Answered step by step

Verified Expert Solution

Question

1 Approved Answer

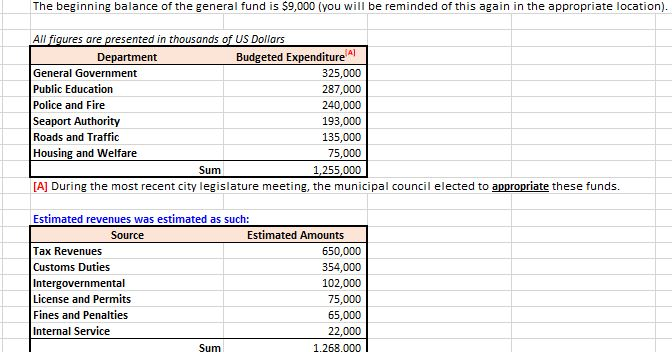

Please create a Budget Schedule for this Non-profit Organization. The beginning balance of the general fund is $9,000 (you will be reminded of this again

Please create a Budget Schedule for this Non-profit Organization.

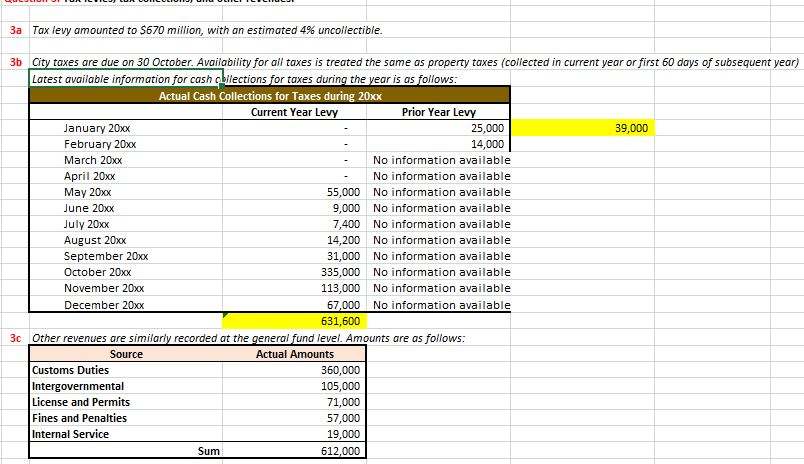

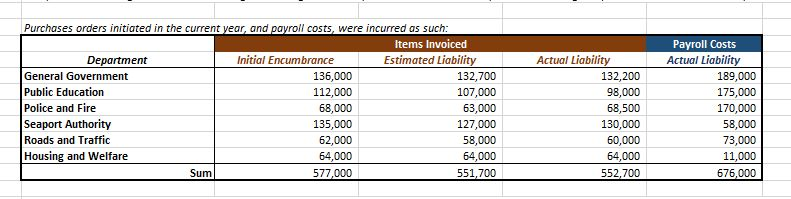

The beginning balance of the general fund is $9,000 (you will be reminded of this again in the appropriate location). All figures are presented in thousands of US Dollars Department Budgeted Expenditure ell General Government 325,000 Public Education 287,000 Police and Fire 240,000 Seaport Authority 193,000 Roads and Traffic 135,000 Housing and Welfare 75,000 Sum 1,255,000 [A] During the most recent city legislature meeting, the municipal council elected to appropriate these funds. Estimated revenues was estimated as such: Source Estimated Amounts Tax Revenues 650,000 Customs Duties 354,000 Intergovernmental 102,000 License and Permits 75,000 Fines and Penalties 65,000 Internal Service 22,000 Sum 1.268.000 3a Tax levy amounted to 5670 million, with an estimated 4% uncollectible. 3b City taxes are due on 30 October. Availability for all taxes is treated the same as property taxes (collected in current year or first 60 days of subsequent year) Latest available information for cash bllections for taxes during the year is as follows: Actual Cash Collections for Taxes during 20xx Current Year Levy Prior Year Levy January 20xx 25,000 39,000 February 20xx 14,000 March 20xx No information available April 20xx No information available May 20xx 55,000 No information available June 20xx 9,000 No information available July 20xx 7,400 No information available August 20xx 14,200 No information available September 20xx 31,000 No information available October 20xx 335,000 No information available November 20xx 113,000 No information available December 20xx 67,000 No information available 631,600 3c Other revenues are similarly recorded at the general fund level. Amounts are as follows: Source Actual Amounts Customs Duties 360,000 Intergovernmental 105,000 License and Permits 71,000 Fines and Penalties 57,000 Internal Service 19,000 Sum 612,000 Purchases orders initiated in the current year, and payroll costs, were incurred as such: Items Invoiced Department Initial Encumbrance Estimated Liability General Government 136,000 132,700 Public Education 112,000 107,000 Police and Fire 68,000 63,000 Seaport Authority 135,000 127,000 Roads and Traffic 62,000 58,000 Housing and Welfare 64,000 64,000 Sum 577,000 551,700 Actual Liability 132,200 98,000 68,500 130,000 60,000 64,000 552,700 Payroll Costs Actual Liability 189,000 175,000 170,000 58,000 73,000 11,000 676,000 The beginning balance of the general fund is $9,000 (you will be reminded of this again in the appropriate location). All figures are presented in thousands of US Dollars Department Budgeted Expenditure ell General Government 325,000 Public Education 287,000 Police and Fire 240,000 Seaport Authority 193,000 Roads and Traffic 135,000 Housing and Welfare 75,000 Sum 1,255,000 [A] During the most recent city legislature meeting, the municipal council elected to appropriate these funds. Estimated revenues was estimated as such: Source Estimated Amounts Tax Revenues 650,000 Customs Duties 354,000 Intergovernmental 102,000 License and Permits 75,000 Fines and Penalties 65,000 Internal Service 22,000 Sum 1.268.000 3a Tax levy amounted to 5670 million, with an estimated 4% uncollectible. 3b City taxes are due on 30 October. Availability for all taxes is treated the same as property taxes (collected in current year or first 60 days of subsequent year) Latest available information for cash bllections for taxes during the year is as follows: Actual Cash Collections for Taxes during 20xx Current Year Levy Prior Year Levy January 20xx 25,000 39,000 February 20xx 14,000 March 20xx No information available April 20xx No information available May 20xx 55,000 No information available June 20xx 9,000 No information available July 20xx 7,400 No information available August 20xx 14,200 No information available September 20xx 31,000 No information available October 20xx 335,000 No information available November 20xx 113,000 No information available December 20xx 67,000 No information available 631,600 3c Other revenues are similarly recorded at the general fund level. Amounts are as follows: Source Actual Amounts Customs Duties 360,000 Intergovernmental 105,000 License and Permits 71,000 Fines and Penalties 57,000 Internal Service 19,000 Sum 612,000 Purchases orders initiated in the current year, and payroll costs, were incurred as such: Items Invoiced Department Initial Encumbrance Estimated Liability General Government 136,000 132,700 Public Education 112,000 107,000 Police and Fire 68,000 63,000 Seaport Authority 135,000 127,000 Roads and Traffic 62,000 58,000 Housing and Welfare 64,000 64,000 Sum 577,000 551,700 Actual Liability 132,200 98,000 68,500 130,000 60,000 64,000 552,700 Payroll Costs Actual Liability 189,000 175,000 170,000 58,000 73,000 11,000 676,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started