please correct any numbers within the excel sheet. will rate well

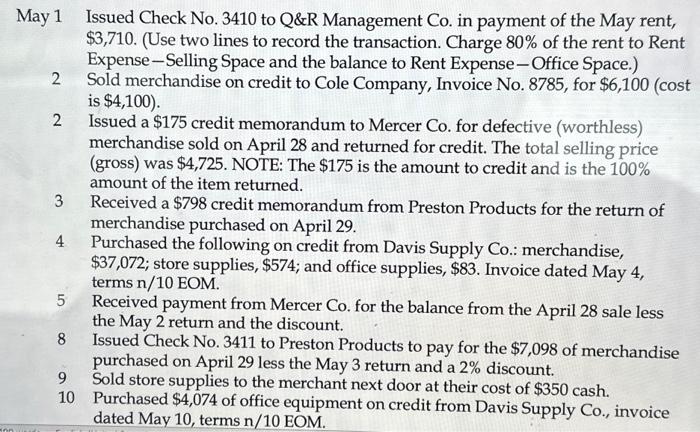

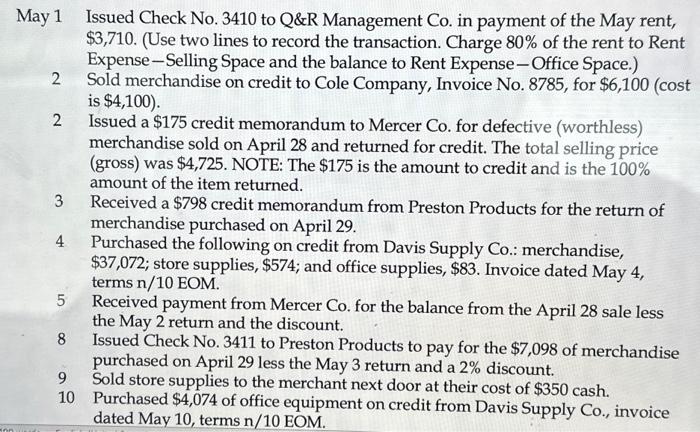

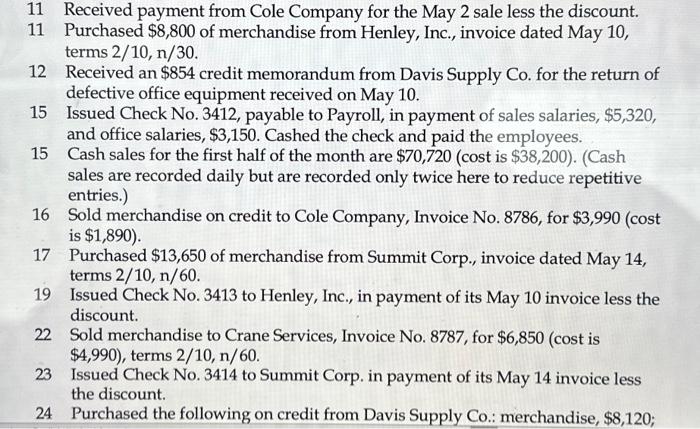

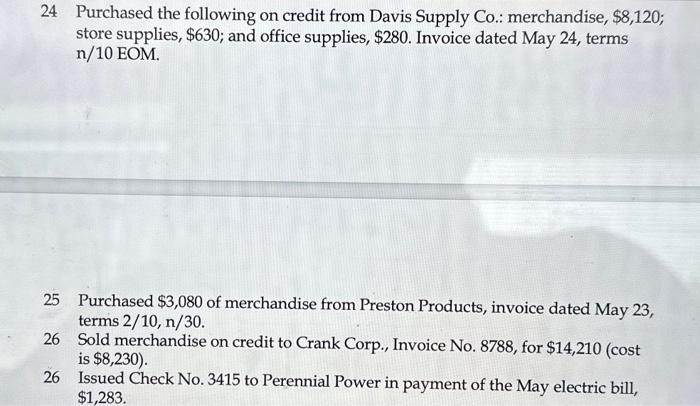

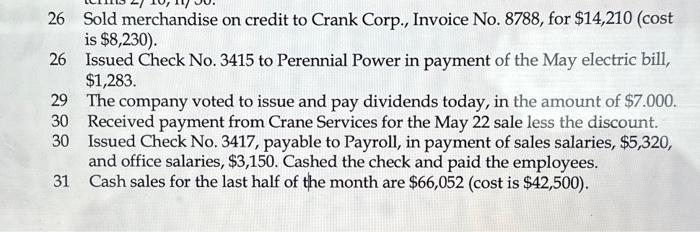

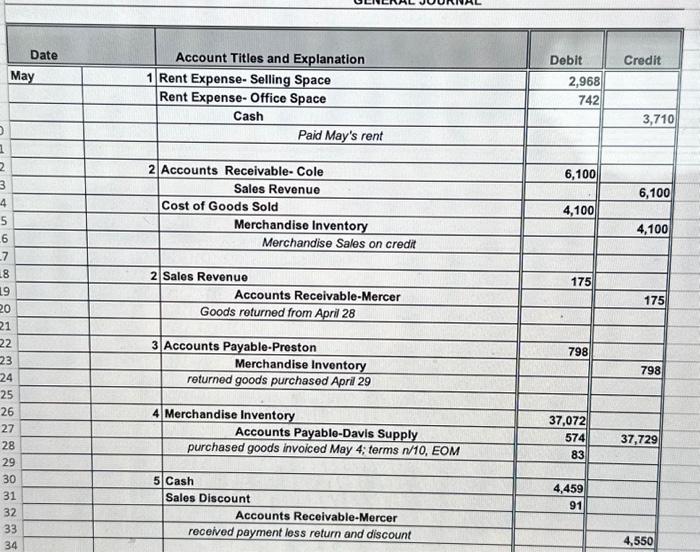

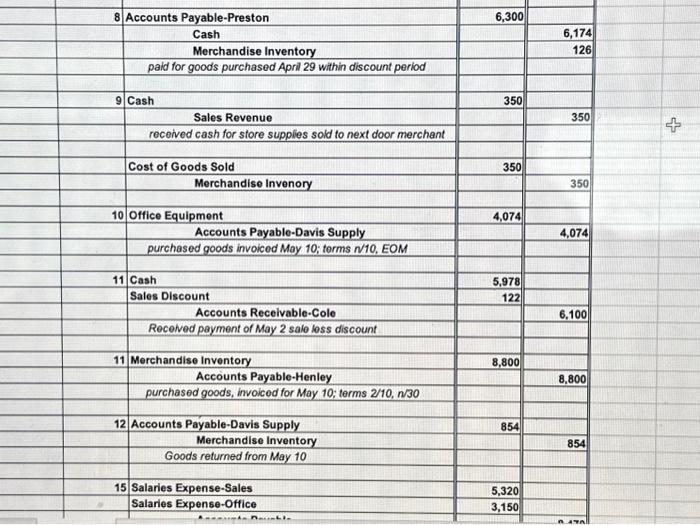

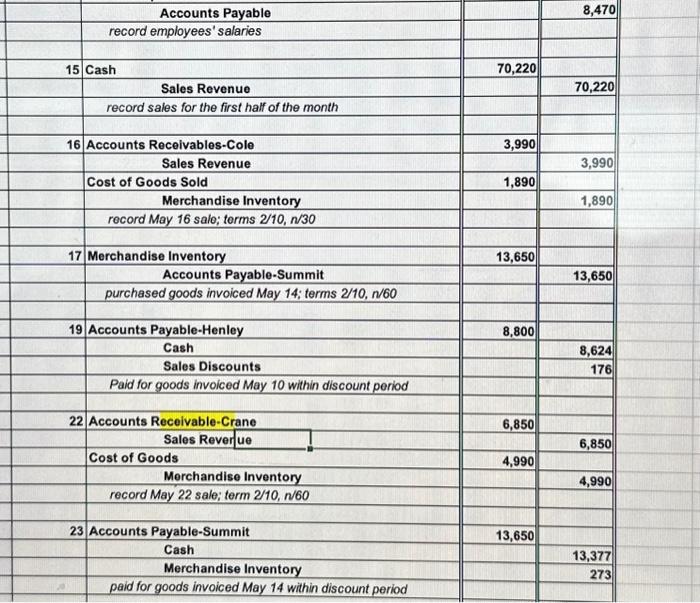

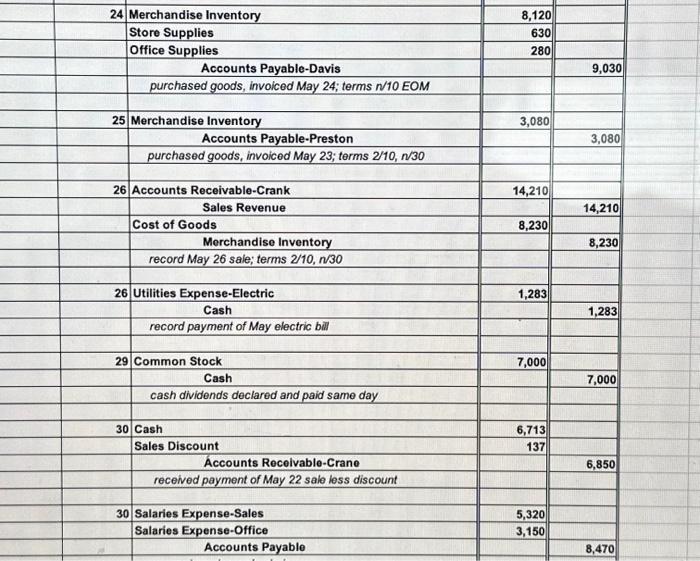

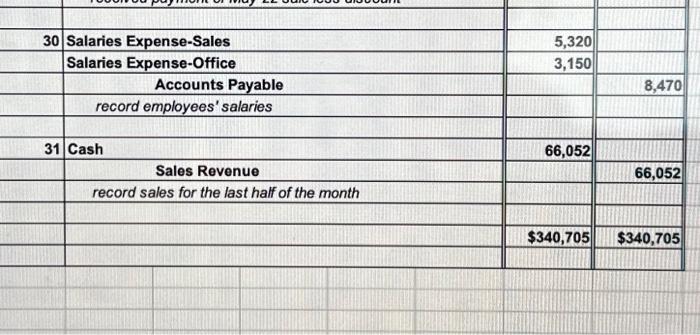

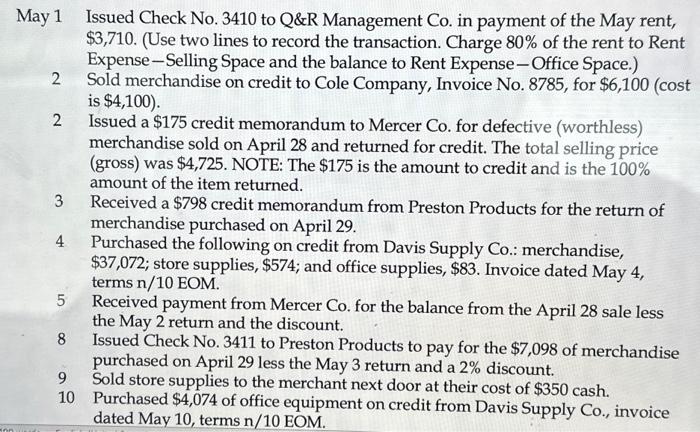

24 Purchased the following on credit from Davis Supply Co.: merchandise, $8,120; store supplies, \$630; and office supplies, \$280. Invoice dated May 24, terms n/10EOM. 25 Purchased $3,080 of merchandise from Preston Products, invoice dated May 23, terms 2/10,n/30. 26 Sold merchandise on credit to Crank Corp., Invoice No. 8788 , for $14,210 (cost is $8,230 ). 26 Issued Check No. 3415 to Perennial Power in payment of the May electric bill, $1,283. May 1 Issued Check No. 3410 to Q\&R Management Co. in payment of the May rent, $3,710. (Use two lines to record the transaction. Charge 80% of the rent to Rent Expense-Selling Space and the balance to Rent Expense-Office Space.) 2 Sold merchandise on credit to Cole Company, Invoice No. 8785, for $6,100 (cost is $4,100 ). 2 Issued a $175 credit memorandum to Mercer Co. for defective (worthless) merchandise sold on April 28 and returned for credit. The total selling price (gross) was $4,725. NOTE: The $175 is the amount to credit and is the 100% amount of the item returned. 3 Received a $798 credit memorandum from Preston Products for the return of merchandise purchased on April 29. 4 Purchased the following on credit from Davis Supply Co.: merchandise, $37,072; store supplies, $574; and office supplies, $83. Invoice dated May 4, terms n/10 EOM. 5 Received payment from Mercer Co. for the balance from the April 28 sale less the May 2 return and the discount. 