Answered step by step

Verified Expert Solution

Question

1 Approved Answer

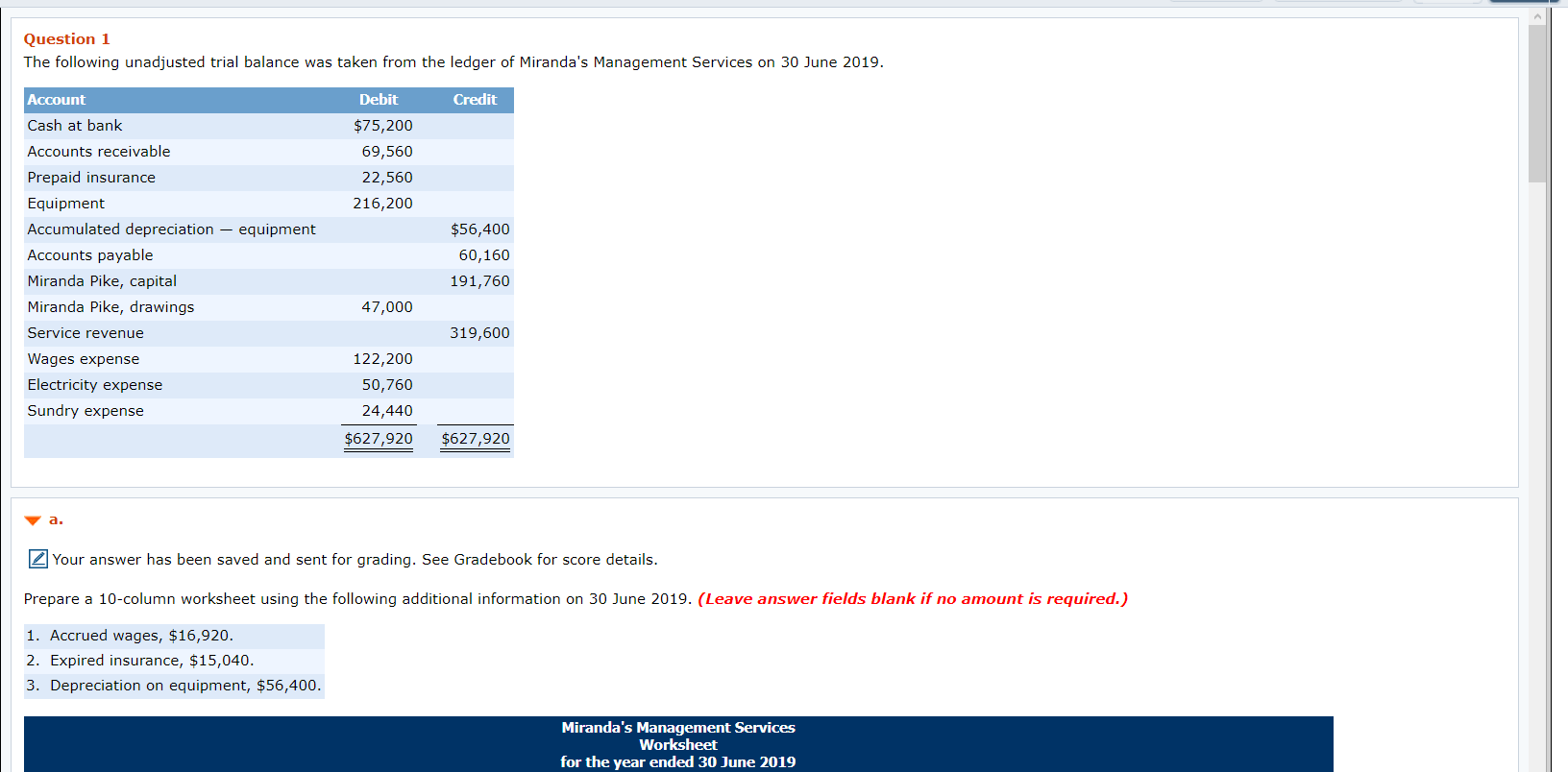

please complete the income, equity statement and balance sheet asap thanks . Question 1 The following unadjusted trial balance was taken from the ledger of

please complete the income, equity statement and balance sheet asap thanks .

