please complete the Free Cash Flow For year 0-5

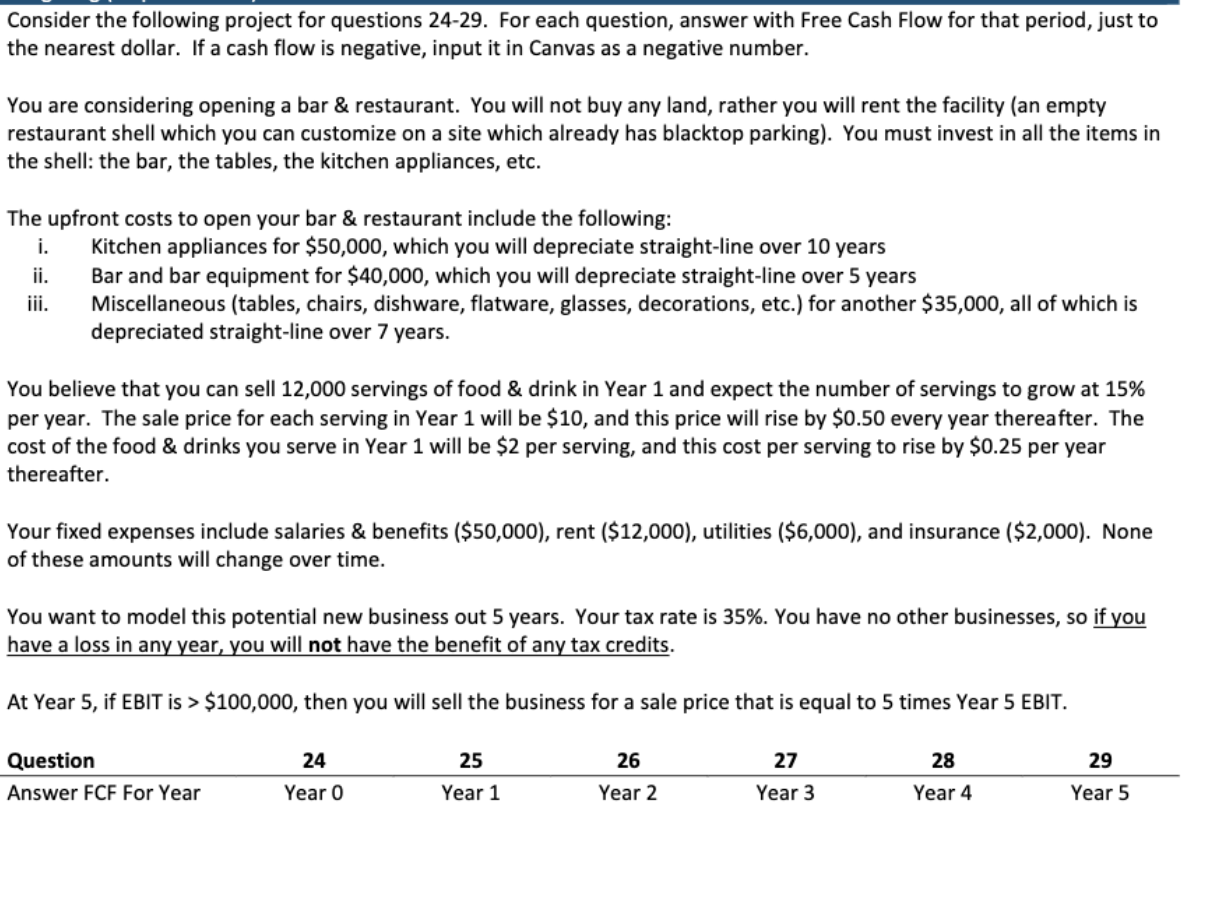

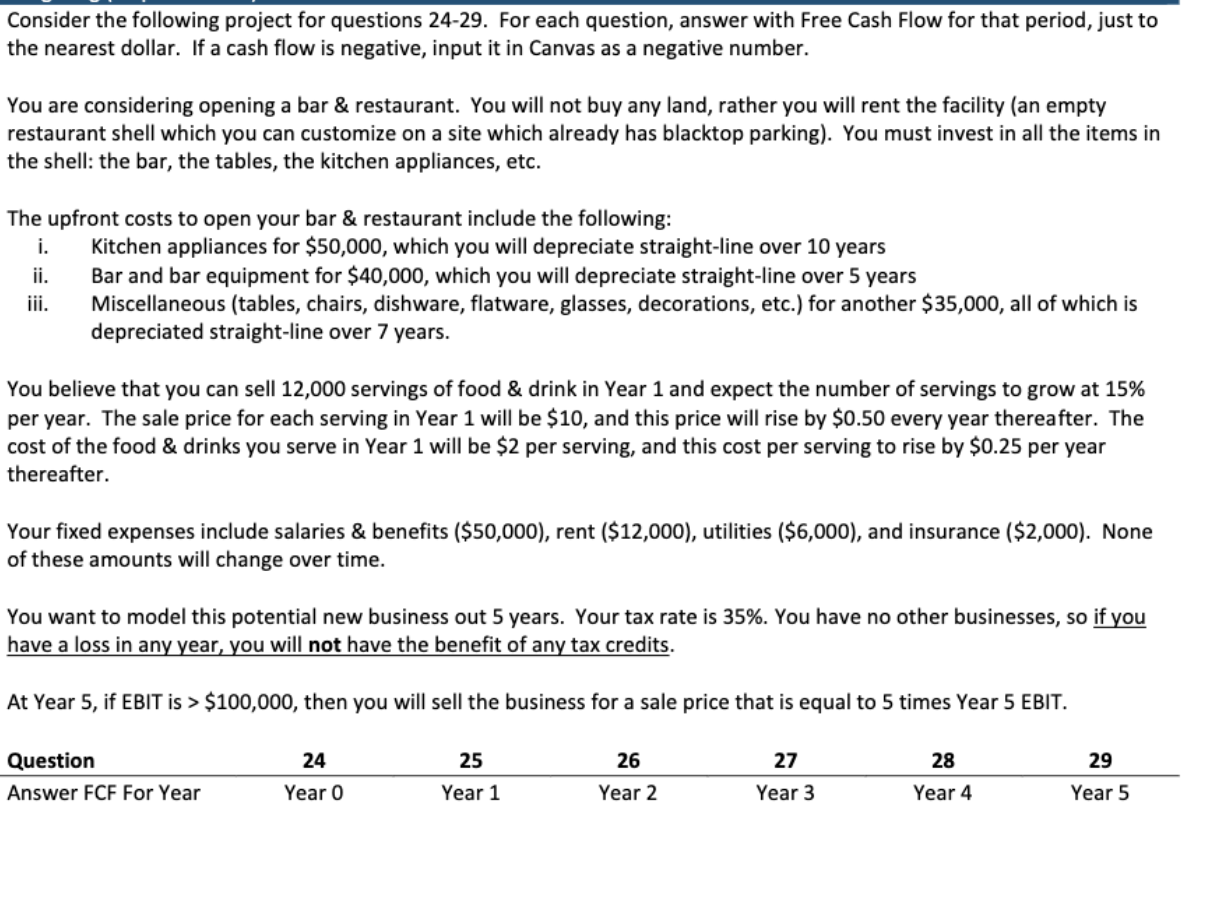

Consider the following project for questions 24-29. For each question, answer with Free Cash Flow for that period, just to the nearest dollar. If a cash flow is negative, input it in Canvas as a negative number. You are considering opening a bar & restaurant. You will not buy any land, rather you will rent the facility (an empty restaurant shell which you can customize on a site which already has blacktop parking). You must invest in all the items in the shell: the bar, the tables, the kitchen appliances, etc. The upfront costs to open your bar & restaurant include the following: i. Kitchen appliances for $50,000, which you will depreciate straight-line over 10 years Bar and bar equipment for $40,000, which you will depreciate straight-line over 5 years ii. iii. Miscellaneous (tables, chairs, dishware, flatware, glasses, decorations, etc.) for another $35,000, all of which is depreciated straight-line over 7 years. You believe that you can sell 12,000 servings of food & drink in Year 1 and expect the number of servings to grow at 15% per year. The sale price for each serving in Year 1 will be $10, and this price will rise by $0.50 every year thereafter. The cost of the food & drinks you serve in Year 1 will be $2 per serving, and this cost per serving to rise by $0.25 per year thereafter. Your fixed expenses include salaries & benefits ($50,000), rent ($12,000), utilities ($6,000), and insurance ($2,000). None of these amounts will change over time. You want to model this potential new business out 5 years. Your tax rate is 35%. You have no other businesses, so if you have a loss in any year, you will not have the benefit of any tax credits. At Year 5, if EBIT is > $100,000, then you will sell the business for a sale price that is equal to 5 times Year 5 EBIT. Question 24 25 26 27 28 29 