Answered step by step

Verified Expert Solution

Question

1 Approved Answer

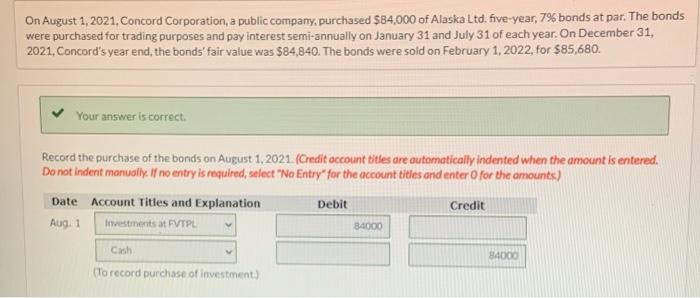

please correct the answers that are incorrect On August 1, 2021. Concord Corporation, a public company, purchased $84,000 of Alaska Ltd, five-year, 7% bonds at

please correct the answers that are incorrect

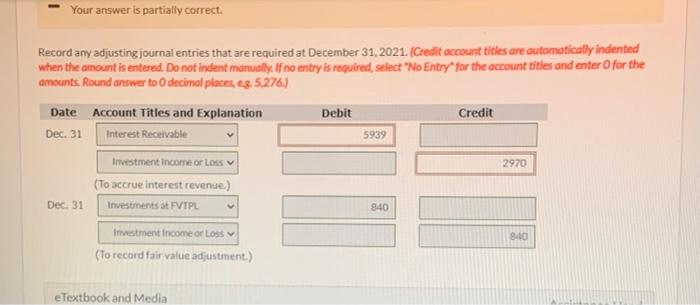

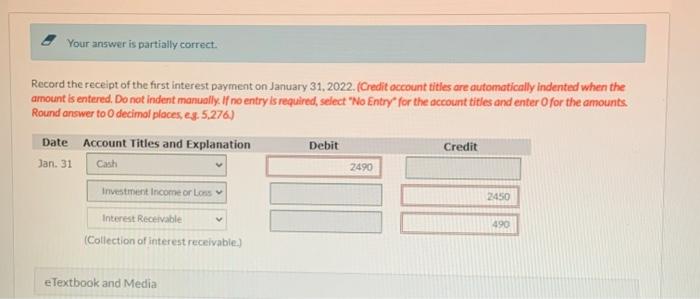

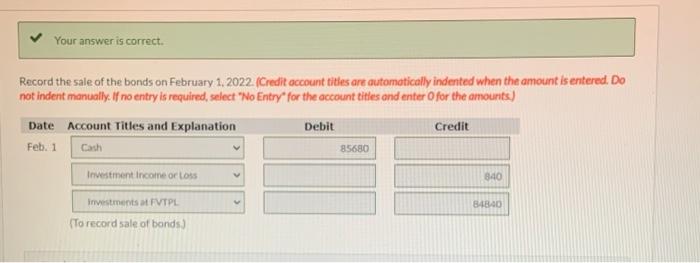

On August 1, 2021. Concord Corporation, a public company, purchased $84,000 of Alaska Ltd, five-year, 7% bonds at par. The bonds were purchased for trading purposes and pay interest semi-annually on January 31 and July 31 of each year. On December 31, 2021, Concord's year end, the bonds' fair value was $84,840. The bonds were sold on February 1, 2022, for $85,680. Your answer is correct Record the purchase of the bonds on August 1, 2021. (Credit account titles are automatically indented when the amount is entered Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Aug. 1 tvestments at FVTPL Credit 84000 Cash 14000 To record purchase of investment.) Your answer is partially correct. Record any adjusting journal entries that are required at December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answer to decimal places, eg. 5,276.) Date Account Titles and Explanation Debit Credit Dec. 31 Interest Receivable Investment income or Loss (To accrue interest revenue.) Investments at PVTPL 5939 2970 Dec 31 v 840 Investment income or Loss 940 (To record fair value adjustment.) eTextbook and Media Your answer is partially correct. Record the receipt of the first interest payment on January 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Round answer to decimal places, es. 5.276) Date Account Titles and Explanation Debit Credit Jan. 31 Cash 2490 2450 Investment Income or Lions Interest Receivable (Collection of interest receivable.) 490 e Textbook and Media Your answer is correct. Record the sale of the bonds on February 1, 2022 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit 85680 Investment Income or loss Investments VTPL To record sale of bonds) Feb. 1 Cash 840 B4840 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started