Please could you make sure to use the labels and amount description when filling out the statement of cash flows so that I can earn all points and avoid any errors thank you!

Please could you make sure to use the labels and amount description when filling out the statement of cash flows so that I can earn all points and avoid any errors thank you!

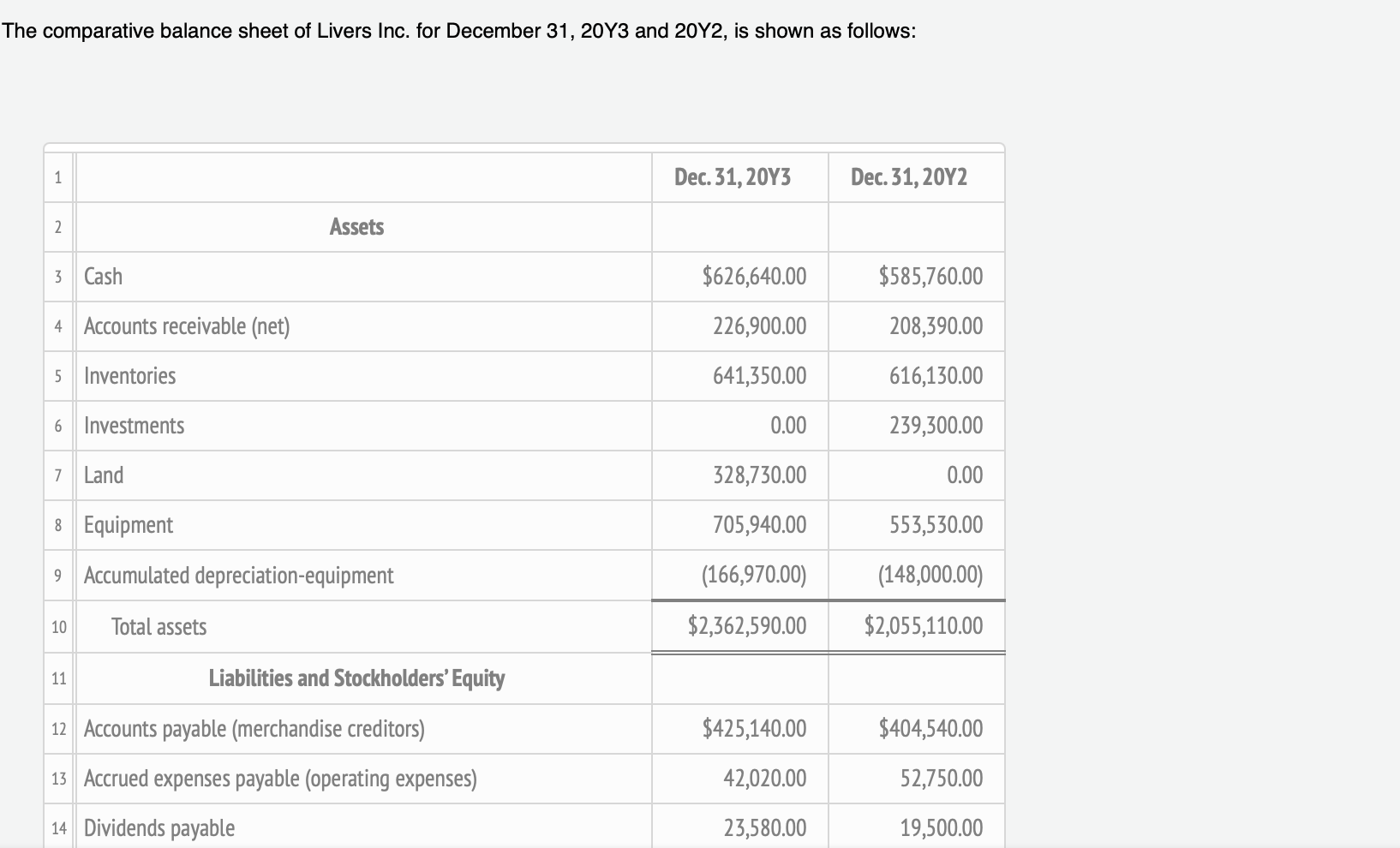

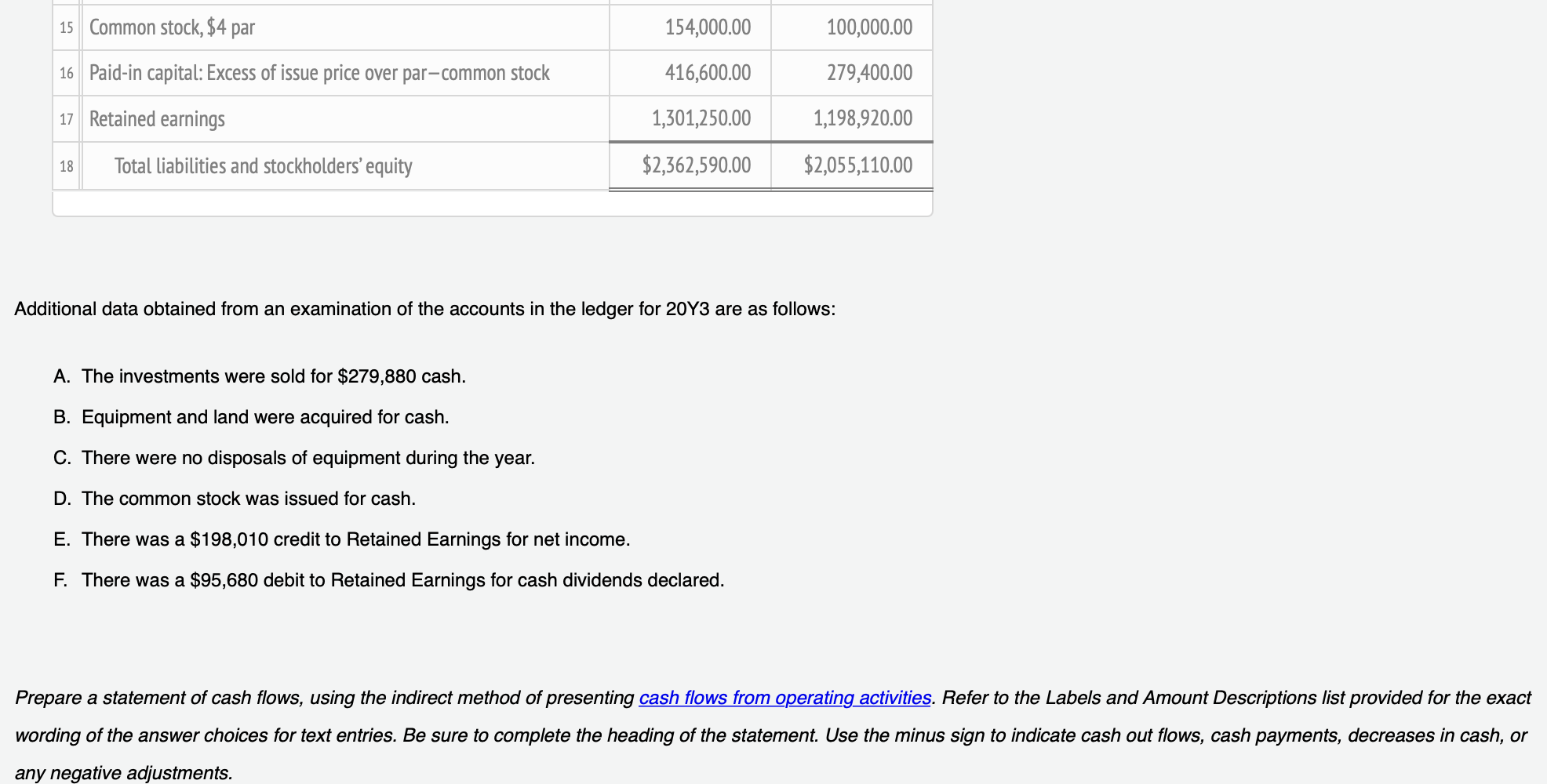

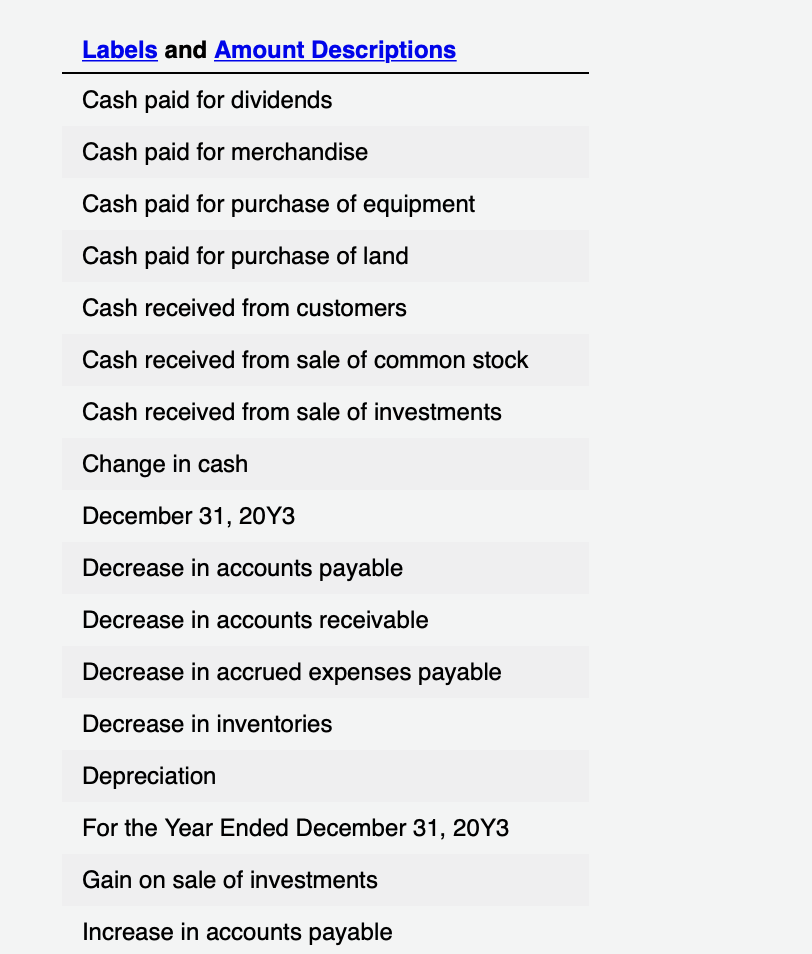

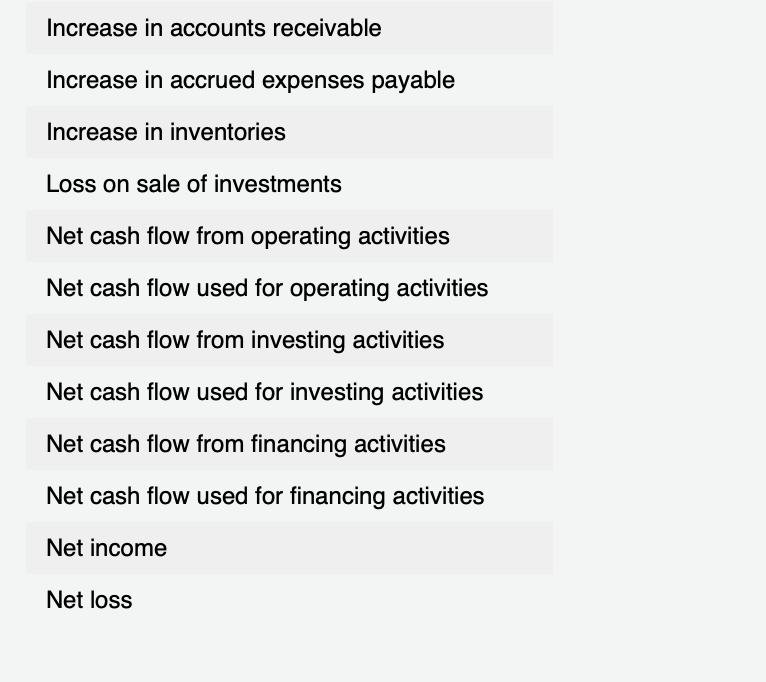

