Please complete the following Statements from the given statements

-

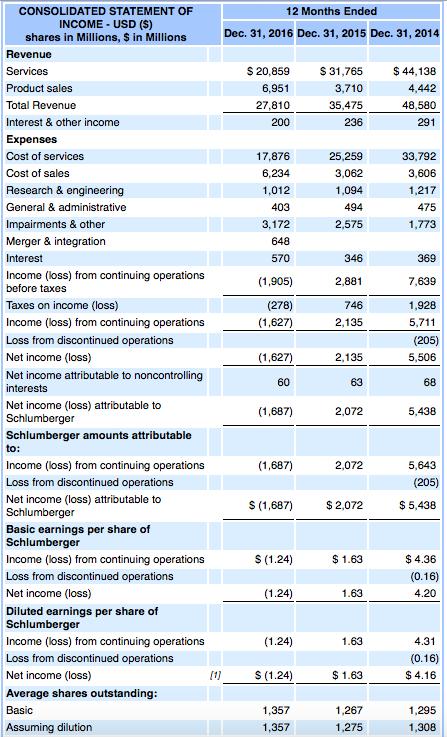

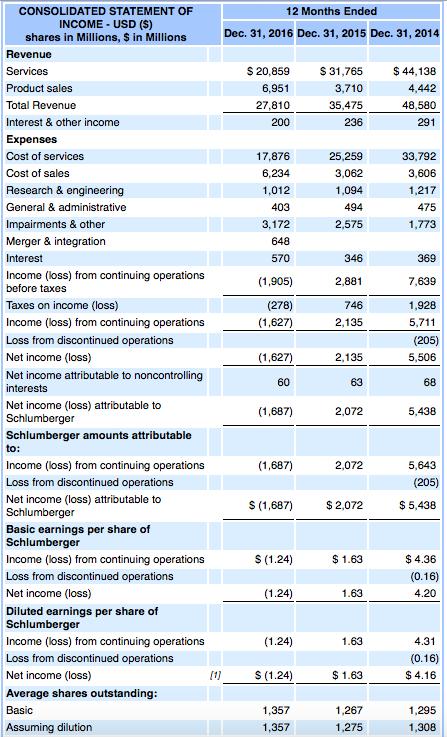

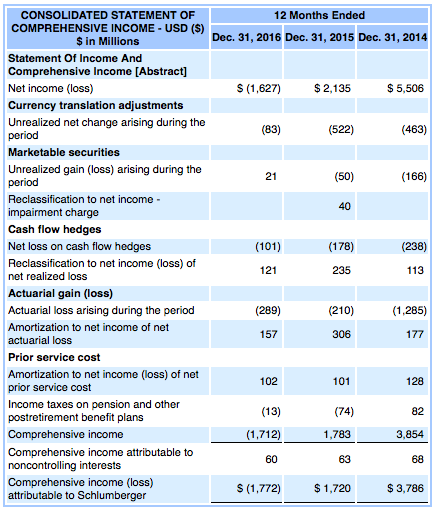

Income Statement

-

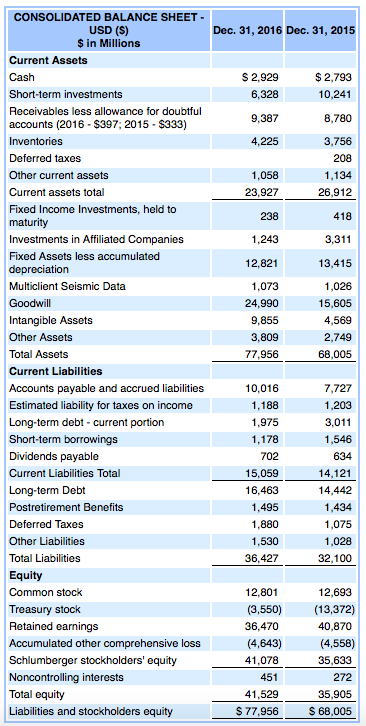

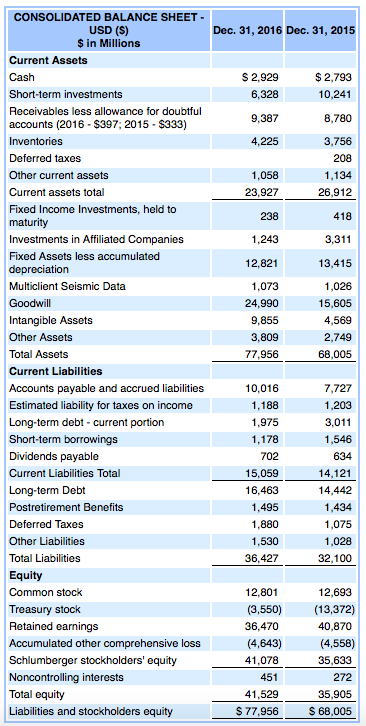

Balance Statement

-

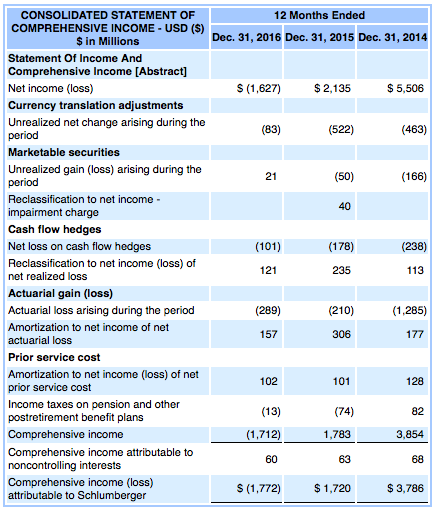

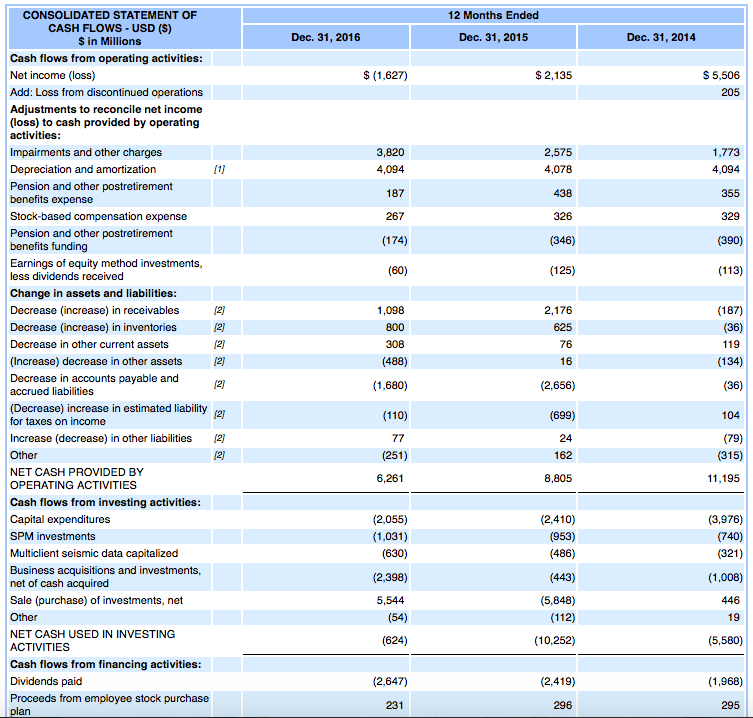

Financial Statement

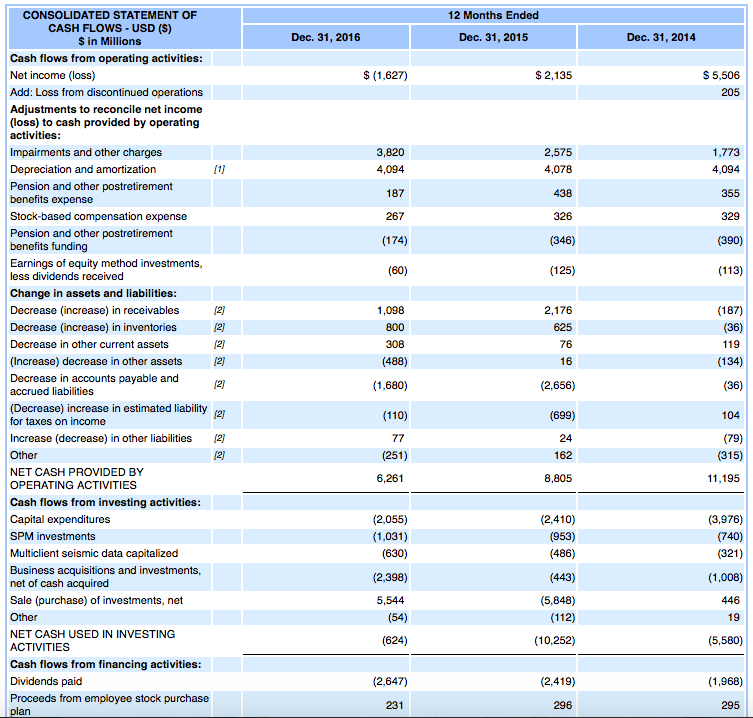

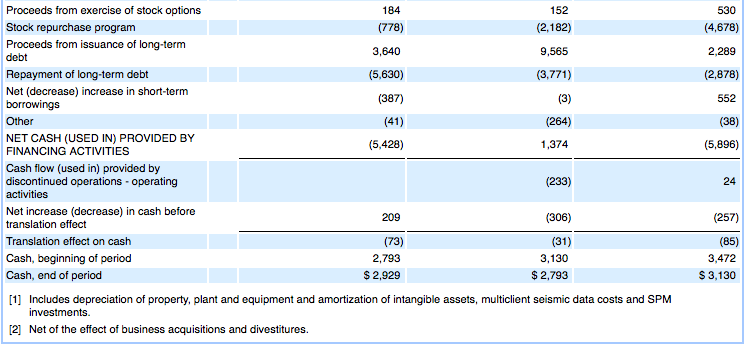

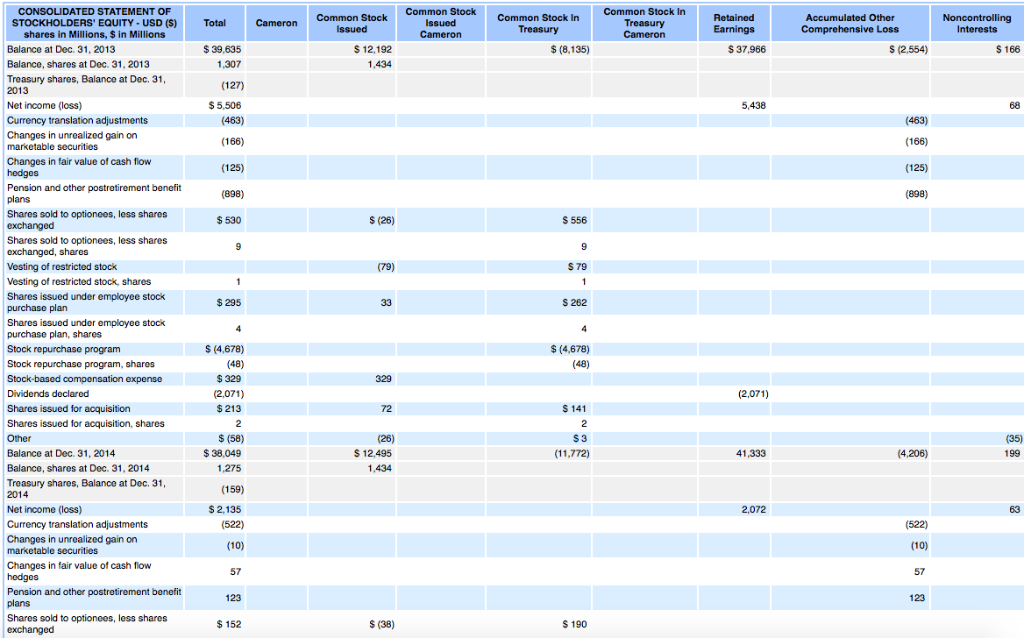

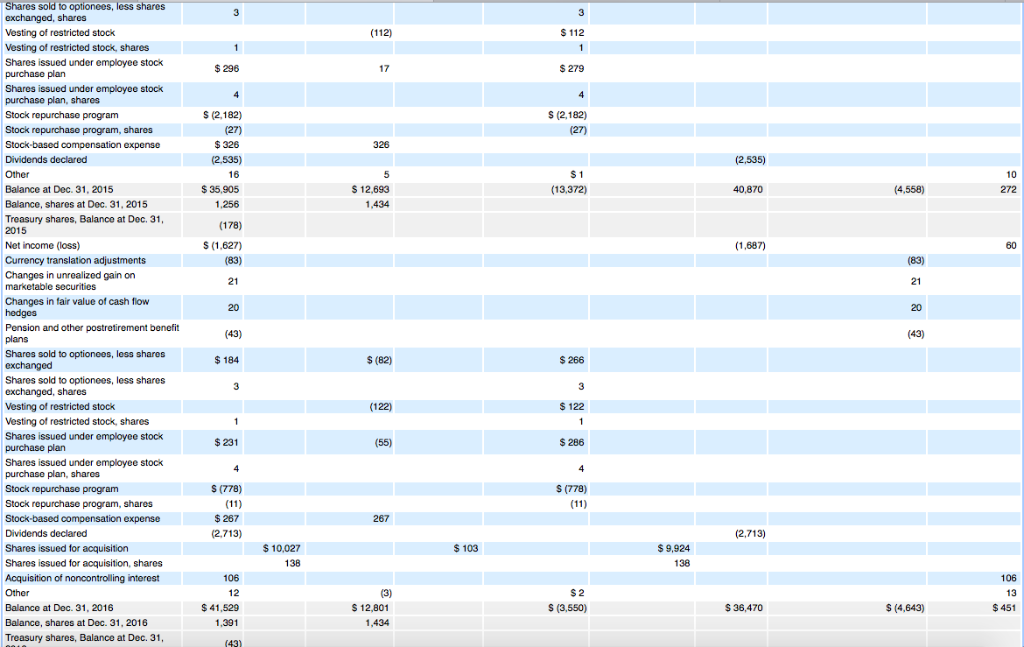

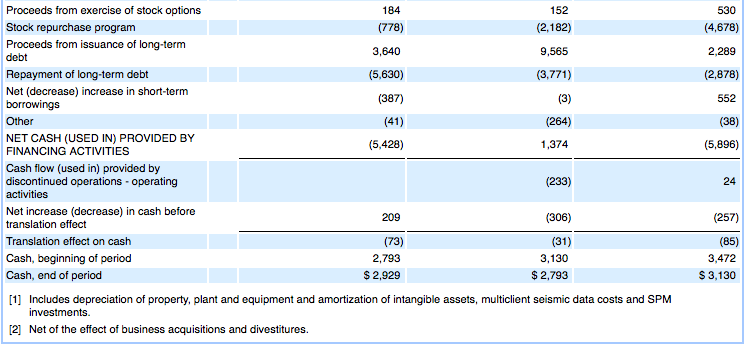

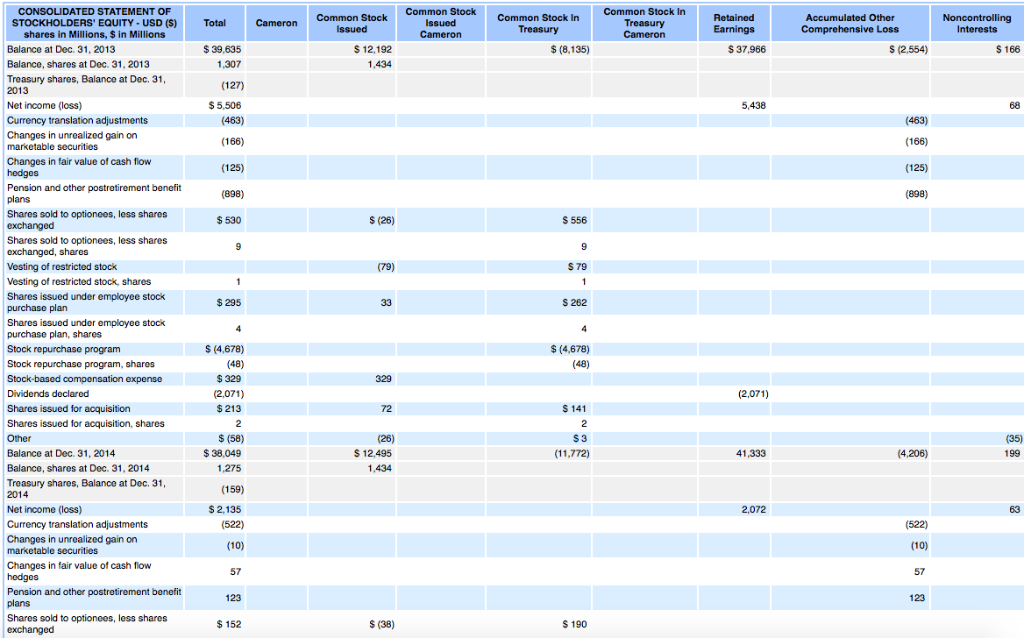

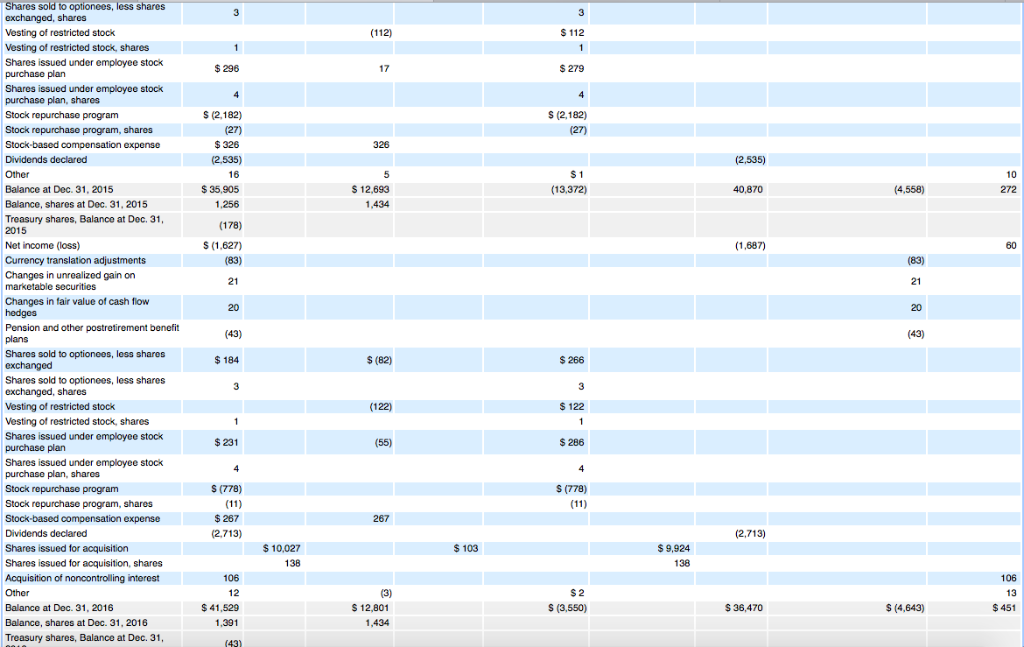

