Please create a balance sheet with this information!

Thank you!

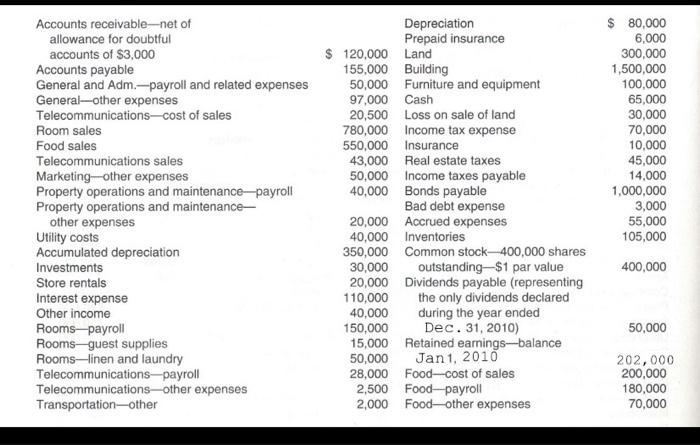

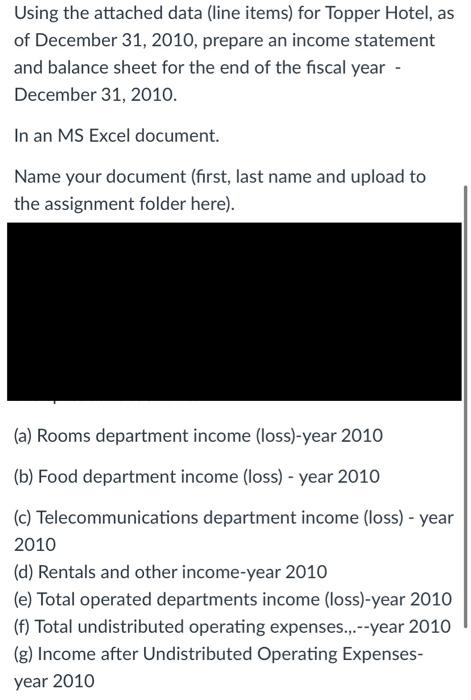

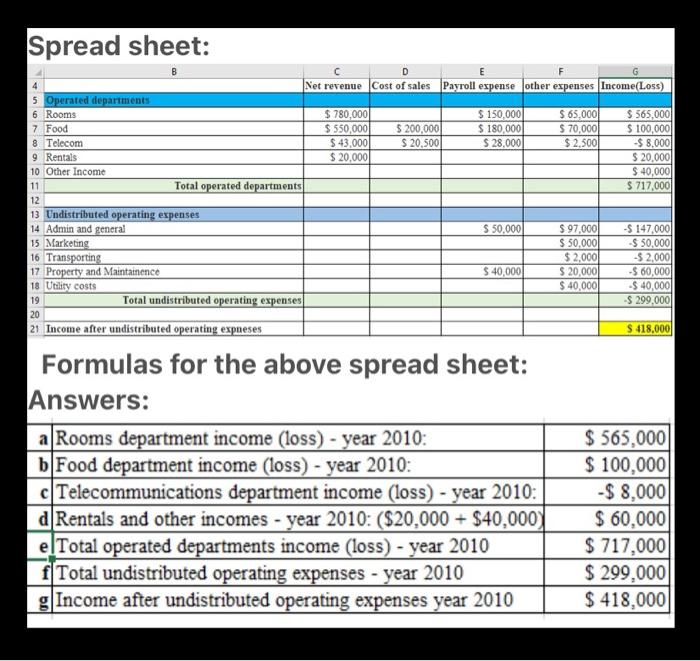

Accounts receivable-net of allowance for doubtful accounts of $3,000 Accounts payable General and Adm.-payroll and related expenses General other expenses Telecommunicationscost of sales Room sales Food sales Telecommunications sales Marketing-other expenses Property operations and maintenance-payroll Property operations and maintenance- other expenses Utility costs Accumulated depreciation Investments Store rentals Interest expense Other income Rooms-payroll Rooms-guest supplies Rooms-linen and laundry Telecommunications-payroll Telecommunications-other expenses Transportation-other Depreciation Prepaid insurance $ 120,000 Land 155,000 Building 50,000 Furniture and equipment 97,000 Cash 20,500 Loss on sale of land 780,000 Income tax expense 550,000 Insurance 43,000 Real estate taxes 50,000 Income taxes payable 40,000 Bonds payable Bad debt expense 20,000 Accrued expenses 40,000 Inventories 350,000 Common stock 400,000 shares 30,000 outstanding-$1 par value 20,000 Dividends payable (representing 110,000 the only dividends declared 40,000 during the year ended 150,000 Dec. 31, 2010) 15,000 Retained earnings-balance 50,000 Jan 1, 2010 28,000 Food-cost of sales 2,500 Food-payroll 2,000 Foodother expenses $ 80,000 6,000 300,000 1,500,000 100,000 65,000 30,000 70,000 10,000 45,000 14,000 1,000,000 3,000 55,000 105,000 400,000 50,000 202,000 200,000 180,000 70,000 Using the attached data (line items) for Topper Hotel, as of December 31, 2010, prepare an income statement and balance sheet for the end of the fiscal year - December 31, 2010. In an MS Excel document. Name your document (first, last name and upload to the assignment folder here). (a) Rooms department income (loss)-year 2010 (b) Food department income (loss) - year 2010 (c) Telecommunications department income (loss) - year 2010 (d) Rentals and other income-year 2010 (e) Total operated departments income (loss)-year 2010 (f) Total undistributed operating expenses...--year 2010 (g) Income after Undistributed Operating Expenses- year 2010 Spread sheet: B D 4 Net revenue Cost of sales Payroll expense other expenses Income(Loss) 5 Operated departments 6 Rooms $ 780,000 $ 150,000 $ 65,000 $ 565,000 7 Food $ 550,000 $ 200,000 $ 180,000 $ 70,000 $ 100,000 8. Telecom $ 43,000 $ 20,5001 $ 28,000 $2.500 $ 8.000 9 Rentals $ 20,000 $ 20,000 10 Other Income $ 40,000 11 Total operated departments $ 717,000 12 13 Undistributed operating expenses 14 Admin and general $ 50,000 $ 97,000 -$ 147,000 15 Marketing $ 50.000 $ 50.000 16 Transporting $ 2.000 $ 2.000 17 Property and Maintainence $ 40,000 $ 20,000 $ 60,000 18 Utility costs $ 40,000 $ 40,000 19 Total undistributed operating expenses $ 299,000 20 21 Income after undistributed operating expueses S 418,000 Formulas for the above spread sheet: Answers: a Rooms department income (loss) - year 2010: b Food department income (loss) - year 2010: c Telecommunications department income (loss) - year 2010: d Rentals and other incomes - year 2010: ($20,000+ $40,000) e Total operated departments income (loss) - year 2010 f Total undistributed operating expenses - year 2010 g Income after undistributed operating expenses year 2010 $ 565,000 $ 100,000 -$ 8,000 $ 60,000 $ 717,000 $ 299,000 $ 418,000