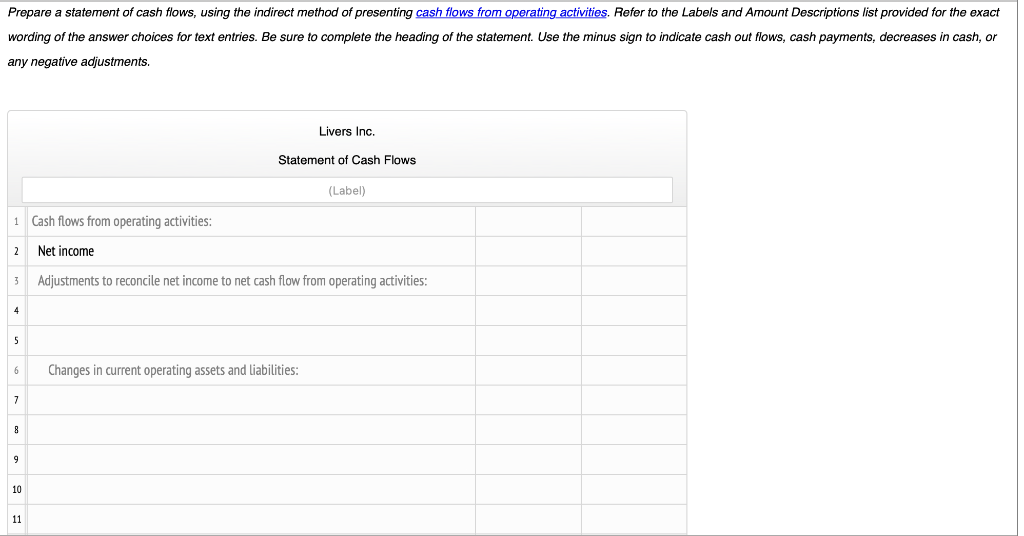

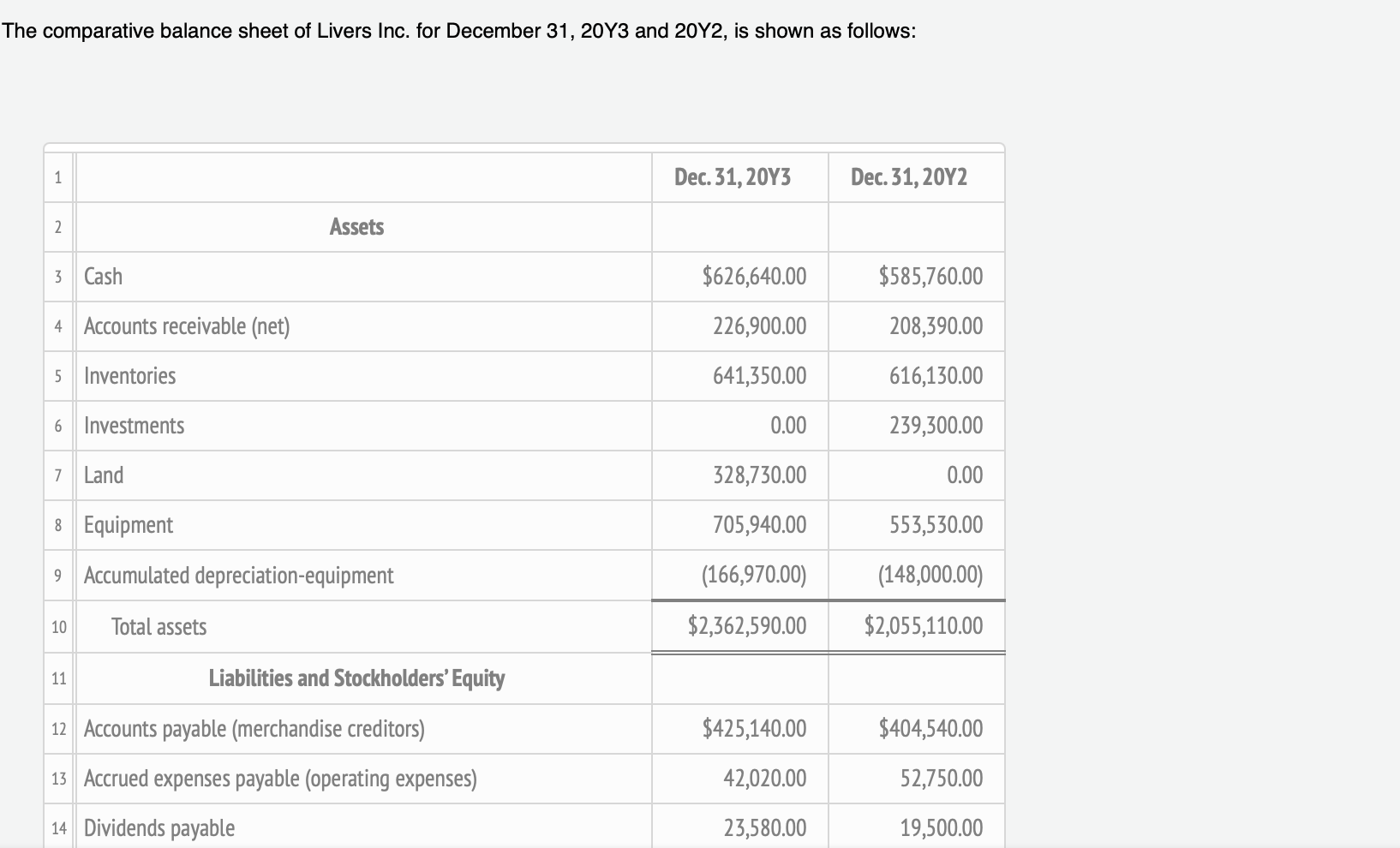

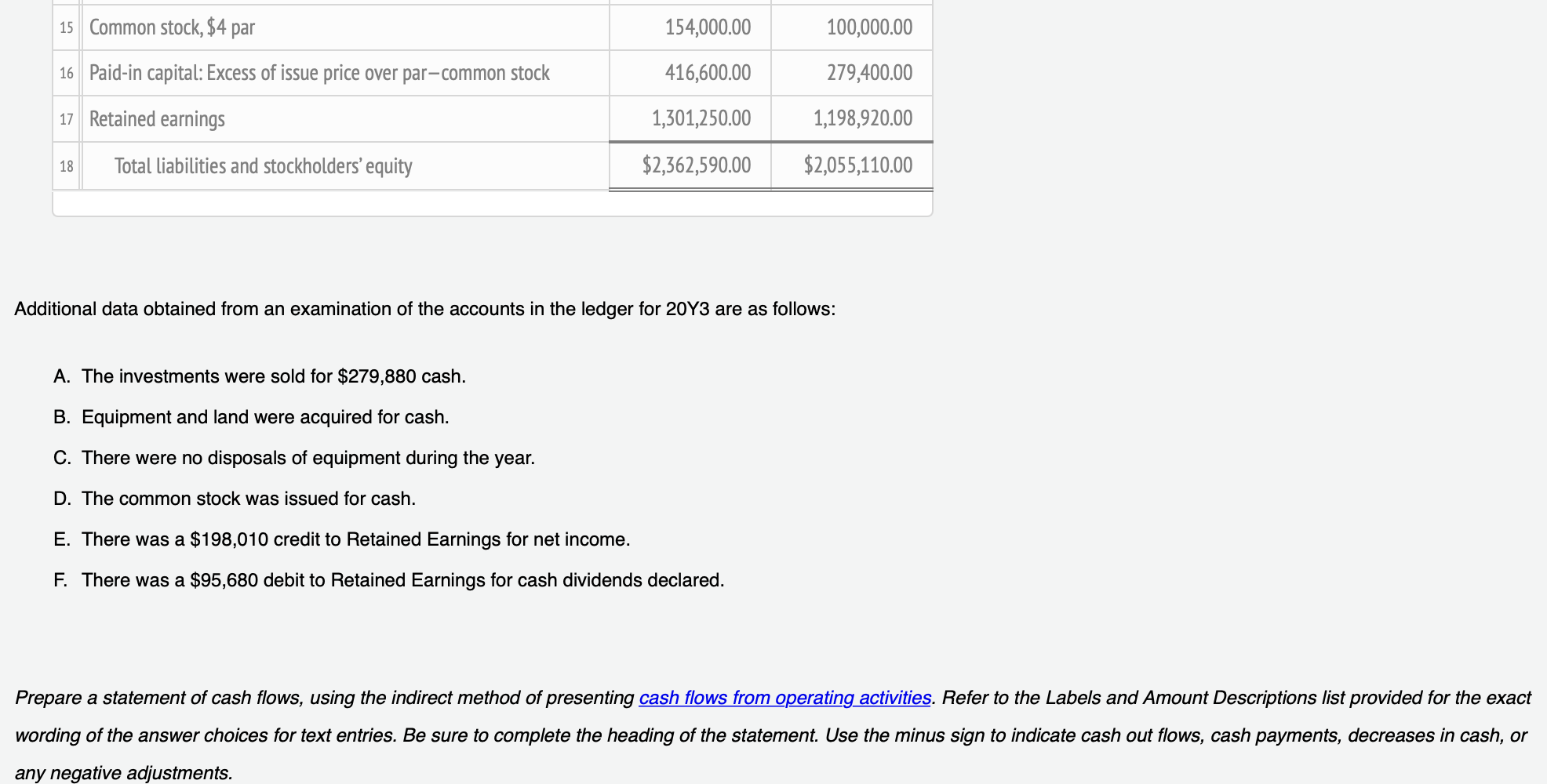

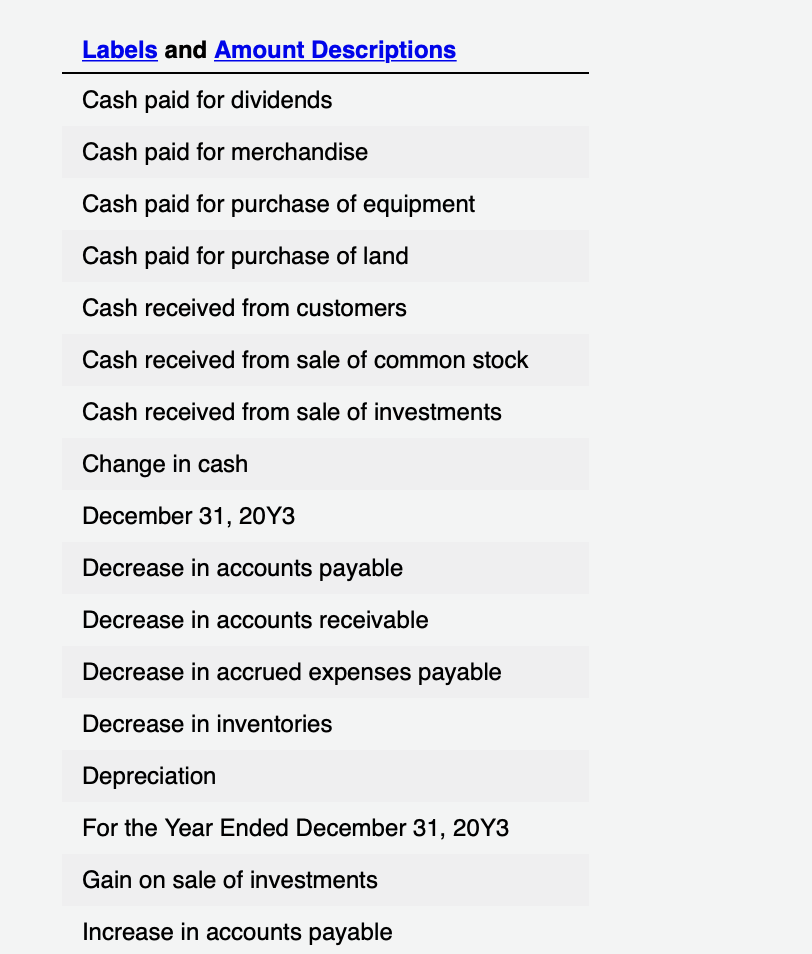

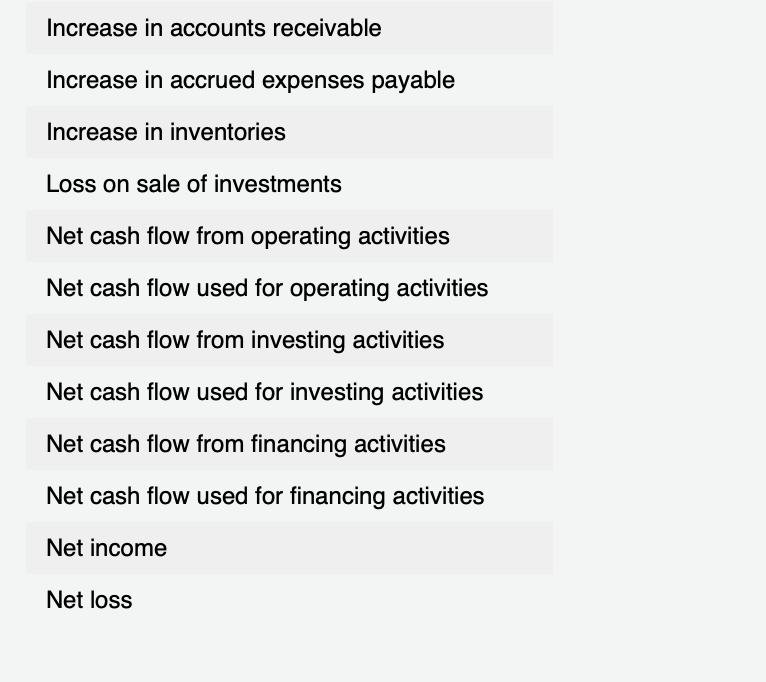

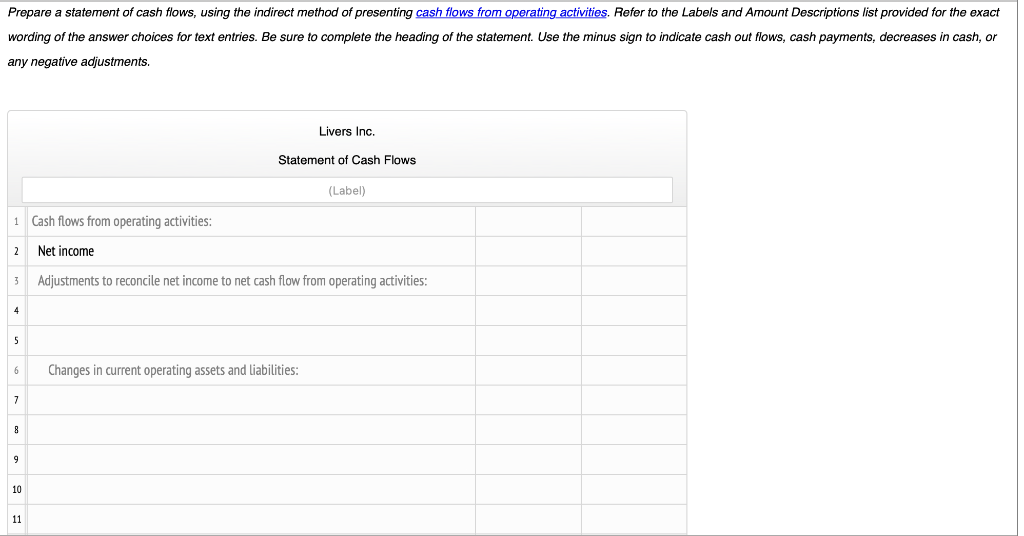

The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows: 1 Dec. 31, 20Y3 Dec. 31, 20Y2 2 Assets 3 Cash $626,640.00 $585,760.00 4 Accounts receivable (net) 226,900.00 208,390.00 5 Inventories 641,350.00 616,130.00 6 Investments 