, because they have no children, they could reduce their life insurance needs by protecting one an other's income for only four years, assuming the sur- vivor would be able to fend for himself or herself after that time. They also realize that their savings fund is so low that it would have no bearing on their life insurance needs. Harry and Belinda are basing their calculations on a projected 4 percent rate of return after taxes and infla- tion. They also estimate the following expenses: $15,000 for final expenses, $20,000 for readjustment expenses, and $5,000 for repayment of short-term debts. (a) Should the $3,000 interest earnings from Harry's trust fund be included in his annual income for the purposes of calculating the likely dollar loss if he were to die? (See the discussions about the Johnsons in Chapter 1 beginning on page 34.) Explain your response. (b) Based on your response to the previous question, how much more life insurance does Harry need? Use the Run the Numbers worksheet on page 366 to arrive at your answer. (c) Repeat the calculations to arrive at the additional life insurance needed on Belinda's life. (d) How might the Johnsons most economically meet any additional life insurance needs you have determined they may have? Factors Affecting Need 1. Final-expense needs Example Your Figures Includes funeral, burial, travel, and other items of expense just prior to and after death $ 12,000 Income-replacement needs Multiply 75 percent of annual income* by the interest factor from + 823,217 Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return (542,000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment period needs To cover employment interruptions and possible education expenses + 19,000 for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including + 10,000 credit cards and personal loans 5. College-expense needs + 75,000 To provide a fund to help meet college expenses of dependents + 0 6. Other special needs +$939,217 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. - 390,369 ($2725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) - 100,000 Current insurance assets $ 448,848 Life insurance needed + + +