Question

Please complete part C, D,E (the answers to part A and B are posted below) answers to A and B: a) In equilibrium in IS

Please complete part C, D,E (the answers to part A and B are posted below)

answers to A and B:

a)

In equilibrium in IS - LM curve, for equililibrium

Money demanded must be equal to money invested

Therefore, 12.25 +0,5Y -550r =36.25 - 250r

=> 0.5Y = 24 +250r

=> Y = 2(24 +250r) = 48 + 500r

Now, Aggregate Demand AD = Y = C +I + G

= 21.6 +0.7(Y- T) -300r +36.25 - 250r + G

=57.85 -550r +G +0.7(Y- T)

=> Y = 57.85 -550r +G +0.7Y -0.7T

=> 0.3Y =57.85 -550r -0.7T +G

=> Y ={57.85-550r -0.7T+ G)10/3

Answer (b)

Now G= 10 , T = 8, we put their value in AD

We get Y = {57.85-550r -0.7T+ G)}10/3

= {57.85 -550r - 0.7x8 + 10}10/3

= {57.85 -550r - 5.6 +10}10/3

=(62.25-550r) 10/3

Now we can equate this Ad with Y of money demand we get

(48 + 500r)3 = 622.5 -5500r

=> 144 + 1500r = 622.5 -5500r

=> 7000r = 478.5

=> r =478.5/7000 = 0.068357

Rate of return is 6.8 percent

Therefore Y = 48 + 500r = 48 + 500x0.068 =48 + 34 = 82

Now C = 21.6 + 0.7(Y- T) - 300r

Put value of Y, t and r, we get

C = 21.6 +0.7(82 - 8) - 300r

= 21.6 + 0.7x74 - 300x0.068

=21.6 +51.8 - 20.4

= 53

Now I = 36.25 - 250r

= 36.25 - 250x0.068

= 36.25 - 17

= 19.25

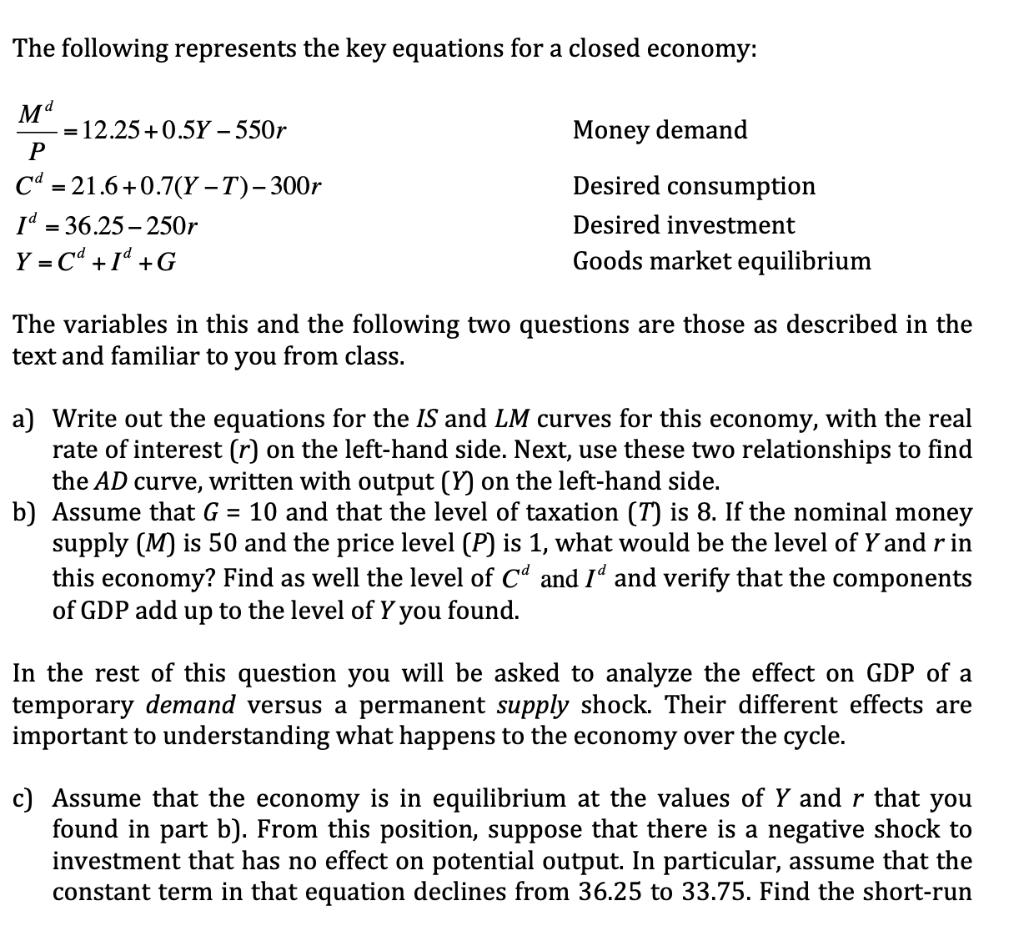

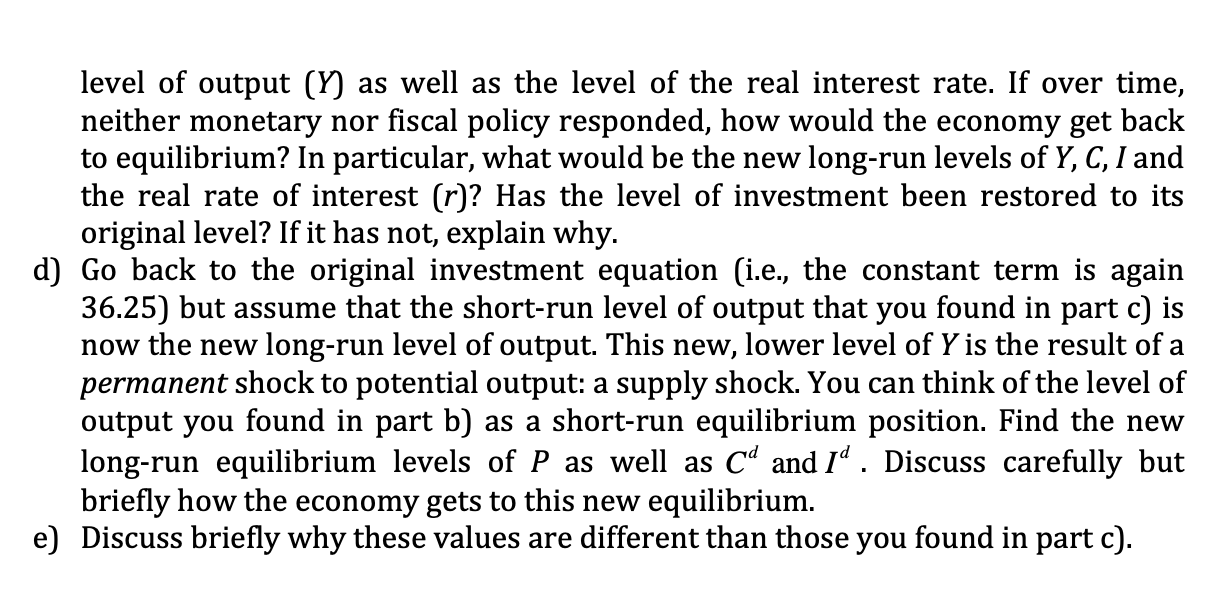

The following represents the key equations for a closed economy: Ma Money demand = 12.25 +0.5Y - 550r P Cd = 21.6+0.7(Y T)-300r Id = 36.25 250r Y=Cd + Id +G Desired consumption Desired investment Goods market equilibrium The variables in this and the following two questions are those as described in the text and familiar to you from class. a) Write out the equations for the IS and LM curves for this economy, with the real rate of interest (r) on the left-hand side. Next, use these two relationships to find the AD curve, written with output (Y) on the left-hand side. b) Assume that G = 10 and that the level of taxation (T) is 8. If the nominal money supply (M) is 50 and the price level (P) is 1, what would be the level of Y and rin this economy? Find as well the level of cd and I' and verify that the components of GDP add up to the level of Y you found. In the rest of this question you will be asked to analyze the effect on GDP of a temporary demand versus a permanent supply shock. Their different effects are important to understanding what happens to the economy over the cycle. c) Assume that the economy is in equilibrium at the values of Y and r that you found in part b). From this position, suppose that there is a negative shock to investment that has no effect on potential output. In particular, assume that the constant term in that equation declines from 36.25 to 33.75. Find the short-run level of output (Y) as well as the level of the real interest rate. If over time, neither monetary nor fiscal policy responded, how would the economy get back to equilibrium? In particular, what would be the new long-run levels of Y, C, I and the real rate of interest (r)? Has the level of investment been restored to its original