please correct my answers if there any errors and i need help in last questions, thanks

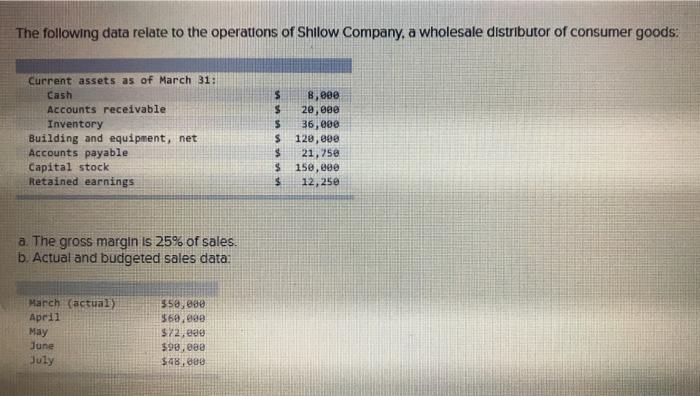

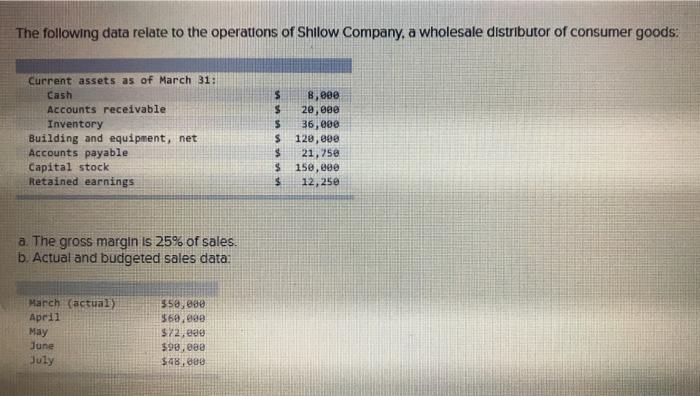

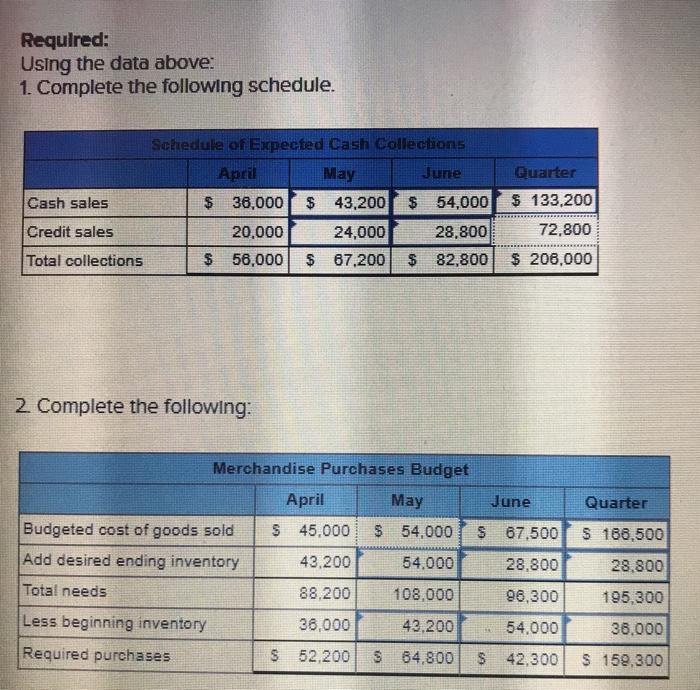

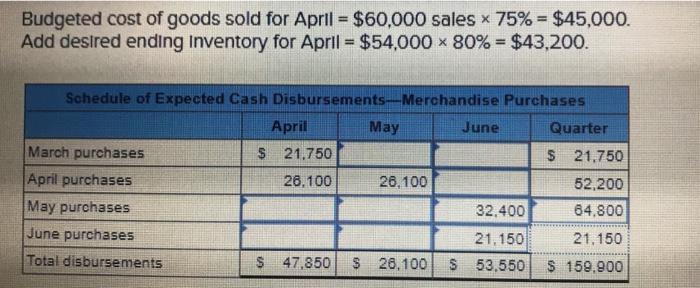

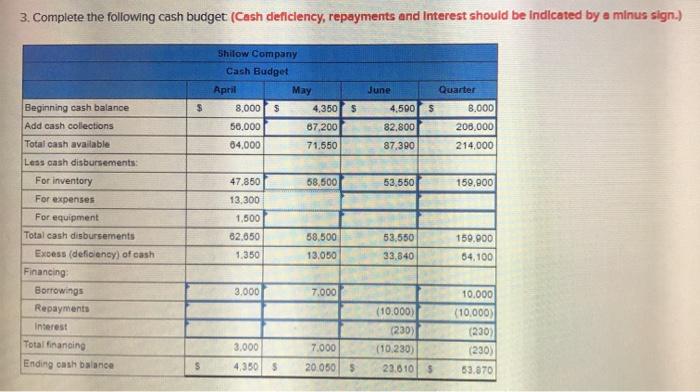

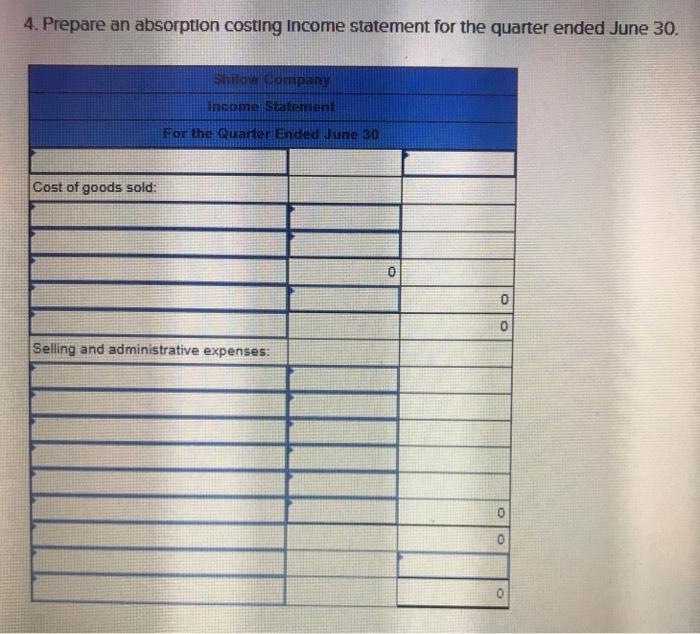

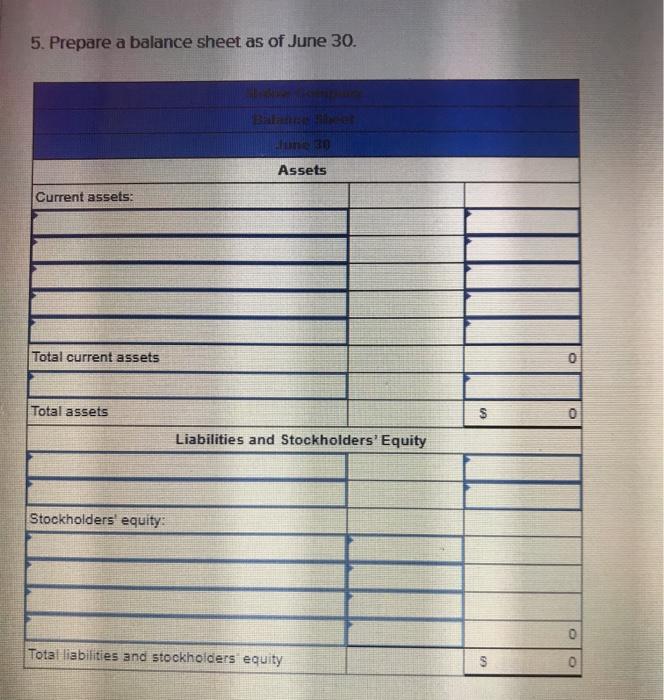

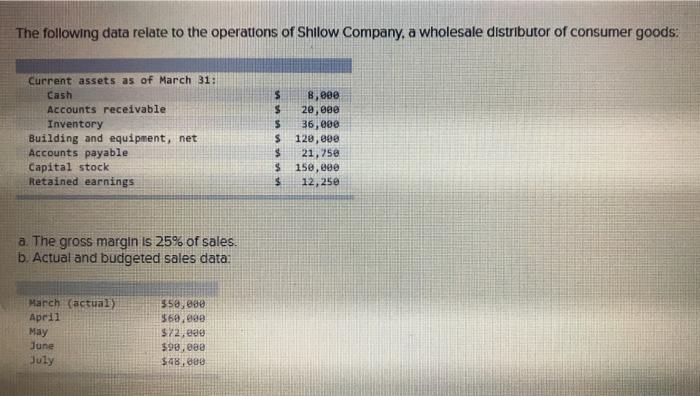

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods. Current assets as of March 31: Cash Accounts receivable Inventory Building and equipment, net Accounts payable Capital stock Retained earnings $ 8,888 $ 20,000 $ 36,000 $ 120,00 $ 21,25e $ 158,000 $ 12,25e a. The gross margin is 25% of sales. b. Actual and budgeted sales data. March (actual) April May June July 559.ge $69.000 $72.000 $99, eae 548,888 Required: Using the data above: 1. Complete the following schedule. Quarter $ 133,200 Cash sales Schedule of Expected Cash Collections April May June $ 38,000 $ 43,200 $ 