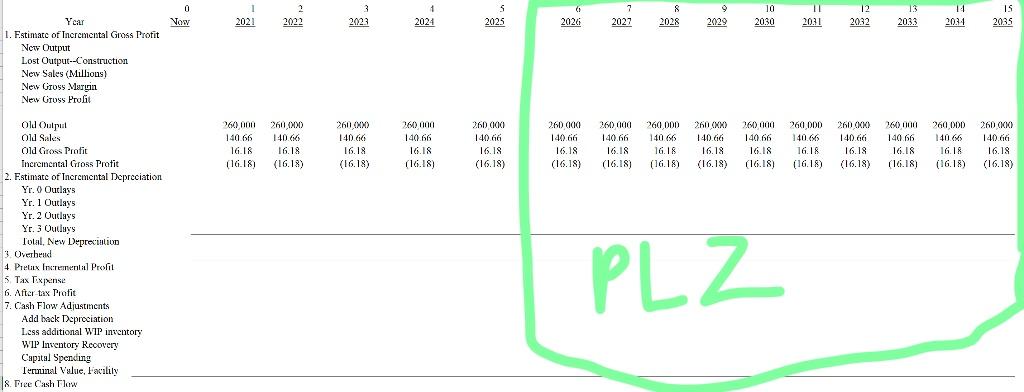

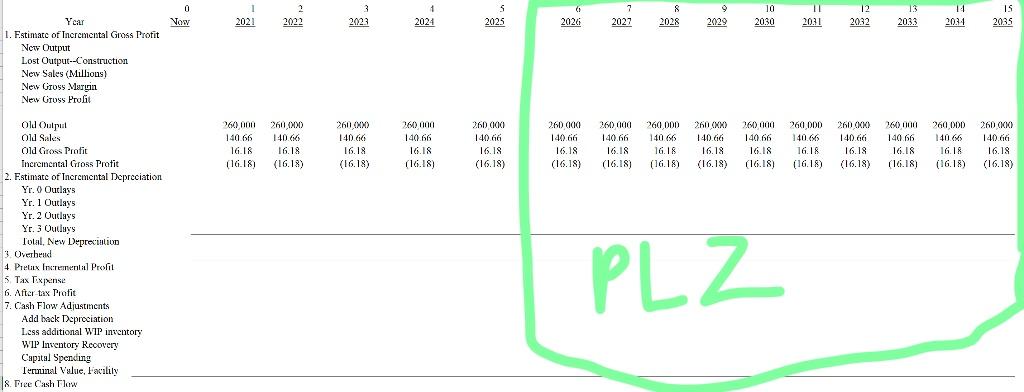

Please complete the calculation questions, including data from 2026 to 2035. Please DO NOT copy answers from other questions, I just want to know the data and process from 2026 to 2035, thank you very much!

Hilary Maskona, the CEO of AllVax, met with her advisor, Vincent Purell, to review a capital-expenditure proposal on a production plant to produce COVID-19 vaccines using mRNA technology. The proposal, named AntiCov Flow project, calls for an expenditure of $9 million spread over three years to convert an existing production plant from batch to continuous-flow technology and to install sophisticated state-of-the-art process controls throughout the plant. This project is only feasible with a continuous source of cationic lipids from a chemical synthesis process conducted in a specialised manufacturing facility. The proposal suggests AllVax to purchase this type of manufacturing facility from a supplier (rather than sourcing the cationic lipids from two separate suppliers). AllVax has an option to exclusively purchase the cationic lipids facility from a supplier for $4 million (included in the proposed $9 million expenditure). The option was purchased several years earlier. Vincent advises the CEO that a comparable cationic lipids manufacturing facility can be sold today for $7 million in an auction. Vincent also forecasts that at the end of the project, the value of the cationic lipids manufacturing facility will be $30 million. This option will expire in 5 months.

