Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete task 5 with full workings, all content info needed is here. Fenton Ltd - continued: The finance office (cost and management accounts) recently

please complete task 5 with full workings, all content info needed is here.

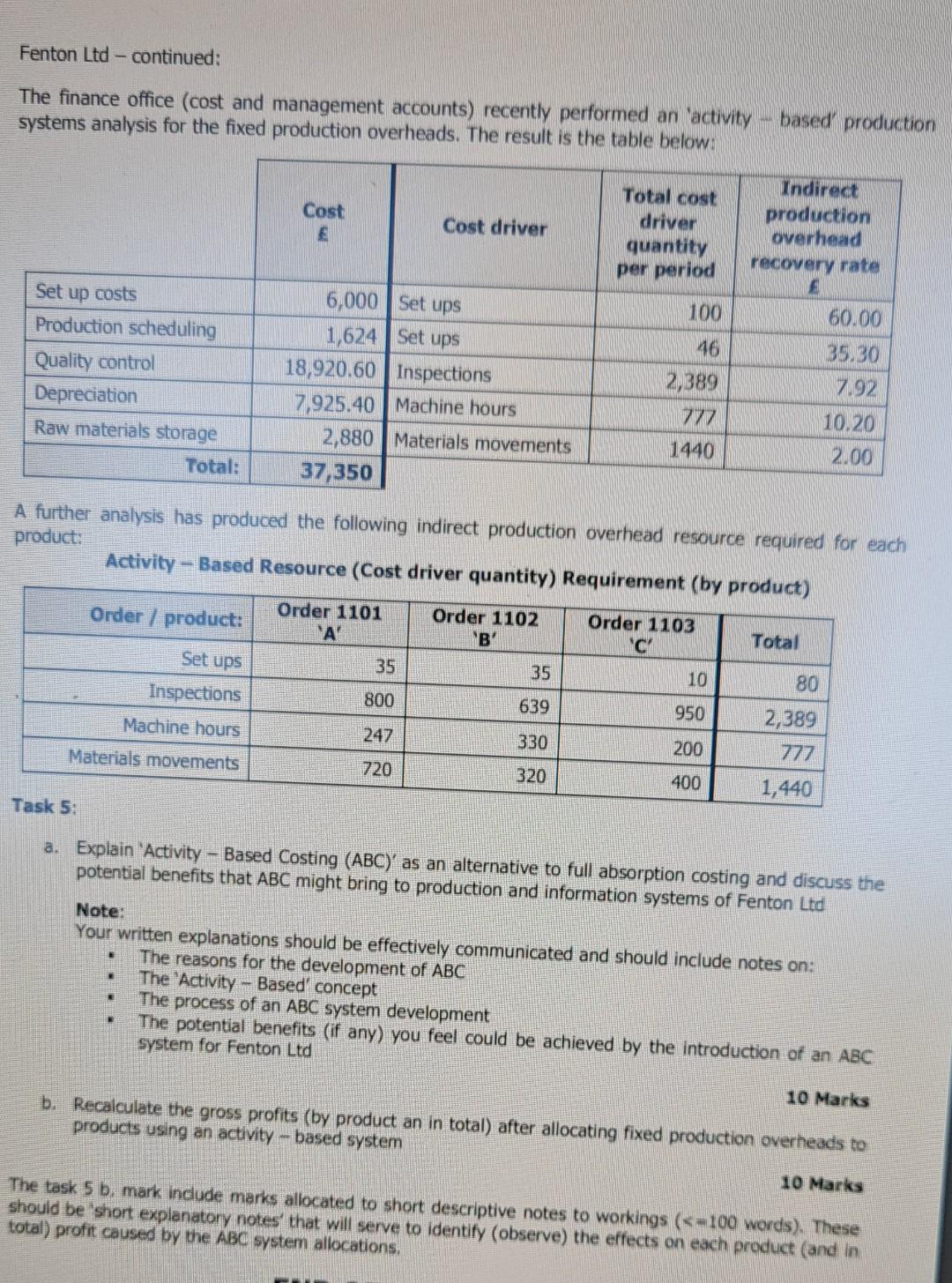

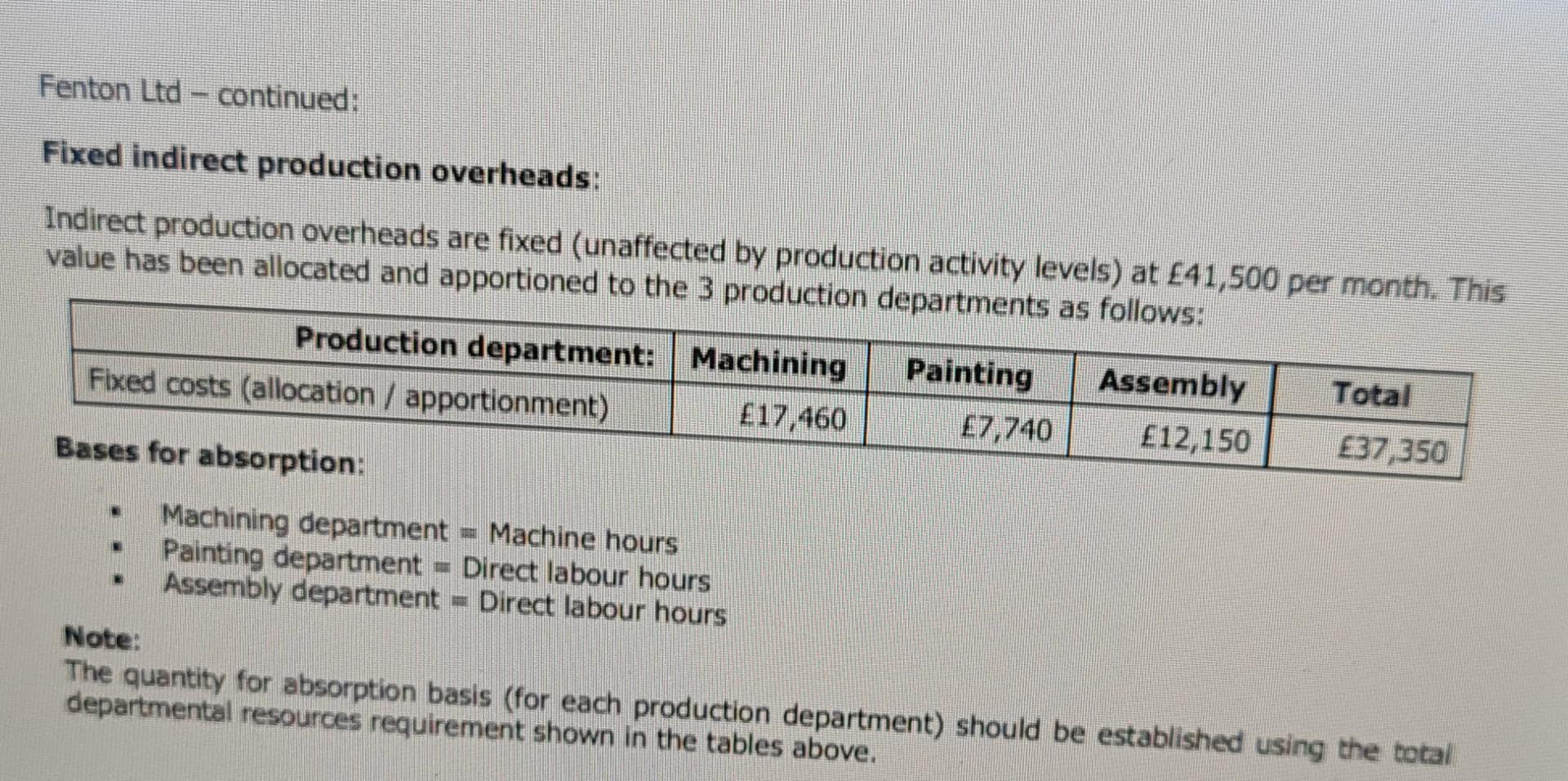

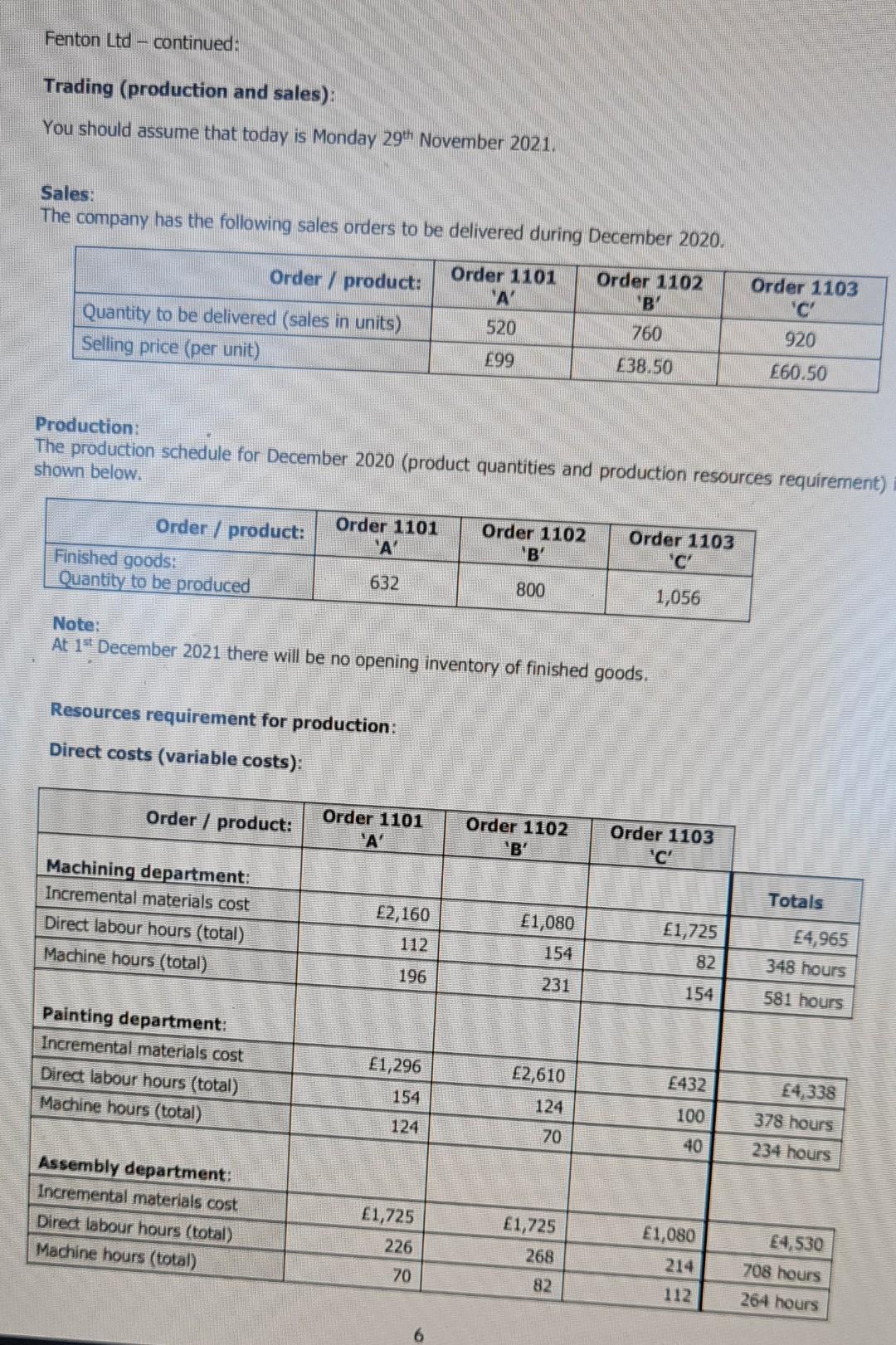

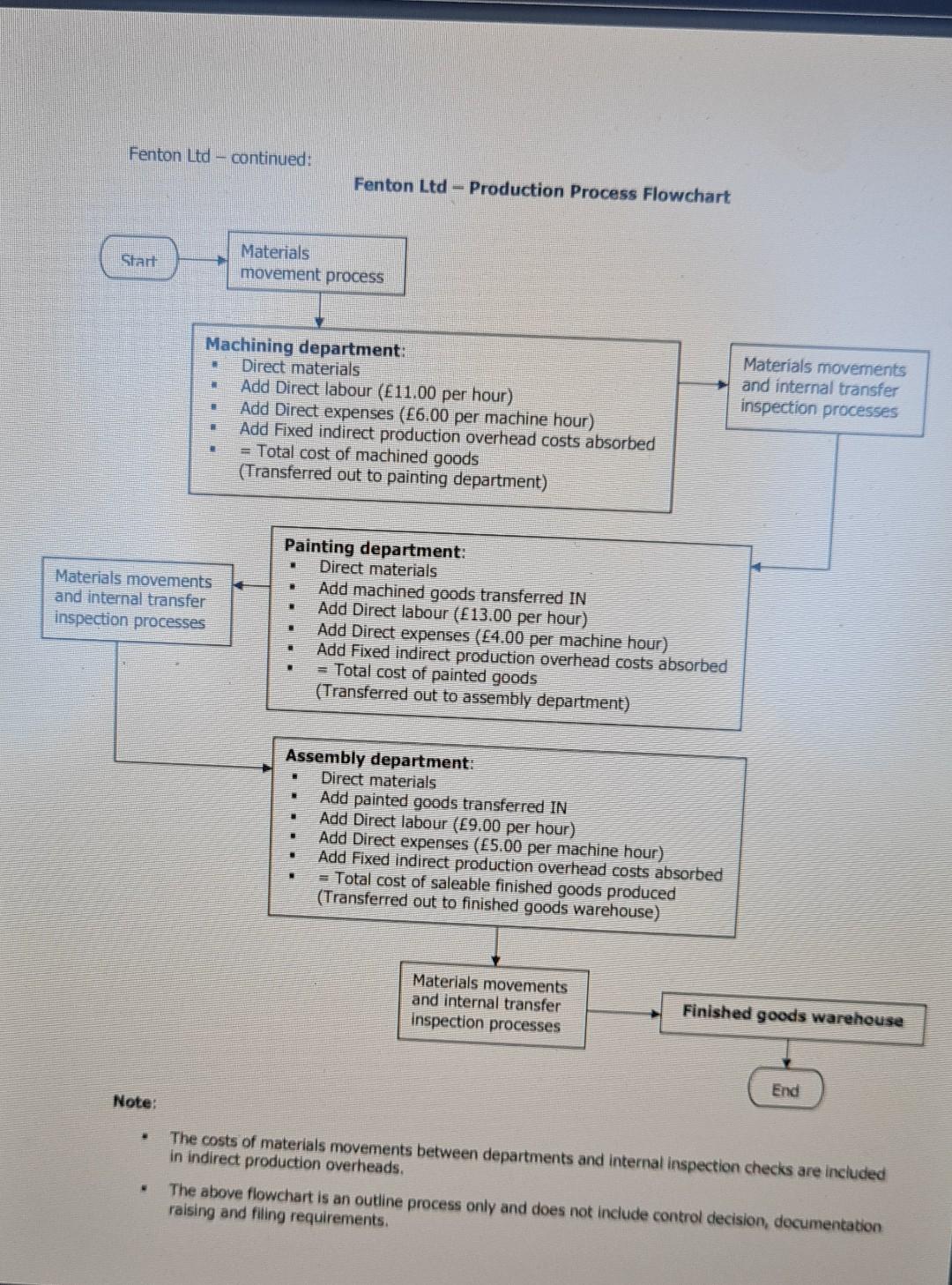

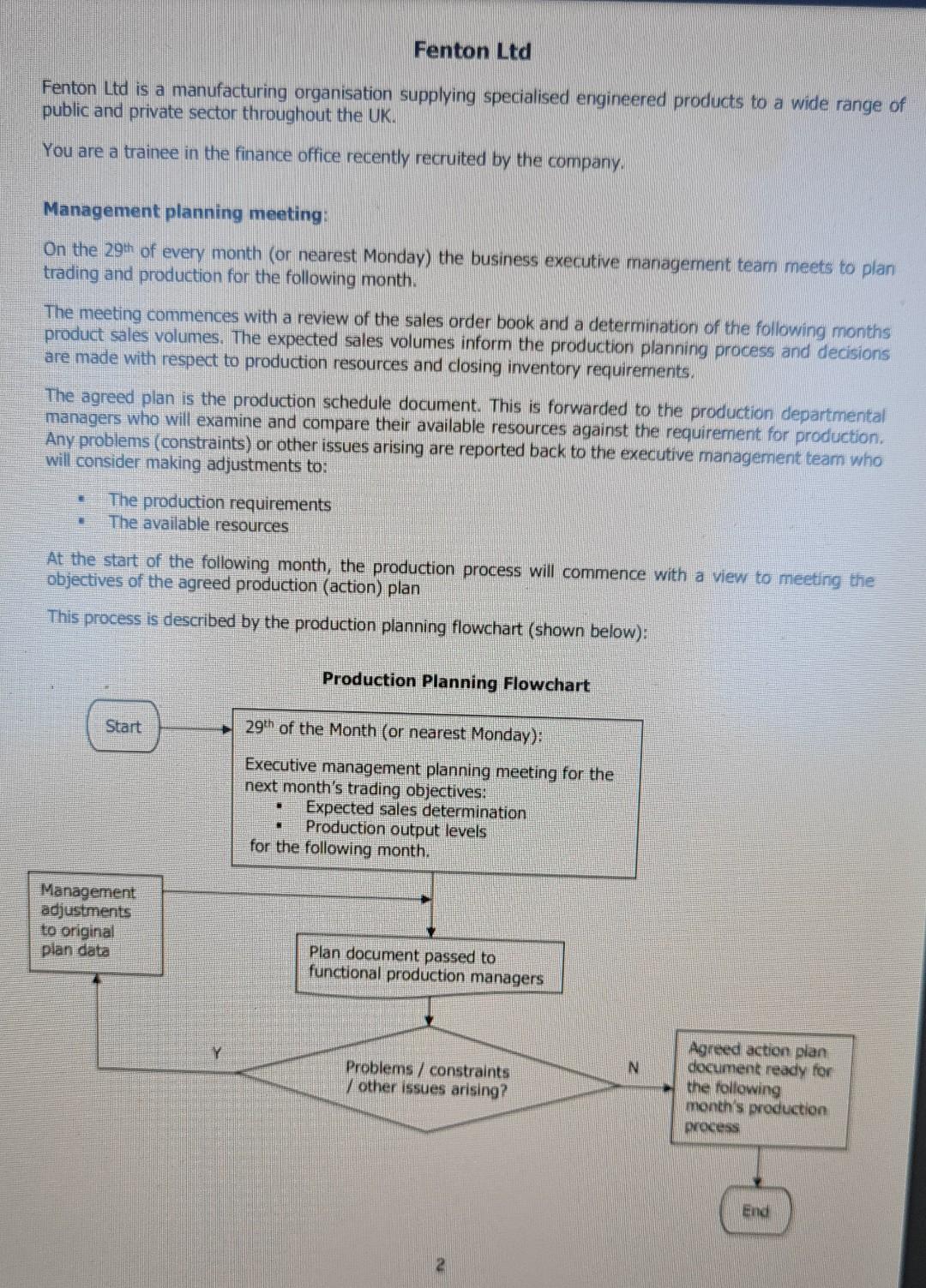

Fenton Ltd - continued: The finance office (cost and management accounts) recently performed an activity systems analysis for the fixed production overheads. The result is the table below: based production Cost Total cost driver Cost driver Indirect production overhead recovery rate quantity per period 100 Set up costs Production scheduling Quality control Depreciation Raw materials storage Total: 6,000 Set ups 1,624 Set ups 18,920.60 Inspections 7,925.40 Machine hours 2,880 Materials movements 37,350 46 2,389 777 60.00 35.30 7.92 10.20 2.00 1440 A further analysis has produced the following indirect production overhead resource required for each product: Activity Based Resource (Cost driver quantity) Requirement (by product) Order / product: Order 1101 Order 1102 Order 1103 B C Total 35 35 10 80 Inspections 800 639 950 2,389 Machine hours 247 330 200 777 Materials movements 720 320 400 1,440 Task 5: Set ups a. Explain 'Activity Based Costing (ABC) as an alternative to full absorption costing and discuss the potential benefits that ABC might bring to production and information systems of Fenton Ltd Note: Your written explanations should be effectively communicated and should include notes on: The reasons for the development of ABC The 'Activity Based' concept The process of an ABC system development The potential benefits (if any) you feel could be achieved by the introduction of an ABC system for Fenton Ltd 10 Marks b. Recalculate the gross profits (by product an in total) after allocating fixed production overheads to products using an activity based system 10 Marks The task 5 b, mark indude marks allocated to short descriptive notes to workings (-100 words). These should be short explanatory notes' that will serve to identify (observe) the effects on each product (and in total) profit caused by the ABC system allocations, Fenton Ltd - continued: Fixed indirect production overheads: Indirect production overheads are fixed (unaffected by production activity levels) at 41,500 per month. This value has been allocated and apportioned to the 3 production departments as follows: Production department: Machining Fixed costs (allocation / apportionment) 17,460 Painting 7,740 Assembly 12,150 Total 37,350 Bases for absorption: Machining department - Machine hours Painting department Direct labour hours Assembly department - Direct labour hours Note: The quantity for absorption basis (for each production department) should be established using the total departmental resources requirement shown in the tables above. Fenton Ltd continued: Trading (production and sales). You should assume that today is Monday 29th November 2021, Sales: The company has the following sales orders to be delivered during December 2020, Order / product: Order 1101 'A 520 Quantity to be delivered (sales in units) Selling price (per unit) Order 1102 B 760 Order 1103 'C' 920 99 38.50 60.50 Production: The production schedule for December 2020 (product quantities and production resources requirement) shown below. Order / product: Finished goods: Quantity to be produced Order 1101 'A Order 1102 'B' Order 1103 'C 632 800 1,056 Note: At 19 December 2021 there will