Question

Please complete the following in Excel and show formulas. Many thanks! According to the Insurance Information Institute (III), the largest writer of property/casualty insurance by

Please complete the following in Excel and show formulas. Many thanks!

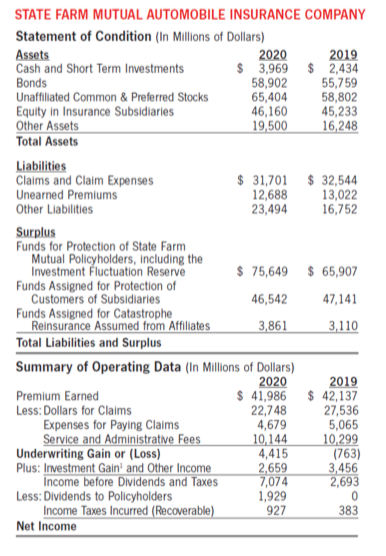

According to the Insurance Information Institute (III), the largest writer of property/casualty insurance by direct premiums written in 2020, is State Farm Mutual Automobile Insurance. The 2020 annual report to policy holders can be found below and contains data for 2019 and 2020: To forecast 2021 values, assume that the growth rate in the values between 2020 and 2019 will remain the same for 2021. To calculate the 2021 values (where X is any specific variable), apply the Future Value formula

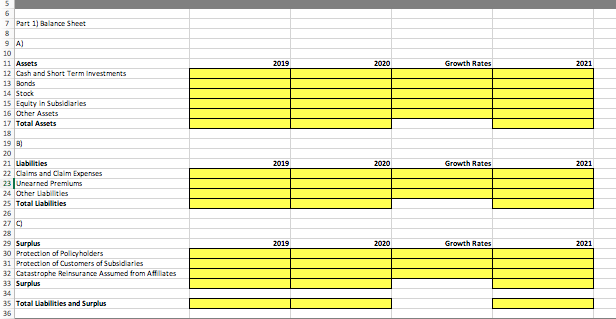

Part 1: Balance Sheet Fill in the assets portion of the table and calculate Total Assets Fill in the liabilities portion of the table and calculate Total Liabilities Fill in the surplus portion of the table and calculate Surplus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started