Answered step by step

Verified Expert Solution

Question

1 Approved Answer

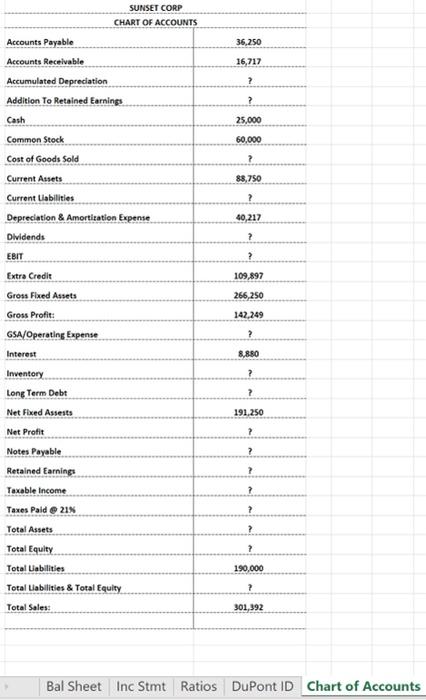

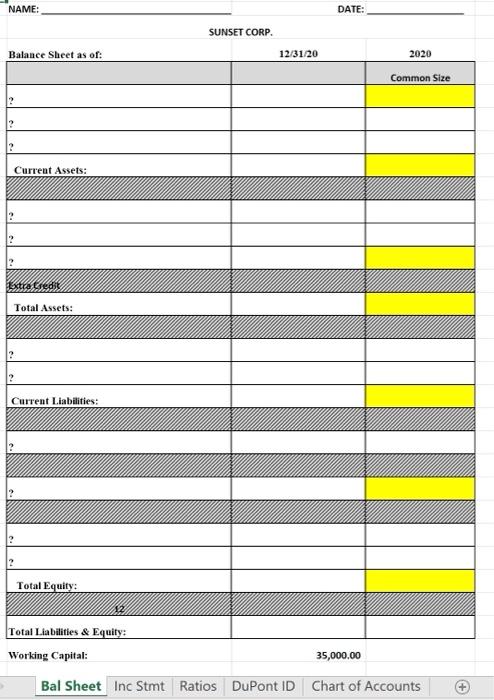

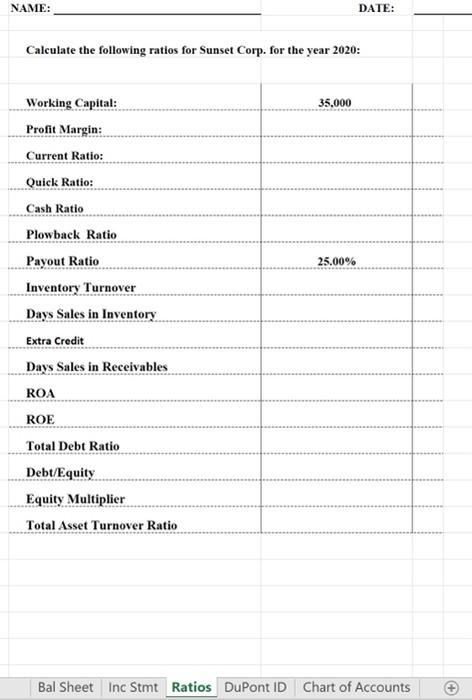

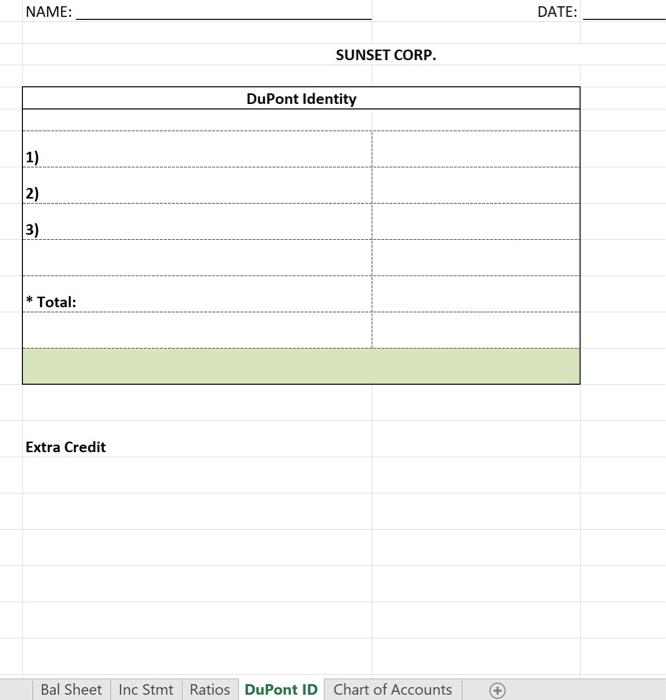

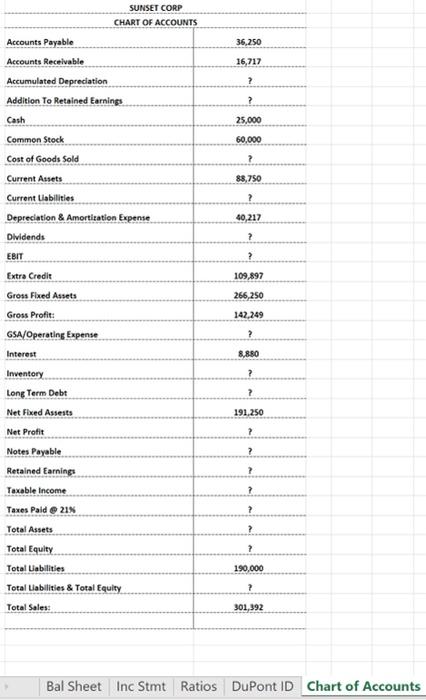

