Answered step by step

Verified Expert Solution

Question

1 Approved Answer

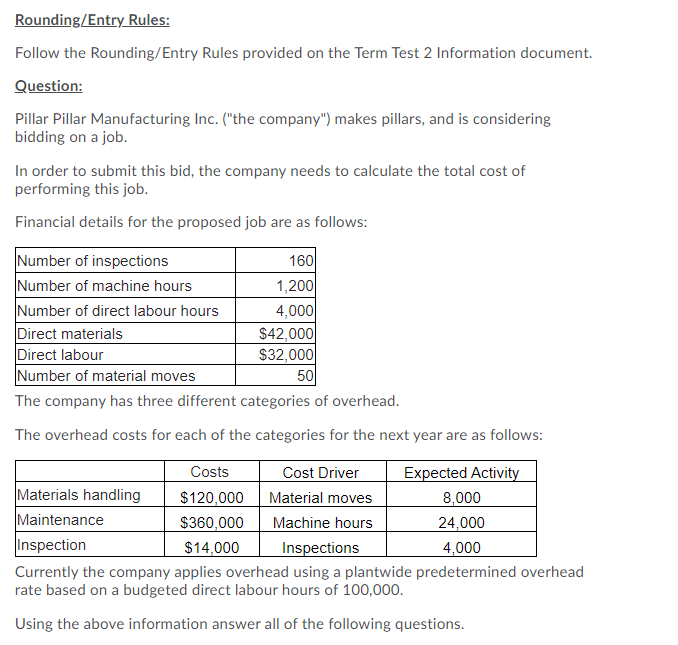

Please correct me! Rounding/Entry Rules: Follow the Rounding/Entry Rules provided on the Term Test 2 Information document. Question: Pillar Pillar Manufacturing Inc. (the company) makes

Please correct me!

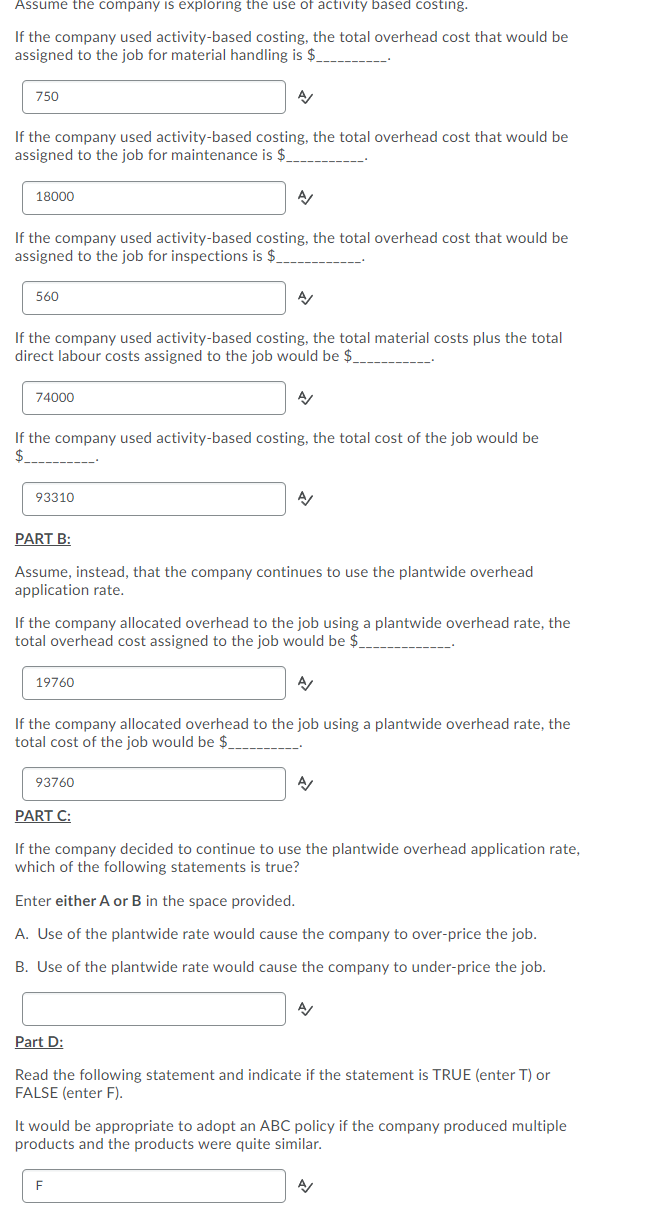

Rounding/Entry Rules: Follow the Rounding/Entry Rules provided on the Term Test 2 Information document. Question: Pillar Pillar Manufacturing Inc. ("the company") makes pillars, and is considering bidding on a job. In order to submit this bid, the company needs to calculate the total cost of performing this job. Financial details for the proposed job are as follows: Number of inspections 1601 Number of machine hours 1,200 Number of direct labour hours 4,000 Direct materials $42,000 Direct labour $32,000 Number of material moves 50 The company has three different categories of overhead. The overhead costs for each of the categories for the next year are as follows: Costs Cost Driver Expected Activity Materials handling $120,000 Material moves 8,000 Maintenance $360,000 Machine hours 24,000 Inspection $14,000 Inspections 4,000 Currently the company applies overhead using a plantwide predetermined overhead rate based on a budgeted direct labour hours of 100,000. Using the above information answer all of the following questions. Assume the company is exploring the use of activity based costing. If the company used activity-based costing, the total overhead cost that would be assigned to the job for material handling is $_ 750 A If the company used activity-based costing, the total overhead cost that would be assigned to the job for maintenance is $ 18000 A If the company used activity-based costing, the total overhead cost that would be assigned to the job for inspections is $ 560 A If the company used activity-based costing, the total material costs plus the total direct labour costs assigned to the job would be $ 74000 A/ If the company used activity-based costing, the total cost of the job would be $ 93310 A PART B: Assume, instead, that the company continues to use the plantwide overhead application rate. If the company allocated overhead to the job using a plantwide overhead rate, the total overhead cost assigned to the job would be $ 19760 A/ If the company allocated overhead to the job using a plantwide overhead rate, the total cost of the job would be $ 93760 A PART C: If the company decided to continue to use the plantwide overhead application rate, which of the following statements is true? Enter either A or B in the space provided. A. Use of the plantwide rate would cause the company to over-price the job. B. Use of the plantwide rate would cause the company to under-price the job. Part D: Read the following statement and indicate if the statement is TRUE (enter T) or FALSE (enter F). It would be appropriate to adopt an ABC policy if the company produced multiple products and the products were quite similar. F AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started