please correct and complete

please complete

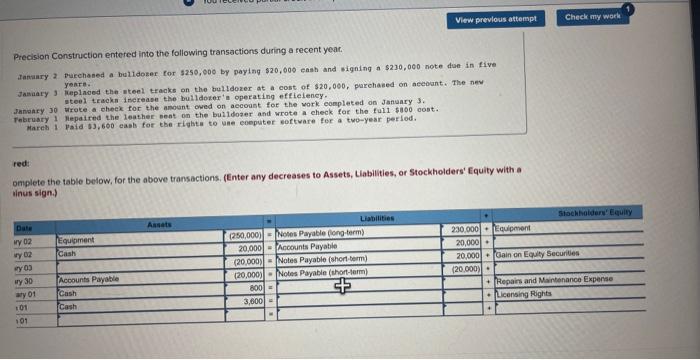

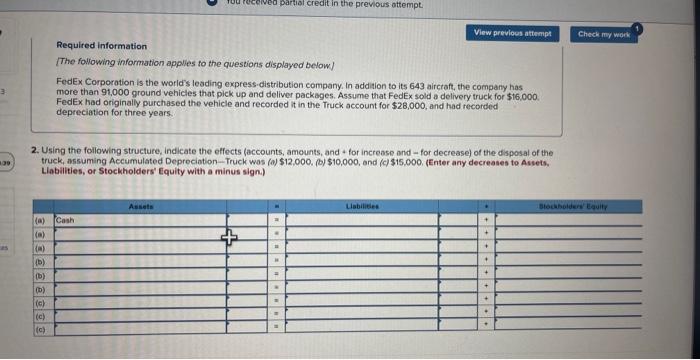

Precision Construction entered into the following transactions during a recent year. Tanaary 2 purchaned a bulidoser tor $250,000 by paying $20,000 eash and wigning a $230,000 note doe in tive Jasaary 3 leplased the nteel tracks on the bultdozer at a cost of $20,000, parchased on aceount. The nev yenre. weplaned the steel tracks on the buttdozer at a cost of s20, inerease the bulldoker' operating effieiency. Janeary 30 wroke a oheck for the anount owed on aecount for the work completed on January 3. Tnbruary 1 Ilepaired the leather sent on the bulidozer and wrote a check for the fu11 5100 oost. Mares i paid $3,600 easb for ebe rigbta to une eoeputer software for a two-year perlod. red: omplete the table below, for the above transactions, (Enter any decreases to Assets, Llabilities, or Stockholders' Equity with a vinus sign.) Required information (The following information applies to the questions displayed below] FedEx Corporation is the world's lesding express.distribution company, In addition to its 643 aircratt, the company has more than 91,000 ground vehicles that pick up and deliver packages. Assume that FedEx sold a delivery truck for $16,000. FedEx had originally purchased the vehicle and recorded it in the Truck account for $28,000, and had recorded depreciation for three years. 2. Using the following structure, indicate the effects laccounts, amounts, and + for increase and - for decrease) of the disposal of the truck, assuming Accumulated Depreciotion-Truck wos (o) $12,000, (b) $10,000, and (c)$15,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) Precision Construction entered into the following transactions during a recent year. Tanaary 2 purchaned a bulidoser tor $250,000 by paying $20,000 eash and wigning a $230,000 note doe in tive Jasaary 3 leplased the nteel tracks on the bultdozer at a cost of $20,000, parchased on aceount. The nev yenre. weplaned the steel tracks on the buttdozer at a cost of s20, inerease the bulldoker' operating effieiency. Janeary 30 wroke a oheck for the anount owed on aecount for the work completed on January 3. Tnbruary 1 Ilepaired the leather sent on the bulidozer and wrote a check for the fu11 5100 oost. Mares i paid $3,600 easb for ebe rigbta to une eoeputer software for a two-year perlod. red: omplete the table below, for the above transactions, (Enter any decreases to Assets, Llabilities, or Stockholders' Equity with a vinus sign.) Required information (The following information applies to the questions displayed below] FedEx Corporation is the world's lesding express.distribution company, In addition to its 643 aircratt, the company has more than 91,000 ground vehicles that pick up and deliver packages. Assume that FedEx sold a delivery truck for $16,000. FedEx had originally purchased the vehicle and recorded it in the Truck account for $28,000, and had recorded depreciation for three years. 2. Using the following structure, indicate the effects laccounts, amounts, and + for increase and - for decrease) of the disposal of the truck, assuming Accumulated Depreciotion-Truck wos (o) $12,000, (b) $10,000, and (c)$15,000. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.)