Please complete the two income statements and PLEASE SHOW ANY EXCEL FORMULAS USED!!

Please complete the two income statements and PLEASE SHOW ANY EXCEL FORMULAS USED!!

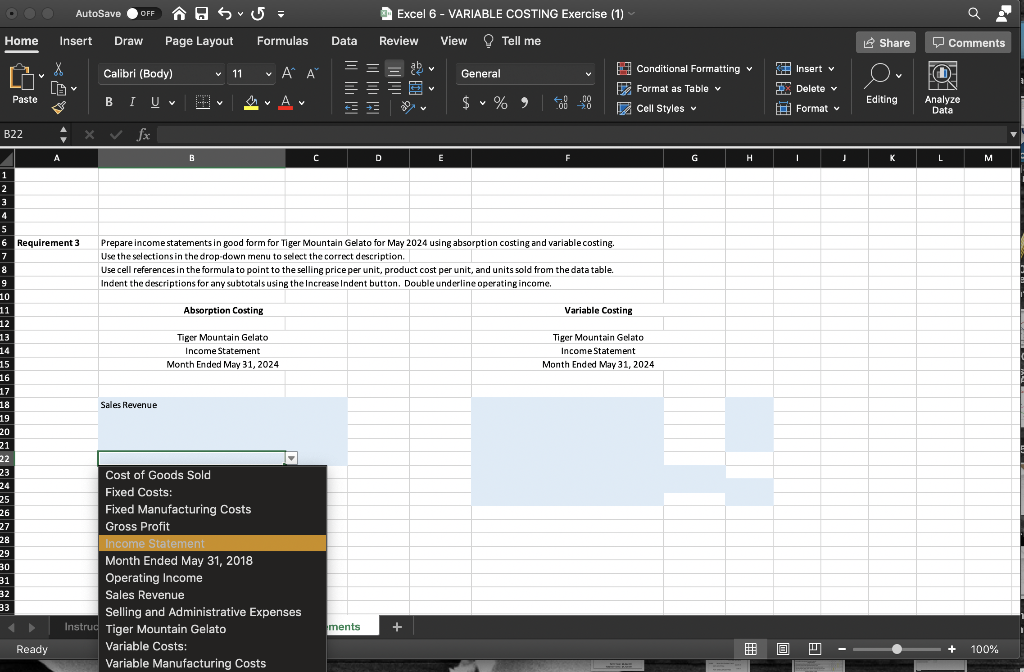

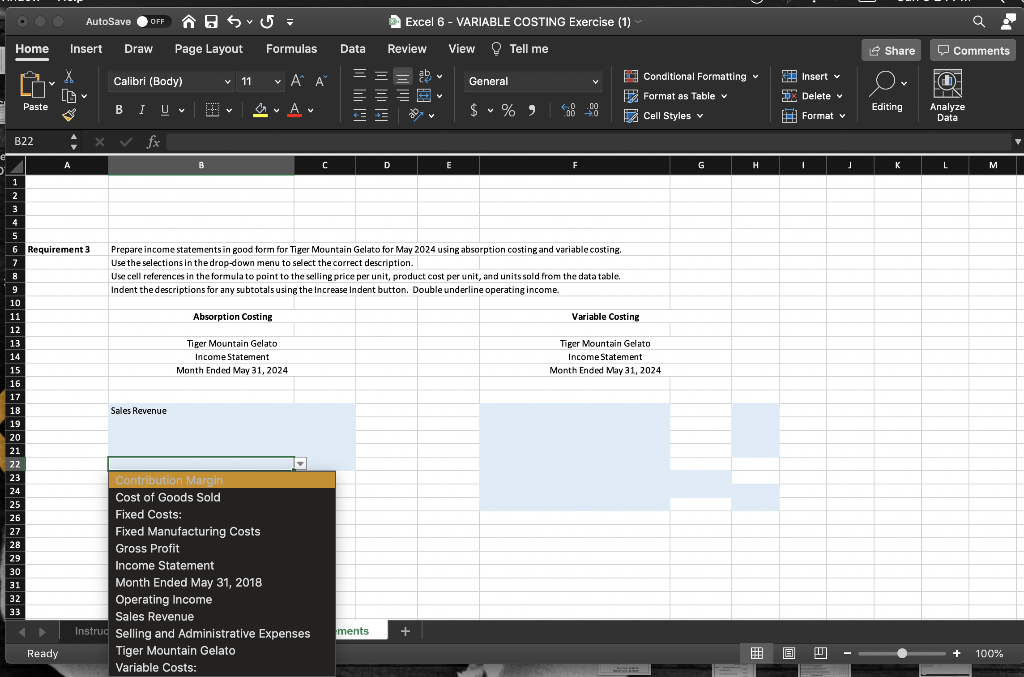

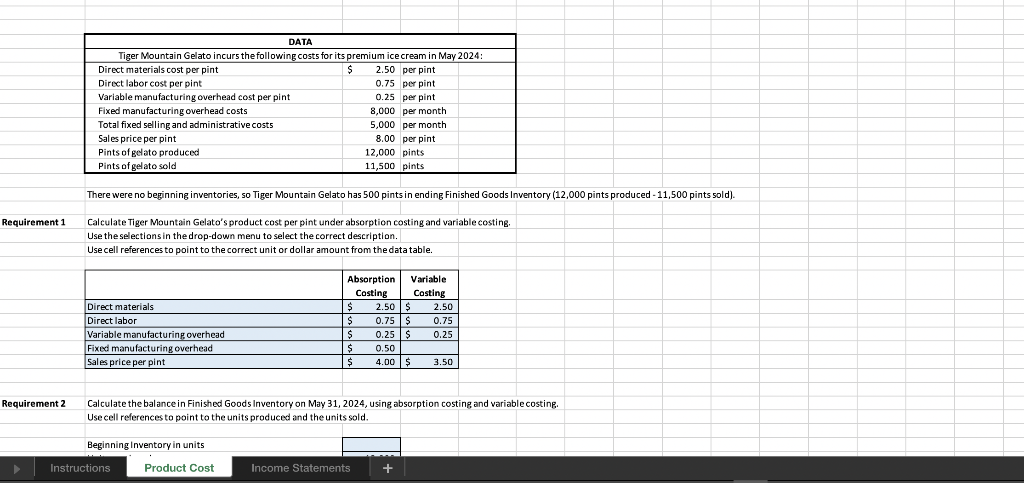

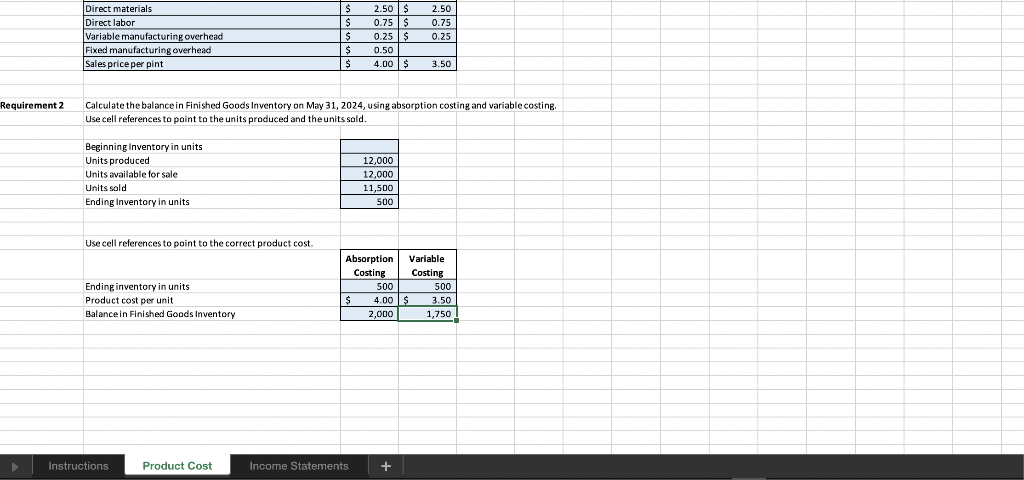

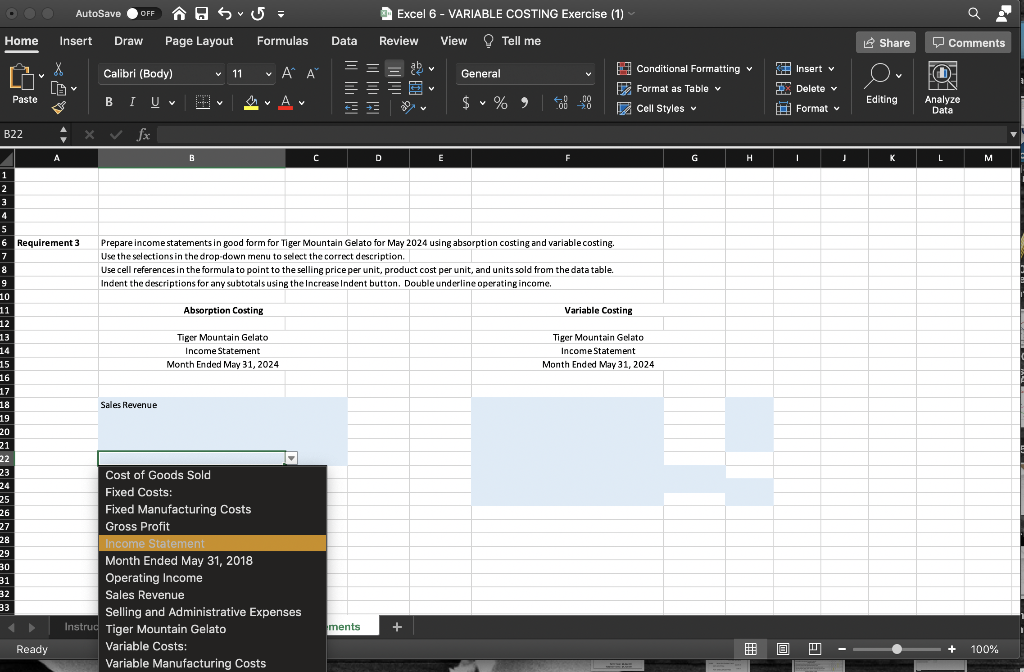

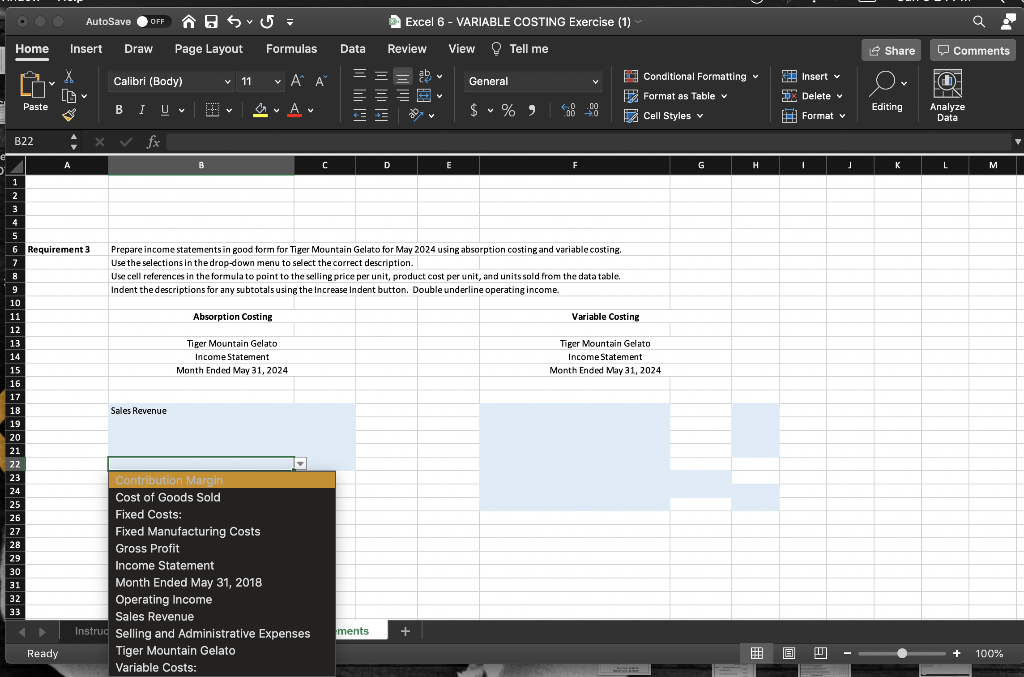

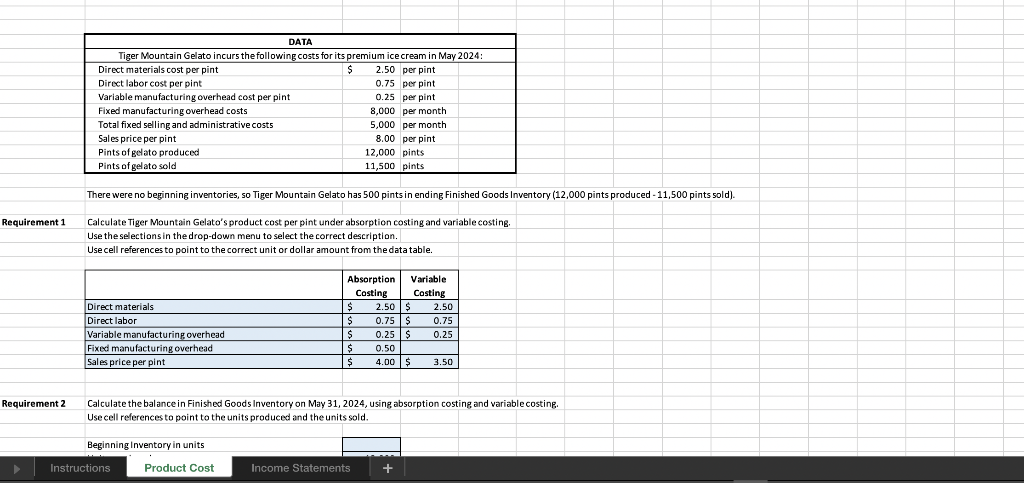

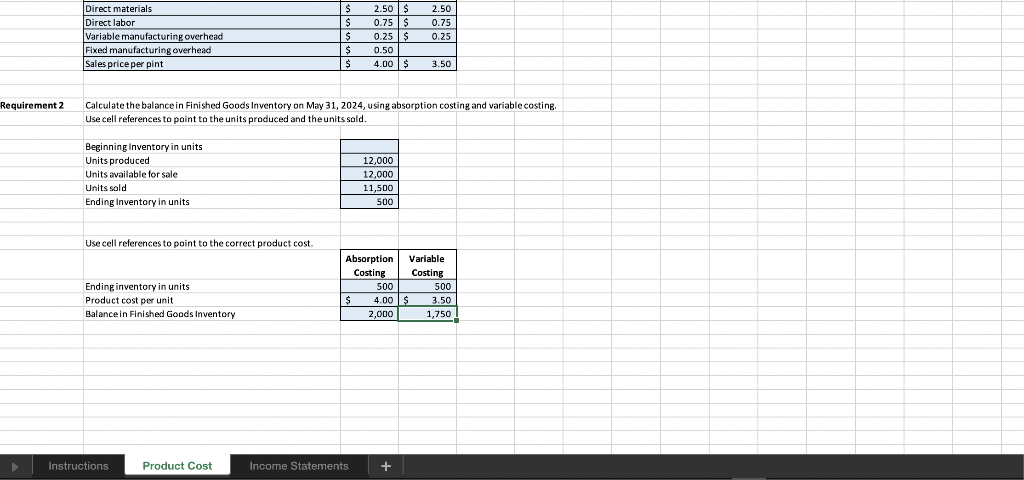

OOC AutoSave OFF Excel 6 - VARIABLE COSTING Exercise (1) Q os5 - Page Layout Formulas Home Insert Draw Data Review View Tell me Share Comments Insert v Calibri (Body) V 11 A == , General Conditional Formatting Format as Table v 1 Cell Styles O D Delete Paste BIV . V Av Editing $ % 8-98 PN Analyze Data Format v B22 - X fx G . J K L M . A B D E F 1 2 3 4 5 6 Requirement 3 Prepare income statements in good form for Tiger Mountain Gelato for May 2024 using absorption costing and variable costing. 7 Use the selections in the drop-down menu to select the correct description. 