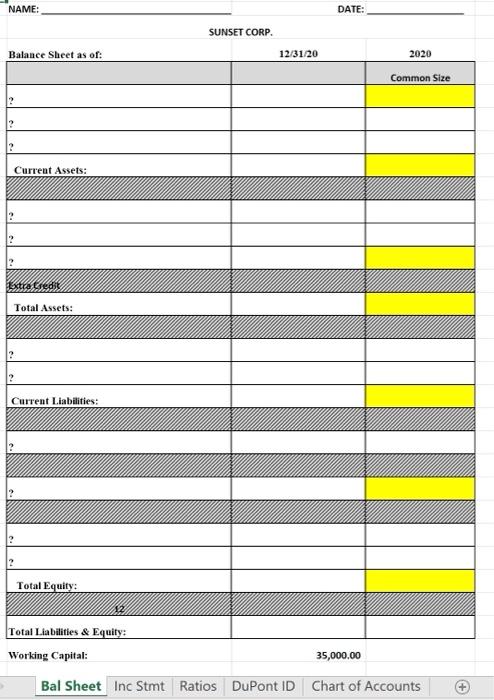

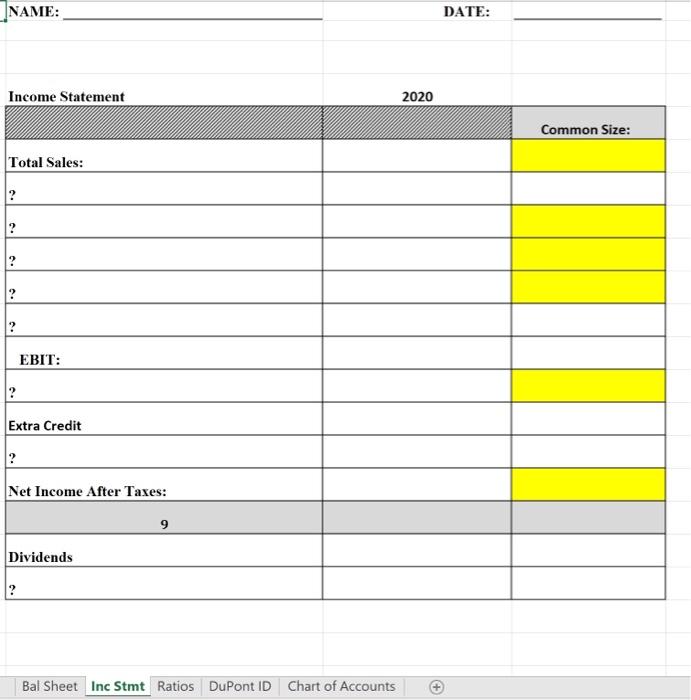

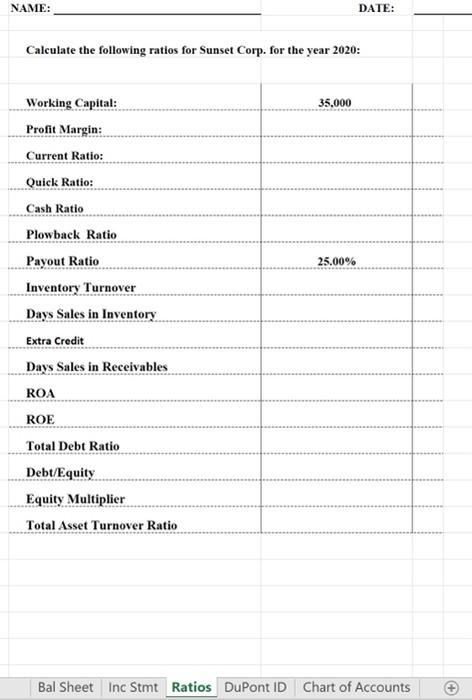

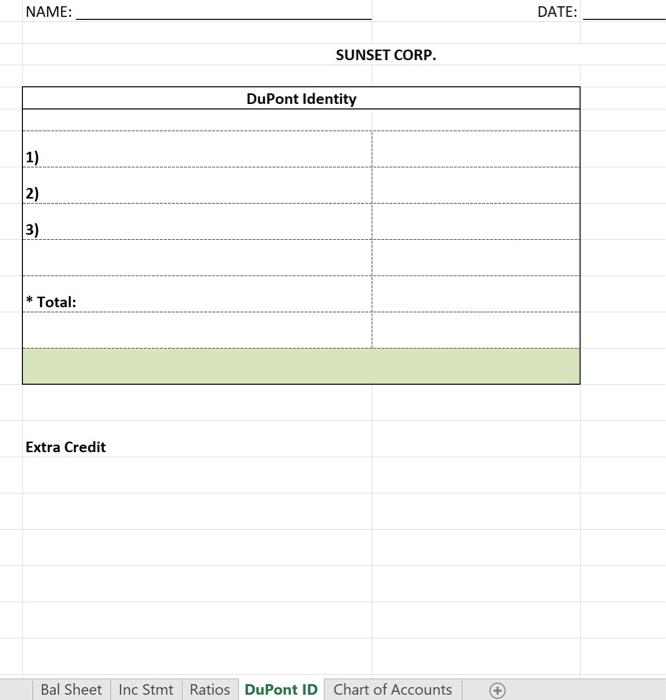

Please complete the attached Financial Statement which consists of a Balance Sheet, an Income Statement, and certain Ratios. A Chart of Accounts page is provided

Please complete the attached Financial Statement which consists of a Balance Sheet, an Income Statement, and certain Ratios. A Chart of Accounts page is provided with all of the accounts needed to complete the statement. Complete the statements in Excel and attach solution