The proposal will require the plant to be shut down for 5 months in the 1st year, 4 months in the 2nd year, and 3 months in the 3rd year. Vincent believes the loss will not be permanent. The benefits include an increase of 6% in new output gain on old output [new output = old output x (1+6%)] and an increase of 3% in gross margin on old gross margin of 11.5% (new gross margin = old gross margin + gross margin increase). The increased outputs will necessitate additional work-in-process inventory in value to 3% of the increased cost of goods. Vincent suggests that new assets will be fully depreciated on a straightline basis over the life of the project. It is AllVaxs policy to record depreciation expenses in the same year as expenditures. Vincent also estimates that overhead costs are at 3.5% of the increased sales. Inflation is set at 0%.

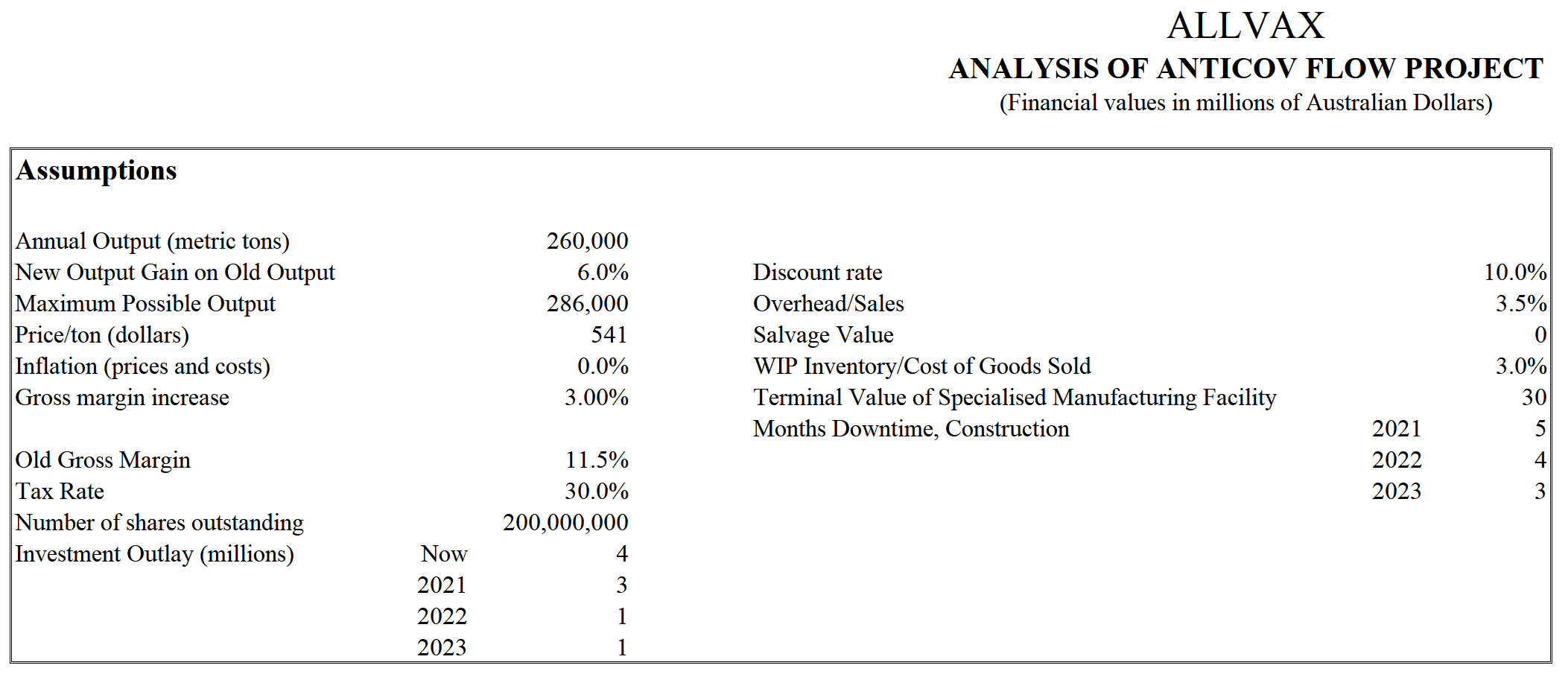

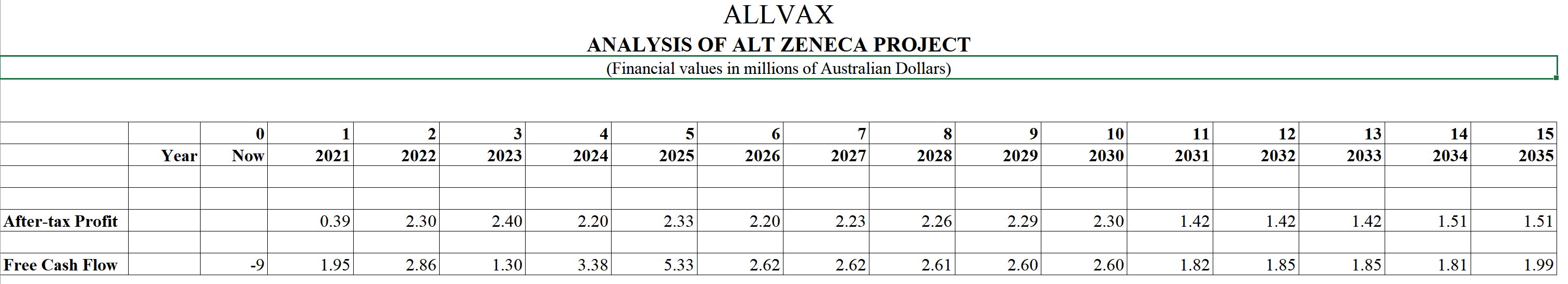

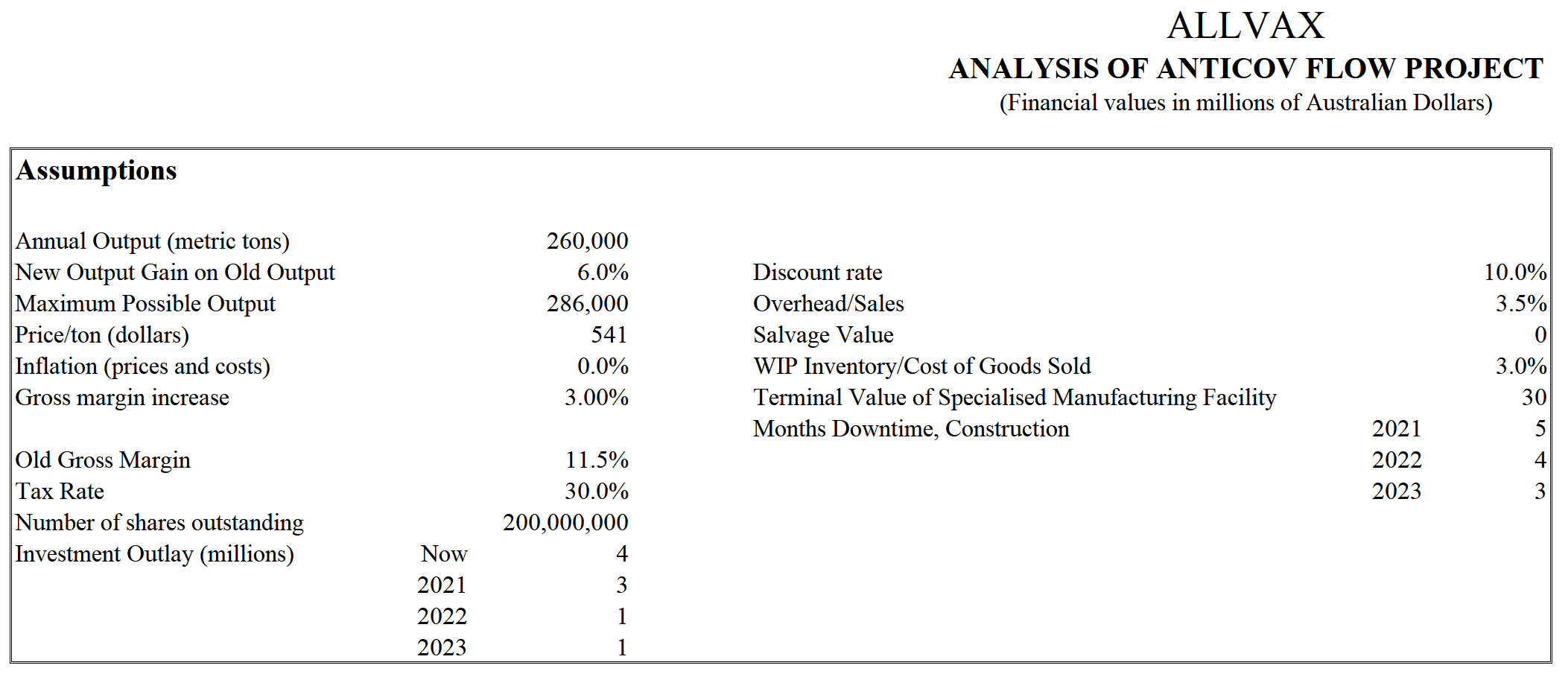

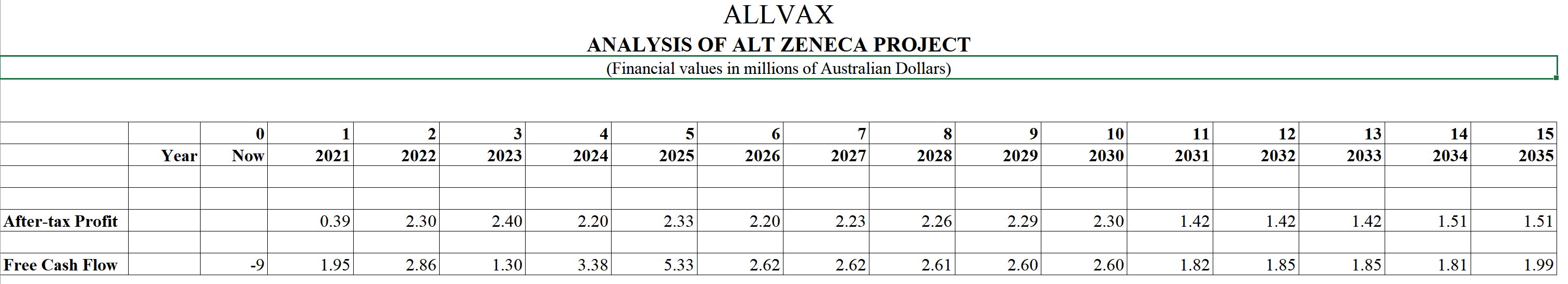

ALLVAX ANALYSIS OF ANTICOV FLOW PROJECT (Financial values in millions of Australian Dollars) Assumptions Annual Output (metric tons) New Output Gain on Old Output Maximum Possible Output Price/ton (dollars) Inflation (prices and costs) Gross margin increase 260,000 6.0% 286,000 541 