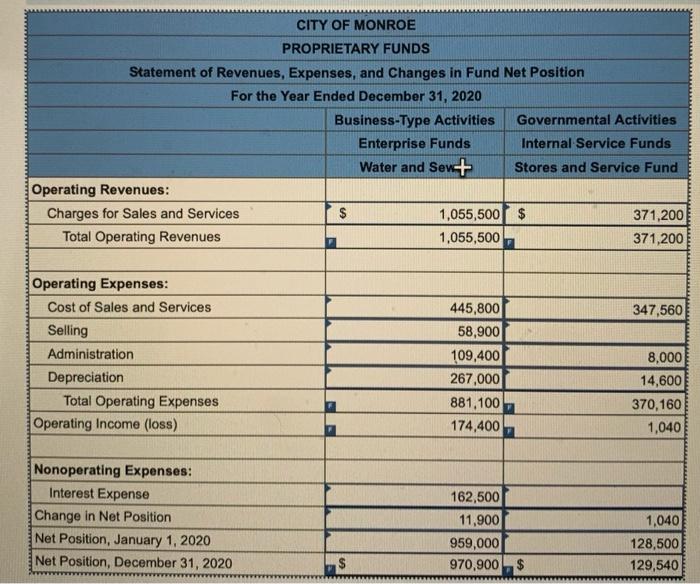

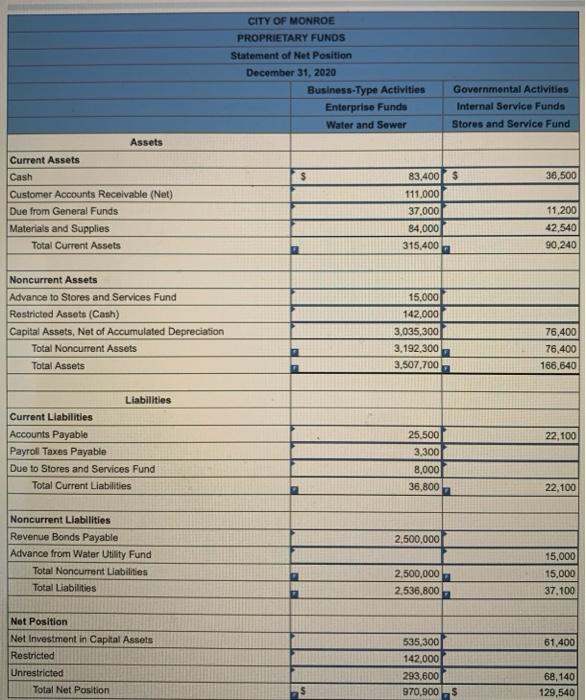

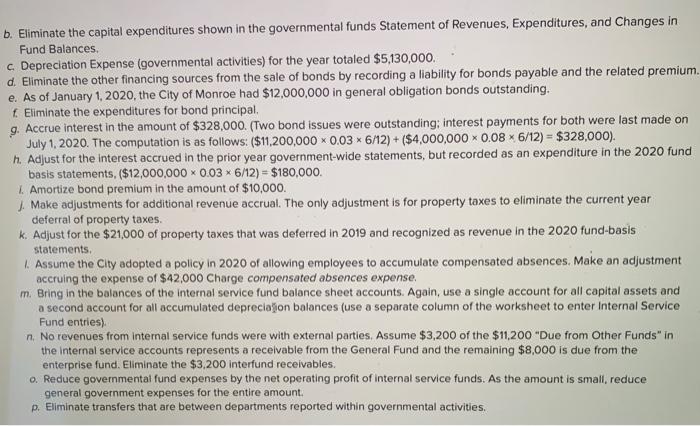

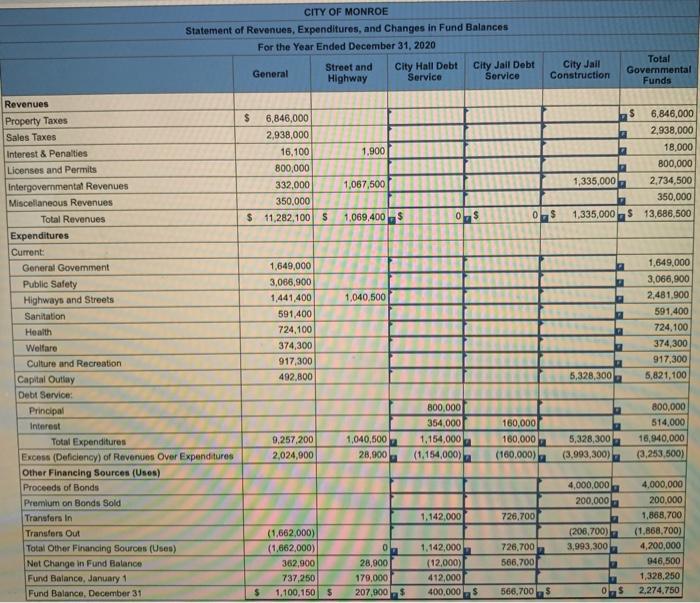

Please complete the journal entries using the information from these financial statements