be no opening inventory of finished goods. Resources requirement for production: Direct costs (variable costs): Order / product: Order 1101 'A' Order 1102 Order 1103 'C' Totals Machining department: Incremental materials cost Direct labour hours (total) Machine hours (total) 2,160 112 1,080 1,725 154 4,965 348 hours 82 196 231 154 581 hours Painting department: Incremental materials cost Direct labour hours (total) Machine hours (total) 1,296 2,610 124 432 154 4,338 124 70 100 40 378 hours 234 hours Assembly department: Incremental materials cost Direct labour hours (total) Machine hours (total) 1,725 226 1,725 1,080 214 4,530 268 82 70 708 hours 264 hours 112 6 Fenton Ltd - continued: Fenton Ltd - Production Process Flowchart Start Materials movement process Machining department: Direct materials Add Direct labour (11.00 per hour) Add Direct expenses (6.00 per machine hour) Add Fixed indirect production overhead costs absorbed - Total cost of machined goods (Transferred out to painting department) Materials movements and internal transfer inspection processes Materials movements and internal transfer inspection processes Painting department: Direct materials Add machined goods transferred IN Add Direct labour (13.00 per hour) Add Direct expenses (4.00 per machine hour) Add Fixed indirect production overhead costs absorbed = Total cost of painted goods (Transferred out to assembly department) 3 Assembly department: Direct materials Add painted goods transferred IN Add Direct labour (9.00 per hour) Add Direct expenses (5.00 per machine hour) Add Fixed indirect production overhead costs absorbed = Total cost of saleable finished goods produced (Transferred out to finished goods warehouse) Materials movements and internal transfer Inspection processes Finished goods warehouse End Note: The costs of materials