level? If it has not, explain why. d) Go back to the original investment equation (i.e., the constant term is again 36.25) but assume that the short-run level of output that you found in part c) is now the new long-run level of output. This new, lower level of Y is the result of a permanent shock to potential output: a supply shock. You can think of the level of output you found in part b) as a short-run equilibrium position. Find the new long-run equilibrium levels of P as well as cd and Id. Discuss carefully but briefly how the economy gets to this new equilibrium. e) Discuss briefly why these values are different than those you found in part c). The following represents the key equations for a closed economy: Ma Money demand = 12.25 +0.5Y - 550r P Cd = 21.6+0.7(Y T)-300r Id = 36.25 250r Y=Cd + Id +G Desired consumption Desired investment Goods market equilibrium The variables in this and the following two questions are those as described in the text and familiar to you from class. a) Write out the equations for the IS and LM curves for this economy, with the real rate of interest (r) on the left-hand side. Next, use these two relationships to find the AD curve, written with output (Y) on the left-hand side. b) Assume that G = 10 and that the level of taxation (T) is 8. If the nominal money supply (M) is 50 and the price level (P) is 1, what would be the level of Y and rin this economy? Find as well the level of cd and I' and verify that the components of GDP add up to the level of Y you found. In the rest of this question you will be asked to analyze the effect on GDP of a temporary demand versus a permanent supply shock. Their different effects are important to understanding what happens to the economy over the cycle. c) Assume that the economy is in equilibrium at the values of Y and r that you found in part b). From this position, suppose that there is a negative shock to investment that has no effect on potential output. In particular, assume that the constant term in that equation declines from 36.25 to 33.75. Find the short-run level of output (Y) as well as the level of the real interest rate. If over time, neither monetary nor fiscal policy responded, how would the economy get back to equilibrium? In particular, what would be the new long-run levels of Y, C, I and the real rate of interest (r)? Has the level of investment been restored to its original level? If it has not, explain why. d) Go back to the original investment equation (i.e., the constant term is again 36.25) but assume that the short-run level of output that you found in part c) is now the new long-run level of output. This new, lower level of Y is the result of a permanent shock to potential output: a supply shock. You can think of the level of output you found in part b) as a short-run equilibrium position. Find the new long-run equilibrium levels of P as well as cd and Id. Discuss carefully but briefly how the economy gets to this new equilibrium. e) Discuss briefly why these values are different than those you found in part c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started