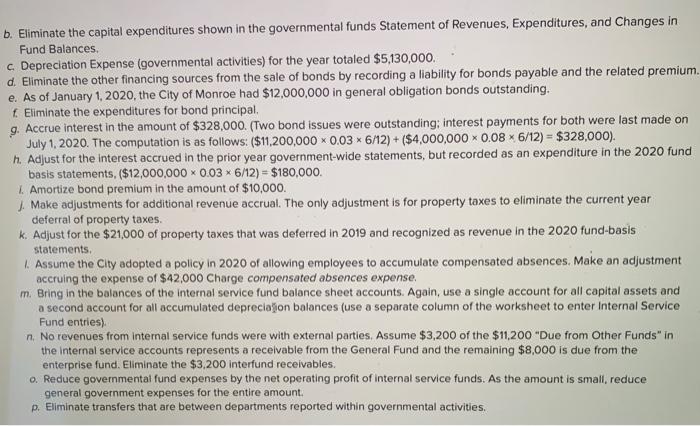

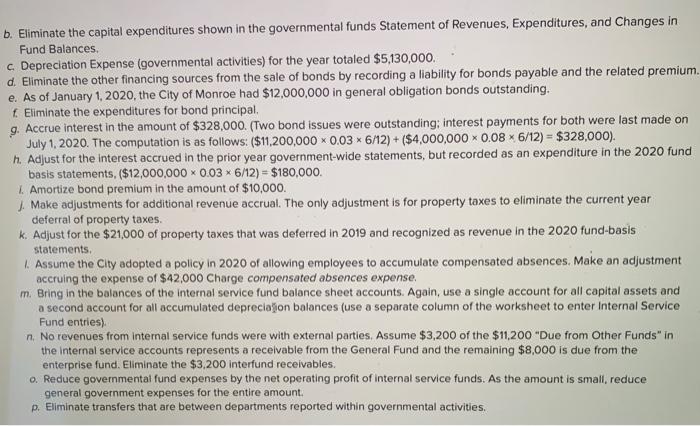

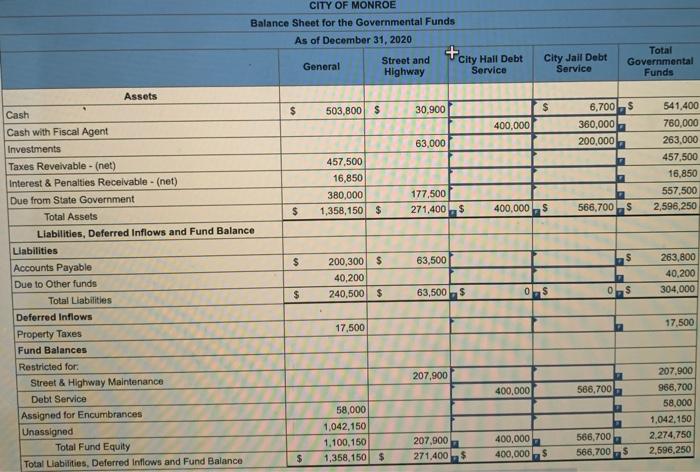

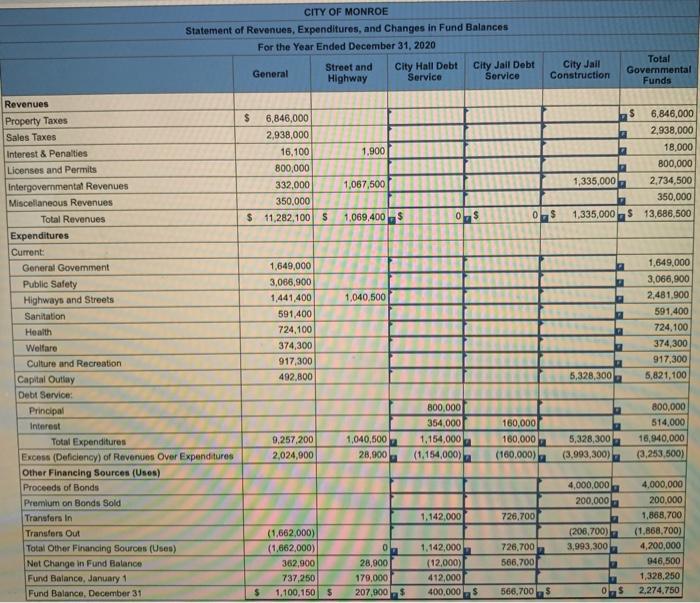

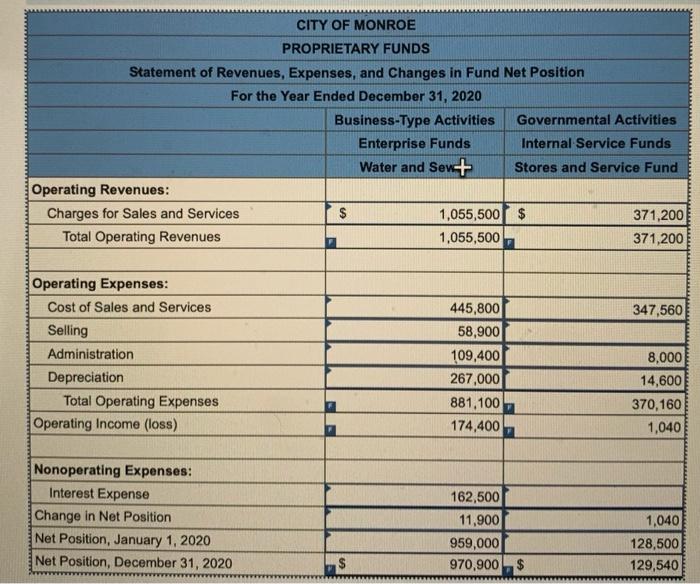

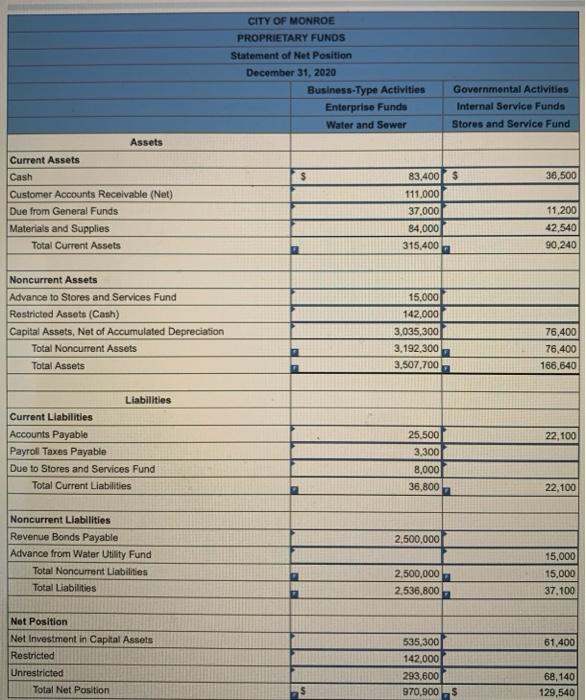

b. Eliminate the capital expenditures shown in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances c Depreciation Expense (governmental activities) for the year totaled $5,130,000. d. Eliminate the other financing sources from the sale of bonds by recording a liability for bonds payable and the related premium. e. As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. f Eliminate the expenditures for bond principal 9. Accrue interest in the amount of $328,000. (Two bond issues were outstanding; interest payments for both were last made on July 1, 2020. The computation is as follows: ($11,200,000 0.03 * 6/12) + ($4,000,000 0.08 * 6/12) = $328,000). h. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 0.03 * 6/12) = $180,000 1. Amortize bond premium in the amount of $10,000. J. Make adjustments for additional revenue accrual. The only adjustment is for property taxes to eliminate the current year deferral of property taxes. k. Adjust for the $21,000 of property taxes that was deferred in 2019 and recognized as revenue in the 2020 fund basis statements 1. Assume the City adopted a policy in 2020 of allowing employees to accumulate compensated absences. Make an adjustment accruing the expense of $42,000 Charge compensated absences expense. m. Bring in the balances of the internal service fund balance sheet accounts. Again, use a single account for all capital assets and a second account for all accumulated depreciation balances (use a separate column of the worksheet to enter Internal Service Fund entries) n. No revenues from internal service funds were with external parties. Assume $3,200 of the $11,200 "Due from Other Funds" in the Internal service accounts represents a receivable from the General Fund and the remaining $8,000 is due from the enterprise fund. Eliminate the $3,200 interfund receivables. o. Reduce governmental fund expenses by the net operating profit of internal service funds. As the amount is small, reduce general government expenses for the entire amount. p. Eliminate transfers that are between departments reported within governmental activities. CITY OF MONROE Balance Sheet for the Governmental Funds As of December 31, 2020 + Total General Street and City Hall Debt City Jail Debt Governmental Highway Service Service Funds Assets Cash $ 503,800 $ 30.900 $ 6,700 S 541,400 Cash with Fiscal Agent 400,000 360,000 760,000 Investments 63.000 200,000 263,000 Taxes Reveivable - (net) 457,500 7 