54,000 20,000 24,000 28.800 $ 56,000 $ 67,200 $ 82,800 Credit sales 72,800 Total collections $ 206,000 2. Complete the following: Merchandise Purchases Budget April May June Quarter $ 45,000 $ 54,000 $ 67,500 $ 168,500 Budgeted cost of goods sold Add desired ending inventory Total needs 43,200 54.000 28.800 28.800 108,000 96,300 195,300 88,200 36,000 42,200 54,000 36.000 Less beginning inventory Required purchases $ 52,200 $ 64,800 $ 42,300 $ 159,300 Budgeted cost of goods sold for April = $60,000 sales x 75% = $45,000. Add desired ending Inventory for April = $54,000 * 80% = $43,200. Schedule of Expected Cash Disbursements-Merchandise Purchases April May June Quarter March purchases $ 21,750 $ 21.750 April purchases 26.100 26,100 52,200 May purchases 32,400 64,800 June purchases 21.150 21,150 Total disbursements $ 47.850 $26.100 $ 53,550 $ 159.900 3. Complete the following cash budget (Cash deficiency, repayments and Interest should be indicated by a minus sign.) June Shilow Company Cash Budget April May 8.000 5 4,350 50.000 87,200 64,000 71,550 $ $ 4,500 $ Beginning cash balance Add cash collections Quarter 3.000 208,000 82.800 87.390 214,000 47.850 58,500 53,550 159,000 13.300 1,500 58,500 Total cash available Less cash disbursements: For inventory For expenses For equipment Total cash disbursements Excess (deficiency) of cash Financing Borrowings Repayments Interest Total financing Ending cash balance 82.650 1.350 53,550 33.840 159.900 54,100 13.050 3.000 7.000 (10.000) (230) (10.230) 10,000 (10,000) (230) (230) 63.870 3.000 4,350 $ 7.000 20.050 S 5 23.6105 4. Prepare an absorption costing Income statement for the quarter ended June 30. Shilow Company Income Statement For the Quarter Ended June 30 Cost of goods sold: 0 0 O Selling and administrative expenses: 0 0 5. Prepare a balance sheet as of June 30. BA une 30 Assets Current assets: Total current assets Total assets $ Liabilities and Stockholders' Equity Stockholders' equity: 0 Total liabilities and stockholders equity GA