0.0% 3.00% Discount rate Overhead/Sales Salvage Value WIP Inventory/Cost of Goods Sold Terminal Value of Specialised Manufacturing Facility Months Downtime, Construction 10.0% 3.5% 0 3.0% 30 5 2021 2022 2023 4 3 Old Gross Margin Tax Rate Number of shares outstanding Investment Outlay (millions) Now 2021 2022 2023 11.5% 30.0% 200,000,000 4 3 1 1 0 Now 1 2021 2 2022 1 2024 S 2025 6 2026 7 2027 8 2028 10 2030 2023 12 2032 2029 2031 IS 2035 2033 2034 Year 1. Estimate of Incremental Gross Profit New Output Lost Output -Construction New Sales (Millious) New Gross Maruin Ne Gruss Profit 260) DOO 140.66 16.18 (16.18) 2601 MM 140.66 16.18 (16.18) 140.66 16.18 (16.18) 261) 000 140.66 16.18 (16.18) 260 140.66 16.18 (16.18) 260 00 140.66 16.18 (16.18) 260 000 140.66 16.18 (16.18) 260 DDD 140.66 16.18 (16.18) 2011 (XX) 140.66 16.18 (16.18) 161) 1100 140.66 16.18 (16.181 260 DDD 140.663 16.18 (16.18) 140.66 16.18 (16.18) 160000 140.66 16.18 (16.18) 260 DDD 140.63 16.18 (16.18) (MINI 140.66 16.18 (16.18) Old Output Old Sales Old Gross Profit Incremental Gross Pratit 2. Estimate of incremental Depreciation Yr. 0 Outlays Yr. 1 Outlay's Yr. 2 Outlay's Yr. 3 Outly's Toul, New Depreciation 3 Overheud 4 Prelax Incremental Profit S Tax Tixpense 6. After tax Tafit 7. Cash Flow Adjustments Add hack Depreciation