Answered step by step

Verified Expert Solution

Question

1 Approved Answer

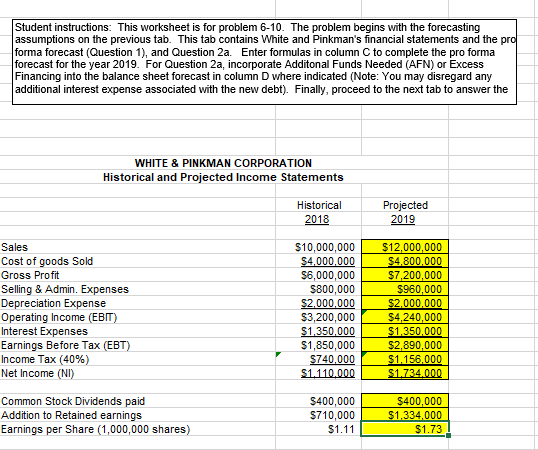

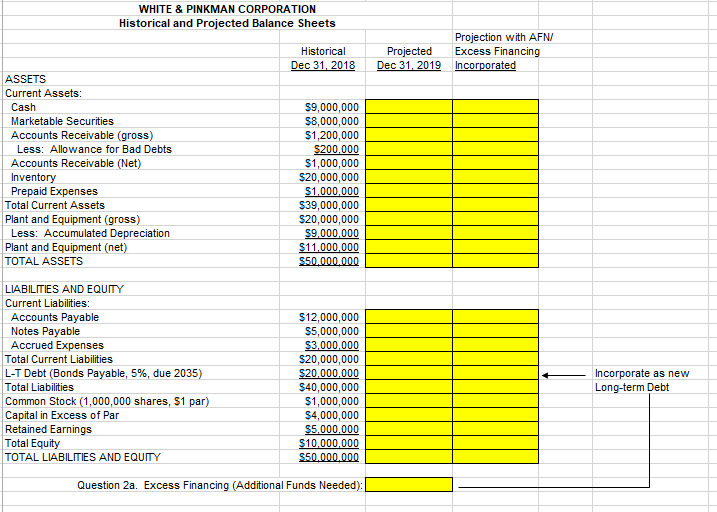

Please complete the assets section for this pro-forma invoice Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on

Please complete the assets section for this pro-forma invoice

Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a. Enter formulas in column C to complete the pro forma forecast for the year 2019. For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast in column D where indicated (Note: You may disregard any additional interest expense associated with the new debt). Finally, proceed to the next tab to answer the WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historical 2018 Projected 2019 Sales $10,000,000 $4.000,000 $6,000,000 S12,000,000 $4,800,000 $7,200,000 Cost of goods Sold Gross Profit Selling & Admin. Expenses Depreciation Expense Operating Income (EBIT) Interest Expenses Earnings Before Tax (EBT) Income Tax (40 % ) Net Income (NI) S800,000 S2,000.000 $3,200,000 S1,350,000 S1,850,000 $960,000 $2,000,000 $4,240,000 $1,350,000 $2,890,000 S1.156,000 S1.734,000 S740,000 $1.110.000 Common Stock Dividends paid Addition to Retained earnings Earnings per Share (1,000,000 shares) $400,000 $710,000 $1.11 $400,000 $1,334,000 $1.73 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Projection with AFN/ Excess Financing Incorporated Historical Dec 31, 2018 Projected Dec 31, 2019 ASSETS Current Assets: Cash S9,000,000 S8,000,000 S1,200,000 Marketable Securities Accounts Receivable (gross) Less: Allowance for Bad Debts Accounts Receivable (Net) Inventory Prepaid Expenses S200,000 S1,000,000 $20,000,000 $1,000,000 S39,000,000 $20,000,000 $9,000,000 S11,000,000 S50.000.000 Total Current Assets Plant and Equipment (gross) Less: Accumulated Depreciation Plant and Equipment (net) TOTAL ASSETS LIABILITIES AND EQUITY Current Liabilities: Accounts Payable Notes Payable Accrued Expenses $12,000,000 S5,000,000 S3.000,000 $20,000,000 Total Current Liabilities S20,000,000 $40,000,000 $1,000,000 $4,000,000 $5,000,000 $10,000,000 S50.000.000 L-T Debt (Bonds Payable, 5% , due 2035) Total Liabilities Common Stock (1,000,000 shares, $1 par) Capital in Excess of Par Retained Earnings Total Equity Incorporate as new Long-term Debt TOTAL LIABILIMES AND EQUTY Question 2a. Excess Financing (Additional Funds Needed): Student instructions: This worksheet is for problem 6-10. The problem begins with the forecasting assumptions on the previous tab. This tab contains White and Pinkman's financial statements and the pro forma forecast (Question 1), and Question 2a. Enter formulas in column C to complete the pro forma forecast for the year 2019. For Question 2a, incorporate Additonal Funds Needed (AFN) or Excess Financing into the balance sheet forecast in column D where indicated (Note: You may disregard any additional interest expense associated with the new debt). Finally, proceed to the next tab to answer the WHITE & PINKMAN CORPORATION Historical and Projected Income Statements Historical 2018 Projected 2019 Sales $10,000,000 $4.000,000 $6,000,000 S12,000,000 $4,800,000 $7,200,000 Cost of goods Sold Gross Profit Selling & Admin. Expenses Depreciation Expense Operating Income (EBIT) Interest Expenses Earnings Before Tax (EBT) Income Tax (40 % ) Net Income (NI) S800,000 S2,000.000 $3,200,000 S1,350,000 S1,850,000 $960,000 $2,000,000 $4,240,000 $1,350,000 $2,890,000 S1.156,000 S1.734,000 S740,000 $1.110.000 Common Stock Dividends paid Addition to Retained earnings Earnings per Share (1,000,000 shares) $400,000 $710,000 $1.11 $400,000 $1,334,000 $1.73 WHITE & PINKMAN CORPORATION Historical and Projected Balance Sheets Projection with AFN/ Excess Financing Incorporated Historical Dec 31, 2018 Projected Dec 31, 2019 ASSETS Current Assets: Cash S9,000,000 S8,000,000 S1,200,000 Marketable Securities Accounts Receivable (gross) Less: Allowance for Bad Debts Accounts Receivable (Net) Inventory Prepaid Expenses S200,000 S1,000,000 $20,000,000 $1,000,000 S39,000,000 $20,000,000 $9,000,000 S11,000,000 S50.000.000 Total Current Assets Plant and Equipment (gross) Less: Accumulated Depreciation Plant and Equipment (net) TOTAL ASSETS LIABILITIES AND EQUITY Current Liabilities: Accounts Payable Notes Payable Accrued Expenses $12,000,000 S5,000,000 S3.000,000 $20,000,000 Total Current Liabilities S20,000,000 $40,000,000 $1,000,000 $4,000,000 $5,000,000 $10,000,000 S50.000.000 L-T Debt (Bonds Payable, 5% , due 2035) Total Liabilities Common Stock (1,000,000 shares, $1 par) Capital in Excess of Par Retained Earnings Total Equity Incorporate as new Long-term Debt TOTAL LIABILIMES AND EQUTY Question 2a. Excess Financing (Additional Funds Needed)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started