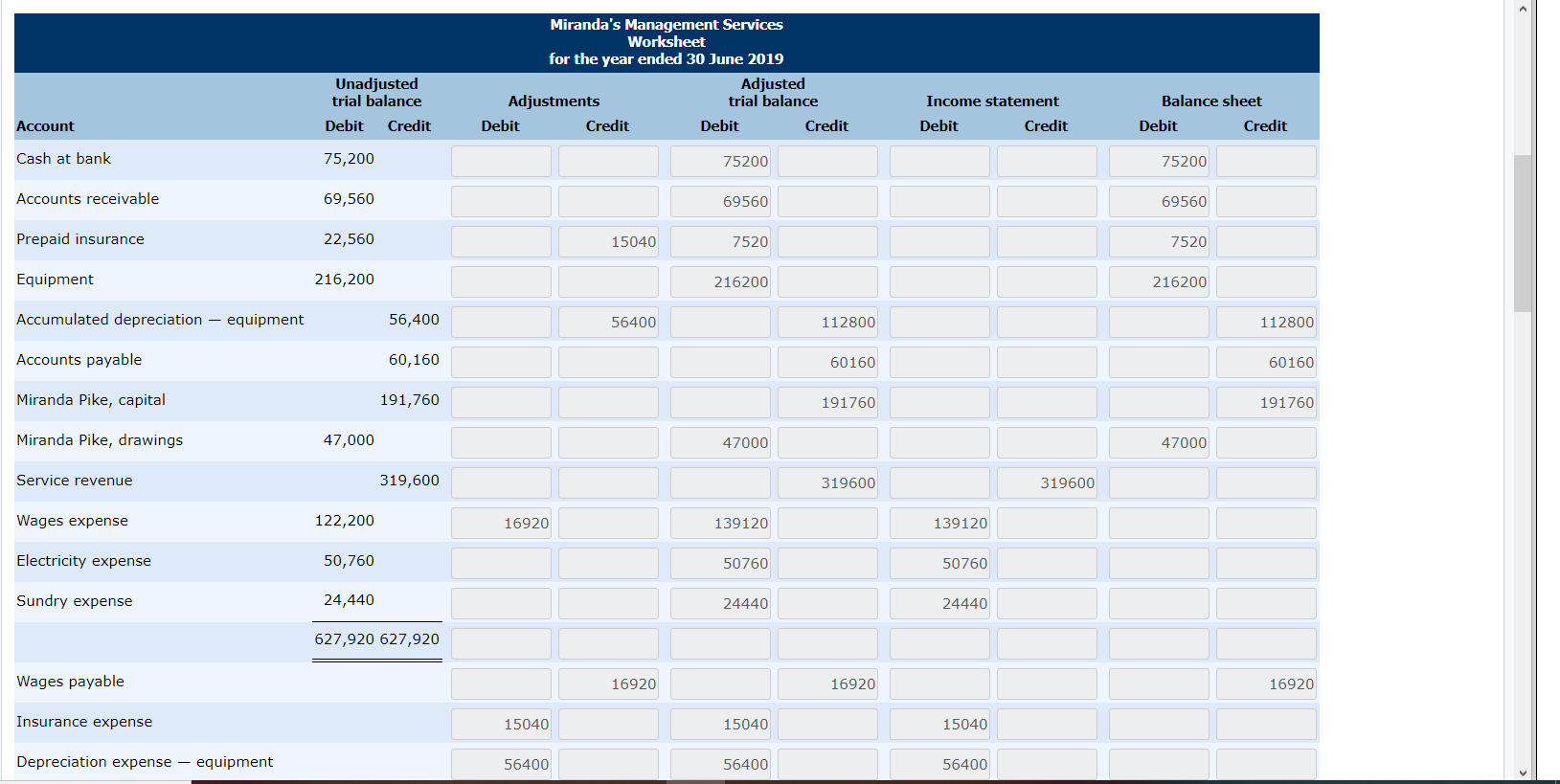

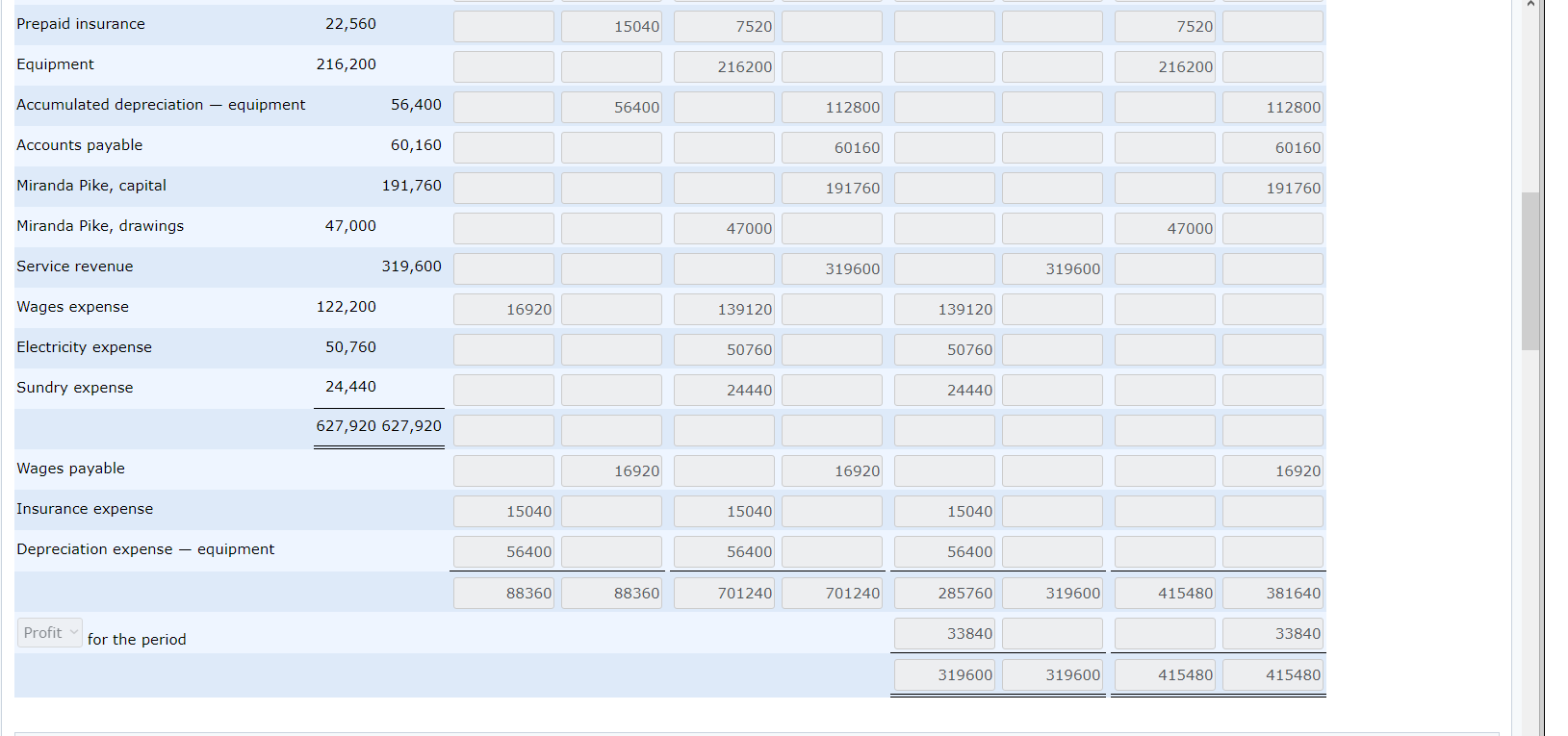

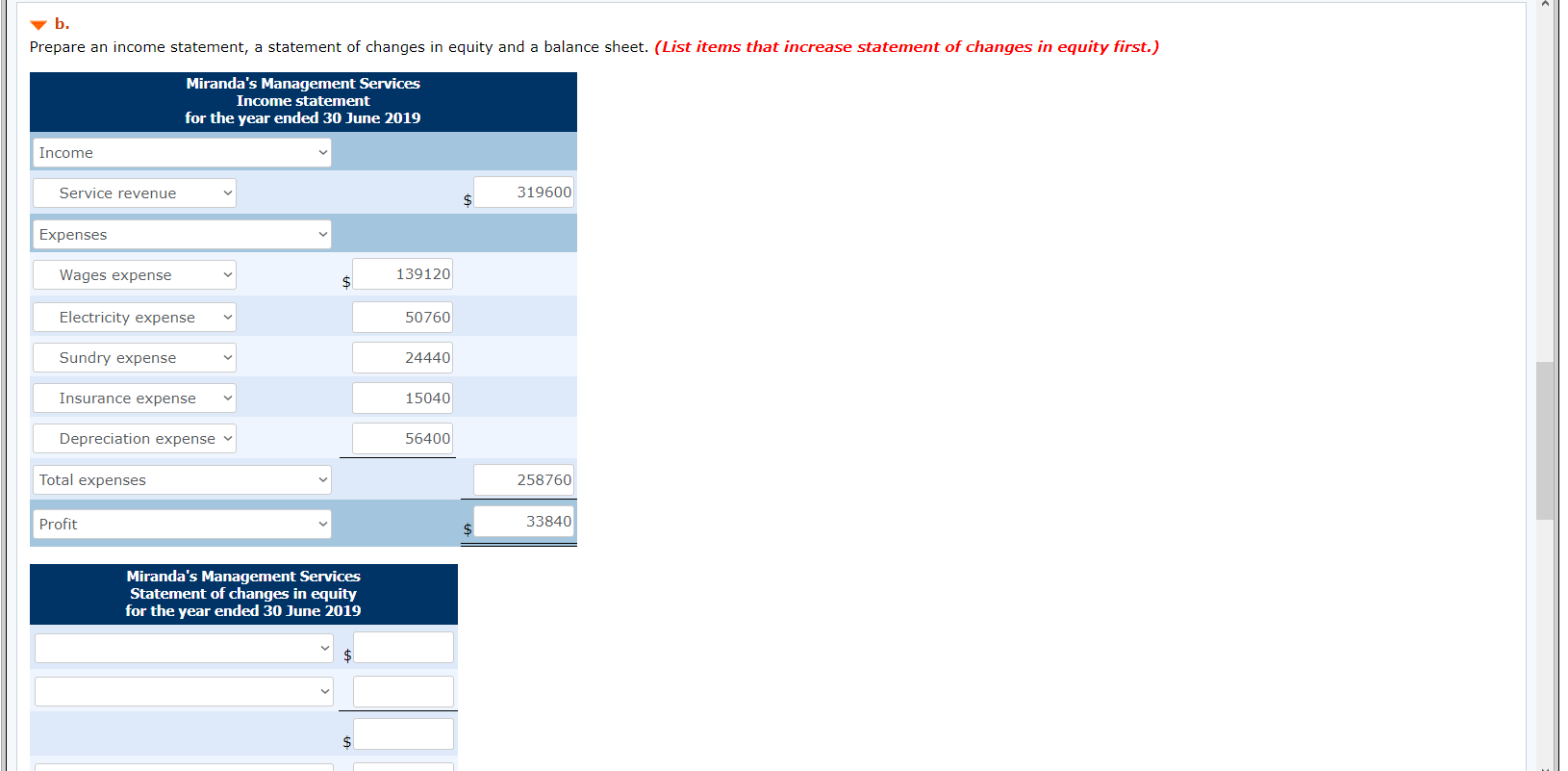

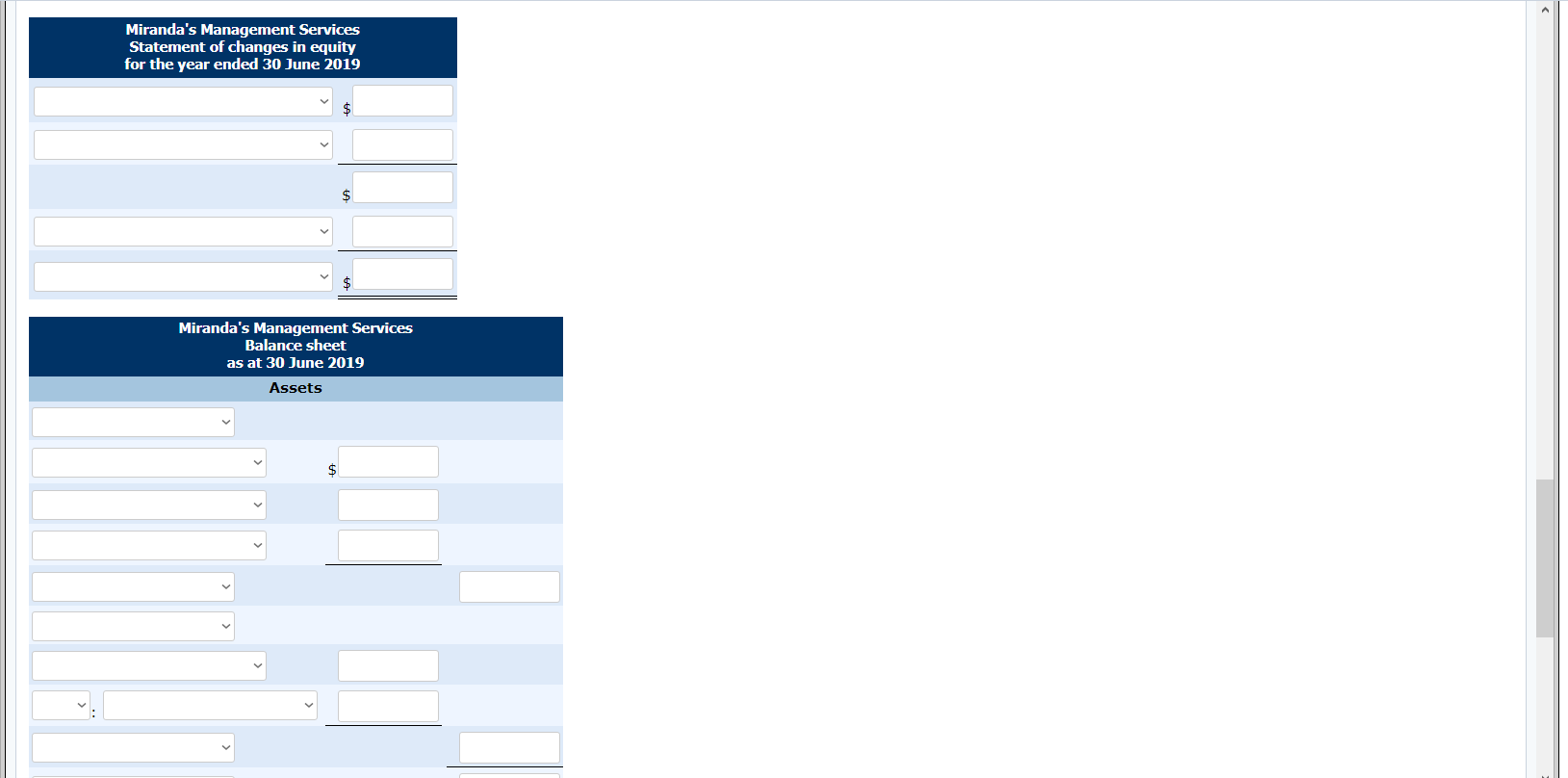

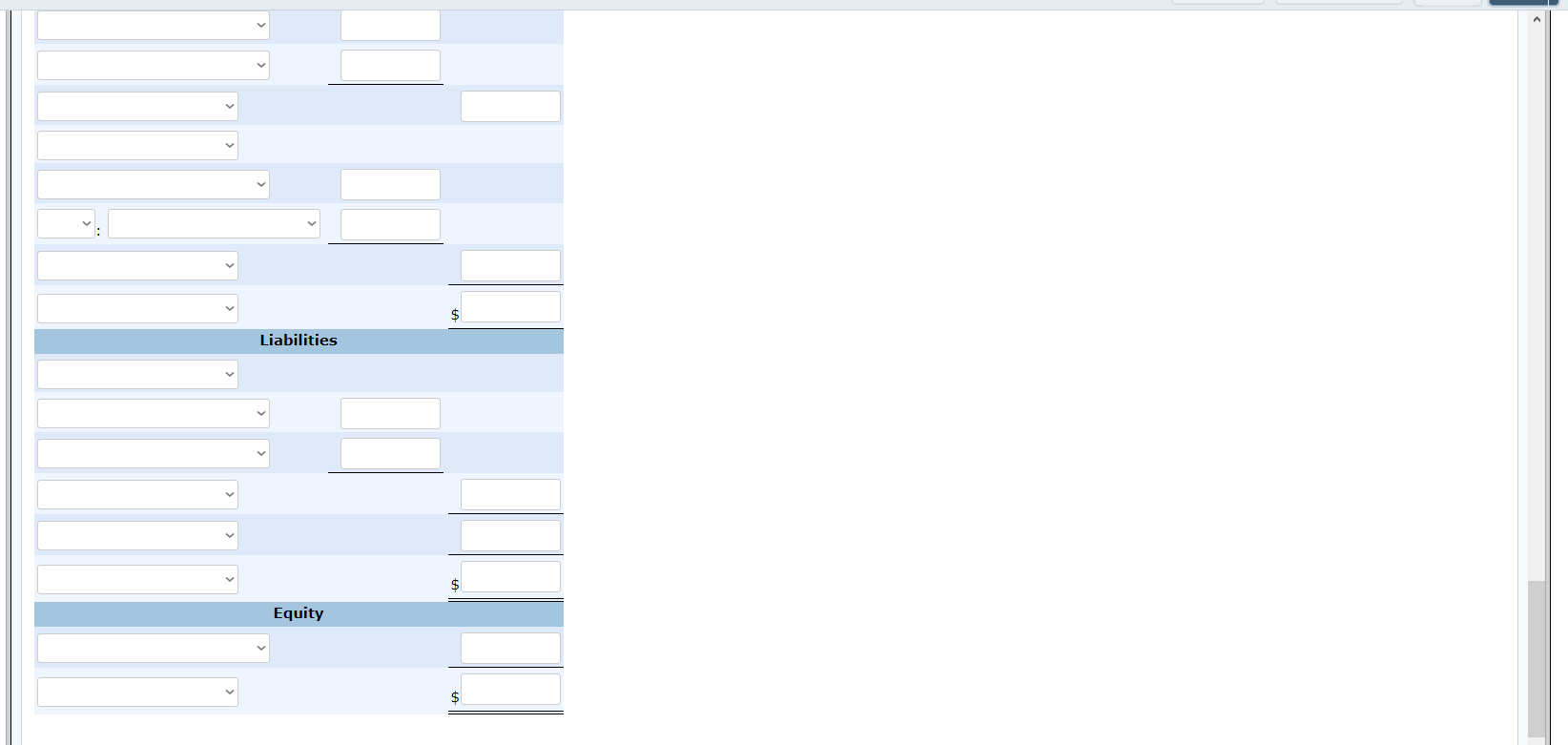

Question 1 The following unadjusted trial balance was taken from the ledger of Miranda's Management Services on 30 June 2019. Account Debit Credit $75,200 69,560 22,560 216,200 Cash at bank Accounts receivable Prepaid insurance Equipment Accumulated depreciation equipment Accounts payable Miranda Pike, capital Miranda Pike, drawings Service revenue $56,400 60,160 191,760 47,000 319,600 Wages expense Electricity expense Sundry expense 122,200 50,760 24,440 $627,920 $627,920 Your answer has been saved and sent for grading. See Gradebook for score details. Prepare a 10-column worksheet using the following additional information on 30 June 2019. (Leave answer fields blank if no amount is required.) 1. Accrued wages, $16,920. 2. Expired insurance, $15,040. 3. Depreciation on equipment, $56,400. Miranda's Management Services Worksheet for the year ended 30 June 2019 Unadjusted trial balance Debit Credit Miranda's Management Services Worksheet for the year ended 30 June 2019 Adjusted Adjustments trial balance Debit Credit Debit Credit Income statement Debit Credit Balance sheet Debit Credit Account Cash at bank 75,200 75200 75200 Accounts receivable 69,560 69560 69560 Prepaid insurance 22,560 15040 7520 7520 Equipment 216,200 216200 216200 Accumulated depreciation equipment 56,400 56400 112800 112800 Accounts payable 60,160 60160 60160 Miranda Pike, capital 191,760 191760 191760 Miranda Pike, drawings 47,000 47000 7000 Service revenue 319,600 319600 319600 Wages expense 122,200 16920 139120 139120 Electricity expense 50,760 50760 50760 Sundry expense 24,440 24440 24440 627,920 627,920 Wages payable 16920 16920 16920 Insurance expense 15040 15040 15040 Depreciation expense equipment 56400 56400 56400 Prepaid insurance 22,560 15040 7520 7520 Equipment 216,200 216200 216200 