457,500 Interest & Penalties Receivable - (net) 16,850 16,850 Due from State Government 380,000 177,500 557,500 Total Assets $ 1,358,150 $ 271,400$ 400,000 566,700 S 2,596,250 Liabilities, Deferred Inflows and Fund Balance Liabilities Accounts Payable $ 200,300 $ 63,500 $ 263,800 Due to Other funds 40,200 7 40,200 Total Liabilities $ 240,500 $ 63,500 $ 05 OS 304,000 Deferred Inflows Property Taxes 17,500 17,500 Fund Balances Restricted for Street & Highway Maintenance 207,900 207.900 Debt Service 400,000 966,700 Assigned for Encumbrances 58,000 7 58,000 Unassigned 1,042,150 1,042,150 Total Fund Equity 1,100,150 207.900 400,000 586,700 2.274,750 Total Liabilities, Deferred Inflows and Fund Balance $ 1,358,150 $ 271,400$ 400,000 $ 566,700$ 2,596,250 566,700 CITY OF MONROE Statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended December 31, 2020 General Street and Highway City Hall Debt Service City Jail Debt Service City Jail Construction Total Governmental Funds 1.900 $ 6,846,000 2,938,000 16,100 800,000 332,000 350,000 $ 11,282,100 $ $ 6,846,000 2,938,000 18,000 800,000 1,335,000 2,734,500 350,000 1,335,000 $13,686,500 1,067,500 1,069.400$ OS 0$ Revenues Property Taxes Sales Taxes Interest & Penalties Licenses and Permits Intergovernmental Revenues Miscellaneous Revenues Total Revenues Expenditures Current: General Government Public Safety Highways and Streets Sanitation Health Welfare Culture and Recreation Capital Outlay Debt Service: Principal Interest Total Expenditures Excess (Deficiency) of Revenues Over Expenditures Other Financing Sources (Uses) Proceeds of Bonds 1,040,500 1,649,000 3,065,900 1,441,400 591,400 724,100 374,300 917,300 492,800 1,649.000 3,066,900 2,481,900 591,400 724,100 374,300 917,300 5,821,100 5,328,300 800,000 354,000 1,154,000 (1.154,000) 800,000 514,000 18,940,000 (3,253,500) 9,257,200 2,024,900 160,000 160,000 (160.000) 1,040,500 28,900 5,328,300 (3,993,300) 4,000,000 200,000 1,142,000 726.700 Premium on Bonds Sold Transfers in Transfers Out Total Other Financing Sources (Uses) Net Change in Fund Balance Fund Balance, January 1 Fund Balance, December 31 (206,700) 3,993,300 (1,662,000) (1,662,000) 362,900 737,250 1,100,150 $ 4,000,000 200,000 1,868,700 (1.868,700) 4,200,000 946,500 1,328,250 2,274,750 726,700 566,700 0 28.900 179,000 207,900 $ 1,142,000 (12,000) 412,000 400,000 $ $ 566,700$ OS CITY OF MONROE PROPRIETARY FUNDS Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Business-Type Activities Governmental Activities Enterprise Funds Internal Service Funds Water and Sent Stores and Service Fund Operating Revenues: Charges for Sales and Services 1,055,500 $ 371,200 Total Operating Revenues 1,055,500 371,200 347,560 Operating