Question

Please create a balnce sheet and an income statement with the following info The cost of goods sold for plant and flower stores had averaged

Please create a balnce sheet and an income statement with the following info

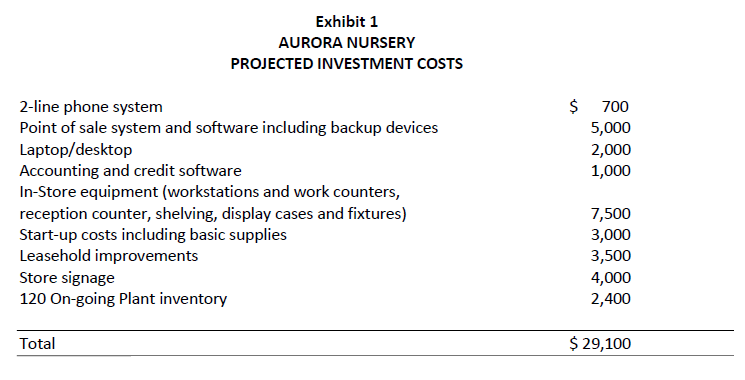

The cost of goods sold for plant and flower stores had averaged 47 per cent over the past few years and most gardening shops, after all expenses, earned a net income after tax between 10 and 12 per cent of gross sales. Most customers purchased plants for themselves and visited a gardening store four to five times a year. Amayah did some research through observing traffic through gardening shops. She recorded an average of about 10 customers per hour, for which about half of them made purchases. These customers spent an average of $30 per purchase (before taxes), but many customers bought basic supplies like soil and mulch for example. Tropical plants would normally fetch a higher average price point of about $40 per transaction. Amayah estimated the stores supplies and bookkeeping to cost $3000 each annually. Parttime employees would work eight hours per day, six days a week for 50 weeks. She planned to rotate two workers so the store will be open 7 days / week from 9 am 7 pm. Minimum wage was $14 / hr. Benefits (EI, CPP, etc.) for employees would average 10 per cent of their wages. As she was now starting her business, she planned to pay herself $2000 per month. She also wanted to add an annual expense of $750 for maintenance, repairs and office supplies. The Aurora Nursery store would be 820-square feet at a rental cost of $44 per square foot per year plus $10 per square foot per year for the common area maintenance. Insurance cost for a $2 million general liability insurance policy would cost $2000 annually. Telephone, internet and utilities combined would average $3000 monthly. To advertise her new store, she could choose among one or more promotional methods, such as flyers, an online presence through her website, social media, google ads, advertisements in the Brampton Community newspapers. She was also considering communicating special offers on new plant varieties through direct marketing such as email and direct mail, maybe even through a Aurora Nursery loyalty club. Everything Amayah read had suggested that gardening stores needed to spend around $6000 to $10000 for advertising annually. Finally, taxes for small businesses tend to average about 10% of Net Profit. Based on the size of her proposed plant store, she projected her investment costs to total just under $30,000. Exhibit 1 provides the breakdown of these costs. Just the in-store equipment, Leasehold Improvements and store signage were considered fixed assets depreciable at a rate of 25% per year. The balance of the start up expenses would need to be expensed in the first year. With respect to financing, Amayah had saved $10,000 and planned to borrow Cdn$20,000 from her family, thereby saving on bank interest costs. She planned to re-pay half of this loan from her family by the end of her first year of business.

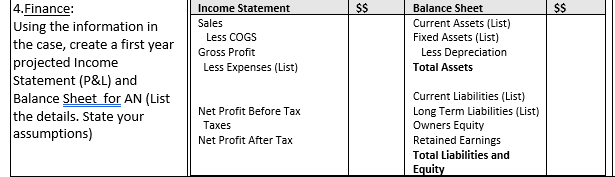

Exhibit 1 AURORA NURSERY PROJECTED INVESTMENT COSTS $ 700 5,000 2,000 1,000 2-line phone system Point of sale system and software including backup devices Laptop/desktop Accounting and credit software In-Store equipment (workstations and work counters, reception counter, shelving, display cases and fixtures) Start-up costs including basic supplies Leasehold improvements Store signage 120 On-going Plant inventory 7,500 3,000 3,500 4,000 2,400 Total $ 29,100 SS SS 4.Finance: Using the information in the case, create a first year projected Income Statement (P&L) and Balance Sheet for AN (List the details. State your assumptions) Income Statement Sales Less COGS Gross Profit Less Expenses (List) Balance Sheet Current Assets (List) Fixed Assets (List) Less Depreciation Total Assets Net Profit Before Tax Taxes Net Profit After Tax Current Liabilities (List) Long Term Liabilities (List) Owners Equity Retained Earnings Total Liabilities and EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started