Accumulated depreciation equipment 56,400 56400 112800 112800 Accounts payable 60,160 60160 60160 Miranda Pike, capital 191,760 191760 191760 Miranda Pike, drawings 47,000 47000 47000 Service revenue 319,600 319600 319600 Wages expense 122,200 16920 139120 139120 Electricity expense 50,760 50760 50760 Sundry expense 24,440 24440 24440 627,920 627,920 Wages payable 16920 16920 16920 Insurance expense 15040 15040 15040 Depreciation expense equipment 56400 56400 56400 88360 88360 701240 701240 285760 319600 415480 381640 Profit for the period 33840 33840 319600 319600 415480 415480 b. Prepare an income statement, a statement of changes in equity and a balance sheet. (List items that increase statement of changes in equity first.) Miranda's Management Services Income statement for the year ended 30 June 2019 Income Service revenue 319600 Expenses Wages expense 139120 $ Electricity expense 50760 Sundry expense 24440 Insurance expense 15040 Depreciation expense 56400 Total expenses 258760 Profit 33840 $ Miranda's Management Services Statement of changes in equity for the year ended 30 June 2019 Miranda's Management Services Statement of changes in equity for the year ended 30 June 2019 Miranda's Management Services Balance sheet as at 30 June 2019 Assets $ Liabilities EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started