movements between departments and internal inspection checks are included in indirect production overheads. The above flowchart is an outline process only and does not include control decision, documentation raising and filing requirements. Fenton Ltd Fenton Ltd is a manufacturing organisation supplying specialised engineered products to a wide range of public and private sector throughout the UK. You are a trainee in the finance office recently recruited by the company. Management planning meeting: On the 29th of every month (or nearest Monday) the business executive management team meets to plan trading and production for the following month. The meeting commences with a review of the sales order book and a determination of the following months product sales volumes. The expected sales volumes inform the production planning process and decisions are made with respect to production resources and closing inventory requirements, The agreed plan is the production schedule document. This is forwarded to the production departmental managers who will examine and compare their available resources against the requirement for production. Any problems (constraints) or other issues arising are reported back to the executive management team who will consider making adjustments to: E The production requirements The available resources At the start of the following month, the production process will commence with a view to meeting the objectives of the agreed production (action) plan This process is described by the production planning flowchart (shown below): Production Planning Flowchart Start 29th of the Month (or nearest Monday): Executive management planning meeting for the next month's trading objectives: Expected sales determination Production output levels for the following month. 3 Management adjustments to original plan data Plan document passed to functional production managers Y N Problems / constraints / other issues arising? Agreed action plan document ready for the following month's production process End Fenton Ltd - continued: The finance office (cost and management accounts) recently performed an activity systems analysis for the fixed production overheads. The result is the table below: based production Cost Total cost driver Cost driver Indirect production overhead recovery rate quantity per period 100 Set up costs Production scheduling Quality control Depreciation Raw materials storage Total: 6,000 Set ups 1,624 Set ups 18,920.60 Inspections 7,925.40 Machine hours 2,880 Materials movements 37,350 46 2,389 777 60.00 35.30 7.92 10.20 2.00 1440 A further analysis has produced the following indirect production overhead resource required for each product: Activity Based Resource (Cost driver quantity) Requirement (by product) Order / product: Order 1101 Order 1102 Order 1103 B C Total 35 35 10 80 Inspections 800 639 950 2,389 Machine hours 247 330 200 777 Materials movements 720 320 400 1,440 Task 5: Set ups a. Explain 'Activity Based Costing (ABC) as an alternative to full absorption costing and discuss the potential benefits that ABC might bring to production and information systems of Fenton Ltd Note: Your written explanations should be effectively communicated and should include notes on: The reasons for the development of ABC The 'Activity Based' concept The process of an ABC system development The potential benefits (if any) you feel could be achieved by the introduction of an ABC system for Fenton Ltd 10 Marks b. Recalculate the gross profits (by product an in total) after allocating fixed production overheads to products using an activity based system 10 Marks The task 5 b, mark indude