Expenses: Cost of Sales and Services Selling Administration Depreciation Total Operating Expenses Operating Income (loss) 445,800 58,900 109,400 267,000 881,100 174,400 8,000 14,600 370,160 1,040 Nonoperating Expenses: Interest Expense Change in Net Position Net Position, January 1, 2020 Net Position, December 31, 2020 162,500 11,900 959,000 970,900$ 1,040 128,500 129,540 CITY OF MONROE PROPRIETARY FUNDS Statement of Net Position December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund $ 36,500 Assets Current Assets Cash Customer Accounts Receivable (Net) Due from General Funds Materials and Supplies Total Current Assets 83,400 $ 111.000 37,000 84,000 11,200 42,540 90,240 315.400 Noncurrent Assets Advance to Stores and Services Fund Restricted Assets (Cash) Capital Assets. Net of Accumulated Depreciation Total Noncurrent Assets Total Assets 15,000 142,000 3,035,300 3.192.300 3,507,700 76,400 76,400 166,640 22,100 Liabilities Current Liabilities Accounts Payable Payroll Taxes Payable Due to Stores and Services Fund Total Current Liabilities 25,500 3.300 8,000 36,800 22,100 2,500,000 Noncurrent Liabilities Revenue Bonds Payable Advance from Water Utility Fund Total Noncurrent Liabilities Total Liabilities 2,500,000 2,536.800 15,000 15,000 37.100 61,400 Net Position Net Investment in Capital Assets Restricted Unrestricted Total Net Position 535,300 142.000 293,600 970.900S 68,140 129,540 b. Eliminate the capital expenditures shown in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances c Depreciation Expense (governmental activities) for the year totaled $5,130,000. d. Eliminate the other financing sources from the sale of bonds by recording a liability for bonds payable and the related premium. e. As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. f Eliminate the expenditures for bond principal 9. Accrue interest in the amount of $328,000. (Two bond issues were outstanding; interest payments for both were last made on July 1, 2020. The computation is as follows: ($11,200,000 0.03 * 6/12) + ($4,000,000 0.08 * 6/12) = $328,000). h. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 0.03 * 6/12) = $180,000 1. Amortize bond premium in the amount of $10,000. J. Make adjustments for additional revenue accrual. The only adjustment is for property taxes to eliminate the current year deferral of property taxes. k. Adjust for the $21,000 of property taxes that was deferred in 2019 and recognized as revenue in the 2020 fund basis statements 1. Assume the City adopted a policy in 2020 of allowing employees to accumulate compensated absences. Make an adjustment accruing the expense of $42,000 Charge compensated absences expense. m. Bring in the balances