Please complete requirements 2,3, and 4.

Please complete requirements 2,3, and 4.

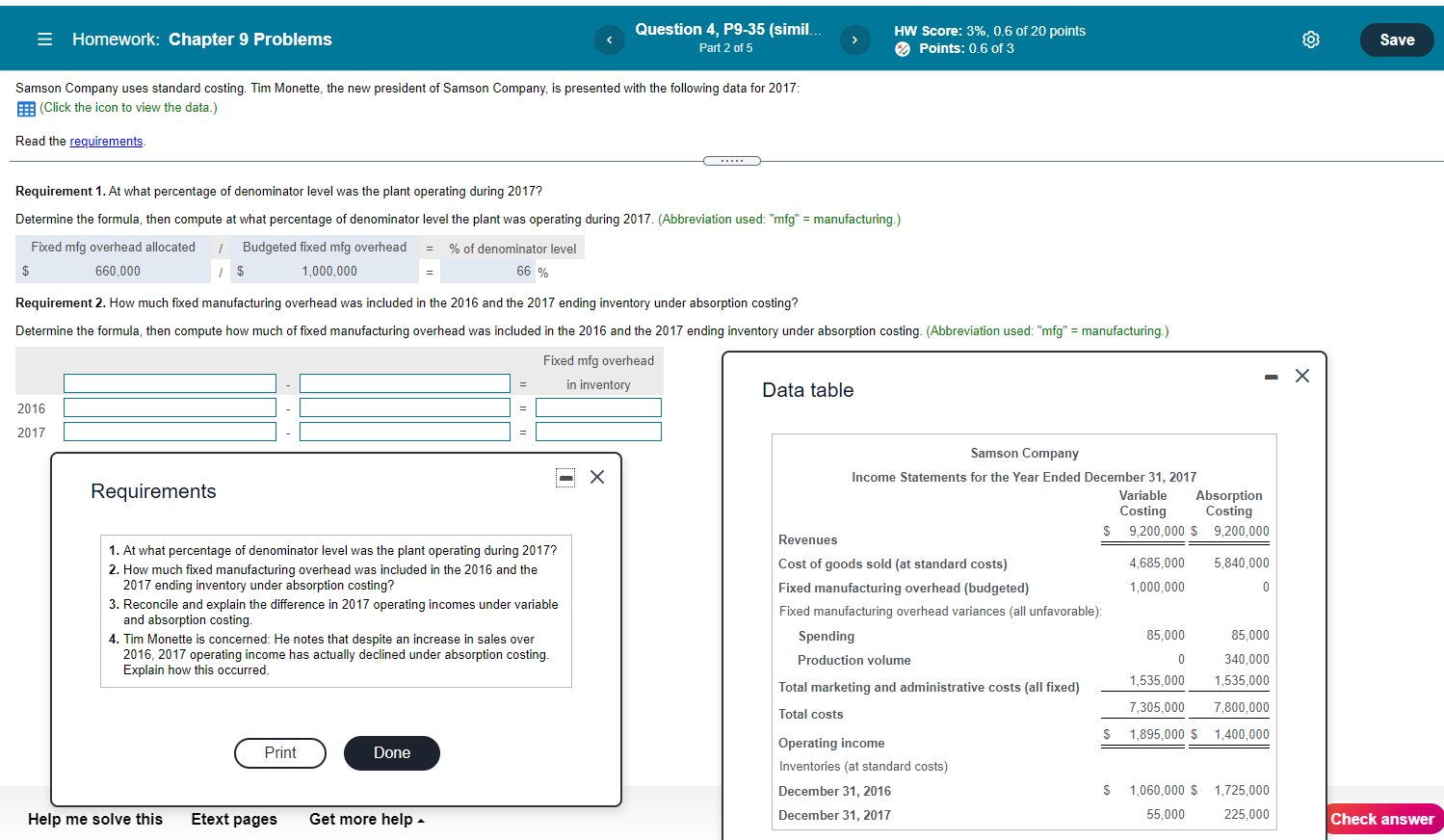

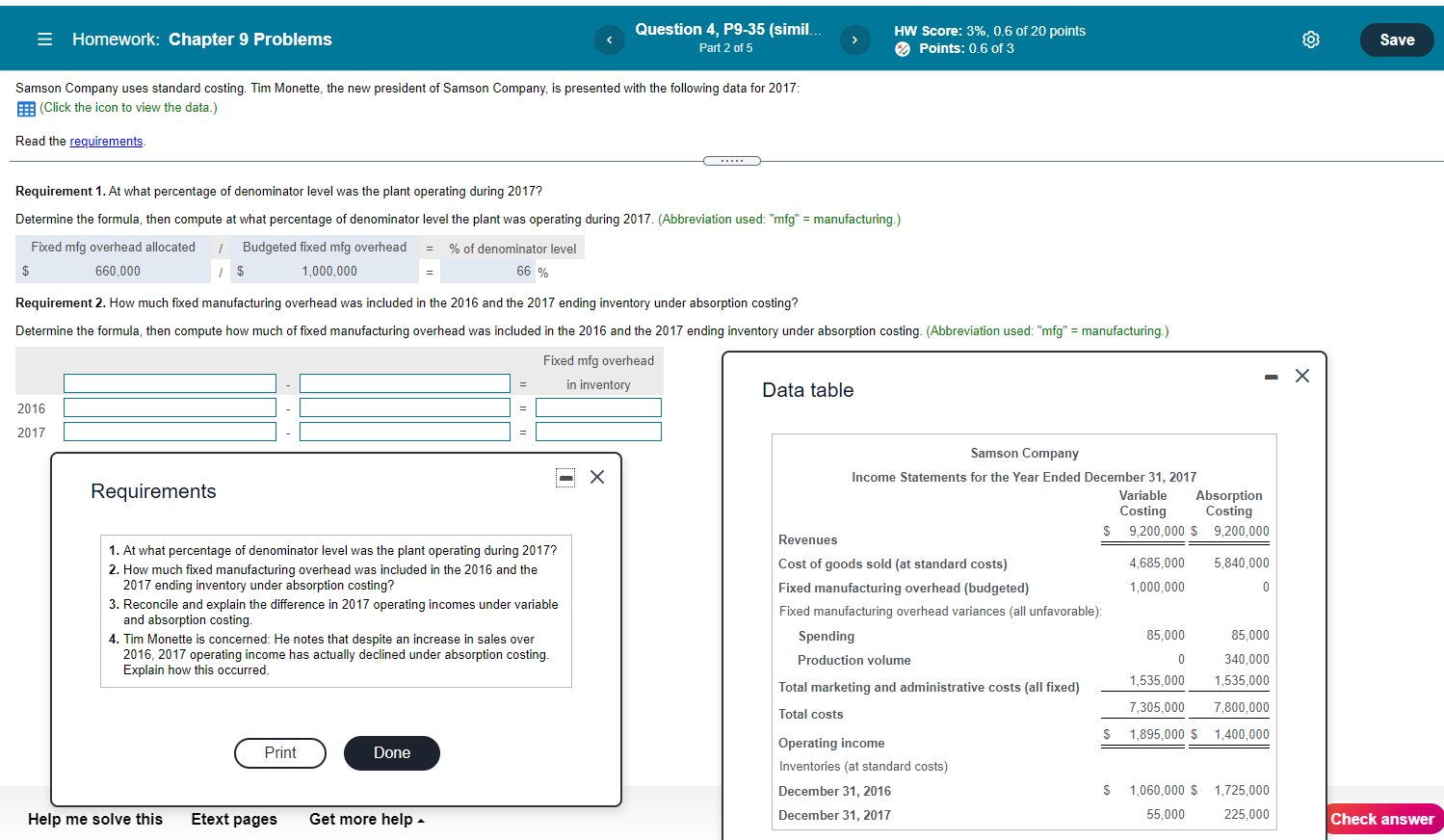

Homework: Chapter 9 Problems Question 4, P9-35 (simil. Part 2 of 5 HW Score: 3%, 0.6 of 20 points Points: 0.6 of 3 Save Samson Company uses standard costing. Tim Monette, the new president of Samson Company, is presented with the following data for 2017: (Click the icon to view the data.) Read the requirements Requirement 1. At what percentage of denominator level was the plant operating during 2017? Determine the formula, then compute at what percentage of denominator level the plant was operating during 2017. (Abbreviation used: "mfg" = manufacturing.) Fixed mfg overhead allocated 1 Budgeted fixed mfg overhead % of denominator level $ 660,000 1 $ 1,000,000 66 % = Requirement 2. How much fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing? Determine the formula, then compute how much of fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing. (Abbreviation used: "mfg" = manufacturing.) Fixed mfg overhead in inventory Data table 2016 2017 X Requirements 1. At what percentage of denominator level was the plant operating during 2017? 2. How much fixed manufacturing overhead was included in the 2016 and the 2017 ending inventory under absorption costing? 3. Reconcile and explain the difference in 2017 operating incomes under variable and absorption costing 4. Tim Monette is concerned: He notes that despite an increase in sales over 2016, 2017 operating income has actually declined under absorption costing. Explain how this occurred. Samson Company Income Statements for the Year Ended December 31, 2017 Variable Absorption Costing Costing S 9,200,000 $ 9,200,000 Revenues Cost of goods sold (at standard costs) 4,685,000 5,840,000 Fixed manufacturing overhead (budgeted) 1,000,000 0 Fixed manufacturing overhead variances (all unfavorable): Spending 85.000 85,000 Production volume 0 340,000 1,535,000 1,535,000 Total marketing and administrative costs (all fixed) Total costs 7,305,000 7,800,000 $ 1,895,000 $ 1,400,000 Operating income Inventories (at standard costs) December 31, 2016 S 1,060,000 $ 1,725,000 December 31, 2017 55,000 225,000 Print Done Help me solve this Etext pages Get more help Check

Please complete requirements 2,3, and 4.

Please complete requirements 2,3, and 4.