marks allocated to short descriptive notes to workings (-100 words). These should be short explanatory notes' that will serve to identify (observe) the effects on each product (and in total) profit caused by the ABC system allocations, Fenton Ltd - continued: Fixed indirect production overheads: Indirect production overheads are fixed (unaffected by production activity levels) at 41,500 per month. This value has been allocated and apportioned to the 3 production departments as follows: Production department: Machining Fixed costs (allocation / apportionment) 17,460 Painting 7,740 Assembly 12,150 Total 37,350 Bases for absorption: Machining department - Machine hours Painting department Direct labour hours Assembly department - Direct labour hours Note: The quantity for absorption basis (for each production department) should be established using the total departmental resources requirement shown in the tables above. Fenton Ltd continued: Trading (production and sales). You should assume that today is Monday 29th November 2021, Sales: The company has the following sales orders to be delivered during December 2020, Order / product: Order 1101 'A 520 Quantity to be delivered (sales in units) Selling price (per unit) Order 1102 B 760 Order 1103 'C' 920 99 38.50 60.50 Production: The production schedule for December 2020 (product quantities and production resources requirement) shown below. Order / product: Finished goods: Quantity to be produced Order 1101 'A Order 1102 'B' Order 1103 'C 632 800 1,056 Note: At 19 December 2021 there will be no opening inventory of finished goods. Resources requirement for production: Direct costs (variable costs): Order / product: Order 1101 'A' Order 1102 Order 1103 'C' Totals Machining department: Incremental materials cost Direct labour hours (total) Machine hours (total) 