8 Issued Check No. 3411 to Preston Products to pay for the $7,098 of merchandise purchased on April 29 less the May 3 return and a 2% discount. 9 Sold store supplies to the merchant next door at their cost of $350 cash. 10 Purchased $4,074 of office equipment on credit from Davis Supply Co., invoice dated May 10 , terms n/10 EOM. 11 Received payment from Cole Company for the May 2 sale less the discount. 11 Purchased $8,800 of merchandise from Henley, Inc., invoice dated May 10, terms 2/10, n/30. 12 Received an $854 credit memorandum from Davis Supply Co. for the return of defective office equipment received on May 10. 15 Issued Check No. 3412, payable to Payroll, in payment of sales salaries, \$5,320, and office salaries, $3,150. Cashed the check and paid the employees. 15 Cash sales for the first half of the month are $70,720 (cost is $38,200 ). (Cash sales are recorded daily but are recorded only twice here to reduce repetitive entries.) 16 Sold merchandise on credit to Cole Company, Invoice No. 8786, for $3,990 (cost is $1,890 ). 17 Purchased $13,650 of merchandise from Summit Corp., invoice dated May 14, terms 2/10, n/60. 19 Issued Check No. 3413 to Henley, Inc., in payment of its May 10 invoice less the discount. 22 Sold merchandise to Crane Services, Invoice No. 8787 , for $6,850 (cost is $4,990), terms 2/10,n/60. 23 Issued Check No. 3414 to Summit Corp. in payment of its May 14 invoice less the discount. 24 Purchased the following on credit from Davis Supply Co.: merchandise, $8,120. 26 Sold merchandise on credit to Crank Corp., Invoice No. 8788, for $14,210 (cost is $8,230 ). 26 Issued Check No. 3415 to Perennial Power in payment of the May electric bill, $1,283. 29 The company voted to issue and pay dividends today, in the amount of $7.000. 30 Received payment from Crane Services for the May 22 sale less the discount. 