of the internal service fund balance sheet accounts. Again, use a single account for all capital assets and a second account for all accumulated depreciation balances (use a separate column of the worksheet to enter Internal Service Fund entries) n. No revenues from internal service funds were with external parties. Assume $3,200 of the $11,200 "Due from Other Funds" in the Internal service accounts represents a receivable from the General Fund and the remaining $8,000 is due from the enterprise fund. Eliminate the $3,200 interfund receivables. o. Reduce governmental fund expenses by the net operating profit of internal service funds. As the amount is small, reduce general government expenses for the entire amount. p. Eliminate transfers that are between departments reported within governmental activities. CITY OF MONROE Balance Sheet for the Governmental Funds As of December 31, 2020 + Total General Street and City Hall Debt City Jail Debt Governmental Highway Service Service Funds Assets Cash $ 503,800 $ 30.900 $ 6,700 S 541,400 Cash with Fiscal Agent 400,000 360,000 760,000 Investments 63.000 200,000 263,000 Taxes Reveivable - (net) 457,500 7 457,500 Interest & Penalties Receivable - (net) 16,850 16,850 Due from State Government 380,000 177,500 557,500 Total Assets $ 1,358,150 $ 271,400$ 400,000 566,700 S 2,596,250 Liabilities, Deferred Inflows and Fund Balance Liabilities Accounts Payable $ 200,300 $ 63,500 $ 263,800 Due to Other funds 40,200 7 40,200 Total Liabilities $ 240,500 $ 63,500 $ 05 OS 304,000 Deferred Inflows Property Taxes 17,500 17,500 Fund Balances Restricted for Street & Highway Maintenance 207,900 207.900 Debt Service 400,000 966,700 Assigned for Encumbrances 58,000 7 58,000 Unassigned 1,042,150 1,042,150 Total Fund Equity 1,100,150 207.900 400,000 586,700 2.274,750 Total Liabilities, Deferred Inflows and Fund Balance $ 1,358,150 $ 271,400$ 400,000 $ 566,700$ 2,596,250 566,700 CITY OF MONROE Statement of Revenues, Expenditures, and Changes in Fund Balances For the Year Ended December 31, 2020 General Street and Highway City Hall Debt Service City Jail Debt Service City Jail Construction Total Governmental Funds 1.900 $ 6,846,000 2,938,000 16,100 800,000 332,000 350,000 $ 11,282,100 $ $ 6,846,000 2,938,000 18,000 800,000 1,335,000 2,734,500 350,000 1,335,000 $13,686,500 1,067,500 1,069.400$ OS 0$ Revenues Property Taxes Sales Taxes Interest & Penalties Licenses and Permits Intergovernmental Revenues Miscellaneous Revenues Total Revenues Expenditures Current: General Government Public Safety Highways and Streets Sanitation Health Welfare Culture and Recreation Capital Outlay Debt Service: Principal Interest Total Expenditures Excess (Deficiency) of