Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please consider the above information to determine how much should be actually produced each week. a) Solve the problem using an IP formulation. b) Solve

Please consider the above information to determine how much should be actually produced each week. a) Solve the problem using an IP formulation. b) Solve the problem applying the Wagner-Within properties via a dynamic programming approach.

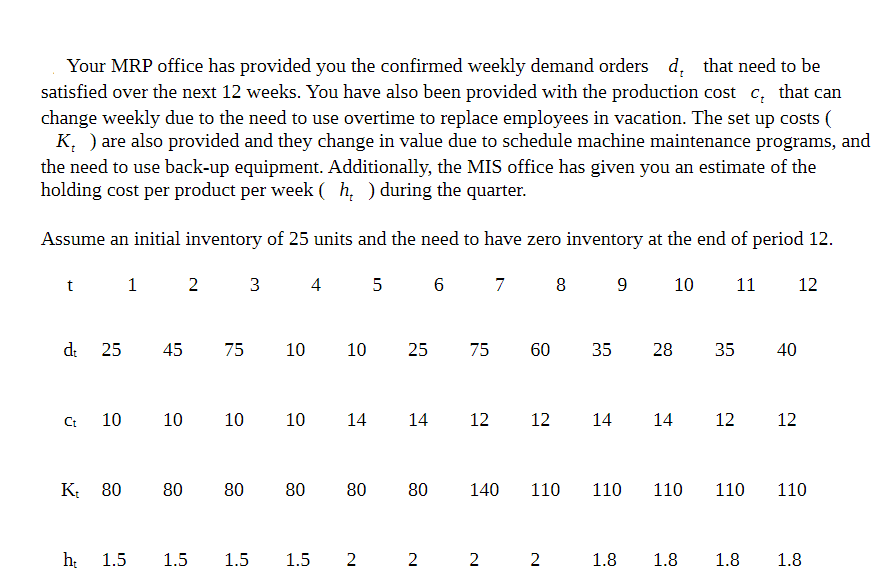

Your MRP office has provided you the confirmed weekly demand orders dt that need to be satisfied over the next 12 weeks. You have also been provided with the production cost ct that can change weekly due to the need to use overtime to replace employees in vacation. The set up costs ( Kt ) are also provided and they change in value due to schedule machine maintenance programs, an the need to use back-up equipment. Additionally, the MIS office has given you an estimate of the holding cost per product per week ( ht) during the quarter. Your MRP office has provided you the confirmed weekly demand orders dt that need to be satisfied over the next 12 weeks. You have also been provided with the production cost ct that can change weekly due to the need to use overtime to replace employees in vacation. The set up costs ( Kt ) are also provided and they change in value due to schedule machine maintenance programs, an the need to use back-up equipment. Additionally, the MIS office has given you an estimate of the holding cost per product per week ( ht) during the quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started