30 Issued Check No. 3417, payable to Payroll, in payment of sales salaries, $5,320, and office salaries, $3,150. Cashed the check and paid the employees. 31 Cash sales for the last half of the month are $66,052 (cost is $42,500 ). 24 Purchased the following on credit from Davis Supply Co.: merchandise, $8,120; store supplies, \$630; and office supplies, \$280. Invoice dated May 24, terms n/10EOM. 25 Purchased $3,080 of merchandise from Preston Products, invoice dated May 23, terms 2/10,n/30. 26 Sold merchandise on credit to Crank Corp., Invoice No. 8788 , for $14,210 (cost is $8,230 ). 26 Issued Check No. 3415 to Perennial Power in payment of the May electric bill, $1,283. May 1 Issued Check No. 3410 to Q\&R Management Co. in payment of the May rent, $3,710. (Use two lines to record the transaction. Charge 80% of the rent to Rent Expense-Selling Space and the balance to Rent Expense-Office Space.) 2 Sold merchandise on credit to Cole Company, Invoice No. 8785, for $6,100 (cost is $4,100 ). 2 Issued a $175 credit memorandum to Mercer Co. for defective (worthless) merchandise sold on April 28 and returned for credit. The total selling price (gross) was $4,725. NOTE: The $175 is the amount to credit and is the 100% amount of the item returned. 3 Received a $798 credit memorandum from Preston Products for the return of merchandise purchased on April 29. 4 Purchased the following on credit from Davis Supply Co.: merchandise, $37,072; store supplies, $574; and office supplies, $83. Invoice dated May 4, terms n/10 EOM. 5 Received payment from Mercer Co. for the balance from the April 28 sale less the May 2 return and the discount. 8 Issued Check No. 3411 to Preston Products to pay for the $7,098 of merchandise purchased on April 29 less the May 3 return and a 2% discount. 