0.00 239,300.00 7 Land 328,730.00 0.00 8 Equipment 705,940.00 553,530.00 9 Accumulated depreciation-equipment (166,970.00) (148,000.00) 10 Total assets $2,362,590.00 $2,055,110.00 11 Liabilities and Stockholders' Equity 12 Accounts payable (merchandise creditors) $425,140.00 $404,540.00 13 Accrued expenses payable (operating expenses) 42,020.00 52,750.00 14 Dividends payable 23,580.00 19,500.00 15 Common stock, $4 par 154,000.00 100,000.00 16 Paid-in capital: Excess of issue price over par-common stock 416,600.00 279,400.00 17 Retained earnings 1,301,250.00 1,198,920.00 18 Total liabilities and stockholders' equity $2,362,590.00 $2,055,110.00 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for $279,880 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. D. The common stock was issued for cash. E. There was a $198,010 credit to Retained Earnings for net income. F. There was a $95,680 debit to Retained Earnings for cash dividends declared. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the heading of the statement. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Labels and Amount Descriptions Cash paid for dividends Cash paid for merchandise Cash paid for purchase of equipment Cash paid for purchase of land Cash received from customers Cash received from sale of common stock Cash received from sale of investments Change in cash December 31, 20Y3 Decrease in accounts payable Decrease in accounts receivable Decrease in accrued expenses payable Decrease in inventories Depreciation For the Year Ended December 31, 20Y3 Gain on sale of investments Increase in accounts payable Increase in accounts receivable Increase in accrued expenses payable Increase in inventories Loss on sale of investments Net cash flow from operating activities Net cash flow used for operating activities Net cash flow from investing activities Net cash flow used for investing activities Net cash flow from financing activities Net cash flow used for financing activities Net income Net loss Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Refer to the Labels and Amount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the heading of the statement. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Livers Inc. Statement of Cash Flows (Label) 1 Cash flows from operating activities: 2 Net income 3 Adjustments to reconcile net income to net cash flow from operating activities: 4 5 6 Changes in current operating assets and Liabilities: 7 8 9 10 11 12 13 Cash flows from investing activities: 14 15 16 17 18 19 Cash flows from financing activities: 20 21 22 23 24 Cash at the beginning of the year 25 Cash at the end of the year

Please could you make sure to use the labels and amount description when filling out the statement of cash flows so that I can earn all points and avoid any errors thank you!

Please could you make sure to use the labels and amount description when filling out the statement of cash flows so that I can earn all points and avoid any errors thank you!