Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the assignment in an Excel file. Please note that this is an open book assignment so feel free to utilize all the resources.

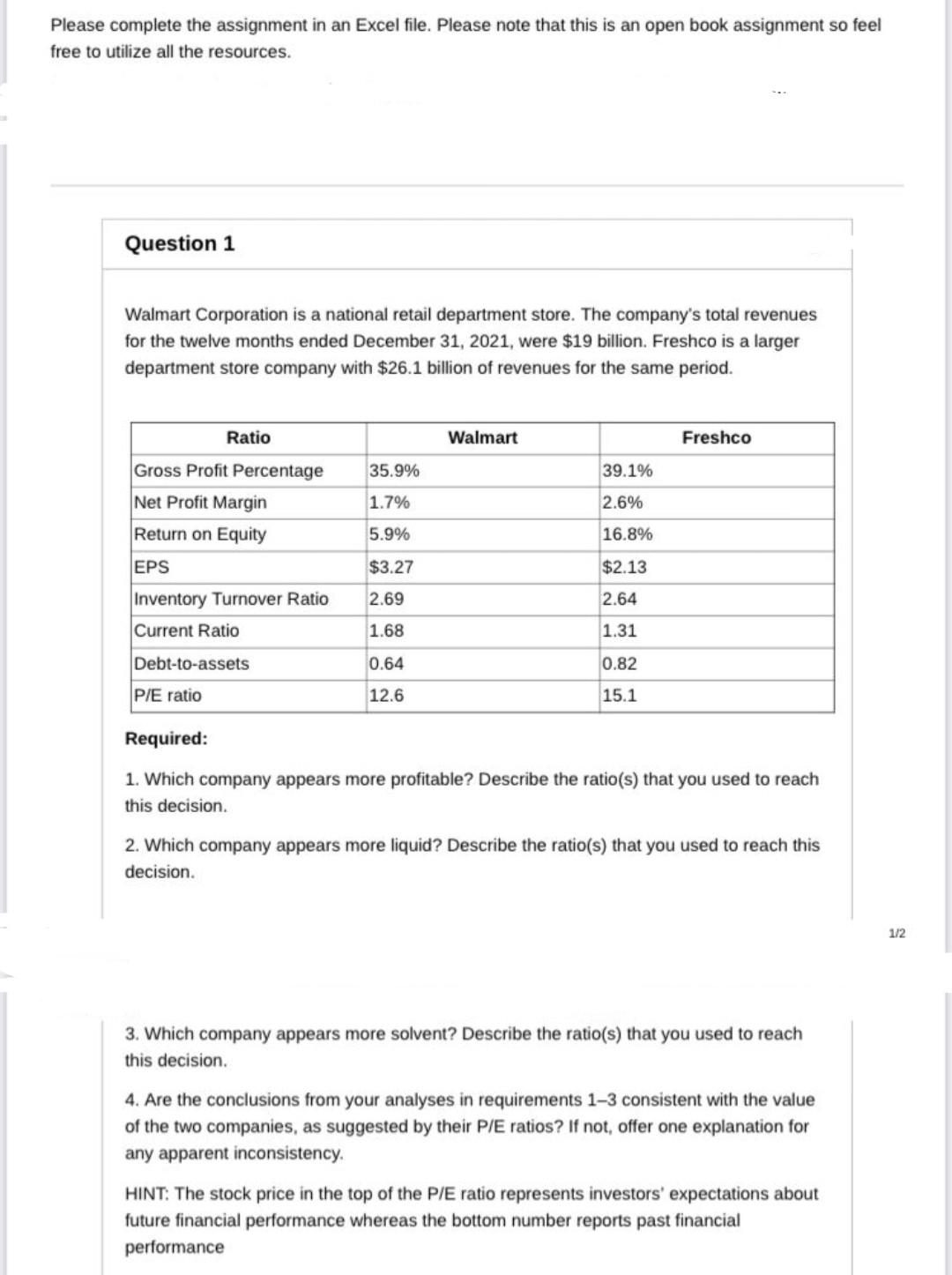

Please complete the assignment in an Excel file. Please note that this is an open book assignment so feel free to utilize all the resources. Question 1 Walmart Corporation is a national retail department store. The company's total revenues for the twelve months ended December 31, 2021, were $19 billion. Freshco is a larger department store company with $26.1 billion of revenues for the same period. Ratio Walmart Freshco Gross Profit Percentage 35.9% 39.1% Net Profit Margin 1.7% 2.6% Return on Equity 5.9% 16.8% EPS $3.27 $2.13 Inventory Turnover Ratio 2.69 2.64 Current Ratio 1.68 1.31 Debt-to-assets 0.64 0.82 P/E ratio 12.6 15.1 Required: 1. Which company appears more profitable? Describe the ratio(s) that you used to reach this decision. 2. Which company appears more liquid? Describe the ratio(s) that you used to reach this decision. 3. Which company appears more solvent? Describe the ratio(s) that you used to reach this decision. 4. Are the conclusions from your analyses in requirements 1-3 consistent with the value of the two companies, as suggested by their P/E ratios? If not, offer one explanation for any apparent inconsistency. HINT: The stock price in the top of the P/E ratio represents investors' expectations about future financial performance whereas the bottom number reports past financial performance 1/2 Please complete the assignment in an Excel file. Please note that this is an open book assignment so feel free to utilize all the resources. Question 1 Walmart Corporation is a national retail department store. The company's total revenues for the twelve months ended December 31, 2021, were $19 billion. Freshco is a larger department store company with $26.1 billion of revenues for the same period. Ratio Walmart Freshco Gross Profit Percentage 35.9% 39.1% Net Profit Margin 1.7% 2.6% Return on Equity 5.9% 16.8% EPS $3.27 $2.13 Inventory Turnover Ratio 2.69 2.64 Current Ratio 1.68 1.31 Debt-to-assets 0.64 0.82 P/E ratio 12.6 15.1 Required: 1. Which company appears more profitable? Describe the ratio(s) that you used to reach this decision. 2. Which company appears more liquid? Describe the ratio(s) that you used to reach this decision. 3. Which company appears more solvent? Describe the ratio(s) that you used to reach this decision. 4. Are the conclusions from your analyses in requirements 1-3 consistent with the value of the two companies, as suggested by their P/E ratios? If not, offer one explanation for any apparent inconsistency. HINT: The stock price in the top of the P/E ratio represents investors' expectations about future financial performance whereas the bottom number reports past financial performance 1/2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started