Fields with question marks are to be competed based on the partially given info

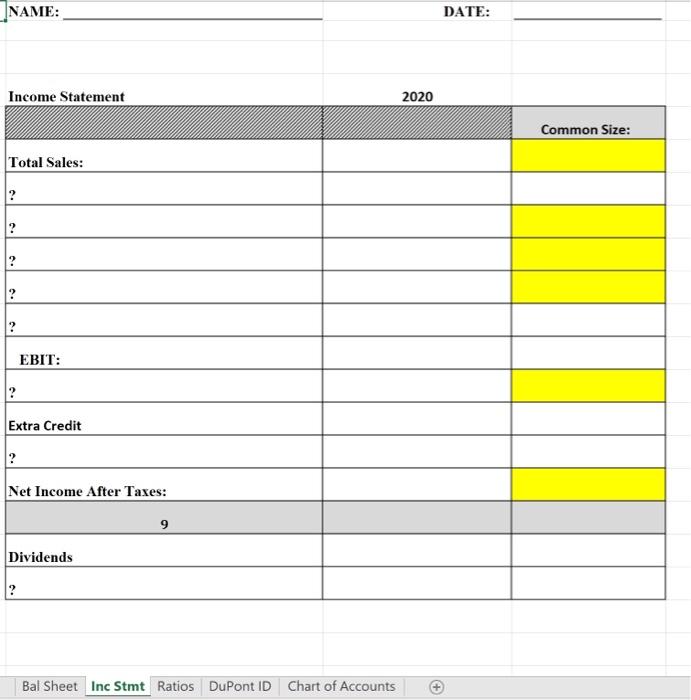

SUNSET CORP CHART OF ACCOUNTS Accounts Payable 36,250 Accounts Receivable 16,717 ? Accumulated Depreciation Addition To Retained Earnings 2 Cash 25,000 60,000 ? 88,750 ? 40,217 ? ? 109,897 266,250 142,249 ? 8,880 Common Stock Cost of Goods Sold Current Assets Current Liabilities Depreciation & Amortization Expense Dividends EBIT Extra Credit Gross Fixed Assets Gross Profit GSA/Operating Expense Interest Inventory Long Term Debt Net Fixed Assets Net Profit Notes Payable Retained Earnings Taxable income Taxes Pald 21 Total Assets Total Equity Total Liabilities Total Liabilities & Total Equity Total Sales: ? ? 191,250 ? ? ? ? ? 7 190,000 ? 301,392 Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: SUNSET CORP. Balance Sheet as of 12/31/20 2020 Common Size 2 Current Assets: Extra Credit Total Assets: Current Liabilities: Total Equity: Total Liabilities & Equity: Working Capital: 35,000.00 Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: Income Statement 2020 Common Size: Total Sales: ? EBIT: ? Extra Credit ? Net Income After Taxes: Dividends Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: Calculate the following ratios for Sunset Corp. for the year 2020: 35,000 Working Capital: Profit Margin: Current Ratio: Quick Ratio: Cash Ratio Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory Extra Credit Days Sales in Receivables ROA ROE 25.00% Total Debt Ratio Debt/Equity Equity Multiplier Total Asset Turnover Ratio Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts + NAME: DATE: SUNSET CORP. DuPont Identity 1) 2) 3) * Total: Extra Credit Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts SUNSET CORP CHART OF ACCOUNTS Accounts Payable 36,250 Accounts Receivable 16,717 ? Accumulated Depreciation Addition To Retained Earnings 2 Cash 25,000 60,000 ? 88,750 ? 40,217 ? ? 109,897 266,250 142,249 ? 8,880 Common Stock Cost of Goods Sold Current Assets Current Liabilities Depreciation & Amortization Expense Dividends EBIT Extra Credit Gross Fixed Assets Gross Profit GSA/Operating Expense Interest Inventory Long Term Debt Net Fixed Assets Net Profit Notes Payable Retained Earnings Taxable income Taxes Pald 21 Total Assets Total Equity Total Liabilities Total Liabilities & Total Equity Total Sales: ? ? 191,250 ? ? ? ? ? 7 190,000 ? 301,392 Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: SUNSET CORP. Balance Sheet as of 12/31/20 2020 Common Size 2 Current Assets: Extra Credit Total Assets: Current Liabilities: Total Equity: Total Liabilities & Equity: Working Capital: 35,000.00 Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: Income Statement 2020 Common Size: Total Sales: ? EBIT: ? Extra Credit ? Net Income After Taxes: Dividends Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts NAME: DATE: Calculate the following ratios for Sunset Corp. for the year 2020: 35,000 Working Capital: Profit Margin: Current Ratio: Quick Ratio: Cash Ratio Plowback Ratio Payout Ratio Inventory Turnover Days Sales in Inventory Extra Credit Days Sales in Receivables ROA ROE 25.00% Total Debt Ratio Debt/Equity Equity Multiplier Total Asset Turnover Ratio Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts + NAME: DATE: SUNSET CORP. DuPont Identity 1) 2) 3) * Total: Extra Credit Bal Sheet Inc Stmt Ratios DuPont ID Chart of Accounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started