Less additional WIP inventory WIP Inventory Recovery Capital Spending Terminal Vulue, Facility 8. Tree Cash Flow PLZ ALLVAX ANALYSIS OF ALT ZENECA PROJECT (Financial values in millions of Australian Dollars) 0 1 4 6 5 2025 7 2027 10 2030 11 2031 12 2032 13 2033 14 2034 15 2035 Year Now 2021 2022 2023 2024 2026 2028 2029 After-tax Profit 0.39 2.30 2.40 2.20 2.33 2.20 2.23 2.26 2.29 2.30 1.42 1.42 1.42 1.51 1.51 Free Cash Flow -9 1.95 2.86 1.30 3.38 5.33 2.62 2.62 2.61 2.60 2.60 1.82 1.85 1.85 1.81 1.99 ALLVAX ANALYSIS OF ANTICOV FLOW PROJECT (Financial values in millions of Australian Dollars) Assumptions Annual Output (metric tons) New Output Gain on Old Output Maximum Possible Output Price/ton (dollars) Inflation (prices and costs) Gross margin increase 260,000 6.0% 286,000 541 0.0% 3.00% Discount rate Overhead/Sales Salvage Value WIP Inventory/Cost of Goods Sold Terminal Value of Specialised Manufacturing Facility Months Downtime, Construction 10.0% 3.5% 0 3.0% 30 5 2021 2022 2023 4 3 Old Gross Margin Tax Rate Number of shares outstanding Investment Outlay (millions) Now 2021 2022 2023 11.5% 30.0% 200,000,000 4 3 1 1 0 Now 1 2021 2 2022 1 2024 S 2025 6 2026 7 2027 8 2028 10 2030 2023 12 2032 2029 2031 IS 2035 2033 2034 Year 1. Estimate of Incremental Gross Profit New Output Lost