Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 3 January 20x4, Windsor Company purchased 10% of the shares of Brampton for $670,000 cash. Windsor will use the equity method. On this

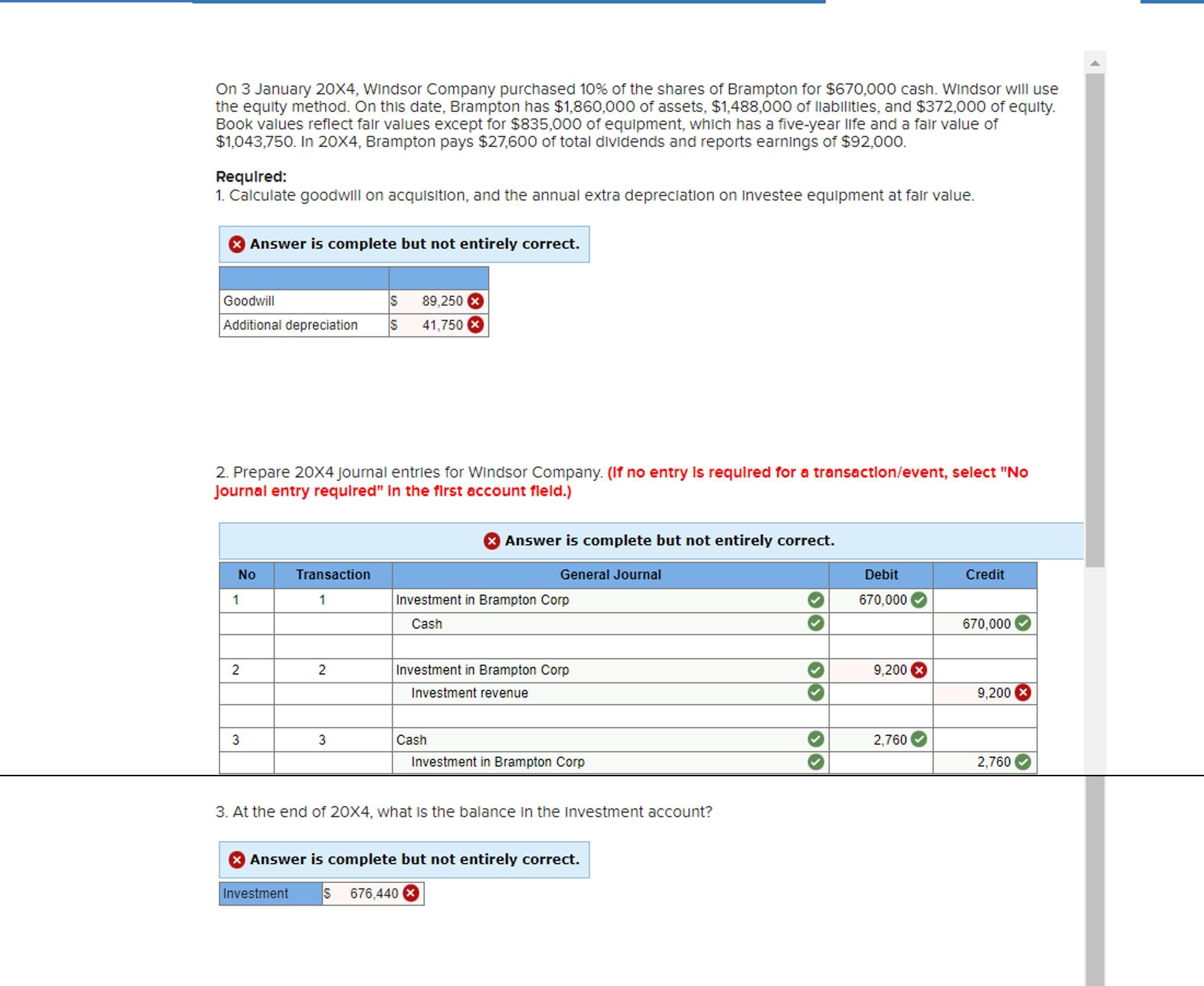

On 3 January 20x4, Windsor Company purchased 10% of the shares of Brampton for $670,000 cash. Windsor will use the equity method. On this date, Brampton has $1,860,000 of assets, $1,488,000 of liabilities, and $372,000 of equity. Book values reflect fair values except for $835,000 of equipment, which has a five-year life and a fair value of $1,043,750. In 20X4, Brampton pays $27,600 of total dividends and reports earnings of $92,000. Required: 1. Calculate goodwill on acquisition, and the annual extra depreciation on investee equipment at fair value. Answer is complete but not entirely correct. Goodwill 89,250 Additional depreciation S 41,750 X 2. Prepare 20X4 journal entries for Windsor Company. (If no entry Is requlred for a transactlon/event, select "No Journal entry required" In the first account fleld.) 8 Answer is complete but not entirely correct. No Transaction General Journal Debit Credit 1 1 Investment in Brampton Corp 670,000 Cash 670,000 Investment in Brampton Corp 9,200 8 Investment revenue 9,200 3 3 Cash 2,760 Investment in Brampton Corp 2,760 3. At the end of 20X4, what is the balance in the Investment acco nt? 8 Answer is complete but not entirely correct. Investment S 676,440 2.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Calculations Requ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started