Answer FCF For Year Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Consider the following project for questions 24-29. For each question, answer with Free Cash Flow for that period, just to the nearest dollar. If a cash flow is negative, input it in Canvas as a negative number. You are considering opening a bar & restaurant. You will not buy any land, rather you will rent the facility (an empty restaurant shell which you can customize on a site which already has blacktop parking). You must invest in all the items in the shell: the bar, the tables, the kitchen appliances, etc. The upfront costs to open your bar & restaurant include the following: i. Kitchen appliances for $50,000, which you will depreciate straight-line over 10 years Bar and bar equipment for $40,000, which you will depreciate straight-line over 5 years ii. iii. Miscellaneous (tables, chairs, dishware, flatware, glasses, decorations, etc.) for another $35,000, all of which is depreciated straight-line over 7 years. You believe that you can sell 12,000 servings of food & drink in Year 1 and expect the number of servings to grow at 15% per year. The sale price for each serving in Year 1 will be $10, and this price will rise by $0.50 every year thereafter. The cost of the food & drinks you serve in Year 1 will be $2 per serving, and this cost per serving to rise by $0.25 per year thereafter. Your fixed expenses include salaries & benefits ($50,000), rent ($12,000), utilities ($6,000), and insurance ($2,000). None of these amounts will change over time. You want to model this potential new business out 5 years. Your tax rate is 35%. You have no other businesses, so if you have a loss in any year, you will not have the benefit of any tax credits. At Year 5, if EBIT is > $100,000, then you will sell the business for a sale price that is equal to 5 times Year 5 EBIT. Question 24 25 26 27 28 29 Answer FCF For Year Year 0 Year 1 Year 2 Year 3 Year 4 Year 5