Question

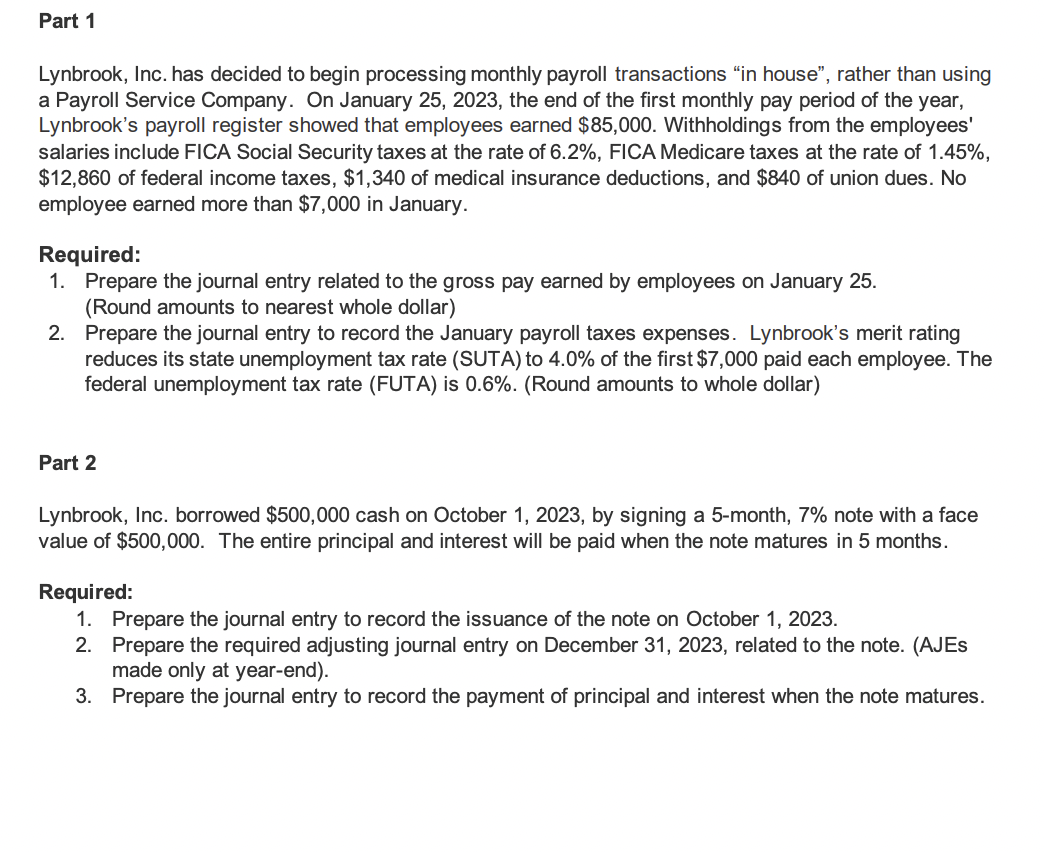

Please create this in excel if possible - I am confused of how it needs to be set up :) Part 1 Lynbrook, Inc. has

Please create this in excel if possible - I am confused of how it needs to be set up :)

Part 1 Lynbrook, Inc. has decided to begin processing monthly payroll transactions in house, rather than using a Payroll Service Company. On January 25, 2023, the end of the first monthly pay period of the year, Lynbrooks payroll register showed that employees earned $85,000. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $12,860 of federal income taxes, $1,340 of medical insurance deductions, and $840 of union dues. No employee earned more than $7,000 in January. Required: 1. Prepare the journal entry related to the gross pay earned by employees on January 25. (Round amounts to nearest whole dollar) 2. Prepare the journal entry to record the January payroll taxes expenses. Lynbrooks merit rating reduces its state unemployment tax rate (SUTA) to 4.0% of the first $7,000 paid each employee. The federal unemployment tax rate (FUTA) is 0.6%. (Round amounts to whole dollar) Part 2 Lynbrook, Inc. borrowed $500,000 cash on October 1, 2023, by signing a 5-month, 7% note with a face value of $500,000. The entire principal and interest will be paid when the note matures in 5 months. Required: 1. Prepare the journal entry to record the issuance of the note on October 1, 2023. 2. Prepare the required adjusting journal entry on December 31, 2023, related to the note. (AJEs made only at year-end). 3. Prepare the journal entry to record the payment of principal and interest when the note matures.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started