8 Use cell references in the formula to point to the selling price per unit, product cost per unit, and units sold from the data table. 9 Indent the descriptions for any subtotals using the Increase Indent button. Doubleunderline operating income. 10 11 Absorption Costing Variable Costing 12 13 Tiger Mountain Gelato Tiger Mountain Gelato 14 Income Statement Income Statement 15 Month Ended May 31, 2024 Month Ended May 31, 2024 16 17 18 Sales Revenue 19 20 21 22 23 Cost of Goods Sold 24 Fixed Costs: 25 26 Fixed Manufacturing Costs 27 Gross Profit 28 Income Statement 29 30 Month Ended May 31, 2018 31 Operating Income 32 Sales Revenue 33 Selling and Administrative Expenses Instrud Tiger Mountain Gelato ments + Ready Variable Costs: Variable Manufacturing Costs a 100% AutoSave OFF Excel 6 - VARIABLE COSTING Exercise (1) a o su Page Layout Formulas Home Insert Draw Data Review View Tell me Share D Comments X Calibri (Body) V 11 v AP = ab v v General Insert v Conditional Formatting Format as Table v h 30Delete Paste BIU a. Av $ %) 8.99 Editing Cell Styles Format v Analyze Data B22 X A B C D E F G H T J K K L M 1 2 3 4 5 6 Requirement 3 Prepare income statements in good form for Tiger Mountain Gelato for May 2024 using absorption costing and variable costing. 7 Use the selections in the drop-down menu to select the correct description 8 Use cell references in the formula to point to the selling price per unit, product cost per unit, and units sold from the data table. 9 Indent the descriptions for any subtotals using the increase Indent button. Double underline operating income. 10 11 Absorption Costing Variable Costing 12 13 Tiger Mountain Gelato Tiger Mountain Gelato 14 Income Statement Income Statement 15 Month Ended May 31, 2024 Month Ended May 31, 2024 16 17 18 Sales Revenue 19 20 21 22 23 Contribution Margin 24 25 Cost of Goods Sold 26 Fixed Costs: 27 Fixed Manufacturing Costs 28 Gross Profit 29 30 Income Statement 31 Month Ended May 31, 2018 32 Operating Income 33 Sales Revenue Instrud Selling and Administrative Expenses ments + Ready Tiger Mountain Gelato Variable Costs: A 100% DATA Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2024: