Create a journal entries of the following entries 3/21/23 Collected $2,143,000 in rent revenue. 3/23/23 Paid $1,187,000 in dividends. 3/24/23 Purchased new equipment for $3,00,000.

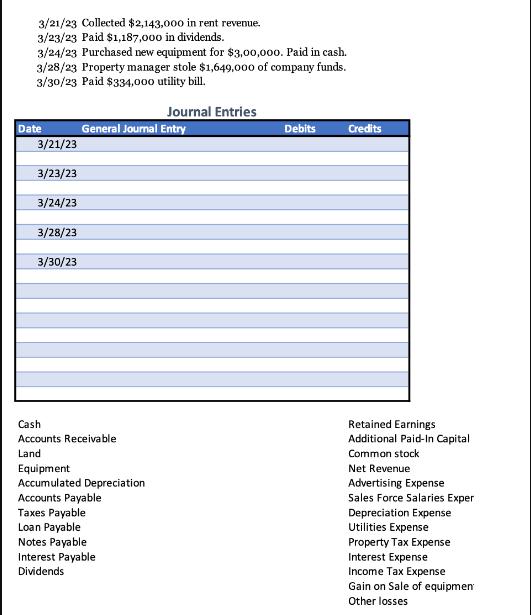

Create a journal entries of the following entries

3/21/23 Collected $2,143,000 in rent revenue. 3/23/23 Paid $1,187,000 in dividends. 3/24/23 Purchased new equipment for $3,00,000. Paid in cash. 3/28/23 Property manager stole $1,649,000 of company funds. 3/30/23 Paid $334,000 utility bill. Date 3/21/23 3/23/23 3/24/23 3/28/23 3/30/23 General Journal Entry Cash Accounts Receivable Land Equipment Accumulated Depreciation Journal Entries Accounts Payable Taxes Payable Loan Payable Notes Payable Interest Payable Dividends Debits Credits Retained Earnings Additional Paid-In Capital Common stock Net Revenue Advertising Expense Sales Force Salaries Exper Depreciation Expense Utilities Expense Property Tax Expense Interest Expense Income Tax Expense Gain on Sale of equipmen Other losses

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions you provided 32123 Debit ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started