Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete the following Problems from Chapter 8 Management of Transaction Exposure Problem 6 Problem 9 Problem 14 6. IBM purchased computer chips from NEC,

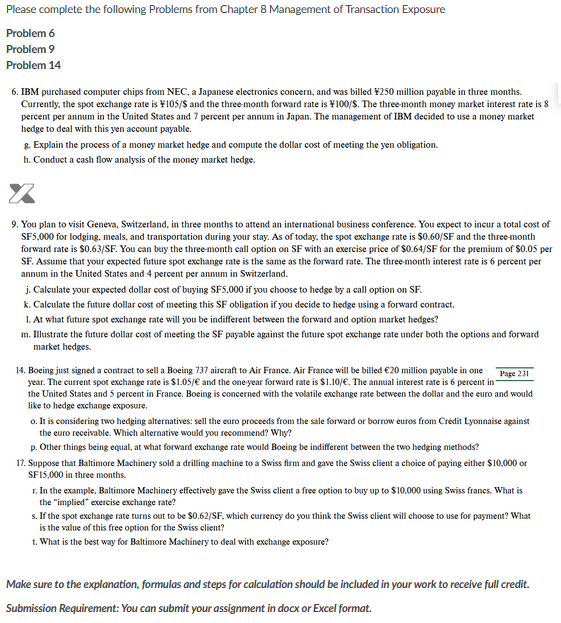

Please complete the following Problems from Chapter 8 Management of Transaction Exposure Problem 6 Problem 9 Problem 14 6. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate is 105/$ and the three-month forward rate is 100/$. The three-month money market interest rate is 8 percent per annum in the United States and 7 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable. g. Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation. h. Conduct a cash flow analysis of the money market hedge. 2 9. You plan to visit Geneva, Switzerland, in three months to attend an international business conference. You expect to incur a total cost of SF5,000 for lodging. meals, and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the three-month forward rate is $0.63/SF. You can buy the three-month call option on SF with an exercise price of $0.64/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The threemonth interest rate is 6 percent per annum in the United States and 4 percent per annum in Switzerland. j. Calculate your expected dollar cost of buying SF5,000 if you choose to hedge by a call option on SF. k. Calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract. 1. At what future spot exchange rate will you be indifferent between the forward and option market hedges? m. Illustrate the future dollar cost of meeting the SF payable against the future spot exchange rate under both the options and forward market hedges. 14. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million payable in one year. The current spot exchange rate is $1.05/ and the one year forward rate is $1.10/. The anntual interest rate is 6 percent in the United States and 5 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. o. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Credit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? p. Other things being equal, at what forward exchange fate would Boeing be indifferent between the two hedging methods? 17. Suppose that Baltimore Machinery sold a drilling machine to a Swiss firm and gave the Swiss client a choice of paying either $10,000 or SF15,000 in three months. r. In the example. Baltimore Machinery effectively gave the Swiss client a free option to buy up to $10.000 using Swiss francs. What is the "implied" exercise exchange rate? s. If the spot exchange rate turns out to be $0.62/SF, which currency do you think the Swiss client will choose to use for payment? What is the value of this free option for the Swiss client? t. What is the best way for Baltimore Machinery to deal with exchange exposure? Make sure to the explanation, formulas and steps for calculation should be included in your work to receive full credit. Submission Requirement: You can submit your assignment in docx or Excel format

Please complete the following Problems from Chapter 8 Management of Transaction Exposure Problem 6 Problem 9 Problem 14 6. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 250 million payable in three months. Currently, the spot exchange rate is 105/$ and the three-month forward rate is 100/$. The three-month money market interest rate is 8 percent per annum in the United States and 7 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable. g. Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation. h. Conduct a cash flow analysis of the money market hedge. 2 9. You plan to visit Geneva, Switzerland, in three months to attend an international business conference. You expect to incur a total cost of SF5,000 for lodging. meals, and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the three-month forward rate is $0.63/SF. You can buy the three-month call option on SF with an exercise price of $0.64/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The threemonth interest rate is 6 percent per annum in the United States and 4 percent per annum in Switzerland. j. Calculate your expected dollar cost of buying SF5,000 if you choose to hedge by a call option on SF. k. Calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract. 1. At what future spot exchange rate will you be indifferent between the forward and option market hedges? m. Illustrate the future dollar cost of meeting the SF payable against the future spot exchange rate under both the options and forward market hedges. 14. Boeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed 20 million payable in one year. The current spot exchange rate is $1.05/ and the one year forward rate is $1.10/. The anntual interest rate is 6 percent in the United States and 5 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. o. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Credit Lyonnaise against the euro receivable. Which alternative would you recommend? Why? p. Other things being equal, at what forward exchange fate would Boeing be indifferent between the two hedging methods? 17. Suppose that Baltimore Machinery sold a drilling machine to a Swiss firm and gave the Swiss client a choice of paying either $10,000 or SF15,000 in three months. r. In the example. Baltimore Machinery effectively gave the Swiss client a free option to buy up to $10.000 using Swiss francs. What is the "implied" exercise exchange rate? s. If the spot exchange rate turns out to be $0.62/SF, which currency do you think the Swiss client will choose to use for payment? What is the value of this free option for the Swiss client? t. What is the best way for Baltimore Machinery to deal with exchange exposure? Make sure to the explanation, formulas and steps for calculation should be included in your work to receive full credit. Submission Requirement: You can submit your assignment in docx or Excel format Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started