Output -Construction New Sales (Millious) New Gross Maruin Ne Gruss Profit 260) DOO 140.66 16.18 (16.18) 2601 MM 140.66 16.18 (16.18) 140.66 16.18 (16.18) 261) 000 140.66 16.18 (16.18) 260 140.66 16.18 (16.18) 260 00 140.66 16.18 (16.18) 260 000 140.66 16.18 (16.18) 260 DDD 140.66 16.18 (16.18) 2011 (XX) 140.66 16.18 (16.18) 161) 1100 140.66 16.18 (16.181 260 DDD 140.663 16.18 (16.18) 140.66 16.18 (16.18) 160000 140.66 16.18 (16.18) 260 DDD 140.63 16.18 (16.18) (MINI 140.66 16.18 (16.18) Old Output Old Sales Old Gross Profit Incremental Gross Pratit 2. Estimate of incremental Depreciation Yr. 0 Outlays Yr. 1 Outlay's Yr. 2 Outlay's Yr. 3 Outly's Toul, New Depreciation 3 Overheud 4 Prelax Incremental Profit S Tax Tixpense 6. After tax Tafit 7. Cash Flow Adjustments Add hack Depreciation Less additional WIP inventory WIP Inventory Recovery Capital Spending Terminal Vulue, Facility 8. Tree Cash Flow PLZ ALLVAX ANALYSIS OF ALT ZENECA PROJECT (Financial values in millions of Australian Dollars) 0 1 4 6 5 2025 7 2027 10 2030 11 2031 12 2032 13 2033 14 2034 15 2035 Year Now 2021 2022 2023 2024 2026 2028 2029 After-tax Profit 0.39 2.30 2.40 2.20 2.33 2.20 2.23 2.26 2.29 2.30 1.42 1.42 1.42 1.51 1.51 Free Cash Flow -9 1.95 2.86 1.30 3.38 5.33 2.62 2.62 2.61 2.60 2.60 1.82 1.85 1.85 1.81 1.99