Direct materials cost per pint $ 2.50 per pint Direct labor cost per pint 0.75 per pint Variable manufacturing overhead cost per pint 0.25 per pint Fixed manufacturing overhead costs 8,000 per month Total fixed selling and administrative costs 5,000 per month Sales price per pint 8.00 per pint Pints of gelato produced 12,000 pints Pints of gelato sold 11.500 pints There were no beginning inventories, so Tiger Mountain Gelato has 500 pintsin ending Finished Goods Inventory (12,000 pints produced - 11,500 pints sold). Requirement 1 Calculate Tiger Mountain Gelato's product cost per pint under absorption costing and variable costing, Use the selections in the drop-down menu to select the correct description. Use cell references to point to the correct unit or dollar amount from the datatable. Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales price per pint Absorption Variable Costing Costing $ 2.50 $ 2.50 $ 0.75$ 0.75 $ 0.25 0.25 $ 0.50 $ 4.00 $ 3.50 Requirement 2 Calculate the balance in Finished Goods Inventory on May 31, 2024, using absorption costing and variable costing. Use cell references to point to the units produced and the units sold. Beginning inventory in units Instructions Product Cost Income Statements + Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing over head Sales price per pint $ $ $ $ $ 2.50 $ 0.75$ 0.25$ 0.50 4.00 $ 2.50 0.75 0.25 3.50 Requirement 2 Calculate the balance in Finished Goods Inventory on May 31, 2024, using absorption costing and variable costing, Use cell references to point to the units produced and the units sold. . Beginning Inventory in units Units produced Units available for sale Units sold Ending Inventory in units 12,000 12,000 11,500 500 Use cell references to point to the correct product cost. Ending inventory in units Product cost per unit Balance in Finished Goods Inventory Absorption Variable Costing Costing 500 500 $ 4.00 $ 3.50 2,000 1,750 Instructions Product Cost Income Statements +

Please complete the two income statements and PLEASE SHOW ANY EXCEL FORMULAS USED!!

Please complete the two income statements and PLEASE SHOW ANY EXCEL FORMULAS USED!!