2,160 112 1,080 1,725 154 4,965 348 hours 82 196 231 154 581 hours Painting department: Incremental materials cost Direct labour hours (total) Machine hours (total) 1,296 2,610 124 432 154 4,338 124 70 100 40 378 hours 234 hours Assembly department: Incremental materials cost Direct labour hours (total) Machine hours (total) 1,725 226 1,725 1,080 214 4,530 268 82 70 708 hours 264 hours 112 6 Fenton Ltd - continued: Fenton Ltd - Production Process Flowchart Start Materials movement process Machining department: Direct materials Add Direct labour (11.00 per hour) Add Direct expenses (6.00 per machine hour) Add Fixed indirect production overhead costs absorbed - Total cost of machined goods (Transferred out to painting department) Materials movements and internal transfer inspection processes Materials movements and internal transfer inspection processes Painting department: Direct materials Add machined goods transferred IN Add Direct labour (13.00 per hour) Add Direct expenses (4.00 per machine hour) Add Fixed indirect production overhead costs absorbed = Total cost of painted goods (Transferred out to assembly department) 3 Assembly department: Direct materials Add painted goods transferred IN Add Direct labour (9.00 per hour) Add Direct expenses (5.00 per machine hour) Add Fixed indirect production overhead costs absorbed = Total cost of saleable finished goods produced (Transferred out to finished goods warehouse) Materials movements and internal transfer Inspection processes Finished goods warehouse End Note: The costs of materials movements between departments and internal inspection checks are included in indirect production overheads. The above flowchart is an outline process only and does not include control decision, documentation raising and filing requirements. Fenton Ltd Fenton Ltd is a manufacturing organisation supplying specialised engineered products to a wide range of public and private sector throughout the UK. You are a trainee in the finance office recently recruited by the company. Management planning meeting: On the 29th of every month (or nearest Monday) the business executive management team meets to plan trading and production for the following month. The meeting commences with a review of the sales order book and a determination of the following months product sales volumes. The expected sales volumes inform the production planning process and decisions are made with respect to production resources and closing inventory requirements, The agreed plan is the production schedule document. This is forwarded to the production departmental managers who will examine and compare their available resources against the requirement for production. Any problems (constraints) or other issues arising are reported back to the executive management team who will consider making adjustments to: E The production requirements The available resources At the start of the following month, the production process will commence with a view to meeting the objectives of the agreed production (action) plan This process is described by the production planning flowchart (shown below): Production Planning Flowchart Start 29th of the Month (or nearest Monday): Executive management planning meeting for the next month's trading objectives: Expected sales determination Production output levels for the following month. 3 Management adjustments to original plan data Plan document passed to functional production managers Y N Problems / constraints / other issues arising? Agreed action plan document ready for the following month's production process EndStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started