Answered step by step

Verified Expert Solution

Question

1 Approved Answer

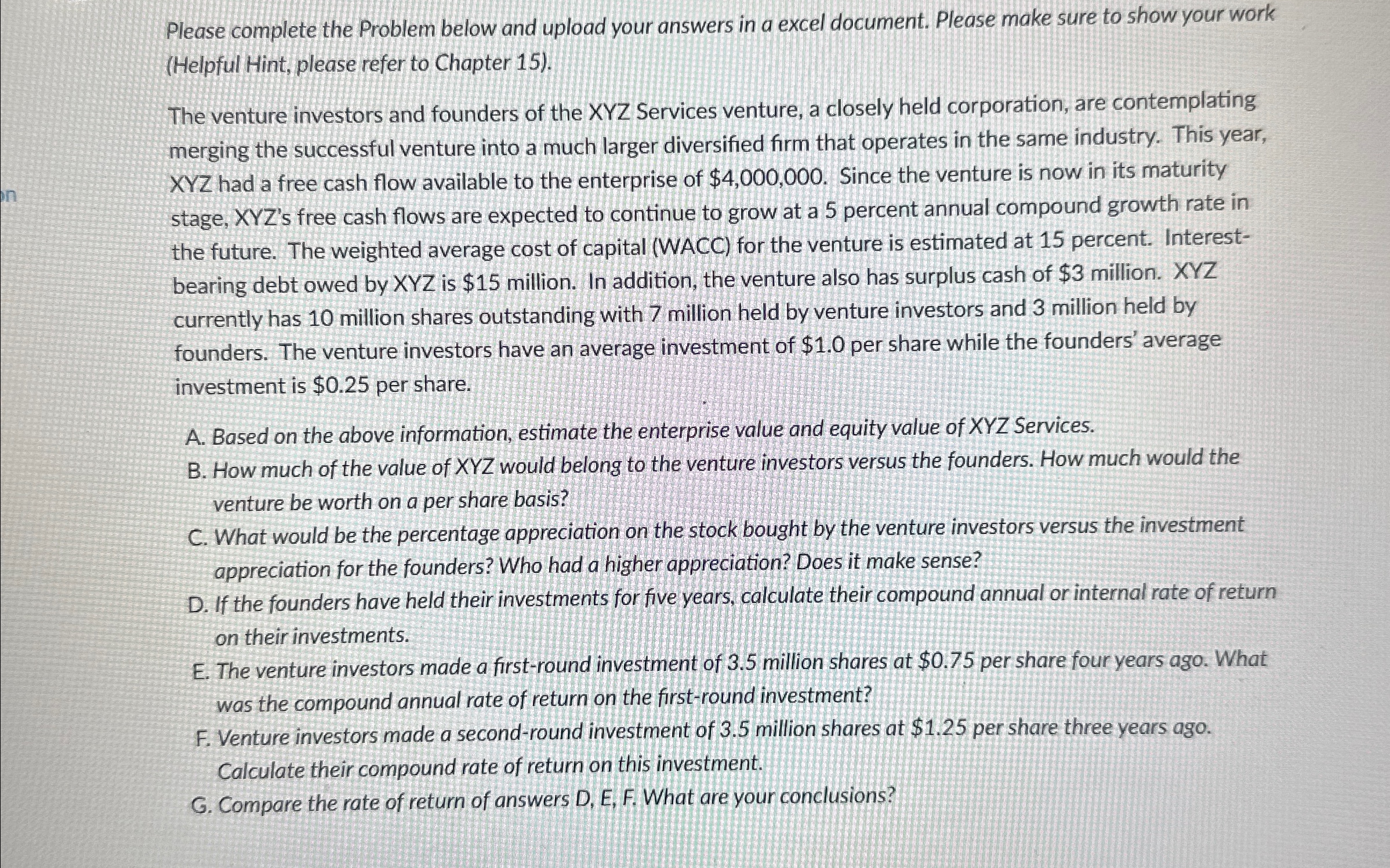

Please complete the Problem below and upload your answers in a excel document. Please make sure to show your work ( Helpful Hint, please refer

Please complete the Problem below and upload your answers in a excel document. Please make sure to show your work Helpful Hint, please refer to Chapter

The venture investors and founders of the XYZ Services venture, a closely held corporation, are contemplating merging the successful venture into a much larger diversified firm that operates in the same industry. This year, XYZ had a free cash flow available to the enterprise of $ Since the venture is now in its maturity stage, XYZs free cash flows are expected to continue to grow at a percent annual compound growth rate in the future. The weighted average cost of capital WACC for the venture is estimated at percent. Interestbearing debt owed by is $ million. In addition, the venture also has surplus cash of $ million. currently has million shares outstanding with million held by venture investors and million held by founders. The venture investors have an average investment of $ per share while the founders' average investment is $ per share.

A Based on the above information, estimate the enterprise value and equity value of XYZ Services.

B How much of the value of XYZ would belong to the venture investors versus the founders. How much would the venture be worth on a per share basis?

C What would be the percentage appreciation on the stock bought by the venture investors versus the investment appreciation for the founders? Who had a higher appreciation? Does it make sense?

D If the founders have held their investments for five years, calculate their compound annual or internal rate of return on their investments.

E The venture investors made a firstround investment of million shares at $ per share four years ago. What was the compound annual rate of return on the firstround investment?

F Venture investors made a secondround investment of million shares at $ per share three years ago. Calculate their compound rate of return on this investment.

G Compare the rate of return of answers D E F What are your conclusions?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started