please confirm How is the remaining calculated?

How is the 60% calculated taking into consideration the 3/4 of customers who will pay with a two percent discount?

Then, How is calculated the 25% projected to be charged the following month?

same for 10 and 5% Provide the steps o How they are calculated in a Budget?

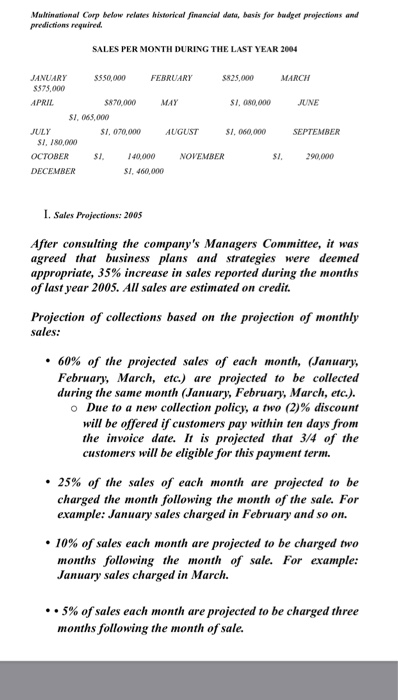

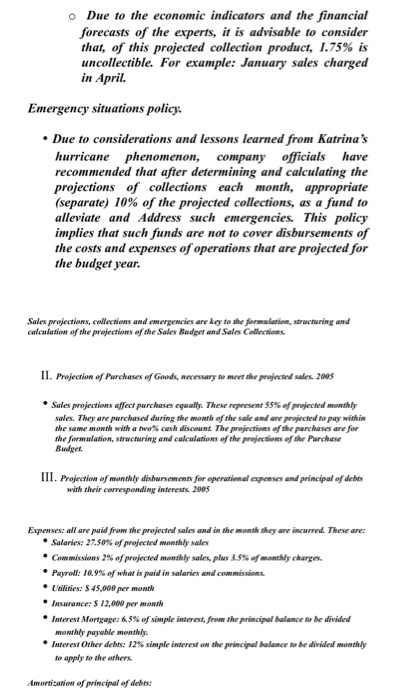

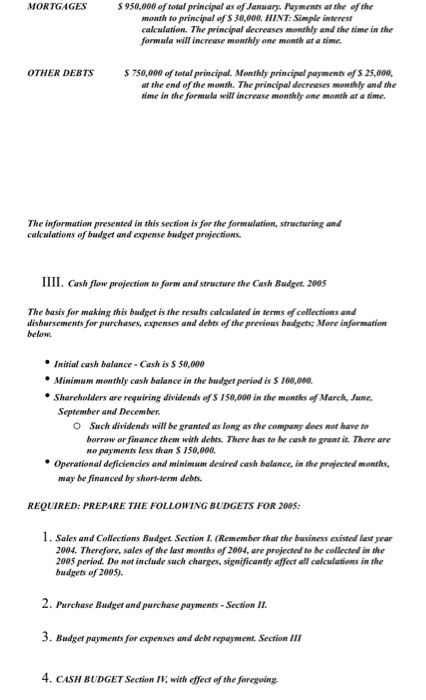

Multinational Corp below relates historical financial data, basis for budget projections and predictions required. SALES PER MONTH DURING THE LAST YEAR 2004 JANUARY $350,000 FEBRUARY 3625,000 MARCH $575.000 APRIL 8870,000 MAY S1, 080,000 JUNE SI, 065,000 JULY SI, 070,000 AUGUST SI, 060,000 SEPTEMBER SI, 180,000 OCTOBER $1. 140.000 NOVEMBER $1. 290,000 DECEMBER SI, 460,000 I. Sales Projections: 2005 After consulting the company's Managers Committee, it was agreed that business plans and strategies were deemed appropriate, 35% increase in sales reported during the months of last year 2005. All sales are estimated on credit Projection of collections based on the projection of monthly sales: 60% of the projected sales of each month, (January, February, March, etc.) are projected to be collected during the same month (January, February, March, etc.). . Due to a new collection policy, a two (2)% discount will be offered if customers pay within ten days from the invoice date. It is projected that 3/4 of the customers will be eligible for this payment term. 25% of the sales of each month are projected to be charged the month following the month of the sale. For example: January sales charged in February and so on. 10% of sales each month are projected to be charged two months following the month of sale. For example: January sales charged in March. . .5% of sales each month are projected to be charged three months following the month of sale. o Due to the economic indicators and the financial forecasts of the experts, it is advisable to consider that, of this projected collection product, 1.75% is uncollectible. For example: January sales charged in April. Emergency situations policy Due to considerations and lessons learned from Katrina's hurricane phenomenon, company officials have recommended that after determining and calculating the projections of collections each month, appropriate (separate) 10% of the projected collections, as a fund to alleviate and Address such emergencies. This policy implies that such funds are not to cover disbursements of the costs and expenses of operations that are projected for the budget year. Sales projections, collections and emergencies are key to the formulation, structuring and calculation of the projections of the Sales Budget and Sales Collections II. Projection of Purchases of Goods, necessary to meet the projected sales 2005 Sales projections affect purchases equally. These represent 55% of projected monthly sales. They are purchased during the month of the sale and are projected to pay within the same month with a no cash discount The projections of the purchases are for the formation, structuring and calculations of the projections of the Purchase Budget III. Projection of monthly disbursements for operational expenses and principal of debes with their corresponding interests. 