Revenues Over Expenditures Other Financing Sources (Uses) Proceeds of Bonds 1,040,500 1,649,000 3,065,900 1,441,400 591,400 724,100 374,300 917,300 492,800 1,649.000 3,066,900 2,481,900 591,400 724,100 374,300 917,300 5,821,100 5,328,300 800,000 354,000 1,154,000 (1.154,000) 800,000 514,000 18,940,000 (3,253,500) 9,257,200 2,024,900 160,000 160,000 (160.000) 1,040,500 28,900 5,328,300 (3,993,300) 4,000,000 200,000 1,142,000 726.700 Premium on Bonds Sold Transfers in Transfers Out Total Other Financing Sources (Uses) Net Change in Fund Balance Fund Balance, January 1 Fund Balance, December 31 (206,700) 3,993,300 (1,662,000) (1,662,000) 362,900 737,250 1,100,150 $ 4,000,000 200,000 1,868,700 (1.868,700) 4,200,000 946,500 1,328,250 2,274,750 726,700 566,700 0 28.900 179,000 207,900 $ 1,142,000 (12,000) 412,000 400,000 $ $ 566,700$ OS CITY OF MONROE PROPRIETARY FUNDS Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended December 31, 2020 Business-Type Activities Governmental Activities Enterprise Funds Internal Service Funds Water and Sent Stores and Service Fund Operating Revenues: Charges for Sales and Services 1,055,500 $ 371,200 Total Operating Revenues 1,055,500 371,200 347,560 Operating Expenses: Cost of Sales and Services Selling Administration Depreciation Total Operating Expenses Operating Income (loss) 445,800 58,900 109,400 267,000 881,100 174,400 8,000 14,600 370,160 1,040 Nonoperating Expenses: Interest Expense Change in Net Position Net Position, January 1, 2020 Net Position, December 31, 2020 162,500 11,900 959,000 970,900$ 1,040 128,500 129,540 CITY OF MONROE PROPRIETARY FUNDS Statement of Net Position December 31, 2020 Business-Type Activities Enterprise Funds Water and Sewer Governmental Activities Internal Service Funds Stores and Service Fund $ 36,500 Assets Current Assets Cash Customer Accounts Receivable (Net) Due from General Funds Materials and Supplies Total Current Assets 83,400 $ 111.000 37,000 84,000 11,200 42,540 90,240 315.400 Noncurrent Assets Advance to Stores and Services Fund Restricted Assets (Cash) Capital Assets. Net of Accumulated Depreciation Total Noncurrent Assets Total Assets 15,000 142,000 3,035,300 3.192.300 3,507,700 76,400 76,400 166,640 22,100 Liabilities Current Liabilities Accounts Payable Payroll Taxes Payable Due to Stores and Services Fund Total Current Liabilities 25,500 3.300 8,000 36,800 22,100 2,500,000 Noncurrent Liabilities Revenue Bonds Payable Advance from Water Utility Fund Total Noncurrent Liabilities Total Liabilities 2,500,000 2,536.800 15,000 15,000 37.100 61,400 Net Position Net Investment in Capital Assets Restricted Unrestricted Total Net Position 535,300 142.000 293,600 970.900S 68,140 129,540