CONSOLIDATED BALANCE SHEET USD (S) $ in Millions Dec. 31, 2016 Dec. 31, 2015 Current Assets Cash Short-term investments Receivables less allowance for doubtful accounts (2016 $397; 2015 $333) Inventories Deferred taxes Other current assets Current assets total Fixed Income Investments, held to maturity Investments in Affiliated Companies Fixed Assets less accumulated depreciation Multiclient Seismic Data Goodwill Intangible Assets Other Assets Total Assets Current Liabilities Accounts payable and accrued liabilities Estimated liability for taxes on income Long-term debt current portion Short-term borrowings Dividends payable Current Liabilities Total S 2,929 6,328 9,387 4,225 $ 2,793 10,241 8,780 3,756 208 1,134 26,912 1,058 23,927 238 1,243 12,821 1,073 24,990 4153 3,311 13,415 1) 9,855 3,809 15,605 2,749 68,005 7,727 10,016 1,188 1,975 3,011 1,546 702 15,059 16,463 1,495 1,880 1,530 634 14,121 14,442 1,434 1,075 1,028 Postretirement Benefits Deferred Taxes Other Liabilities Total Liabilities Equity Common stock Treasury stock Retained earnings 12.10 12,693 (3,550 (13,372) 40,870 12,801 36,470 (4,643) (4,558 Schlumberger stockholders' equity Noncontrolling interests Total equity Liabilities and stockholders equity 35,633 272 35,905 $77,956$68,005 41,078 451 41,529 CONSOLIDATED STATEMENT OF 12 Months Ended CASH FLOWS USD (S) $ in Millions Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Cash flows from operating activities Net income (loss) Add: Loss from discontinued operations Adjustments to reconcile net income (loss) to cash provided by operating activities $(1,627) $ 2,135 S 5,506 Impairments and other charges Depreciation and amortization Pension and other postretirement 3,820 4,094 187 267 (174) 2,575 4,078 1,773 4,094 355 benefits expense Stock-based compensation expense Pension and other postretirement benefits funding Earnings of equity method investments, less dividends received (346) (390) (60) (125) (113) Change in assets and liabilities Decrease (increase) in receivables 1,098 2,176 Decrease (increase) in inventories Decrease in other current assets (36) (134) (36) 104 (79) 308 (488) (1,680) 76 (Increase) decrease in other assets 12 Decrease in accounts payable and accrued liabilities (2,656) (699) 24 162 8,805 (Decrease) increase in estimated liability for taxes on income Increase (decrease) in other liabilities 2) (251) NET CASH PROVIDED BY OPERATING ACTIVITIES Cash flows from investing activities Capital expenditures SPM investments Multiclient seismic data capitalized Business acquisitions and investments, net of cash acquired Sale (purchase) of investments, net 6,261 11,195 (2,055) (1,031) (630) (2,398) 5,544 (54) (624) (2,410) (3,976) (321) (1,008) (486) (443) (5,848) (112) (10,252) NET CASH USED IN INVESTING ACTIVITIES Cash flows from financing activities: Dividends paid Proceeds from employee stock purchase (5,580) (2,647) (2,419) (1,968) 231 295