2005 Expenses: all are paid from the projected sales and in the month they are incurred. These are: Salaries: 27.50% of projected monthly sales Commissions 2% of projected monthly sales, plus 3.5% of monthly charge. Payroll: 10.9% of what is paid in salaries and commissions Utilities: $ 45,000 per month Insurance: $ 12,000 per month Interest Mortgage: 65% of simple interest, from the principal balance to be divided monthly payable monthly Interest Other dehts: 12% simple interest on the principal balance to be divided monthly to apply to the others Amortization of principal of debts: MORTGAGES $ 950,000 of total principal as of January. Payments at the of the month to principal of $ 30,000. HINT: Simple interest calculation. The principal decreases monthly and the time in the formula will increase monthly one month at a time. OTHER DEBTS S 750,000 of total principal. Monthly principal payments of S 25,000 ar the end of the month. The principal decreases monthly and the time in the formula will increase monthly one month of a time. The information presented in this section is for the formulation, structuring and calculations of budget and expense budget projections. III. Cash flow projection to form and structure the Cash Budget 2005 The basis for making this budget is the results calculated in terms of collections and disbursements for purchases, expenses and debts of the previons budgets More information below Initial cash balance - Cash is $ 50,000 Minimum monthly cash balance in the budget period is $100,000 * Shareholders are requiring dividends of $ 150,000 in the months of March, June September and December O Such dividends will be granted as long as the company does not have to borrow or finance them with debts. There has to be cash to grant it. There are ne payments less than $ 150,000 Operational deficiencies and minima desired cash balance in the projected months, may be financed by short-term debts. REQUIRED: PREPARE THE FOLLOWING BUDGETS FOR 2005: 1. Sales and Collections Budget Section I. (Remember that the business existed last year 2004. Therefore, sales of the last months of 2004. are projected to be collected in the 2005 period. Do not include such charges, significantly affect all calculations in the budgets of 2005). 2. Purchase Budget and purchase payments - Section II. 3. Budget payments for expenses and debt repayment. Section III 4. CASH BUDGET Section IV, with effect of the foregoing. Multinational Corp below relates historical financial data, basis for budget projections and predictions required. SALES PER MONTH DURING THE LAST YEAR 2004 JANUARY $350,000 FEBRUARY 3625,000 MARCH $575.000 APRIL 8870,000 MAY S1, 080,000 JUNE SI, 065,000 JULY SI, 070,000 AUGUST SI, 060,000 SEPTEMBER SI, 180,000 OCTOBER $1. 140.000 NOVEMBER $1. 290,000 DECEMBER SI, 460,000 I. Sales Projections: 2005 After consulting the company's Managers Committee, it was agreed that business plans and strategies were deemed appropriate, 35% increase in sales reported during the months of last year 2005. All sales are estimated on credit Projection of collections based on the projection of monthly sales: 60% of the projected sales of each month, (January, February, March, etc.) are projected to be collected during the same month (January, February, March, etc.). . Due to a new collection policy, a two (2)% discount will be offered if customers pay within ten days from the invoice date. It is projected that 3/4 of the customers will be eligible for this payment term. 25% of the sales of each month are projected to be charged the month following the month of the sale. For example: January sales charged in February and so on. 10% of sales each month are projected to be charged two months following the month of sale. For example: January sales charged in March. . .5% of sales each month are projected to be charged three months following the month of sale. o Due to the economic indicators and the financial forecasts of the experts, it is advisable to consider that, of this projected collection product, 1.75% is