Answered step by step

Verified Expert Solution

Question

1 Approved Answer

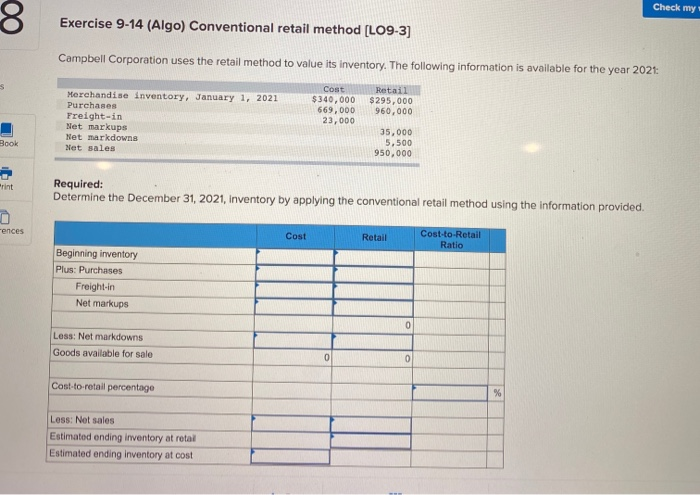

please correct the first problem then complete the second. please show work. thank you. Check my Exercise 9-14 (Algo) Conventional retail method [LO9-3] Campbell Corporation

please correct the first problem then complete the second. please show work. thank you.