9 Sold store supplies to the merchant next door at their cost of $350 cash. 10 Purchased $4,074 of office equipment on credit from Davis Supply Co., invoice dated May 10 , terms n/10 EOM. 11 Received payment from Cole Company for the May 2 sale less the discount. 11 Purchased $8,800 of merchandise from Henley, Inc., invoice dated May 10, terms 2/10, n/30. 12 Received an $854 credit memorandum from Davis Supply Co. for the return of defective office equipment received on May 10. 15 Issued Check No. 3412, payable to Payroll, in payment of sales salaries, \$5,320, and office salaries, $3,150. Cashed the check and paid the employees. 15 Cash sales for the first half of the month are $70,720 (cost is $38,200 ). (Cash sales are recorded daily but are recorded only twice here to reduce repetitive entries.) 16 Sold merchandise on credit to Cole Company, Invoice No. 8786, for $3,990 (cost is $1,890 ). 17 Purchased $13,650 of merchandise from Summit Corp., invoice dated May 14, terms 2/10, n/60. 19 Issued Check No. 3413 to Henley, Inc., in payment of its May 10 invoice less the discount. 22 Sold merchandise to Crane Services, Invoice No. 8787 , for $6,850 (cost is $4,990), terms 2/10,n/60. 23 Issued Check No. 3414 to Summit Corp. in payment of its May 14 invoice less the discount. 24 Purchased the following on credit from Davis Supply Co.: merchandise, $8,120. 26 Sold merchandise on credit to Crank Corp., Invoice No. 8788, for $14,210 (cost is $8,230 ). 26 Issued Check No. 3415 to Perennial Power in payment of the May electric bill, $1,283. 29 The company voted to issue and pay dividends today, in the amount of $7.000. 30 Received payment from Crane Services for the May 22 sale less the discount. 30 Issued Check No. 3417, payable to Payroll, in payment of sales salaries, $5,320, and office salaries, $3,150. Cashed the check and paid the employees. 31 Cash sales for the last half of the month are $66,052 (cost is $42,500 )