uncollectible. For example: January sales charged in April. Emergency situations policy Due to considerations and lessons learned from Katrina's hurricane phenomenon, company officials have recommended that after determining and calculating the projections of collections each month, appropriate (separate) 10% of the projected collections, as a fund to alleviate and Address such emergencies. This policy implies that such funds are not to cover disbursements of the costs and expenses of operations that are projected for the budget year. Sales projections, collections and emergencies are key to the formulation, structuring and calculation of the projections of the Sales Budget and Sales Collections II. Projection of Purchases of Goods, necessary to meet the projected sales 2005 Sales projections affect purchases equally. These represent 55% of projected monthly sales. They are purchased during the month of the sale and are projected to pay within the same month with a no cash discount The projections of the purchases are for the formation, structuring and calculations of the projections of the Purchase Budget III. Projection of monthly disbursements for operational expenses and principal of debes with their corresponding interests. 2005 Expenses: all are paid from the projected sales and in the month they are incurred. These are: Salaries: 27.50% of projected monthly sales Commissions 2% of projected monthly sales, plus 3.5% of monthly charge. Payroll: 10.9% of what is paid in salaries and commissions Utilities: $ 45,000 per month Insurance: $ 12,000 per month Interest Mortgage: 65% of simple interest, from the principal balance to be divided monthly payable monthly Interest Other dehts: 12% simple interest on the principal balance to be divided monthly to apply to the others Amortization of principal of debts: MORTGAGES $ 950,000 of total principal as of January. Payments at the of the month to principal of $ 30,000. HINT: Simple interest calculation. The principal decreases monthly and the time in the formula will increase monthly one month at a time. OTHER DEBTS S 750,000 of total principal. Monthly principal payments of S 25,000 ar the end of the month. The principal decreases monthly and the time in the formula will increase monthly one month of a time. The information presented in this section is for the formulation, structuring and calculations of budget and expense budget projections. III. Cash flow projection to form and structure the Cash Budget 2005 The basis for making this budget is the results calculated in terms of collections and disbursements for purchases, expenses and debts of the previons budgets More information below Initial cash balance - Cash is $ 50,000 Minimum monthly cash balance in the budget period is $100,000 * Shareholders are requiring dividends of $ 150,000 in the months of March, June September and December O Such dividends will be granted as long as the company does not have to borrow or finance them with debts. There has to be cash to grant it. There are ne payments less than $ 150,000 Operational deficiencies and minima desired cash balance in the projected months, may be financed by short-term debts. REQUIRED: PREPARE THE FOLLOWING BUDGETS FOR 2005: 1. Sales and Collections Budget Section I. (Remember that the business existed last year 2004. Therefore, sales of the last months of 2004. are projected to be collected in the 2005 period. Do not include such charges, significantly affect all calculations in the budgets of 2005). 2. Purchase Budget and purchase payments - Section II. 3. Budget payments for expenses and debt repayment. Section III 4. CASH BUDGET Section IV, with effect of the foregoing