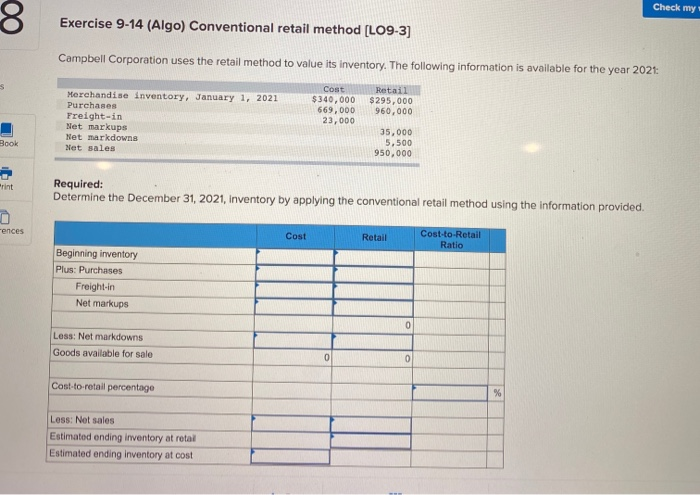

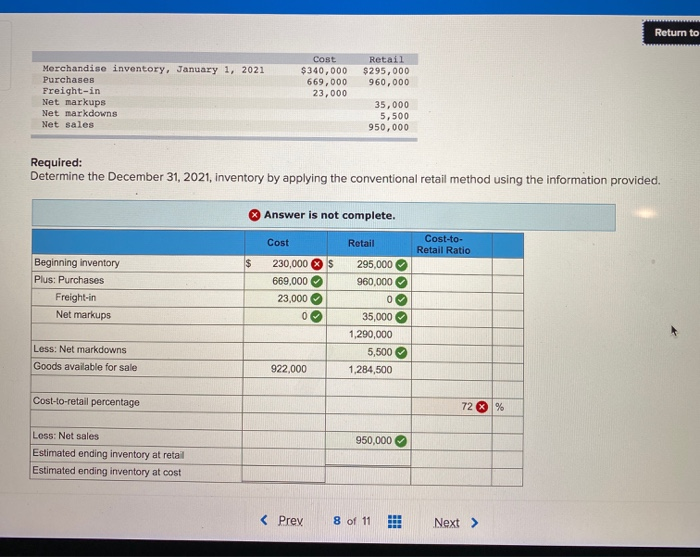

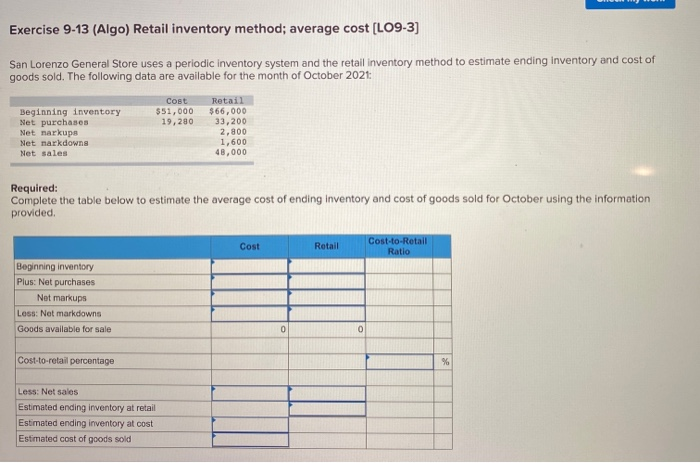

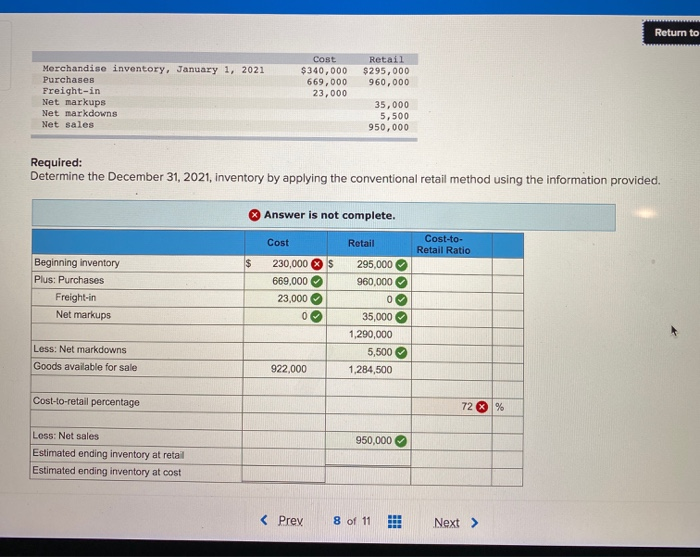

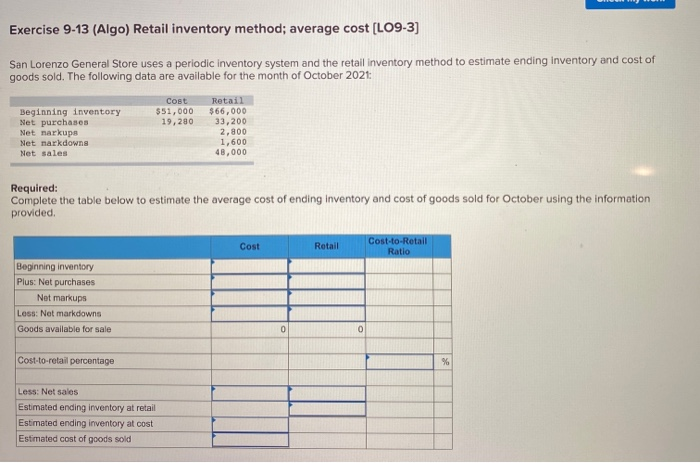

Check my Exercise 9-14 (Algo) Conventional retail method [LO9-3] Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2021 Cost $340,000 669,000 23,000 Retail $295,000 960.000 Merchandise inventory, January 1, 2021 Purchases Freight-in Net markups Net markdowns Net sales Book 35,000 5.500 950,000 erint Required: Determine the December 31, 2021, Inventory by applying the conventional retail method using the information provided. Fences Cost Retail Cost-to-Retail Ratio Beginning inventory Plus: Purchases Freight-in Net markups Less: Net markdowns Goods available for sale Cost-to-retail percentage Less: Net sales Estimated ending inventory at rotal Estimated ending Inventory at cost Return to Cost $340,000 669,000 23,000 Retail $295,000 960,000 Merchandise inventory, January 1, 2021 Purchases Freight-in Net markups Net markdowns Net sales 35,000 5,500 950,000 Required: Determine the December 31, 2021, inventory by applying the conventional retail method using the information provided. X Answer is not complete. Cost Retail Cost-to- Retail Ratio S Beginning inventory Plus: Purchases Freight-in Net markups 230,000 669,000 23,000 0 295,000 960,000 0 35,000 1,290,000 5,500 1,284,500 Less: Net markdowns Goods available for sale 922,000 Cost-to-retail percentage 72 % 950,000 Less: Not sales Estimated ending inventory at retail Estimated ending inventory at cost Exercise 9-13 (Algo) Retail inventory method; average cost [LO9-3) San Lorenzo General Store uses a periodic inventory system and the retail inventory method to estimate ending Inventory and cost of goods sold. The following data are available for the month of October 2021 Cost 551,000 Beginning inventory Net purchases Netmarkups Net markdowns Net sales Retail $66.000 33,200 2.800 1,600 48,000 Required: Complete the table below to estimate the average cost of ending Inventory and cost of goods sold for October using the information provided Cost Retail Cost-to-Retail Ratio Beginning inventory Plus: Net purchases Net markups Less: Not markdowns Goods available for sale Cost-to-retail percentage Less: Net sales Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started